Summary:

- Bank of America or BofA reports its Q1 earnings on April 18.

- The solid releases by its leading Wall Street peers have given buyers confidence that BofA should exceed expectations.

- BAC stock currently trades at a considerable discount compared to its 10-year average, signaling a potential undervaluation that could translate into outperformance.

- A renewed sense of determination has swept over buyers in the past four weeks as they returned to prevent BAC from sliding further below its March lows.

tupungato

Bank of America or BofA (NYSE:BAC) is slated to deliver its Q1 earnings release on April 18, after a solid report by its leading banking peers on Friday (April 14).

As such, investors also lifted BAC on Friday, as buyers returned robustly and supported its price action above the lows last seen in mid-March.

Investors are likely positioning for a better-than-expected beat from CEO Brian Moynihan & his team, as it previously guided for a disappointing net interest income or NII outlook for Q1’23, suggesting that Q4’22 was likely the peak.

However, JPMorgan’s (JPM) Q1 earnings release suggested that the expected fall in NII could be delayed further, as it raised its NII outlook to about $81B for FY23, up nearly 11% from Q4’s guidance.

As such, investors’ positioning indicates that buyers returned robustly to BofA and its G-SIB peers, expecting them to benefit from the surge in low-cost deposit outflows from its regional banking peers.

Despite that, JPMorgan cautioned investors that it doesn’t expect the elevated NII levels to be sustainable over the medium term.

Coupled with the expectations that the Fed is nearing the end of its record rate hikes, and higher deposit costs, investors should still expect BofA’s NII to peak in 2022/23 as we revert to a more normalized level moving ahead.

With that in mind, are the current levels still reasonable after BAC finished well for the week?

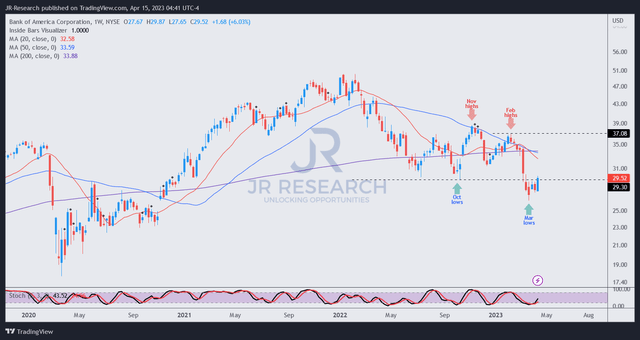

BAC price chart (weekly) (TradingView)

We have been watching the consolidation over the past four weeks as we looked to add more exposure. We like what we saw and believe the BAC seems increasingly likely to bottom out from here.

March lows need to be supported by dip buyers seeing dislocation in BAC’s valuation, as it’s not cheap relative to its peers (though cheap relative to its historical averages).

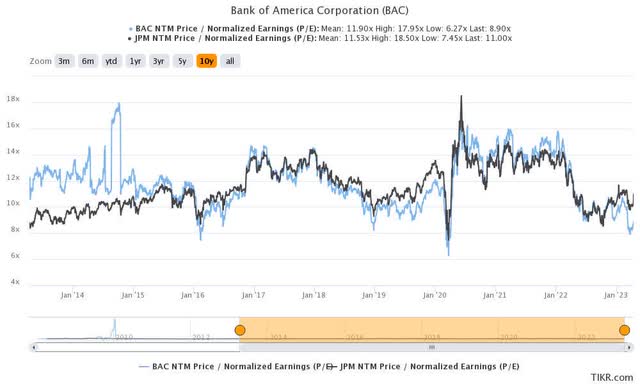

Accordingly, BAC last traded at a next twelve months, or NTM adjusted P/E of 8.9x, higher than its peers’ median of 7.6x (according to S&P Cap IQ). However, it’s well below BAC’s 10Y average of 11.9x.

Hence, we assessed that it’s justified for investors to expect BofA to outperform from here as they return to undergird its recent panic selloff.

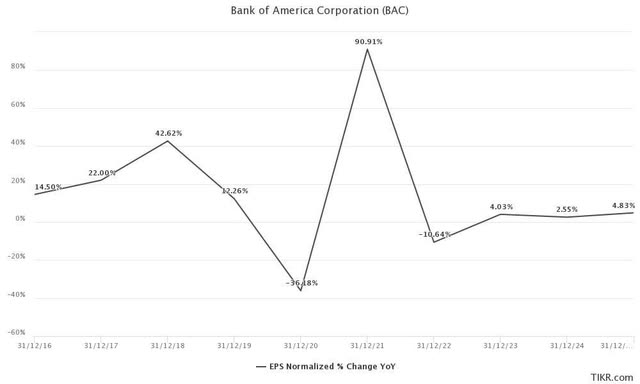

Wall Street analysts’ estimates suggest that BofA’s adjusted EPS growth is expected to turn positive in FY23, increasing by 4% after last year’s 10.6% decline.

BAC price chart (weekly) (TIKR)

However, FY24’s EPS growth is expected to stay relatively tepid, with an adjusted EPS growth of just 2.55%. Hence, we believe the market’s positioning is appropriate, as BAC trades well below its 10Y average.

In other words, even though BAC’s earnings growth is not expected to be spectacular, we believe it has already been priced in.

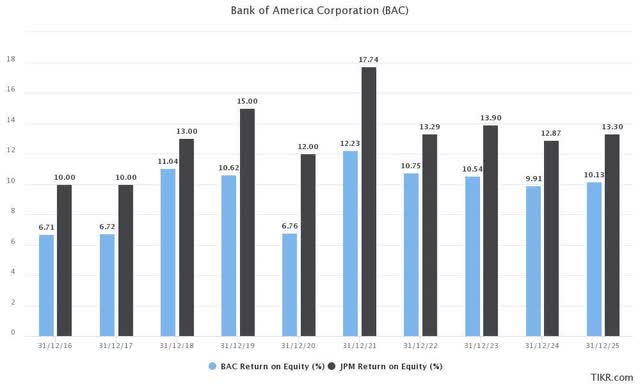

BAC & JPM ROE % consensus estimates (TIKR)

Some investors could point out that JPM is expected to deliver much better ROE metrics than BAC over the next three years.

Coupled with more robust NII projections, BAC could struggle to overturn its recent underperformance against JPM. However, the market has likely incorporated JPM’s expected outperformance in its valuation, as JPM trades at an NTM adjusted P/E of 11x.

BAC & JPM NTM adjusted P/E valuation trend (TIKR)

As seen above, JPM’s NTM adjusted P/E suggests no discernible undervaluation relative to its 10Y average.

However, the market has discounted BAC’s valuation more significantly, reflecting challenges over its earnings growth potential. However, while the market has likely reflected headwinds over its debt securities we discussed in our previous update, BAC is not in imminent danger of facing the need to sell those securities.

As such, the market’s focus is likely on BAC’s ability to recover its earnings growth and ROE to justify its cost of equity of 9.5%.

Therefore, while we think the market seems right to discount BAC relative to JPM, we assessed the relative undervaluation presents a solid opportunity for investors to add exposure.

Takeaway

The market is likely expecting BofA to report a solid earnings report on April 18, reflecting the robust releases posted by its peers. However, investors will also need to consider headwinds related to higher macroeconomic uncertainties and higher reserve build to reflect the headwinds.

Moreover, consumer spending has also weakened, while the momentum from the Fed’s rate hikes could stall moving ahead.

However, BAC’s valuation should provide buyers with a reasonable margin of safety, which is also reflected in its constructive price action, as buyers returned to stanch further selling downside.

Rating: Strong Buy (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!