Summary:

- Bank of America’s Series L preferred shares have yielded a total return of around 15% in the past eight months.

- Bank of America’s pre-tax income decreased slightly, but preferred dividends are well covered with less than 5% of net income.

- The Series L preferred shares offer a 5.85% yield and have potential for capital gains due to low likelihood of forced conversion.

Ceri Breeze/iStock Editorial via Getty Images

Introduction

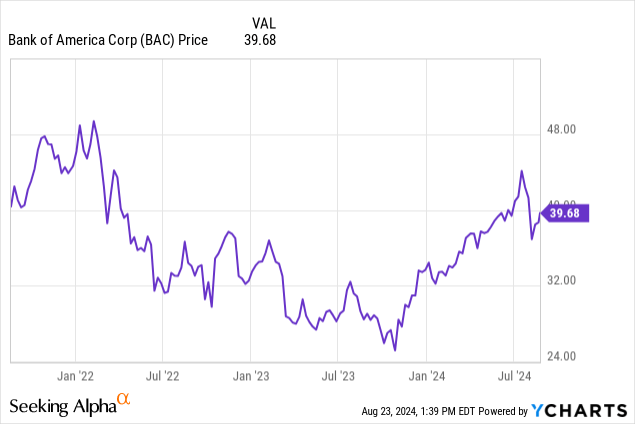

In December of last year, I argued Bank of America’s (NYSE:BAC) non-callable preferred shares were a good idea to speculate on a rate cut (and on decreasing interest rates on the financial markets). So far, the investment has done what I expected it to do. Bank of America continued to make the quarterly preferred dividend payments while the share price is currently approximately 10% higher for a total return of around 15% in the past eight months. As Bank of America recently released its Q2 results, I wanted to make sure my investment thesis for the Series L preferred shares is still valid.

Bank of America obviously remained very profitable

Whenever I look at preferred shares, I want to double check the preferred dividends still enjoy an excellent coverage ratio.

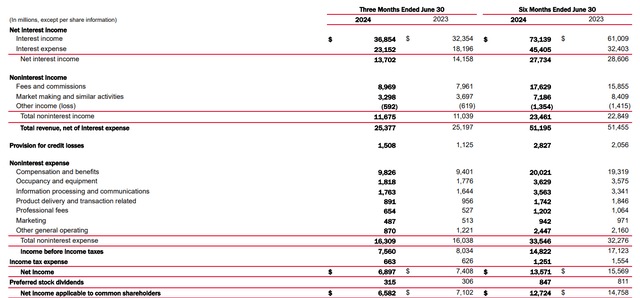

As you can see in the image below, Bank of America reported a slightly lower net interest income compared to the same quarter a year ago, while there also was a slight decrease on a QoQ basis. That being said, the bank’s non-interest income increased by in excess of $600M on a year-over-year basis, while the total amount of non-interest expenses increased by just over $270M and this almost entirely compensated for the lower net interest income.

BAC Investor Relations

That being said, Bank of America’s pre-tax income did come in lower than in the same quarter last year, mainly because the bank increased the amount it has been setting aside for loan loss provisions. A you can see, the total amount increased by approximately $400M and while some other authors can sound very “alarmist” on these matters, it pretty much is the normal course of doing business for banks. During tougher economic times it makes sense to see higher provisions and once the dust settles it happens quite often that banks can recoup some of the provisions they recorded.

In any case, Bank of America recorded a net profit of almost $6.9 billion and after taking the $315M in preferred dividends into account, the net profit attributable to the common shareholders was just under $6.6B. This indicates the preferred dividends are very well-covered as the bank needed less than 5% of its net income to cover the preferred dividends.

The Series L preferred shares are living up to the expectations

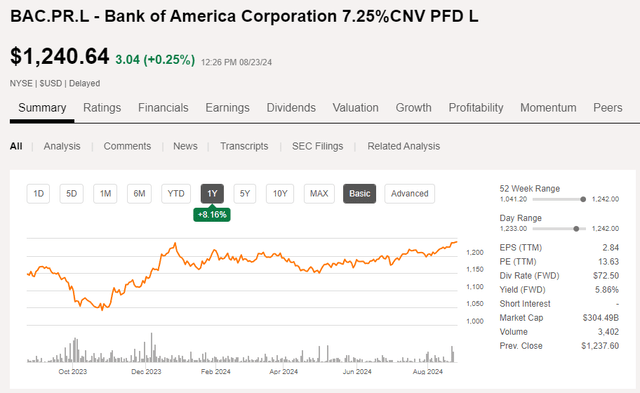

As explained in previous articles, the Series L, trading with (NYSE:BAC.PR.L) as ticker symbol, is a so-called “busted” preferred which cannot be called by Bank of America. The owner of the preferred shares has the option to convert the shares into 20 common shares, and if the underlying shares are trading at$65/share, Bank of America may force the conversion.

But as the common shares are trading at around $40/share, the likelihood of a forced conversion to happen in the next few years is quite low (the share price would have to increase by in excess of 60% from the current share price). And even if that would happen, the owners of the preferred shares would receive at least $1,300 in common shares (20 times $65) of Bank of America. Considering the preferred shares are currently trading at around $1,240, there would be a capital gain of approximately 5% if that would happen, so it’s definitely not a disastrous scenario.

Seeking Alpha

Meanwhile, those preferred shares offer a 7.25% preferred dividend based on the $1,000 principal value of the security. This means that at the current share price of around $1240, this series of preferred equity yields approximately 5.85%. That’s about 203 bps above the 10 year US Treasury Note (which, granted, is an arbitrary comparable as there is no definitive maturity date for the preferred shares).

Investment thesis

The fixed rate preferred shares Series L issued by Bank of America are doing exactly what I expected them to do: Thanks to lower interest rates on the financial markets and the likelihood of seeing additional benchmark rate cuts (which should lead to even lower interest rates on the markets), the stock is already trading about 10% higher than where it was at last December.

I have a long position in the “busted” preferred shares of Wells Fargo and the Series L preferred shares of Bank of America as I like the dual exposure to both income and the potential to generate capital gains.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC.PR.L either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!