Summary:

- Bank of America recently announced a 9% dividend hike, it will go ex-dividend on August 31.

- You’ll need to own Bank of America before August 31 if you hope to collect its upcoming dividend.

- Buying this stock before its ex-dividend date could be a smart move.

- The bank has a high level of liquidity and is not at risk of failure.

- Bank of America’s dividend payout is relatively safe, with low payout ratios and high overall financial strength.

Brian Moynihan

Ian Forsyth/Getty Images News

Bank of America (NYSE:BAC) recently announced a 9% dividend hike. The holder of record date for the stock is September 1, and the ex-dividend date is August 31. If you wish to grab Bank of America’s upcoming dividend, you’ll need to own the stock before August 31.

This may be a good time to buy Bank of America ahead of its dividend payout. The company’s stock got beaten down recently when treasury yields spiked (i.e. their prices declined), leading to concerns about banks’ balance sheets. BAC has about $106 billion in unrealized securities losses, so this isn’t an unreasonable concern to have in principle.

However, the level of concern may be a little overblown. Bank of America does have a lot of unrealized losses, but its liquidity is quite good. Its highly liquid assets make up about 50% of its deposit base, even when you adjust them down to fair value. So, the bank could survive having 50% of its depositors withdraw their money in a short span of time. Additionally, the bank’s liquidity coverage ratio is 119%, which is above the 100% requirement.

Given Bank of America’s high liquidity, it is most likely not at risk of a failure. At the same time, the declining share price means that if you buy the stock today, you will enjoy a higher yield than you would have had you bought it at most points in the last few years. Therefore, BAC stock is a relatively appealing buy at today’s prices.

Bank of America – Dividend Safety

Since we are primarily interested in Bank of America’s dividend here, it makes sense to think about how safe the payout is. There are several metrics we can look at to gauge that. The first metric we can look at is the payout ratio (dividends paid divided by earnings). According to Seeking Alpha Quant, BAC’s payout ratio is 25.3%, which is pretty low and sustainable. That’s a good thing.

However, bank earnings tend to vary a lot with the state of the economy. During the 2008/2009 financial crisis, BAC’s earnings declined 73%. Many other banks’ earnings went negative in the same period. In order for BAC to continue paying its dividend at its current level, it will need to be strong enough to withstand a future recession. While few economists expect the next recession to be a severe one, most do expect there to be a recession in one form or another. So, it helps to look at BAC’s overall financial strength.

We can assess that using a framework known as CAMELS. CAMELS is an acronym that stands for:

-

Capital adequacy – measured by capital ratios.

-

Asset quality.

-

Management quality.

-

Earnings.

-

Liquidity – measured by liquidity coverage ratios.

-

Sensitivity to market risk.

Regulators impose various minimums to the ratios used in the CAMELS framework. By looking at all of them, we can determine whether Bank of America is robust enough to survive a downturn.

Let’s take a look at each of them.

Capital adequacy

A bank’s capital ratios tell you how much high quality capital it has compared to assets. The most popular one is the CET1 ratio, which measures capital against risk weighted assets (the riskier the asset, the more heavily it is weighted). BAC’s CET1 ratio in the second quarter was 11.6%, which is above the regulatory requirement.

Asset quality

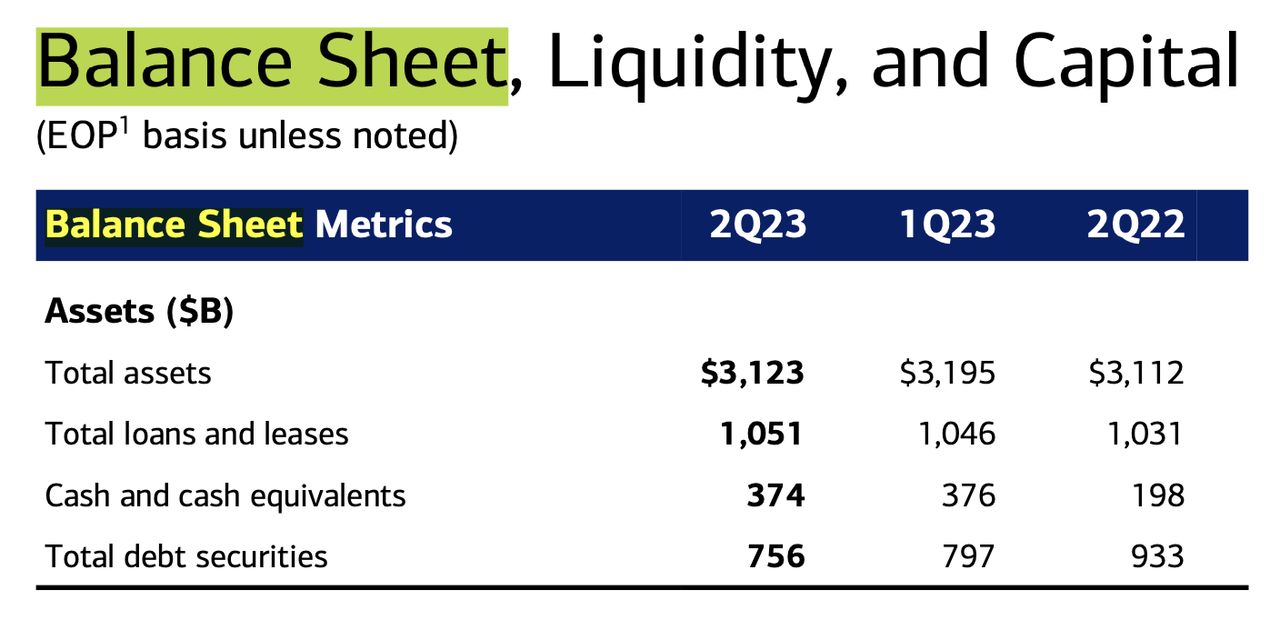

Another important factor when analyzing banks is asset quality. This refers to the bank having a healthy mix of treasuries and other ‘safe’ assets on its balance sheet. While we’d all like to see our banks earning enormous yields on mortgages, the fact is that they have to have liquid assets too. BAC scores pretty well on this front, with about equal amounts of money held in loans and in cash/treasuries combined, as the chart below shows:

Bank of America assets (Bank of America)

Management skill

Management skill is a complex factor. It consists of not only the CEO’s abilities, but also factors like internal controls. Bank of America CEO Brian Moynihan has a good reputation, having earned praise from Warren Buffett, and an 89% approval rating from his employees. The company as a whole has won numerous awards for risk management and overall financial soundness. Overall, its management team appears to be skilled.

Earnings

Next up, we have earnings. Bank of America’s most recent quarterly earnings release was a beat, with revenue of $10.5 billion up 15%, and earnings of $2.9 billion up 19%. The quarter saw a large increase in provisions for credit losses (“PCL”), yet nevertheless saw an appreciable increase in profit. That bodes well for the future. BAC had a 28% net margin in the quarter, implying that the bank’s earnings are higher than its cost of capital. Overall, BAC’s earnings appear to be both high quality and sustainable.

Liquidity

Bank of America’s liquidity picture is quite good. Its highly liquid assets equal about 50% of deposits, even after you adjust them down to fair value. Its liquidity coverage ratio, 119%, is above the requirement (100%). Finally, the bank holds about $374 billion in cash, which is enough to survive a moderate-sized bank run.

Sensitivity to Market Risk

Last but not least, we have sensitivity to market risk, including interest rate risk. Bank of America is fairly sensitive to interest rates. Its revenue and earnings both increased significantly this year as a result of interest rates rising. The inverted yield curve has not put pressure on the bank’s margins yet, but that could happen in the future, as more and more depositors flee to the relatively high yields available on treasuries today. Were that to happen, BAC would need to raise savings account and CD interest, which would reduce its margins.

Taking into account all six of the CAMELS criteria, Bank of America looks likely to remain profitable and solvent for the foreseeable future. It is fairly sensitive to market risk, but it scores well on the other five criteria. For this reason I conclude that BAC’s dividend is reasonably safe, and likely to continue being paid well beyond the scheduled September payment (the one that goes ex-dividend on August 31).

Valuation

Having explored Bank of America’s overall financial strength, we can now proceed to a valuation. According to Seeking Alpha Quant, BAC trades at:

-

8.4 times earnings.

-

2.45 times sales.

-

0.91 times book value.

-

5.21 times operating cash flow.

-

5.26 times free cash flow (this multiple calculated by the author).

All of these multiples are fairly low, suggesting that BAC is a cheap stock. However, the price/book ratio is not as good as it appears at first glance. BAC currently has $254 billion in common equity. If you subtract $106 billion from that (the losses on long term securities), book value is reduced to $148 billion, or $18.32 per share. Using this alternative calculation of book value, the price/book ratio is 1.58, which is actually rather high by bank standards. Overall, I would characterize Bank of America as “modestly” valued, but not an outright bargain.

Risks and Challenges

As we’ve seen, Bank of America is a strong bank with a modest valuation. It is earning far more than it needs to keep paying and raising its dividend. It looks like a pretty compelling picture so far, but there are many risks and challenges for investors to beware:

-

Yield curve inversion. Banks borrow on the short end of the yield curve and lend on the long end. Therefore, inverted yield curves tend to squeeze their margins. This hasn’t happened to Bank of America yet this year, but some smaller banks collapsed earlier this year when their clients pulled out money to invest in treasuries. It’s this kind of thing that forces banks to raise savings/CD interest, which has the effect of reducing their margins.

-

A future recession. Many economists believe there will be a recession next year. The consensus of an imminent recession is not as strong as it was earlier in the year, but there are still many experts who believe that one will occur shortly. If that scenario plays out then BAC’s earnings will probably decline, as bank earnings usually do decline during recessions.

Taking the risks and challenges above into account, Bank of America stock still looks like a decent buy to me. The two risks mentioned are potential, not actual; the yield curve is inverted but it isn’t negatively impacting BAC’s profitability right now, and the expected recession has yet to materialize. Bank of America therefore has high earnings power, and the ability to keep raising its dividend. Perhaps, then, it’s a good idea to buy the stock before it goes ex-dividend. The yield is already 3%, and is on the rise.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.