Summary:

- Bank of America is one of the “big four” banks in the US, with a wide economic moat and a diverse portfolio of financial products and services.

- Despite challenges in the banking industry, Bank of America has maintained strong profitability and liquidity, making it a strong buy.

- The bank has seen a substantial 25% YTD selloff resulting in shares becoming in my opinion materially undervalued by 52%.

- I have initiated a position worth 28% of my total portfolio value in BAC shares.

- Strong Buy rating issued.

Justin Sullivan/Getty Images News

Investment Thesis

Bank of America (NYSE:BAC) is one of the “big four” banks based in and operating in the United States U.S.

Their massive portfolio of financial products and services along with an extensive presence in the consumer banking industry drives a wide and robust economic moat for the firm.

Excessively bearish market sentiments have led investors to sell their shares in the banking giant with valuations having fallen over 24% YTD. I believe this has been excessive given the overall profitability and liquidity present at BoA.

Given a potential 52% undervaluation in shares, I have initiated a position worth around 28% of my total portfolio value in BoA.

Strong Buy rating issued.

Company Background

Bank of America is one of the “big four” banks based in the U.S. ranking second in terms of market capitalization behind JPMorgan Chase & Co (JPM) and ahead of Wells Fargo (WFC) and Citigroup (C).

The firm serves approximately 11% of all American bank deposits with their primary services revolving around consumer banking, global banking, wealth management and investment banking.

BoA’s extensive set of retail branches along with a strong presence within the investment banking industry has allowed the firm to grow rapidly post-2008 with strong revenue growth and a solid balance sheet having become the hallmark of BoA’s business model.

The massive scale upon which they operate and significant pivot towards offering more digital and innovative products to their clients has allowed the firm to remain relevant in a rapidly changing market environment.

CEO Brian Moynihan has been leading BoA since 2010 and looks set to continue managing the bank moving forwards. Moynihan has extensive experience within the BoA corporation having previously held management positions leading each of the firm’s distinct operating units prior to becoming CEO.

Such extensive knowledge of both BoA along with huge experience as an investment banker means Moynihan is uniquely positioned to be perhaps the most suitable CEO of any bank in the world in my opinion. I believe under Moynihan’s guidance BoA has the best opportunity to continue growing their customer base, revenues and margins responsibly moving forwards.

Economic Moat -In Depth Analysis

BoA has a wide economic moat that is primarily build upon their extensive set of services and retail banking networking driving a set of tangible switching costs for both consumer and enterprise oriented clients.

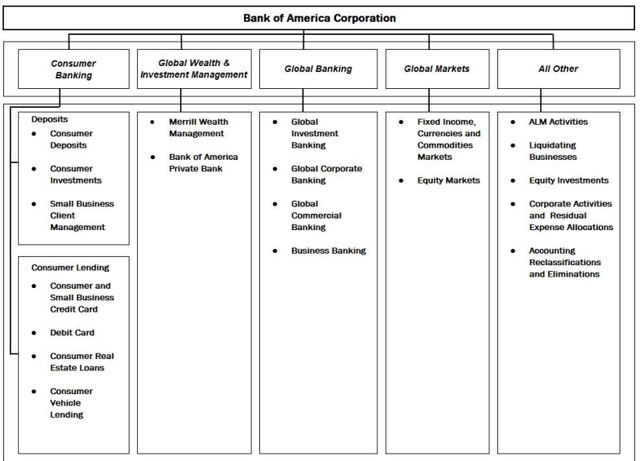

The bank offers customers a wide range of services thanks to their highly differentiated set of businesses. In total, BoA operates five key business segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, Global Markets and All Other.

The firm’s Consumer Banking division deals with consumer deposits, investment and small business clientele along with consumer lending products. BoA’s leading network of retail branches allows the bank to benefit from an increased level of presence among potential consumers compared to other banks.

The huge number of BoA branches increases the bank’s exposure to more potential consumers which, along with their massive set of consumer-oriented deposit and lending services creates a powerful networking effect across the U.S.

BoA is currently one of the top issuers of both debit and credit cards in the U.S. and is currently seeing rapid core client growth with over 36M consumer checking accounts being open with the bank.

The bank saw more than 4.4M new credit card accounts during FY22 alone which represented a 22% increase YoY.

The requirement for significant scale within these product offerings due to the significant fixed costs associated with running such operations helps BoA excel against its competitors thanks to the massive number of accounts and cards issued by the bank.

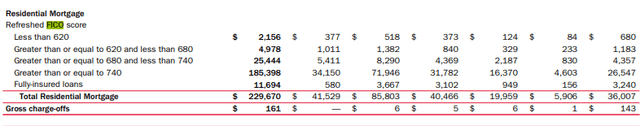

While in the lead up and post-2008 BoA had huge exposure to unsecured consumer loans and subprime mortgages, the bank has reduced this exposure by becoming more conservative with their underwriting policies.

As of FY22, BoA only has exposure to $2.2B in residential mortgage loans with FICO scores of less than 620. The bank also has the vast majority (over 74%) of their credit card term loans with customers having a FICO score of greater than or equal to 740.

I believe this illustrates that the fundamental plague that brought down BoA during the 2008 financial crisis has been dealt with effectively and conservatively which illustrates that Moynihan has been steering the bank with the long-term in mind.

Overall, it is clear to me that BoA’s huge retail network, extensive financial service offerings and continuous innovation within the segment generates their Consumer Banking business a wide economic moat.

BoA also has a substantial presence within the GWIM industry with Merrill and Private Bank being part of the greater BoA portfolio of businesses. Merrill is a wealth and investment management business that aims to serve high net worth and ultra-high net worth clients by providing tailored financial guidance to each of their clients.

Private Bank acts as a comprehensive wealth and estate planning business which once again targets ultra-high net worth clients with investible assets of at least 3 million.

BAC FY22 Annual Report

Merrill in particular has managed to achieve 92% customer satisfaction rates thanks to their client-oriented operational model. When combined with a 40% increase in financial planning discussion in FY22 compared to years gone by, I believe Merrill has real potential to become one of the largest players within the industry.

BoA is a Tier 1 investment bank and while holding a smaller presence within this industry compared to JP Morgan Chase, I believe the reputable image and extensive knowledge BoA harbors generates a narrow moat for this business segment.

BAC FY22 Annual Report

The bank’s global banking business is primarily centered around the provision of business banking services to U.S. companies along with global commercial banking and investment banking solutions.

BoA serviced more than 21,000 small and mid-sized U.S. companies in FY22 while also providing treasury, lending, leasing, advisory and debt equity underwriting services to companies worldwide.

BAC FY22 Annual Report

Almost one-third of all fortune 1000 companies are customers of BoA’s Global Commercial Bank (GCB) which illustrates just how influential the firm is within the business banking sector.

BoA’s complements their international operations by providing global market services to debt, equity, commodity and FX markets. The bank has over 8,000 clients who purchase such market services from the firm with customers ranging from asset managers to hedge funds and all the way to government institutions.

I believe that overall, BoA’s business banking and global banking segment generates a wide economic moat for the firm thanks to the huge resources, scale and relevant industry knowledge the bank provides its clients.

BoA’s “All Other” operational segment should not be overlooked as it has many relevant and important auxiliary services and businesses nestled within its relatively low-key title. The firm’s Asset and Liability management services are critical services required by banks and firms facing liquidity issues, interest rate risk or capital markets risk.

Their liquidation services, residual expense allocations and accounting services provide companies in unique situations with acute assistance and support. While these business segments may not present as much recurring income for BoA, they help to further expand the umbrella of services offered by the bank to its various clients.

Ultimately, it is exactly this huge breadth of services, products and tools offered by BoA to its clients that helps to generate a tangible and broad economic moat for the firm.

The bank’s multiple business segments generate moatiness in and of themselves, but the overall synergies and exposure to potential customers achieved as a result of the cohesion of all services under the BoA umbrella is the real moat driver for the firm.

Therefore, I confidently assign BoA a wide economic moat rating.

Financial Situation

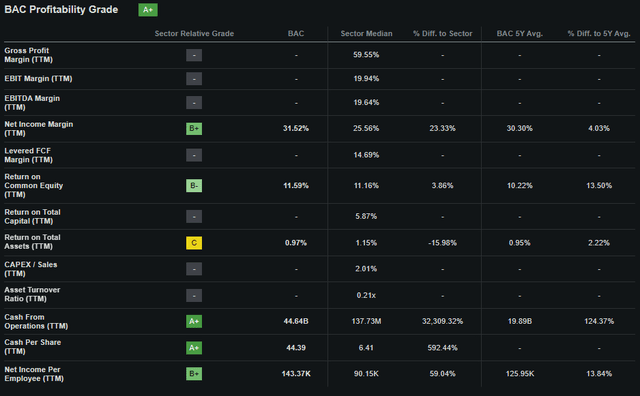

From an operating performance perspective, BoA is right at the front of the pack alongside JPMorgan when compared to the other big four banks.

BoA’s 5Y average net margin is 27.61% which while 2% behind JPMorgan, beats both Wells Fargo and Citi by over 10%. The bank’s 5Y average ROA and ROE are 0.92% and 10.23% respectively which once again beat Wells and Citi by over 50% each.

The bank had a financial leverage ratio of 12.46x in FY22 which is second lowest among the big four banks which illustrates the more conservative and responsible approach to growth adopted by BoA post-2008.

Even from these basic operational performance metrics we can see that BoA is performing very well compared to its key rivals in the U.S. and global diversified banking industry.

2023 has been a difficult year for the banking industry as a whole with BoA not being immune to the headwinds faced in 2023.

While the banking sector was in turmoil in March, April and May of 2023 due to widespread fears of deposit outflows resulting in banks having to sell assets at losses, the fears of widespread contagion faded as the spring turned into summer.

Nonetheless, BoA’s FY23 quarterly reports have presented investors with a mixed bag of results.

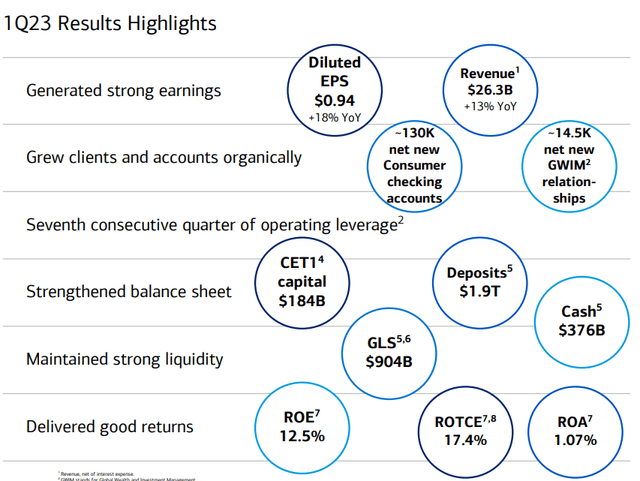

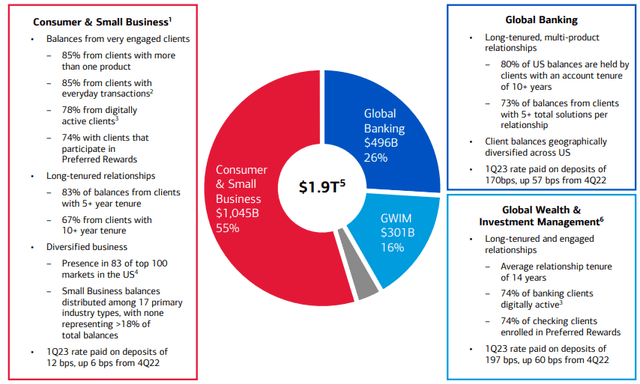

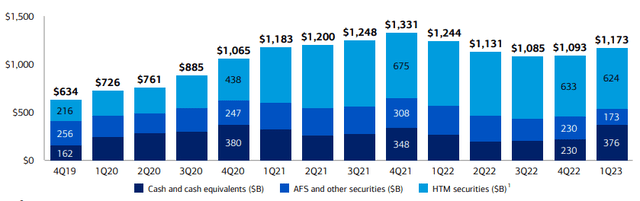

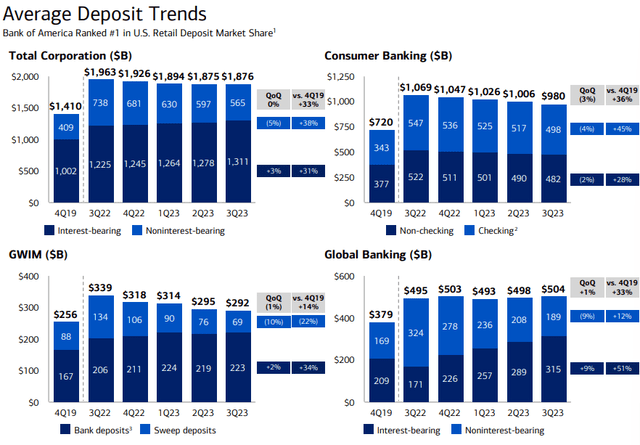

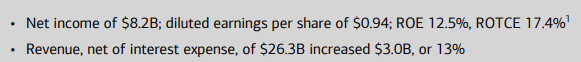

Q1 saw BoA grow revenues net of interest expense by 13% YoY with over 130,000 new consumer checking accounts opened and 14,500 GWIM relationships forged in the quarter. The bank maintained strong liquidity in the quarter despite the turmoil present in the industry with global liquidity sources (GLS) being over $903.5B.

GLS is the cash and high-quality, liquid, unencumbered securities, inclusive of U.S. government securities, U.S. agency securities, U.S. agency MBS, and a variety of non-U.S. government and supranational securities and other investment-grade securities that are readily available to meet funding requirements as they arise.

This fundamental strength amid a difficult macroeconomic environment for banks across the globe helped BoA maintain relatively high levels of investor and client confidence by soothing the growing yet unfounded fears of collapse.

BAC FY23 Q1 Report

Q1 also saw BoA generate meaningful ROTCE of 17.4% along with ROA and ROEs of 1.07% and 12.5% respectively.

Nonetheless, Q1 saw BoA see a $42B drop in deposits QoQ while the firm’s net reserve build fell 69% YoY to just $124MM. PCL fell 18% QoQ to $900M.

BoA’s overall profitability and stability is helped by their massively diversified set of deposit streams and strong excess deposits when compared to loans. Deposits in excess of loans actually increased by $10B QoQ to $1.17T.

Overall, Q1 was a positive quarter for BoA with the overall uncertainty surrounding the banking industry marring and souring investor sentiment. The continued outflow of deposits may not have been ideal, but overall had little effect on BoA’s fundamental stability and profitability.

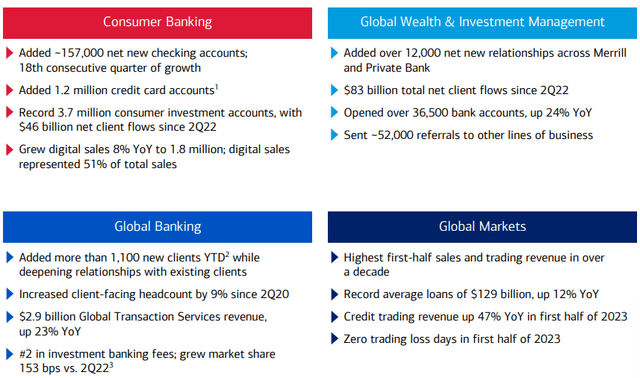

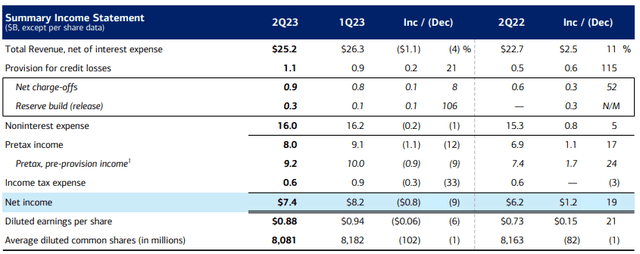

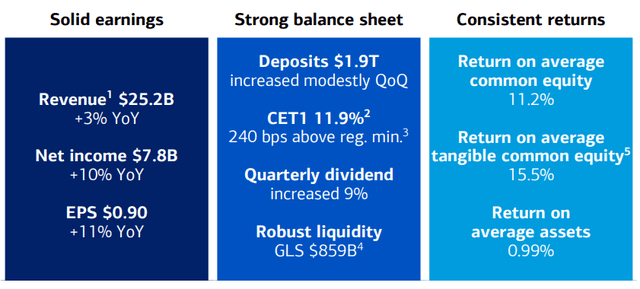

Q2 saw BoA continue to produce positive fiscal results with the bank seeing strong growth in net income, EPS and business segment growth.

BoA added 157,000 new consumer checking accounts along with over 1.2 million new credit card accounts in Q2. Total consumer banking revenues grew by $1.4B YoY (15%) thanks to increased NII driven by higher interest rates and loan balances.

The bank continued to excel in their GWIM segment with another 12,000 new relationships forged across their Merrill and Private Bank operations. However, total revenues fell 4% YoY due to lower average equity and fixed income market levels and decreased transactional volumes which decrease asset management and brokerage fees.

Global banking also saw over 1000 new clients added (YTD) with over $2.9B in global transaction services revenue (up 23% YoY). Global markets also saw solid revenue growth and a record average loan of $129B, up 12% YoY. Total revenues increased 29% YoY for Global Banking and 8% YoY for Global Markets.

Total revenue for BoA increased 11% YoY but fell 4% QoQ during Q2. Net income increased 19% YoY but once again, represented a 9% decrease QoQ.

Overall, BoA continued to produce solid growth across their business segments with the greater overall pressure being placed on consumer by the highly inflationary macroeconomic environment driving consumer deposits down along with loan volumes.

The most recent Q3 results showed some positive signs for BoA. Total revenue was flatline QoQ and up 3% YoY while PCL grew $0.1B QoQ. The bank’s net income increased by $0.4B (5%) QoQ.

NII of $14.4B increased $0.6B QoQ thanks to higher interest rates and loan growth. Noninterest income also grew by $51MM thanks to higher sales and trading revenue along with increased asset management fees from increased transactional volumes.

The consumer banking segment continued to see falling average deposits with a QoQ decrease of 3% to just $980. While these figures are still elevated compared to pre-pandemic levels of around $720, deposits have fallen YoY by 8.3%.

Given the sticky nature of inflation and the decrease in real disposable income available to consumers, it is unsurprising to see such continued weakness with deposit inflows.

The overall ability for BoA to maintain their NII relatively stable around the $14B-$15B level is impressive and suggests that the bank has been able to efficiently manage the difficult macroeconomic conditions are remain profitable throughout.

Crucially, BoA has managed to keep excellent liquidity throughout FY23 so far with Q3 seeing the bank maintain GLS of $859B with overall average deposits being relatively flat at $1.88T.

I believe that the wide economic moat discussed earlier is in action helping the firm to earn outsized returns compared to their competition with recent results illustrating just how diversified and well operated BoA is.

Seeking Alpha | BAC | Profitability

Seeking Alpha’s Quant calculates an “A+” profitability rating for Bank of America which I believe to be an accurate relative representation of BoA’s fiscal performance.

Moody’s credit ratings agency affirmed a reasonable a2 credit rating for Bank of America’s baseline credit assessment and upgraded their LT issuer rating to Aa1. The outlook remains stable.

Moody’s classifies “a2” ratings as being of “upper-medium grade” and classifies “Aa1” rating as being of high-grade investment quality.

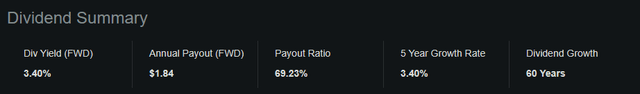

Seeking Alpha | BAC | Dividend

Bank of America pays an impressive dividend with a current FWD dividend yield of 3.77%. The firm’s 9 year dividend growth streak is also impressive and once again suggests that BoA has adopted a long-term focused management style.

The firm’s FWD annual payout is expected to be $0.96 with a payout ratio of 25.21%. The 5Y growth rate is 12.03% which is very healthy indeed.

BoA goes ex-dividend on the 11/30/2023 with the payout date being 12/29/2023.

I believe the nice dividend paid out by BoA should sooth investors and help ensure overall returns from owning shares are reasonable despite the recent drop in share prices.

Valuation

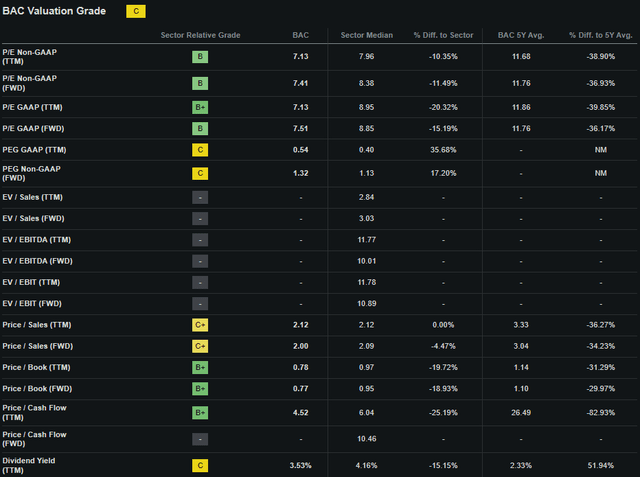

Seeking Alpha | BAC | Valuation

Seeking Alpha’s Quant assigns Bank of America with a “C” Valuation grade. I believe this is an excessively pessimistic representation of the value present within Bank of America stock and perfectly illustrates how even very accurate quant ratings can sometimes poorly represent the real value present in a company’s shares.

The firm currently trades at a P/E GAAP FWD ratio of 7.51x. This represents a huge 36% decrease in the firm’s P/E ratio compared to their running 5Y average.

BoA P/CF TTM of just 4.52x is quite low and once again a whopping 30% lower than their 5Y running average. Their FWD Price/Book of just 0.77x is attractive in my opinion especially when considering the firm’s EV/Sales FWD of just 5.98.

Considering these basic valuation metrics alone I believe BoA should already start to appear undervalued given the stock’s historic averages. While the “C” letter grade assigned by the quant is more ambiguous, we must remember that this grading system is relative to BoA’s peers.

Seeking Alpha | BAC | Advanced Chart

From an absolute perspective, BoA shares are trading at a significant discount relative to previous valuations with current share prices of around $25.00 representing a five-year low for the stock.

However, when compared to the 59% growth seen in the S&P 500 tracking SPY index over the past five years, BoA has been soundly outperformed by the U.S. market index as a whole by over 60%.

I think this underperformance – despite the nice dividend paid out by the bank – has begun to test the patience of some investors who probably understandably feel that the stock has not performed as expected.

When mixed in with the turmoil witnessed within the U.S. banking industry earlier in 2023, it is understandable that many investors have decided to bet against the bank.

While the relative valuation provided by simple metrics and ratios along with the absolute comparison allow for a basic understanding of the value present in Bank of America shares to be obtained, a quantitative approach to valuing the stock is essential.

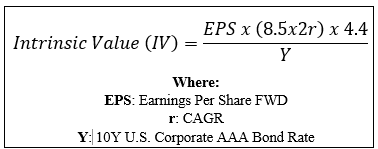

The Value Corner

By utilizing The Value Corner’s specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using BoA’s current share price of $25.47, an estimated 2024 EPS of $3.30, a realistic “r” value of 0.05 (5%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 5.13x, I derive a base-case IV of $51.00. This represents a massive 52% undervaluation in shares.

When using a more pessimistic CAGR value for r of 0.03 (3%) to reflect a scenario where a globally spanning recession causes BoA’s deposit inflows to drop along with some decrease in noninterest related incomes, shares are still valued at around $41.00 representing a 38% undervaluation in shares.

Considering the valuation metrics, absolute valuation and intrinsic value calculation, I believe that Bank of America is soundly trading in what can only be considered to be deep value territory.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. The general uncertainty regarding the future direction of both the U.S. and global markets as a whole means predicting the direction for most stocks from a qualitative side is essentially impossible.

Tax harvesting could see further downward pressure exerted on BoA stock as investors seek to maximize the tax efficiency of their portfolios for 2023.

In the long-term (2-10 years), I see Bank of America continuing to benefit from a tangible competitive advantage thanks to the significant moatiness generated by their diverse business segments.

Their massive portfolio of services and products helps create multiple operational synergies while their huge scale assists in maximizing efficiency through minimizing the relative size of many fixed costs.

Risks Facing Bank of America

Bank of America faces significant risk from both regulatory changes and the threat of macroeconomic conditions impacting consumer and corporate fiscal habits.

Since 2008, BoA has been subject to a huge number of fines and penalties the company has had to pay as a result of their loose capital allocation strategies pre-financial crisis. While this has weighed on their overall turnaround, I believe the majority of these fines are behind the bank.

However, while the massive scale and diverse set of operations present at BoA provide the bank with significant moatiness, BoA must deal with the elevated compliance costs that are associated with such a broad operation.

I believe sudden changes to the regulatory environment both domestically within the U.S. and in global markets could result in BoA having to spend significant amounts of cash on compliance and potentially, on any fines related to the lack thereof.

BoA also faces a tangible risk from the prevailing macroeconomic conditions as essentially all their revenue streams are directly tied to the greater performance of the U.S. economy.

A recessionary period combined with unfavorable phases of interest-rate cycles could expose the bank to worsening credit ratings and increasing levels of nonperforming loans.

While I believe the newfound sense of responsibility with regards to capital allocation strategies should help the bank avoid a repeat of 2008, BoA does face the risk of rapidly deteriorating lines of credit decreasing the bank’s profitability and placing a strain on liquidity.

From an ESG perspective, BoA faces no tangible threats that could place a strain on their reputation or fiscal situation.

BAC FY22 Annual Report | ESG

The bank is actively playing a role in sustainable finance with the issuance of ESG-themed bonds that promote equality and environmental sustainability. BoA has set out to achieve net zero GHG emissions in their financing, operations and supply chain processes before 2050.

I believe the overall lack of major environmental, societal or governance concerns would make Bank of America an excellent pick for a more ESG conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG and sustainability research before investing if these matters are of concern to you.

Summary

Bank of America is one of the most iconic and longstanding banks currently operating in the U.S. Their extensive history has largely been marred by the lack of capital restraint pre-2008 and the ensuing turmoil that surrounded the company moving into the 2010s.

Recent deposit outflows accompanied by an overall bearish macroeconomic environment and worsened by the fears generated by the banking crisis in early 2023 have resulted in investor and public opinions surrounding the bank souring significantly.

This has resulted in a massive share price deterioration which given BoA’s massive liquidity, smart capital allocation and relatively consistent NII, appears excessive. I believe a potential 52% undervaluation may be present in shares of the banking giant.

When combined with a healthy dividend, I believe a great long-term deep value opportunity exists in shares of BoA.

Therefore, I rate the stock a Strong Buy and have initiated a position in the bank which currently accounts for approximately 28% of my total portfolio value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.