Summary:

- Bank of America Corporation stock has underperformed its peers and JPMorgan Chase since late July, despite posting strong Q2 performance.

- The market has derated Bank of America downward to reflect higher execution risks as interest rate tailwinds are expected to peak.

- The risks of higher capital requirements likely worried investors, coupled with its HTM securities in its balance sheet.

- However, Bank of America is cheap relative to its 10Y average, as investors reflected on these headwinds.

- I assessed dip buyers have started accumulating. Buyers who didn’t manage to buy in March are afforded another fantastic opportunity they shouldn’t miss.

Brandon Bell

Investors in Bank of America Corporation (NYSE:BAC) or BofA who have been anticipating a sharp recovery from the malaise it suffered in the first half of 2023 have likely been disappointed. Likewise, I have been frustrated with the market’s perspective on BAC, as it topped out in late July after the release of its second-quarter or FQ2 earnings release.

The company’s FQ2 release in July was robust, as it outperformed analysts’ estimates on its EPS metric. Its full-year NII guidance of $57B was also positive, parlaying the Fed’s rapid rate hikes into its earnings. Despite that, BAC has surprisingly underperformed its financial sector (XLF) peers and JPMorgan Chase (JPM) stock since then as investors rotated out. As such, BAC investors are right to question whether buyers are still convinced about its ability to turn the corner, as it trades well below its 10Y average.

BAC last traded at a forward adjusted P/E of 9.1x, well below its 10Y average of 11.8x. However, it aligns with its sector peers’ median of 9.1x. Seeking Alpha Quant’s “C” valuation grade corroborates the valuation assessment, indicating no relative dislocation to its peers. As such, I believe it’s clear that the market has derated BAC downward to reflect execution risks, as we are potentially close to the peak of its rate hikes.

Therefore, the risks to BofA’s NII growth tailwinds are expected to increase. Management highlighted in a recent conference that it had anticipated the impact in its current year guidance, maintaining its outlook. In addition, I believe the market is likely pricing further risks on the additional capital requirements, which could further hinder its capital allocation activities to boost shareholder value.

Furthermore, the market is likely still concerned with its HTM securities, although management clarified it doesn’t anticipate an impact on its liquidity. Notwithstanding the bank’s assurances, I believe it’s justified for investors to assume higher execution risks, as they anticipate a tighter regulatory oversight on capital requirements. Such concerns were also raised by JPMorgan CEO Jamie Dimon recently, as he cautioned about the hit to banks’ relative competitiveness.

In addition, BofA also highlighted normalization in the commercial space as businesses pull back on borrowing. However, the U.S. consumer remains resilient, even though consumers are expected to continue drawing down their excess reserves. As such, I believe the U.S. economy is well-primed to avoid a hard landing, even though BAC appears priced for such an outcome.

Notwithstanding my optimism, I believe the market is right to assume higher execution risks on BofA against its peers. Coupled with its HTM portfolio and the increasing possibility of higher capital requirements, investors likely rotated out, taking some risks off the table after a sharp recovery through its July 2023 highs. However, BAC holders need to ask whether the current levels reflect an attractive risk/reward upside in view of its relatively attractive valuation.

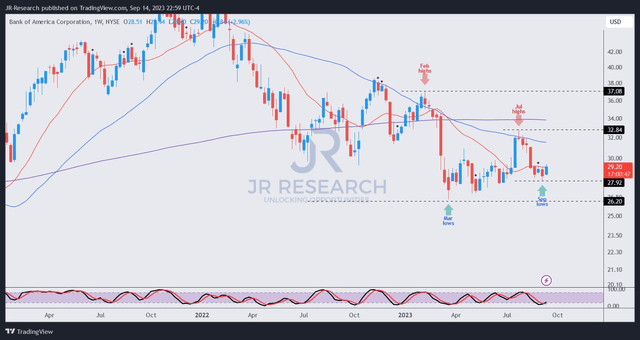

BAC price chart (weekly) (TradingView)

As seen above, dip buyers held its March 2023 lows firmly before momentum investors rushed in, leading to a surge toward its July 2023 highs ($33 level).

However, a violent rotation occurred as it topped out, likely catching these investors by surprise, as BAC fell nearly 15% through its September lows ($28 level).

Despite the sharp selloff, dip buyers were assessed to have returned, undergirding a consolidation zone over the past four weeks. As such, the risk/reward profile for buying more shares makes sense, leveraging the recent dip buying momentum. Furthermore, the higher low market structure corroborates my analysis that BAC’s worst selloff in March is likely over, affording more confidence for investors to add further.

As such, I believe investors still light on their BAC exposure should consider capitalizing on the current levels to buy more shares before the momentum investors return.

Rating: Upgrade to Strong Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC, XLF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!