Summary:

- Speculation and misunderstanding about “hold to maturity” issues at Bank of America have led to market miscalculations and unnecessary fears.

- Hold-to-maturity debt securities at the bank have “disappearing” losses, creating an investment opportunity for those who understand the economics of banking.

- The market revalued debt securities as the outlook for Federal Reserve interest rate decreases improved, reducing paper losses and increasing investor confidence.

- Before any one area of loss is a concern, the whole business needs to be evaluated as a diversified entity often has offsetting gains and losses in the various businesses.

- The bank still has recovery potential and growth ahead.

J. Michael Jones

There has been a lot of speculation about “hold to maturity” issues at Bank of America (NYSE:BAC) that have created a lot of probably unnecessary fears. The sheer amount of misunderstanding about this part of the industry has led to a lot of market miscalculations as to the value of the common (and really any securities attached to the bank). The debt securities that are matched now have “disappearing” losses. This creates an investing opportunity for investors who understand the “Money And Banking” part of economics very well, even though a rally began when the market started to expect some interest rate declines.

Banking is all about matching. Therefore, whatever liability securities (to the bank) cost, the other side has to bring in more money or the transaction does not happen. There are actually variations on this theme in several industries. So, it is not that uncommon an occurrence. Nonetheless, there have been plenty of “what if” scenarios that have been proposed without really much of a chance of becoming reality. It is probably time to explore the realities of the situation with the emotions left outside the front door.

Debt Securities

One of the biggest conversation pieces among investors is a discussion of which “paper losses” are real losses. The answer is that since banks hold to maturity, then as long as anyone assumes a going concern, then none of the securities that are matched in a transaction will have to realize those paper losses.

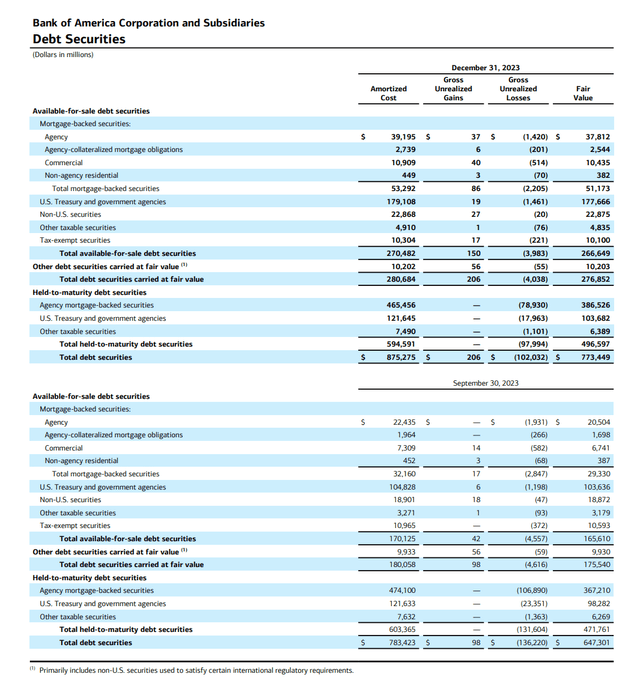

Bank Of America Debt Securities Detail (Bank Of America Fourth Quarter 2023, Supplemental Materials Presentation)

As shown above, a significant chunk of the $136 million of paper losses on the debt securities shown in the third quarter are now gone. This happened because the market revalued those securities as the outlook for Federal Reserve interest rate decreases in the coming year improved. Fellow bank JPMorgan Chase (JPM) mentioned during the third quarter conference call that they had put roughly 6 interest rate cuts into their original forecast.

Of course, the interest rate outlook is often updated at least monthly by the Federal Reserve itself. Probably the key idea is that interest rates are now expected to decline. If there is a pause, then by the time that happens, time will have moved forward to renew any more interest rate declines that were “missed”. It would likely take a major event for the market to abandon any hope of interest rate declines at this point.

Through all this, banking attracts deposits (or some form of liabilities) which is the cost of money to invest. However, management will not attract those deposits if they cannot earn income with it. The balance sheet summarizes the situation. It does not show the details of each transaction. For a company of this size, that would be far too much detail to show every matching transaction. Therefore, investors cannot tell by simply looking at the balance sheet how the matching transactions are doing. The averages that make up the balance sheet may or may not be misleading as to how things were “put together”.

More to the point, the remaining securities showing that $102 million loss are not going to be sold at a loss as far as an ongoing business strategy. There is absolutely no reason for that to happen. Anyone worried about the bank itself needs to review the stress test and other materials that show what the bank intends to do should the need arise for cash. This is one of the financially stronger banks around. There would be a lot more trouble in the banking system before Bank Of America is a worry.

The Deal Is Unwinding

Management does show some of the details of the matching transaction.

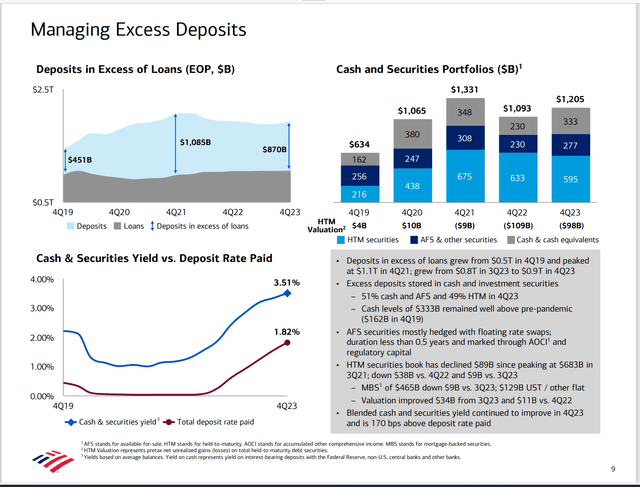

Bank Of America Strategy For Excess Deposits (Bank Of America Fourth Quarter 2023, Corporate Presentation)

An entity the size of Bank of America has professionals that project various outcomes. Therefore, management often has a lot of information about “best guesses” when it comes to what many think of as random inflows and outflows.

The result is what is shown above. The maintenance of the spread between the cost and the income is what is important. A large bank like this one is incredibly good at doing just that.

The key is that the last article had some detail on the conference call about the assumptions going into the hold to maturity securities. This quarter has an update shown above, with more details throughout the quarterly presentation and conference call as well. The main idea would be that this bank is large enough to adjust the matching funds if that needs to happen because an assumption changes materially. Right now, the slide above shows that is not really a necessary action.

Materiality

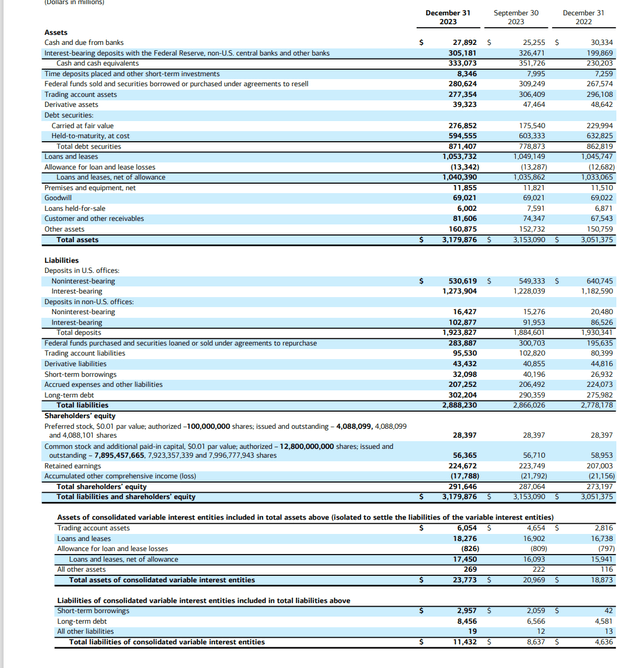

The other consideration is that the hold-to-maturity securities are not really all that material when reviewing the whole balance sheet.

Bank Of America Consolidated Balance Sheet Fourth Quarter 2023 Report (Bank Of America Supplemental Information Fourth Quarter 2023)

Before any investor worries about the hold to maturity security losses, there is far more analysis that needs to be done before any losses need to be reported separately. A balance sheet as big as the one shown above can easily have business elsewhere that offsets what is going on with those securities.

Not only that, but the bank has non-banking businesses as well and is well-diversified for a bank in the banking sector. It would take “trouble” in a number of material areas before a loss in one area is so significant as to require reporting.

Again, assuming a going concern, offsetting losses and gains (with usually more gains than losses) are the order of the day. Many of those would only come into play if the “hold-to-maturity” assumptions fail on a fairly large scale. For money center banks like this one, that would be quite an event.

Key Idea

Focusing on one loss and maintaining that loss is material is an incomplete analysis. Nonetheless, once someone shows an area of concern, the investor needs to really examine the whole balance sheet for a materiality evaluation of the problem at hand. It is not unusual for a diversified company to have offsetting issues on a continuing and ongoing basis. That happens to be the reason for the diversification in the first place.

However, diversification only works if each part pulls its own financial weight. That evaluation is up to the investor. In this case, the bank has some very obvious cash-generating assets like the Merrill Lynch division. But there is also the sale of home loans while retaining servicing rights, servicing car loans, and more. The bank may or may not engage in these and others at any given time.

This puts a money center bank “way ahead” of a local smaller or even regional bank that tends to be less diversified and hence far more dependent upon one source of income. This bank is in many industries and many geographical areas. Therefore, it would take an accumulation of a lot of problems before that “hold-to-maturity” is not a valid assumption.

The bank remains a strong buy because it still appears that the matching for the hold to maturity securities largely applies and largely remains profitable. The deal as management has mentioned is now in the unwinding phase. But management likely has reasons to replace those securities with yet another deal using the same type of securities.

The bank is likely to appeal to growth and income investors as part of a basket of money center banks. The investor can then decide whether to increase the basket risk with a smaller bank or two (or more) depending upon the investor.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to do their own research that includes the review all company documents, and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.