Summary:

- Bank of America is one of the cheapest and most stable SIBs, with a diverse client base and a well-covered dividend.

- The banking sector has seen a rebound, with Bank of America up 13% in total return since my first May 11th article, but still trading at a discount.

- Bank of America’s net interest income has been increasing, thanks to its deposit base size and client diversification.

Justin Sullivan

Diversify your clients

I’d like to reiterate my previous article’s buy rating for Bank of America (NYSE:BAC) and examine why Warren Buffett and Charlie Munger still hold the company as the top bank holding at Berkshire Hathaway (BRK.B)(BRK.A). They have a great diversification of clients and account types, with under 50% of the bank’s accounts being FDIC uninsured.

Many articles refer to a bank’s paper losses for hold-to-maturity securities as the prime risk and key factor of mismanagement. I would argue that many of these low-yielding assets have the safest payback prospects and are very conservative. Time to get to maturity returns the asset values to par. The key is time. If your bank is focused on large accounts that can move with a few big clicks of a whale, then time may not be on your friend.

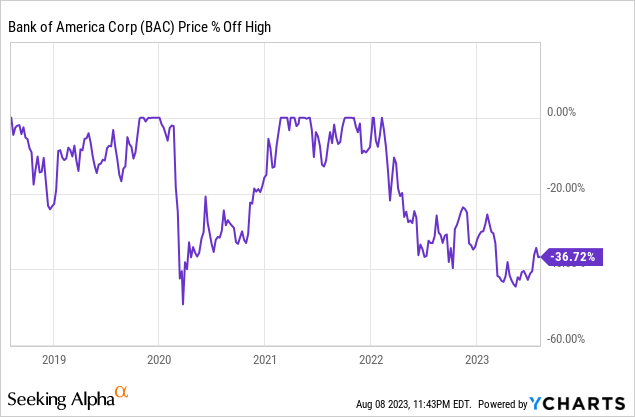

The chart

Still nearly 40% off the 5-year highs, the entire banking sector has several deals. It is no longer an “anti-bubble” of hate as I referred to it in my previous article. Bank of America is up about 13% in total return since May 11th. Even so, it remains a cheap deal for a significantly important bank with a nice, well-covered dividend.

What they do

This is one of the nation’s premier full-service banks. They serve a variety of individuals, small and large businesses as well as serving governments with banking products and liquidity, operating nearly 4,000 physical branches. They are one of the 7 owners of Zelle and own an investment management arm under Merrill Lynch.

Valuation model

The most typical Graham Number stocks are found in financials and insurance. These Buffett and Munger favorites grow pretty steadily with inflation and trade at fair values of assets and earnings. The most stable of this lot that both Munger and Buffett support as evidenced by both the Daily Journal Company (DJCO) and Berkshire Hathaway 13 F is Bank of America. Here is Bank of America’s inputs for the Graham Number, or the price at which price-to-earnings X price-to-book does not exceed 22.5:

- Forward EPS 2023 $3.39.

- Book value per share $23.37.

- Square root of 22.5 X $3.39 X $23.37 = $42.22.

- 26% discount to Graham Number.

While they are not the only undervalued bank in this metric, they are a great combination of both size of deposits combined with a diversity of client base. They have been criticized previously for holding too many low-yielding, US Treasuries and mortgages on their balance sheet. However, I would argue that the key to not being forced to liquidate hold-to-maturity investments is to have a client base with many, smaller accounts rather than larger ones.

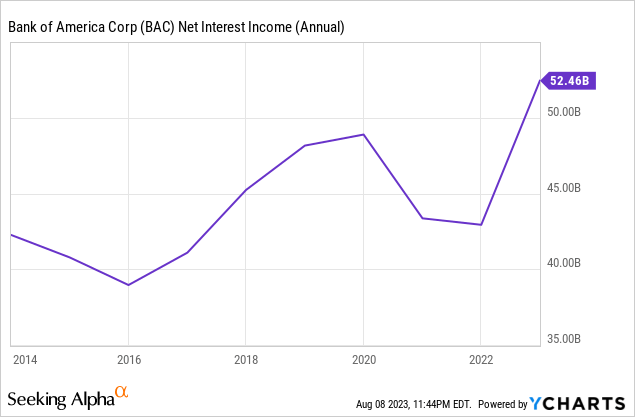

Net interest income

During covid, net interest income dipped with the massive rate cuts but was still relative to 2018 levels due to increased deposits since that time. Attracting deposits usurps return on deposits in the banking sector. As long as you’re making more than you’re paying for the capital you’ll do all right. Be in the most conservative assets and make sure you eventually get the principal back.

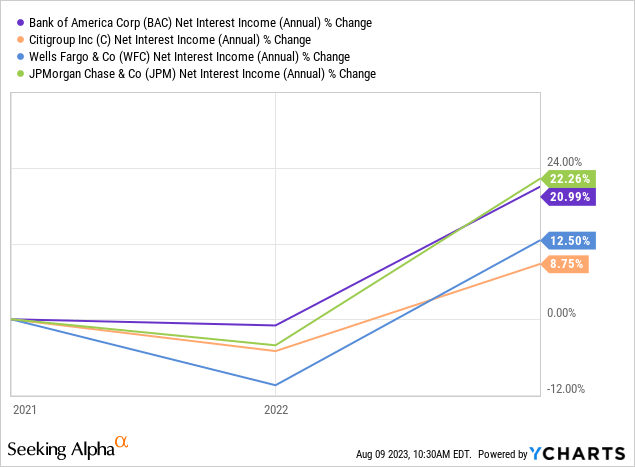

Although Bank of America does not have the highest net interest margins, they are still neck and neck with JPMorgan (JPM) for increases in net interest income. Again, boiling down to deposit base size.

Taking a close look at net interest income trends, the trajectory has been upward even as large banks lose deposits. The deposits, as I emphasized in my previous article are not always lost or transferred. Often it’s a case of “cash sorting” where depositors move their funds from cash to money markets. For most non-full-service banks without an investment arm, the cash could be gone to another brokerage. Bank of America has Merrill Lynch which offers a full array of BlackRock (BLK) money market funds.

As those funds spin off cash, oftentimes investors will put the interest payments back into liquid accounts to be used for life expenses. So even though the cash is sorted out of usable funds for the bank, the money market interest gets sent back to liquid accounts unless reinvested.

Bank of America and Merrill Lynch also have a competitive product that is FDIC-insured called Merrill Preferred Deposit, currently yielding 5.02%. The rates on that savings account product move with the FED rates and are very competitive with money markets. They want to make sure depositors in that class are going to stick around and the minimum to start is $100,000. Eventually, when rates go the other way, it will be seamless for clients to move funds back from money markets to cash and or stocks.

Net interest margins

All numbers in millions courtesy of Seeking Alpha.

- Latest report Total Deposits = 1,872,209.

- Current net interest margin= 57,052/1,872,209 = 3.04%.

Net interest margin is up slightly from my last article where the margin was at 2.89%. This shows progress in deploying cash from operations and or new deposits in higher-yielding investments.

Client diversification

Client diversification is what makes Bank of America one of the best-run banks. Having only 46% of your deposits in accounts exceeding the FDIC-insured limit means that your client base is wide and not singularly focused.

The top 3 banks on the list, Chase, Wells Fargo (WFC), and Bank of America give the banks the most community coverage to ensure they are covering the entire swath of American Society, from the under to over-served. To some, before, the expansion of physical banking might seem like a waste of funds. Banking is a unique business where increased revenue does not necessarily mean an increased workforce. Numbers on a screen increase as rates rise and deposits balloon. Should you, the bank, find yourself with more assets and revenue due to a higher net worth client base, you don’t need any extra employees to run your Excel sheets. They just have to be able to count higher.

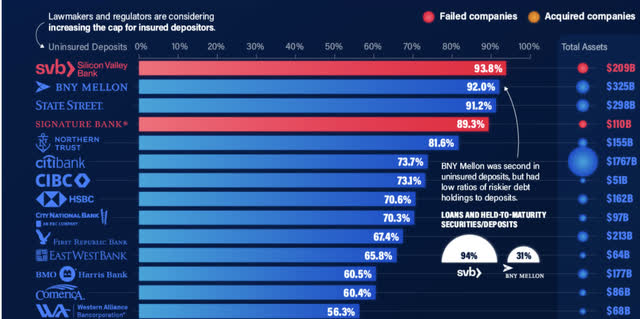

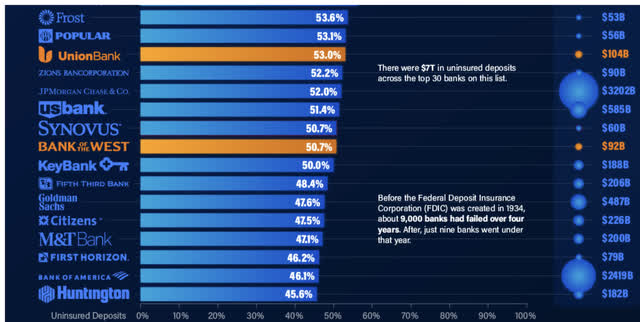

Below is a great infographic from the visual capitalist. These were circulating widely when Silicon Valley Bank went under, but have since been discarded in lieu of HTM evaluations. Enjoy

The top

The bottom

As we can see, Bank of America sits at the bottom of the list. In fact in a more recent, non-visual analysis by S&P Global, both Wells Fargo and Bank of America dropped off the list as their uninsured deposits receded even further.

A fellow friend and analyst pointed out that both State Street (STT) and Bank of New York Mellon (BK), function as the largest custodian banks in the business. Northern Trust (NTRS) as well, holding customers securities and cash positions in custodian and usually for other institutions rather than themselves. This makes them less relevant in this regard to other full service banks like Citigroup (C) or HSBC (HSBC). Even though Citi and HSBC are both in the custodian business as well, they are also commonly used for checking and savings accounts. Where the division between HNWI client accounts and custodian accounts lies in the calculation could be hard to discern.

The dividend and free cash flow

Bank of America has a low 25.29% payout ratio for the dividend. Drilling down on free cash flow per share at $5.53 TTM, we’re looking at a 17% payout. With a high 5-year growth rate, this dividend has room to run.

Catalysts

If any more large pieces of the banking sector fall, more deposits should run the way of the largest of the large banks. Getting through year one of what everyone is worried about, namely the office building debt maturities in CRE that come due in 2024-2025, will show who has the highest exposure to the worst markets. If it proves that Bank of America is as conservative with its commercial loans as they are with its client diversification, this should be a shining jewel of the banking sector. Having seen the high standard that Bank of America has for residential mortgage applications, I would assume their commercial division is similarly prudent.

Risks

The inverse of the catalysts. It is too hard and too early to say who has the most difficulty to manage a CRE portfolio. Residential real estate is also a question as cash-out refinancing and HELOCs seem to have some evidence of an uptick in the face of logic.

To put it bluntly, if you are refinancing your 3-4% loan into a 7-8% one, you are either in a cash crunch or have a deal that will beat that hurdle rate significantly for which you need the funds. My inkling is that it’s probably a cash crunch due to life expenses. Banks will have to wade these waters carefully to not give out too much of the home equity and be left holding the bag. If refinancing levels keep ticking up, this is a risk to the entire sector even if it yields higher net interest income in the interim.

Conclusion

Bank of America and Wells Fargo are my favorite two banks. JPMorgan is excellent as well but trades at a premium valuation to the two and has more accounts over $250,000. Citi is the cheapest, but also the highest on the list of SIBs with around 70% of deposits in accounts over $250,000.

According to Warren Buffett expert Robert Hagstrom, the most important management tenets Warren Buffett looks for are the following:

Management should be rational.

Management should be candid with shareholders.

Management should resist the institutional imperative.

As Bank of America continues to be Berkshire Hathaway’s second-largest holding at nearly $30 billion, they must feel that management has succeeded to some degree better than other banks when it comes to the above three. In the case of the institutional imperative, margin chasing and attracting high-net-worth clients may be the most rational thing that Bank of America has avoided. CEO Brian Moynihan is certainly candid. Bank of America is still a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC, WFC, SPY, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.