Summary:

- Bank of America offers competitive yields on preferred shares, with the 6% yielding fixed preferred share being a better option for income investors.

- Despite facing challenges with rising interest rates, Bank of America has navigated its earnings well and maintained stability in net interest margin.

- Investors should be cautious of risks such as loan losses and consider fixed rate preferred shares over floating rate options in anticipation of interest rate cuts.

ProArtWork

Introduction

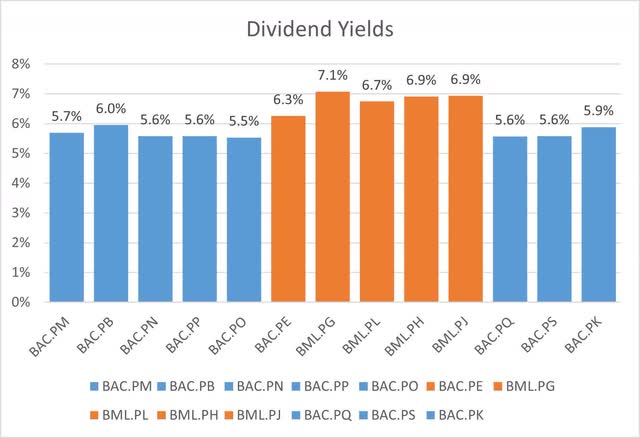

The prospect of interest rate declines later this year has left income investors searching for yield. Among big banks, there are several preferred shares that are offering competitive yields. Bank of America, one of the country’s largest banks, offers 13 different preferred shares, with yields of up to 7%. In the past, I’ve encouraged investors to reach for yield, even with Bank of America when they offered a 6.55% coupon bond. Unfortunately, the higher yield is not always better and after looking at the current options, I believe the 6% yielding preferred share (NYSE:BAC.PR.B) is a better option for income investors.

Bank of America Financial Results

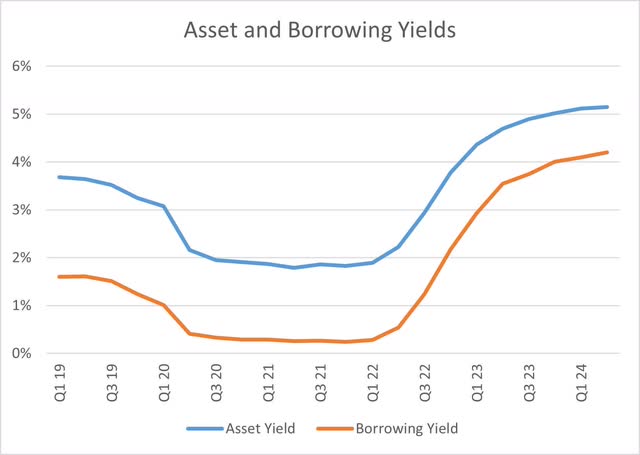

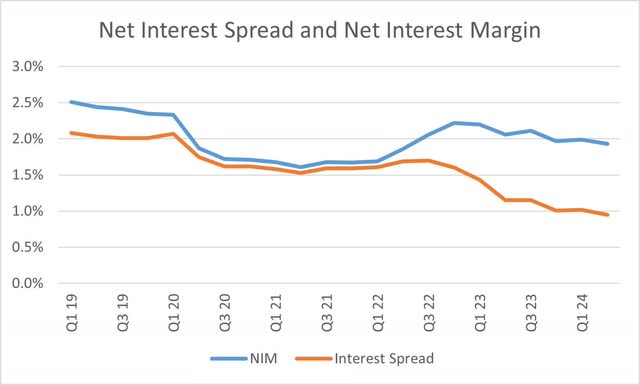

Despite being a “too big to fail” bank, Bank of America is facing the same challenges as other banks with rising interest rates. As rates have risen, Bank of America was able to increase its asset yield from under 2% to over 5%. Unfortunately, the bank’s borrowing yields have surged from under 0.5% to over 4%. The drop in net interest spread to under 1% may be alarming to investors but the weight of assets to liabilities is not considered in this measurement. A broader measure, net interest margin (NIM), shows that Bank of America has been more stable in the face of higher rates as the NIM is still above the pandemic era levels.

Bank Financials Bank Financials

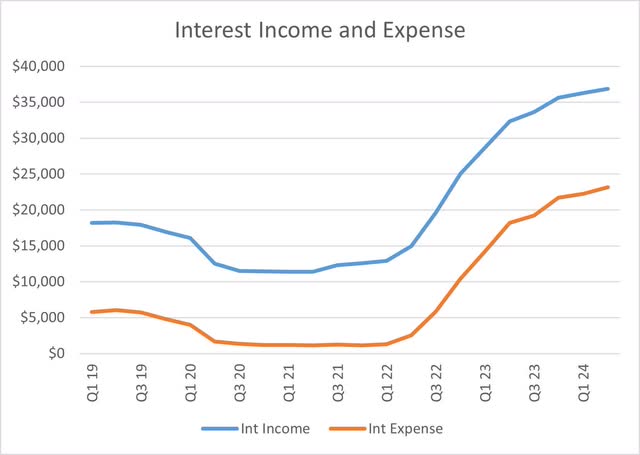

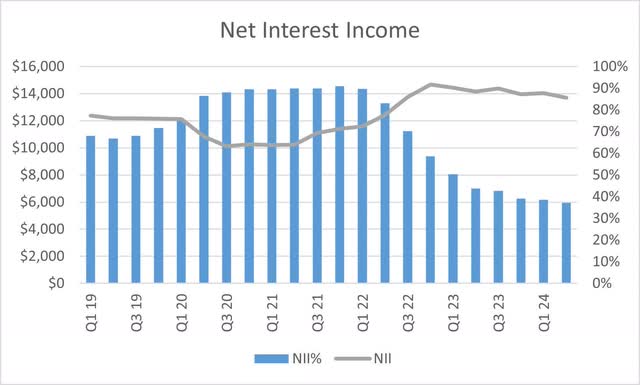

When it comes to profitability, Bank of America has navigated its earnings well in the face of higher interest rates. As rates have risen, both interest income and interest expenses have risen, but the trend in net interest income (interest income less interest expense) is reassuring. Despite being down since the fourth quarter of 2022, net interest income is only marginally lower and is still well above both pre-pandemic and pandemic levels.

Bank Financials Bank Financials

A Look at Loans and Deposits

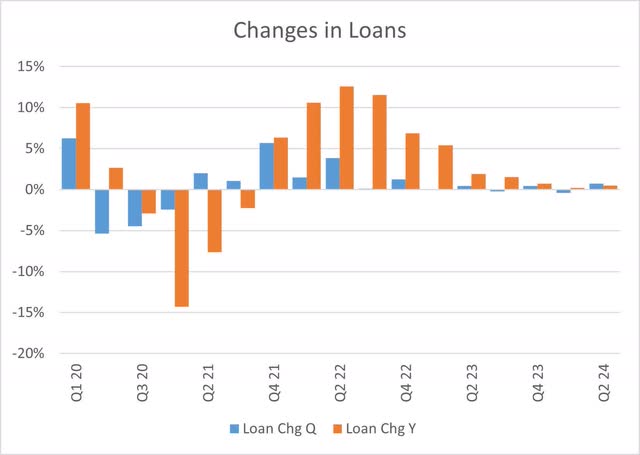

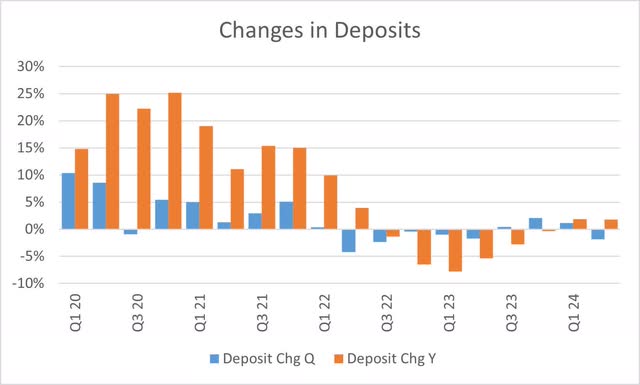

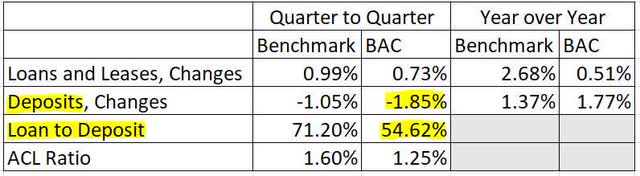

On the balance sheet side, Bank of America’s loan growth edged up by 0.7% in the second quarter. Loan growth during high interest rates is crucial to increasing interest revenues and net interest income. Surprisingly, deposits decreased by nearly 2% during the quarter, 80 basis points lower than the industry average. The deposit drop is contradictory to the assumption investors had been led to believe that uninsured deposits were fleeing regional banks for too big to fail banks.

Bank Financials Bank Financials

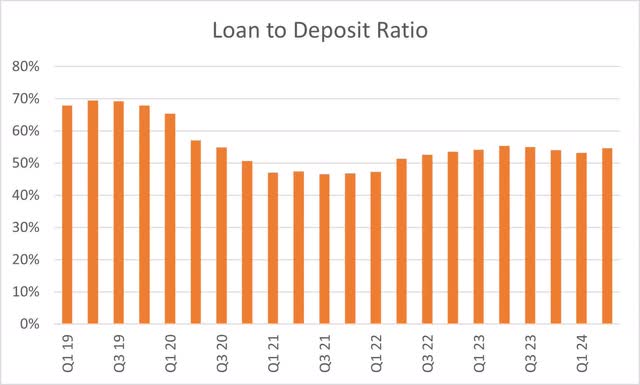

When loans rise and deposits fall, banks may need to tap into external financing to fund loan demand. A good gauge for determining future external financing needs is the loan to deposit ratio. While Bank of America’s loan to deposit ratio has gone up and is above the pandemic levels, it is still at a modest 55%, which is well below the industry averages and indicative of adequate deposits to fund loan demand.

Bank Financials Bank Financials & Federal Reserve

Risks to Bank of America

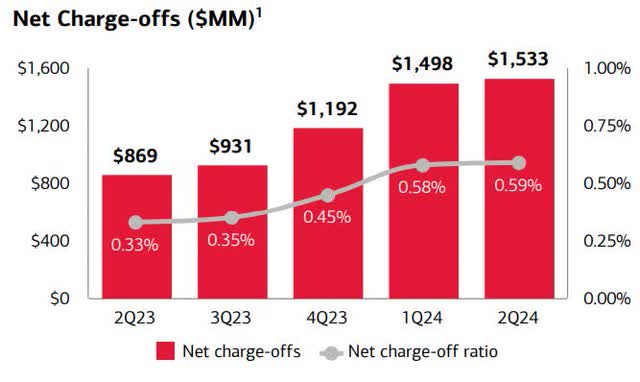

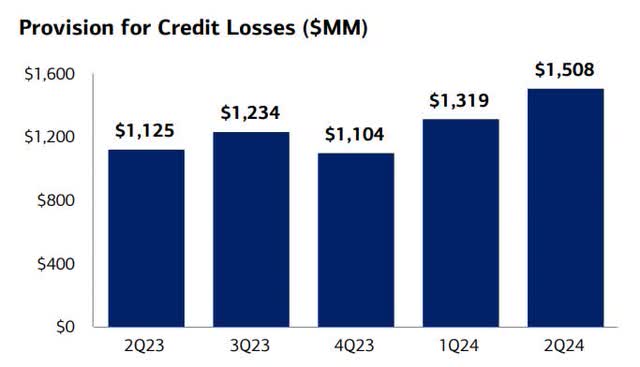

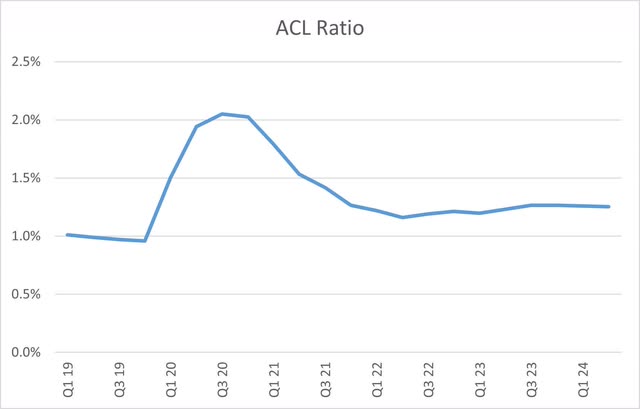

While Bank of America has an implied government backstop, investors should be mindful of the risks that can harm its common and preferred share value. The biggest concern I have for Bank of America is their ability to contain loan losses. In one-year, net charge offs have grown from $869 million to over $1.5 billion and now exceed the provision for loan losses. The allowance for credit losses stands 35 basis points below the commercial bank average at 1.25%. At some point, Bank of America will need to set aside more reserve funds for credit losses, and in doing so, will impair its earnings.

Earnings Presentation Earnings Presentation Bank Financials

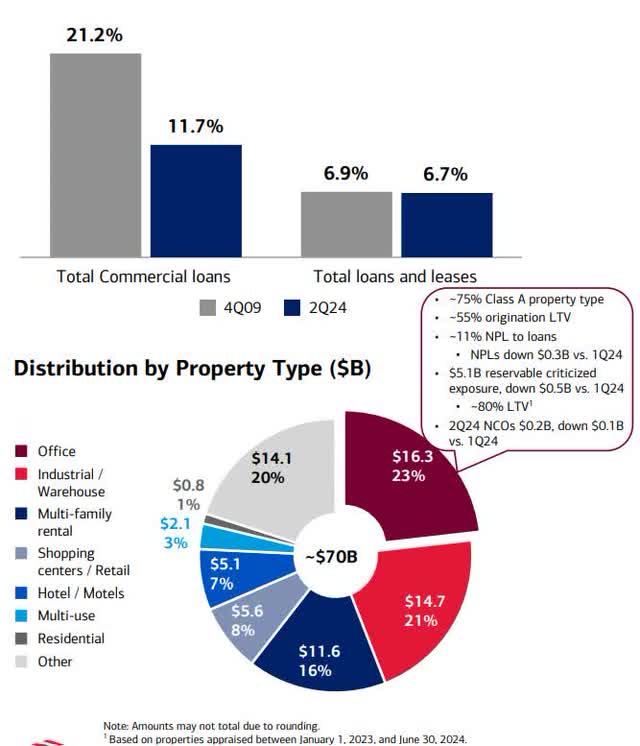

Fortunately, it seems the bank is not overly exposed to commercial real estate, which is a leading area of loan performance concern amongst investors. As it stands, CRE is composed of less than 7% of total loans with office comprising of 23% of total CRE exposure. While the bank appears to be well diversified in its loans, investors should continue to carefully monitor loan performance.

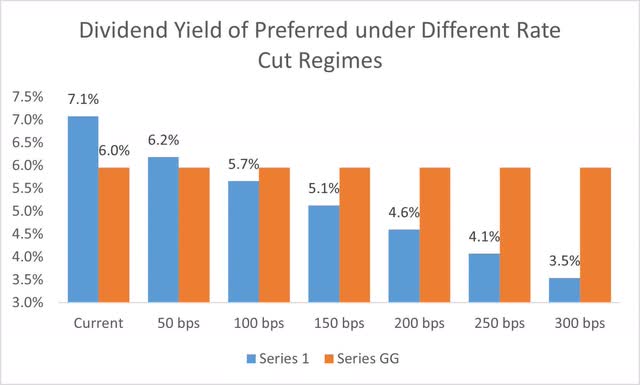

Why Not a 7% Preferred Dividend

While the risks to Bank of America are highly unlikely to impair its preferred share dividends, investors need to understand the dynamics behind the offerings before making their selection. The five highest yielding preferred shares are all currently floating, meaning their dividends are subject to change quarter to quarter depending on interest rates. With interest rate cuts likely in the near-term, these floating yield preferred shares will see their dividends decline to below their fixed rate peers. Even the highest yielding preferred share (BML.PG) falls below BAC.PB and many of the fixed preferred shares after 150 basis points of rate cuts. It does not take much monetary easing for the floating rate preferred shares to be impaired.

Conclusion

We are on the cusp of monetary easing and lower interest rates. Should the landing be harder than expected, investors can expect the Federal Reserve to cut interest rates at a quicker pace. That’s not the time to be holding Bank of America floating yield preferred shares. The 6% yielding Series GG and the 5.9% yielding Series HH (NYSE:BAC.PR.K) are the best two fixed payment preferred share options. While the highest yielding fixed preferred shares are callable, we are farther away (from a rate cut perspective) to rates that would give Bank of America an attractive refinancing point versus the floating yields providing less income. Therefore, I’m recommending income investors avoid the floating preferred shares of Bank of America in favor of the highest yielding fixed rate alternatives.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.