Summary:

- BofA reported strong Q3 2023 results, but also revealed losses in the bank’s HTM portfolio worth $131 billion.

- While I do earnings headwind as a consequence of the HTM paper losses, I defend a differentiated approach to BofA’s ability to deliver shareholder value.

- Consensus sees BofA earning about $3.5/ share through 2028. If this is correct, investors buying the bank’s equity at $27/ share will likely enjoy a 13% yield.

Zolnierek/iStock via Getty Images

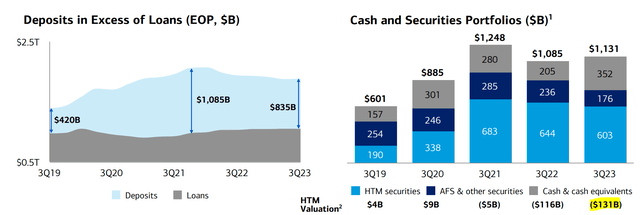

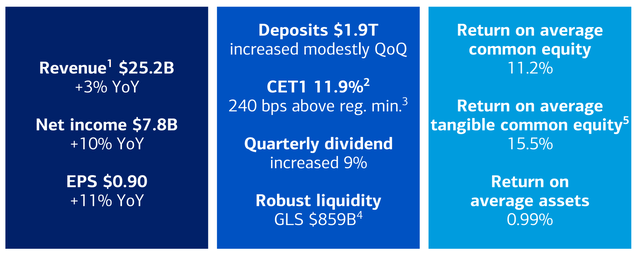

Bank of America (NYSE:BAC) reported results for Q3 on Friday, October 13. With regard to earnings, the performance was quite solid, with the bank achieving 3% year over year growth in revenues, and a 15.5% return on common tangible equity. However, BofA also gave insights into the bank’s balance sheet, where losses on the HTM securities portfolio continue to grow. As of by quarter end 30 September, BofA reportedly held $603 billion worth of HTM securities, which were $131 billion under water (paper loss).

BofA Q3 reporting

The implications of BofA’s paper losses for earnings have been well covered by Cavenagh Research, who writes:

Investors should not forget that paper losses matter for the earnings story. Specifically, I like to argue that paper losses, while not realized or “cash-in-hand” losses, can have real and tangible implications for a bank’s net interest margins because capital is tied up in an underperforming asset. Capital that could have been used more effectively elsewhere, at higher rates. In other words, in order to record a paper loss, a security’s effective, quoted yield must be below the alternative yield that an investor can get elsewhere. The implication of this shouldn’t need any further explanation.

adding that

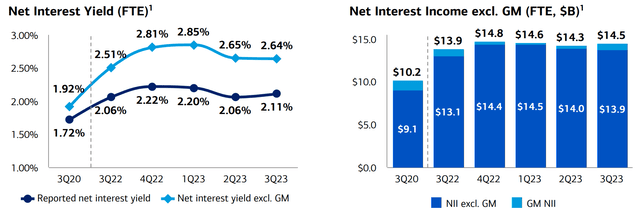

it is very important to consider that with about 25% of BofA’s assets being tied up in low-yielding securities, the bank is less able than competitors to effectively absorb headwinds from the gradual increase in deposit beta; thus, cutting into the bank’s margins. Despite the favorable deposit rate as of Q3 2023, early signs of this thesis are already crystallizing. For the September quarter, BofA’s net interest yield compressed to 2.6%, down from 2.9% peak six months ago

While I do largely agree with Cavenagh’s assessment on how the paper losses will spark an earnings headwind, I defend a differentiated approach on BofA’s ability to deliver shareholder value. I see two core arguments to this thesis: First, I point out that BofA’s decision making process that led to the large paper loss is not necessarily a structural mistake, or a sign of bank mismanagement. In fact, I argue that the thinking that led to the now-unprofitable securities investments was correct, and BofA may only have been somewhat “unlucky”. Second, I argue that at x8 FWD P/E, with 15.5% ROTE, BofA is a “Buy”. Moreover, whatever headwinds the paper losses will imply to earnings should have been largely priced in by now.

You Can Not, And Should Not, Time The Market

To judge whether the large paper losses on BofA’s balance sheet are due to management mistakes, an investor should analyze how the losses came to be.

During COVID, all major U.S. banks experienced a significant increase in deposit base. Bank of America, being the largest consumer bank in the U.S., received even more deposits than others. From 2019 to 2021, BofA’s deposit base jumped from $1.34 billion to $2.06 billion ($720 billion in additional deposits). On the backdrop of muted loan demand, BofA didn’t really need such a strong deposit base. So, BofA management decided to invest the excess deposits heavily in bonds, particularly mortgage bonds and Treasuries, seeking additional return. For context, at the time when the investment decision was made, deposits were remunerated at less than 100 basis points, while long dated Treasuries were yielding close to 2%. So, there was some arbitrage profit to be made.

Some readers may argue that investing huge sums of short-term customer deposits in long-term assets within a Held-to-Maturity account, reflects negatively on a bank’s sophistication, especially as the primary job of a bank is to manage balance sheet maturity and duration. Moreover, the mistake is compounded by the presence of ultra-low interest rates.

However, I argue that both considerations should be reflected on a bit more neutral. First, in late 2020, BofA held close to $370 billion worth of cash and cash equivalents, despite the HTM investments. Given the size of liquid assets, arguing that management would fail a maturity mismatch on deposit withdrawals is simply improbable, and absurd. Second, investors should consider that in 2020-2021 there was little indication that interest rates would rise so aggressively. Who would have guessed that rates would jump above 5% in 2023? This thought has been well expressed by BofA CEO Brian Moynihan:

Deposits have crossed $1.9 trillion and the loans are $900 million and change. And that difference has got to be put to work . . . we’re not timing the market or betting. We just sort of deploy it when we’re sure it’s really going to be there.

A similar thought was reiterated in Q3 2023:

In late 2020 and into 2021, we concluded that additional stimulus was going to remain in client accounts for an extended period, and we increased the hold-to-maturity securities portion so we could lock in value from those deposits. And we made these investments given the core nature of our customers’ deposits.

So, if a reader believes that macro is both unpredictable and impossible to time, like Warren Buffett, Seth Klarman, and Howard Marks believe, then one must acknowledge that BofA’s strategy to not time the market was actually correct. Just the later unfolding of the decision was unfortunate.

BofA Does Look Attractive, At 8x P/E

Paper losses on the balance sheet, or not, Bank of America still delights investors with strong earnings power. In the September quarter, BofA managed to increase profits by 10% year over year, to $7.8 billion. The bank attributed this growth partially to higher interest rates and partially to an exceptionally strong performance from its traders, which marked the best result in more than a decade on high market volatility. Revenues from sales and trading saw an 8% increase, reaching $4.4 billion, with the equities business contributing $1.7 billion to this figure. Moreover, cost-cutting measures also helped deliver a return on tangible common equity of 15.5%: Since Q1 2023, BofA reduced over 4,000 positions bringing its total headcount to just under 213,000.

BofA Q3 reporting

BofA continues to capitalize on a higher rate environment. In Q3 2023, the bank generated $13.9 billion worth of net interest income, excl. NII allocated to global markets. Compared to Q3 2022, this number is up $800 million. And compared to 3Q 2020, the number is up $4.8 billion. On NII it is worth pointing out that BofA has not had to increase payouts as significantly as its rivals to retain deposits. The average interest-bearing deposit account at BofA offers an annual interest rate of 2.1%, lower than JPMorgan’s 2.5% and Citigroup’s 3.4%. While some market observers may argue that BofA may need to step up deposit remuneration in line with competitors, others, myself included, will argue that BofA won’t need to rise deposit yield at a competitive level, because the bank’s best in class consumer franchise buffers competitive pressures. Or in other words, the lower deposit yield is due to the power of the BofA business model.

BofA Q3 reporting

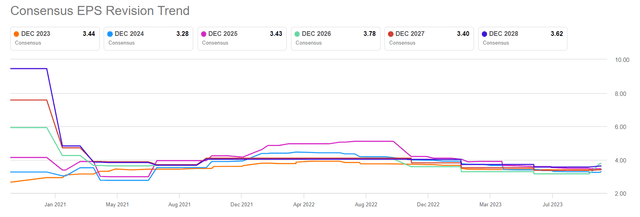

That said, consensus sees BofA earning about $3.5/ share through 2028. If this expectation is correct, investors who buy the bank’s equity at $27/ share will likely enjoy a 13% yield for the next 5 years, well in excess of the 10 year Treasury (~3x).

Seeking Alpha

Investor Takeaway

Bank of America posted a solid Q3 performance with a 10% rise in profits and a 15.5% return on tangible common equity year over year. While earnings were robust, the bank also revealed growing paper losses of $131 billion on its balance sheet due to investments in long-term securities. These paper losses can affect net interest margins, even though they are not realized cash losses. While the losses are unfortunate, the context for these losses stems from a strategic decision during the pandemic to invest excess customer deposits in longer-term assets like mortgage bonds and Treasuries. However, the sharp rise in interest rates and corresponding rerating of bonds was unexpected.

Despite these challenges, BofA remains an attractive investment with a low 8x forward P/E ratio. The bank has exhibited strong earnings growth, and BofA’s consumer franchise positions the bank to navigate the impact of rising deposit costs. As for a final consideration about BofA’s paper loss, we can do the math: As of Q3, the company lost about $131.6 billion on its securities portfolio HTM. Getting this figure in relation to the bank’s 7.9 billion shares in circulation, would suggest a $16.6 loss per share. However, compared to the peak valuation post-COVID, BofA shares are now down more than $20. So, investors may comfortably assume that the lion’s share of the paper loss headwind on earnings should be priced in. To conclude, I advise to be a buyer of BofA stock at these levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.