Summary:

- Bank of America shares have returned 28% since October 2023 when I argued for a “Buy”, outperforming the S&P 500.

- Bank of America’s Q4 results show strong earnings and a ~$33 billion decrease in paper losses in the securities portfolio.

- The outlook for interest rates in 2024 has shifted, setting BofA up for more upside in the bank’s HTM asset portfolio.

- At <10x estimated 2024 earnings, I argue Bank of America stock continues to be a "Buy."

Alex Wong/Getty Images News

I nailed the bottom in Bank of America (NYSE:BAC) shares, as I argued back in October 2023 that Bank of America shares look undervalued compared to the bank’s strong earnings power and expanding business franchise. A key argument for my bullish assessment was also based on investor’s “irrational fear” relating to losses in the bank’s securities portfolio, which provided the opportunity to scoop up BofA stock at a depressed valuation.

Since my writing less than 3 months ago, BAC shares have returned 28%, compared to a gain of 13% for the S&P 500 (SP500).

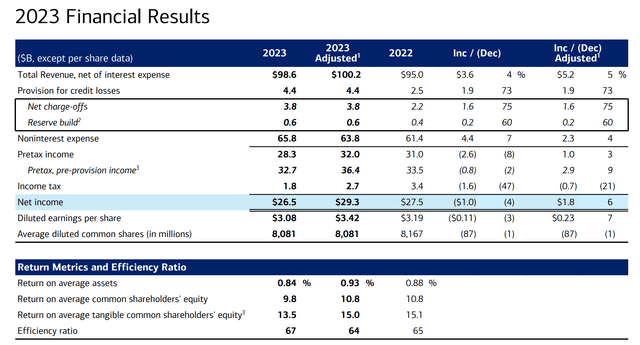

Following Bank of America’s recently announced Q4 results, I revisit my Buy thesis for the bank’s stock. Overall, I remain encouraged to see that the bank is generating solid earnings throughout the fourth quarter, supported by strong net interest income and healthy investment banking activity. Moreover, I am encouraged to note that Bank of America’s paper losses in the securities portfolio have dropped by an approximate $33 billion during the December quarter, as rates started to fall on an anticipated 2024 Fed pivot.

BofA Reports Earnings Above Expectations

Even though Bank of America’s profits dipped in the recent Q4 quarter, the bank still outperformed analysts’ predictions. The adjusted earnings per share came in at $0.70, beating the expected $0.64. This positive outcome was influenced by two key factors: firstly, lower-than-anticipated provisions for credit losses, dropping by approximately $130 million compared to Q3, totaling $1.10 billion; and secondly, a more favorable operating expense base, with salaries decreasing by around $100 million compared to Q3.

Bank of America’s quarterly net interest income approximately matched consensus at $14.1 billion. Meanwhile, the bank’s trading revenue saw a modest increase to $3.8 billion, led by a notable 12% revenue jump in equities. The bank’s investment banking segment also reported a 7% rise in fees, reaching $1.1 billion, buoyed by a revitalized dealmaking scene in the quarter.

As a Q4 headwind for Bank of America, but non-operating, I highlight that the bank recorded charges totaling $2.1 billion, including a special fee to the deposit insurance fund. This fund was depleted by a total of $16 billion last year to protect depositors from the fallout of the Silicon Valley Bank and Signature Bank collapses. Additionally, there were additional charges of $1.6 billion related to the expiration of a Bloomberg interest rate benchmark used in some loan agreements.

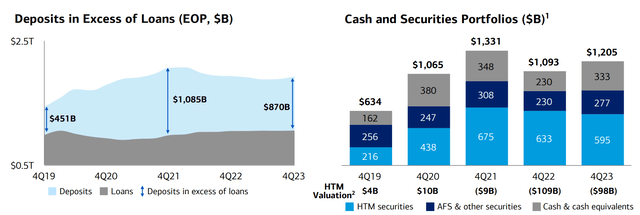

Looking beyond the moving parts on the income statement, a major bullish signal for Bank of America shareholders relates to the bank’s balance sheet: Specifically, I note that Bank of America’s unrealized losses on the bank’s securities portfolio dropped to $98 billion. While the number is still elevated, investors should consider that in Q3 these losses totalled $131 billion, reflecting a favorable contraction of close to $33 billion.

Favorable Rates Outlook Heading Into 2024

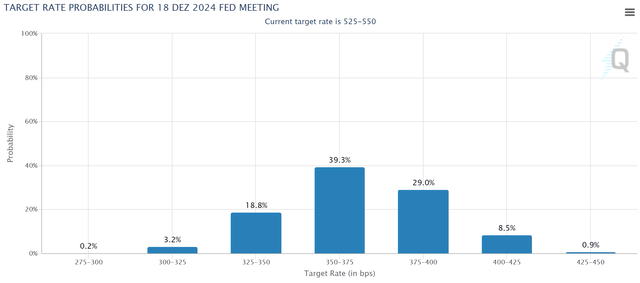

Heading into the new year, I expect that the pressure relation to Bank of America’s HTM portfolio will ease further, as the outlook for interest rates in 2024 and beyond has undergone a significant shift in the past few months. The FOMC projections released on December 13 diverge sharply from the previously prevalent “higher for longer” narrative. Notably, committee members have substantially revised down their end-of-year 2023 inflation estimates compared to their September assessments. The collective forecast now expects inflation to range between 2.8-2.9% year-on-year, a noteworthy decrease from the prior 3.2-3.4% range. Concurrently, GDP expansion projections have surged from around 2.1% YoY in September to the current estimate of 2.6%.

In light of the expanding economy and declining inflation trend, FOMC participants have significantly adjusted their 2024 rate forecasts. The prevailing consensus now anticipates an approximate 75 basis points increase in the coming year, a stark departure from the earlier expectation of only about 25 basis points in cuts projected as recently as September. This rapid shift, occurring in less than three months, underscores a robust dovish momentum.

Interestingly, traders seem to be ahead of the Fed in anticipating rate cuts. Many traders expect the Fed to commence rate cuts as early as March, with a 75% probability of a 25 basis point rate cut according to the CME FedWatch tool. By the end of 2024, traders are currently forecasting a substantial 150 basis points in cuts, bringing rates to approximately 3.50 to 3.75%.

Given that Bank of America’s $1,205 billion bond portfolio appreciates by $33 billion on an approximate 1.2% yield drop in the 10 year Treasury, we can approximately estimate the bank portfolio’s Modified Duration at -2.3%. This metric suggests that Bank of America’s HTM portfolio may appreciate close to $28 billion for every 100 basis points worth of rate cuts (>10% of BAC’s market capitalization as of early 2024).

Conclusion

Bank of America shares have returned 28% since October 2023 when I argued for a “Buy”, outperforming the S&P 500. Now, reflecting on Bank of America’s solid Q4 results, underscoring alpha-rich earnings power at 11-12% ROTE and a ~$33 billion decrease in paper losses in the securities portfolio, I continue to remain optimistic on BofA shares. Most notably, I point out that the outlook for interest rates in 2024 has shifted, setting BofA’s balance sheet up for more upside in the bank’s HTM asset portfolio, equalling asset appreciation of about $28 billion for every 100 basis points worth of rate cuts. Meanwhile, investors are likely to underprice Bank of America’s alpha-rich earnings, with shares trading <10x P/E. In my opinion, Bank of America stock continues to be a “Buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.