Summary:

- Bank of America’s Q2 earnings indicate that preferred dividends are well covered.

- The HH series of preferred shares offer a dividend yield of just over 6%.

- The Series L preferred shares may be a better option, offering a higher yield and potential for capital gains.

Justin Sullivan/Getty Images News

Introduction

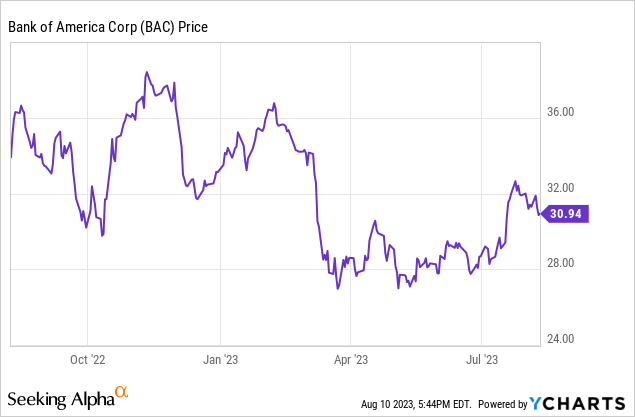

About a month ago, I discussed the Series GG of the Bank of America (NYSE:BAC.PK) preferred shares, trading with (BAC.PB) as its ticker symbol. Of course there are plenty of other preferred shares issued by Bank of America (BAC) and in this article I’d like to zoom in on the HH series which currently offer a dividend yield of just over 6%.

The strong Q2 earnings indicate the preferred dividends are well-covered

When I look at preferred shares, there are two important elements I’m keeping an eye one: The dividend coverage ratio and the asset coverage ratio.

To determine how well the preferred dividend is covered, we need to have a look at Bank of America’s financial performance. The company reported its financial results at the end of July, so there was plenty of time to digest them.

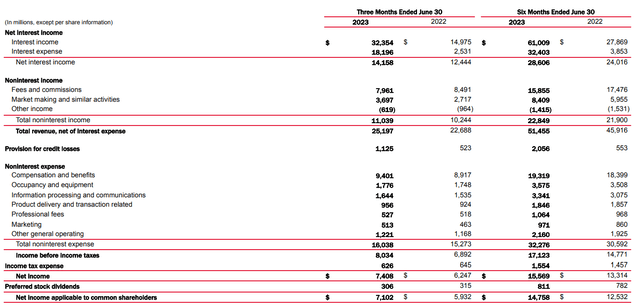

As you can see below in the income statement, the bank’s net interest expense decreased compared to the first quarter of the current financial year but is still substantially higher compared to the same quarter last year. The net interest income in the second quarter was a relatively strong $14.2B (compared to just under $14.5B in the first quarter of the year as the rather aggressive rate hikes are having an impact on the net interest income) while the net non-interest expenses were just around $5B which is a very similar level compared to the second quarter of last year.

Bank of America Investor Relations

This resulted in a pre-tax and pre-provision income of about $9.15B. The bank also recorded about $1.13B in loan loss provisions (which is higher than the $931M recorded in the first quarter) and this resulted in a pre-tax income of $8.03B and a net income of $7.4B. That’s about 20% higher than in Q2 last year and just slightly lower than in the first quarter of last year.

And as you can see in the image above, the total amount of preferred dividends was just $306M. That’s a lot of money in absolute terms, but it really represents just over 4% of the after-tax income of the bank. This means the preferred dividends are very well covered. The total amount of preferred dividends in the entire first semester was $811M on a total net income of just under $15.6B, which means the payout ratio in the first semester was just over 5%. That obviously is very encouraging for the preferred shares.

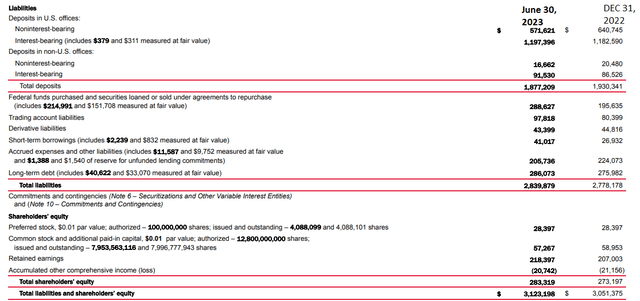

Looking at the balance sheet, Bank of America has a total asset base of in excess of $3.12T. Of that amount, about $283B is equity and the preferred shares represent about $28.4B, as you can see below.

Bank of America Investor Relations

This means that about $255B of the total amount of equity ranks junior to the preferred shares. And while the balance sheet of major banks can fluctuate pretty fast, the relatively sizeable cushion provided by the common equity provides additional certainty.

A closer look at the Series HH preferreds

In my previous article, I chose to focus on the Series GG of the preferred shares as that specific issue pays an annual preferred dividend of $1.50 for a total yield of 6% based on the $25 principal value. Most preferred shares issued by Bank of America are now effectively trading in pretty much the same trading range with a 6-6.2% yield. I wanted to have a look at the Series HH which are trading with (NYSE:BAC.PK) as ticker symbol.

The Series HH have a fixed preferred dividend of $1.46875 per share per year, payable in four equal quarterly installments of $0.3671875. These preferred shares currently are trading at $24.28 resulting in a yield of 6.04%. One of the interesting features of this preferred share is the fact this series is callable at any time (since a few weeks). As Bank of America isn’t too keen on retiring a preferred security with a cost of capital of less than 6%, its investors are now generating a yield north of 6%. And just in case Bank of America does decide to call these securities, its owners will generate an overnight capital gain of about 3% as the call price of the securities is obviously $25/share.

Does this mean the Series HH are the best series of preferred shares right now? Not necessarily. As mentioned before, most of the fixed-rate preferred shares issued by Bank of America are trading in that 6-6.10 range. As the creditworthiness of all of them is the same, you should focus on the ones with the highest yield.

But there’s one security that might be even better. The Series L, trading with (NYSE:BAC.PL) as ticker symbol, is a so-called “busted” preferred which cannot be called by Bank of America. The owner of the preferred shares has the option to convert the shares into 20 common shares, and if the underlying shares are trading at $65/share, Bank of America may force the conversion. But with the common shares trading at just around $30, the likelihood of a forced conversion to happen in the next few years is close to zero. And even if that would happen, receiving at least $1,300 in common shares of Bank of America would result in an immediate 10% capital gain. Meanwhile, those preferred shares offer a 7.25% preferred dividend based on the $1,000 principal value of the security. Which means that at the current share price of $1,168, this security is yielding about 6.20%. That’s higher than the Series HH but without the potential to generate capital gains on a call (unless the share price of the common shares more than doubles from the current level).

Investment thesis

Is BAC.PK the best preferred issued by Bank of America to invest in? It depends on one’s investment style. The yield of just over 6% is attractive, but most preferred shares of Bank of America are offering a similar yield. Investors with a long-term horizon should perhaps strongly consider the Series L preferred shares as well given the lack of a call option as the only possibility for Bank of America to redeem these shares is if/when the common shares more than double from the current share price. And in that case (which I don’t think is likely to happen soon), a shareholder of the Series L will generate a 10% capital gain.

I currently have no position in the preferred shares of Bank of America as the non-cumulative feature of the preferred shares is a deterrent. But I could be interested as part of a diversification in my portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!