Summary:

- Bank of America has been negatively impacted by the regional banking crisis and rising interest rates, causing a $100B+ unrealized loss in its bond portfolio.

- The bank has benefited from the Fed’s interest rate increases and the bank’s book value, despite the banking crisis, is still growing.

- Bank of America just passed the Fed’s stress test and has significant liquidity, thereby no need to sell any bonds.

- If Bank of America holds its investments until maturity, no bond losses will ever have to be realized.

Brandon Bell

Bank of America (NYSE:BAC) has been negatively impacted in FY 2023, not only by the regional banking crisis in the first-quarter, but also by the continual rise in interest rates which the Fed enacted in order to counter the increase in consumer prices. The rise in interest rates especially resulted in a $100B+ unrealized loss in the bank’s bond portfolio, according to the FDIC, a development that continues to keep investors on the sidelines… which I believe is a mistake as Bank of America could be set for a strong Q2 earnings report in July. Additionally, top tier banks like Bank of America have sufficient liquidity, have recently passed the Fed’s stress test and are under no pressure to realize these unrealized losses if they hold fixed income investments until maturity!

Bank of America’s $100B+ in bond losses are mostly an imaginary problem

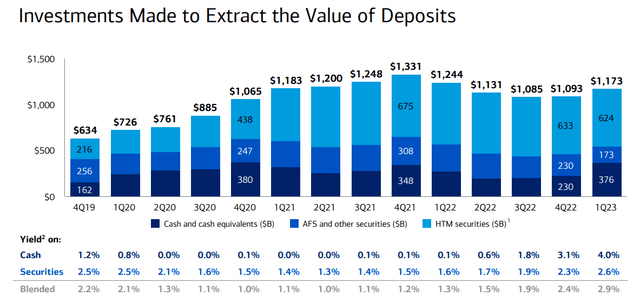

With earnings for the second-quarter just around the corner, too many investors are still too worried about the sector’s large unrealized losses as they relate to their fixed income portfolios. In the last few years, banks like Bank of America have aggressively invested excess deposits into mortgage-backed securities as well as bonds issued by the U.S. government. The majority of Bank of America’s investments were made into held-to-maturity securities.

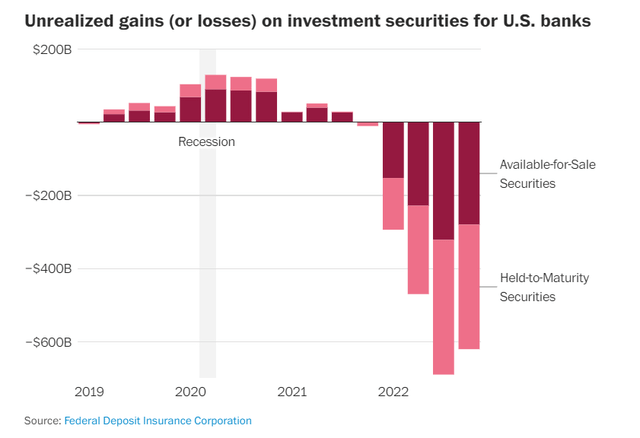

Due to the Fed raising interest rates, bank’s held-to-maturity portfolios are showing large unrealized losses on these fixed income investments. Bank of America, as an example, had a $100B+ unrealized loss in its bond portfolio at the end of the first-quarter. In total, the FDIC reported that the banking sector was sitting on more than $600B in unrealized losses as rising interest rates lowered the value of fixed income instruments, the majority of which related to banks’ held-to-maturity portfolios.

Now, with earnings set to be reported soon, investors are likely to return their focus on Bank of America’s unrealized losses. However, I believe that Bank of America’s unrealized losses are chiefly an imaginary problem and one that investors really have no reason to panic about ahead of the Q2 earnings report.

First of all, investors have been well aware of these unrealized losses ever since Silicon Valley Bank failed in March, largely because it was forced to sell securities in order to meet deposit withdrawal requests. Bank of America has not seen unusual deposit outflows in the first-quarter and is therefore highly unlikely to report abnormal deposit trends for the second-quarter.

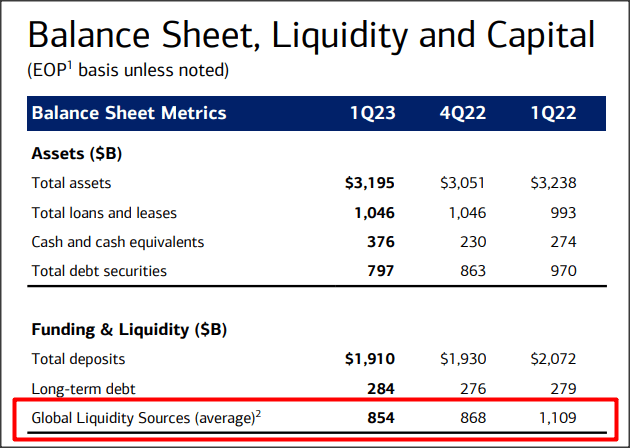

Secondly, I don’t see why Bank of America would have had to sell any of its devalued HTM bonds in the second-quarter, chiefly because the bank has more than enough liquidity. Bank of America had access to approximately $854B in liquidity at the end of the first-quarter.

Source: Bank of America

Thirdly, Bank of America just passed the Fed’s stress test, meaning the bank has been judged by the regulator to have sufficient capital in the event of a severe recession. In other words, Bank of America likely had no reason whatsoever in the second-quarter to liquidate a portion of its bond portfolio and incur valuation losses.

Why I believe Bank of America could surprise to the upside with its Q2’23 earnings sheet

Bank of America is due to report earnings for its second-quarter on 7/18/2023 (Pre-Market) and expectations are not especially high after the sector was hit by a banking crisis in the first-quarter. Analysts expect the bank to report $0.85 per-share in Q2’23 earnings compared to $0.94 per-share in Q1’23. In the last ninety days, there were 10 EPS down-side revisions compared to just 3 EPS up-side revisions, meaning analysts don’t expect much from Bank of America.

However, I believe that top tier banks in general will be able to display their value to investors by reporting resilient earnings (net interest income) and continual book value growth.

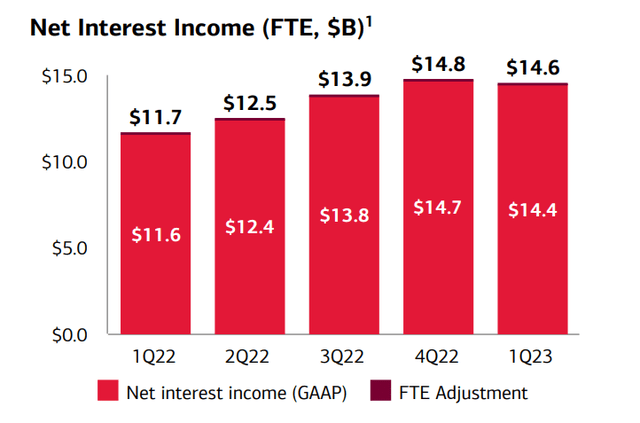

Bank of America generated $14.6B in net interest income in Q1’23, showing a $2.9B increase due to loan growth and higher interest rates. For the second-quarter, I expect Bank of America to report $14.3-$14.4B in net interest income, showing a potential year over year increase of $1.95B, at mid-point.

Bank of America’s valuation

I expect Bank of America to report a moderate 1-2% Q/Q increase in its book value as the bank likely benefited from strong deposit and loan performance as well as high interest rates. Bank of America added about $1 per-share in book value in Q1’23, despite the banking crisis. I also don’t expect Bank of America to report any meaningful declines (sales) in its bond portfolio.

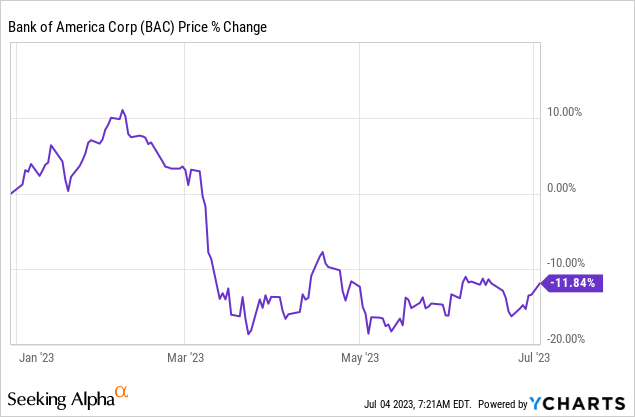

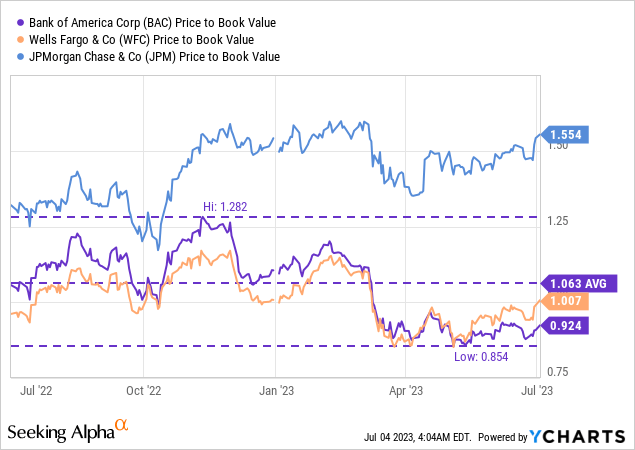

Bank of America has not yet meaningfully recovered from the Q1’23 sell-off and shares continue to trade at a discount to book value… which I believe is undeserved. As a systemically-important bank, Bank of America has a considerable advantage over regionally-oriented banks and investors should ultimately return to reward Bank of America’s shares for its relative stability with a premium to book value.

Currently, Bank of America has a price-to-book ratio below 1X, as opposed to JPMorgan Chase (JPM) and Wells Fargo (WFC): Bank of America trades at 0.92X book value and if shares revalue to the 1-year average P/B ratio, then shares of the bank have about 15% upside potential. If Bank of America reprices to its upper-range P/B ratio of 1.28X, then shares could see up to 39% upside potential over the longer term.

Risks with Bank of America

Bank of America has benefited from significant net interest income tailwinds due to the Fed raising interest rates in the last year. The biggest risk for Bank of America, as I see it, is the Fed actually slowing the rate of interest rate increases because it removes a powerful earnings catalyst from the bank. I don’t believe, however, that Bank of America’s unrealized bond losses will affect either the bank’s short term or longer term earnings potential.

Closing thoughts

I see Bank of America as a strong buy ahead of Q2’23 earnings… which are set to be released on 7/18/2023. Bank of America put up a strong earnings sheet for the first-quarter, in the midst of a banking crisis, and the bank added about $1 per-share to its book value. Since the bank should continue to benefit from higher average interest rates and loan growth, Bank of America could beat low EPS expectations, in my opinion. Additionally, Bank of America passed the Fed’s stress test last week, giving investors one more reason to have confidence in the bank’s capital and liquidity positions.

The $100B+ unrealized loss in Bank of America’s bond portfolio sounds like a big problem, but it isn’t, in my opinion: investors have to understand that these losses don’t have to be realized and Bank of America does not have a strained liquidity situation that would require the bank to liquidate (a portion of) its HTM portfolio. As long as Bank of America holds these investments until maturity, no unrealized loss will have to be recognized and it certainly won’t affect the bank’s Q2 earnings!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC, WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.