Summary:

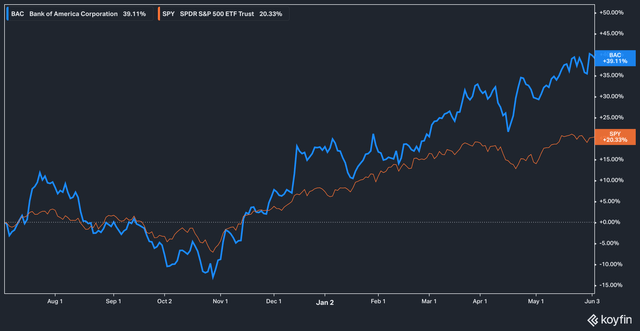

- Bank of America’s stock has outperformed the S&P 500 with a 39% total return since July 2023.

- The stock currently trades at 1.2x price to book, a relative bargain compared to long term historical price to book valuations.

- The latest concern about consumer credit card debt may be overblown, as charge off rates are moving in the right direction.

E_Y_E

A Market Beater

We last covered banking behemoth Bank of America (NYSE:BAC) in July of 2023 (you can read that article here). At the time, we were bullish on the bank’s prospects. During that year the bank’s stock had been pummeled by the regional banking crisis (remember that?) and concerns that the bank (and others like it) were putting themselves at risk with massive held-to-maturity [HTM] loan balances on their books.

Time, however, has been good to us. Since July 2023, Bank of America’s stock has handily outperformed the broader S&P 500 (SPY), delivered a 39% total return against the index’s 20% return.

So, where do we think things stand with the bank today? Does it still seem like a good time to be in, or have the boom times come and gone? Let’s dive in.

A Question of Value

All things in investing are relative, so let’s start with valuations. When we last wrote about Bank of America, the stock traded below 1x book value — which we, at the time, thought was an irrational valuation. Today things are a bit rosier, but not by a lot. While the stock no longer trades below book, the premium is does carry seems a bit insignificant compared with its peers.

BAC vs JPM, WFC, C P/B (Koyfin)

Today, Bank of America stock trades at 1.2x price to book on a trailing twelve month basis, a relative bargain compared with J.P. Morgan’s (JPM) 1.9x valuation, Wells Fargo (WFC) trading just above it, and Citigroup (C) bringing up the rear, trading at just 0.6x book value.

Is this a rational valuation? In our view, it’s a bit skewed. While J.P. Morgan is the undoubted leader in the money bank space, it’s not clear at all that Wells Fargo — which often finds itself the target of lawmaker ire — is worth more or as much as Bank of America.

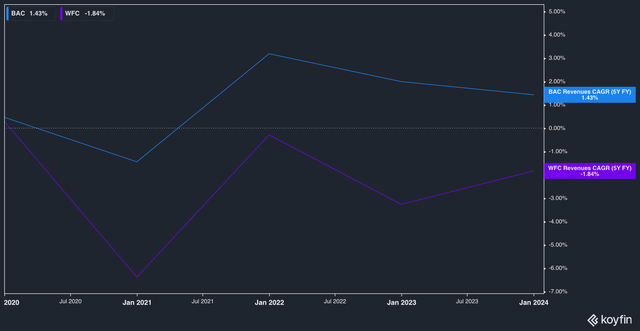

Consider, for example, the following chart:

WFC vs BAC, 5yr Revenue CAGR (Koyfin)

While B of A has only achieved a 1.43% 5-year CAGR (honestly not terrible, but not great), Wells Fargo’s CAGR has been negative for some time. While this isn’t the only point to be made, it’s illustrative of our belief that the current valuation for B of A stock is currently a bit dislocated.

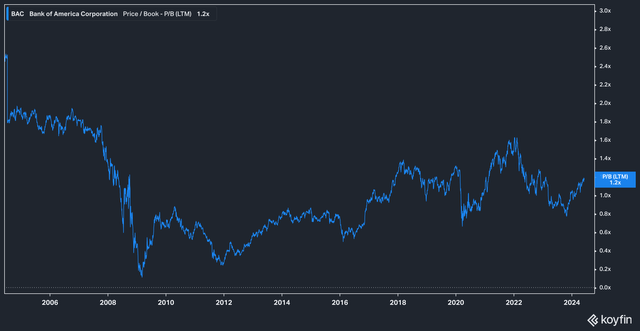

Let’s return to the price to book question. Pulling the lens back a little bit, however, will allow us to gain a better perspective on where the Bank’s price to book valuation currently sits.

BAC Price to Book 20yr Chart (Koyfin)

On the eve of the Great Financial Crisis, Bank of America traded between ~1.6x-1.9x P/B on a trailing basis. The devastation of the GFC laid the stock low, drawing it down to an incredible 0.1x (yes, you read that right), price to book. Since that time the stock has been unable to achieve its prior highs, for a mix of reasons. Increasing regulatory scrutiny, for one, along with the introduction of the Fed’s ZIRP policy, all made it difficult for banks to turn the same kinds of profits they once did while at the same time dissuading investors from seeing large money-center banks as the appealing investments they once did.

Against this historical backdrop we see Bank of America’s shares as still a bit under-valued — or, at the very least, inexpensive when considered against the post-GFC valuation range the stock has experienced.

Are Consumers Beginning to Crack?

Much has been made of the fact that consumer credit-card debt has ballooned to all-time highs over the last two years, in large part due to the breakneck rate hikes from the Fed which have naturally trickled down in the consumer lending space.

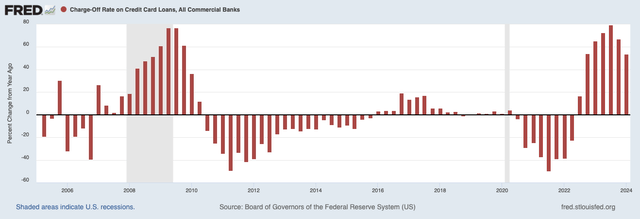

All of this has led to a concern among investors that the U.S. consumer will begin to crack under the pressure and, eventually, run out of the collective ability to service all this debt. There has been reason to be concerned — credit card loan charge off rates (the balances banks write off as bad) have jumped significantly over the last year.

However, when we again pull back the lens to observe a broader historical perspective, things do not appear as bad as they seem.

Commercial Bank Credit Card Loan Charge Off Rate, % change from one year prior (FRED)

The year-over-year percentage change in credit card loan charge offs over the last four quarters did not exceed the velocity of change seen in the GFC. In fact, it’s largely the weak comps against which 2023 and 2024 have been judged that make the numbers appear worse than we think they are — on an absolute basis, the peak charge off rate during the GFC was 10.5% (in Q4, 2009). In Q1 2024 it was 4.4%, a much more manageable figure.

Bank of America CEO Brian Moynihan addressed this concern at the Bernstein’s Annual Strategic Decisions Conference at the end of last month. Here’s what he had to say to an analyst question regarding the state of consumer credit:

So the concern was, are you normalizing and will it stop on the consumer side in terms of delinquencies and charge-offs in that? And so if you look — and that was going on everywhere. You see the trust data, all the stuff that you guys look at, plus the quarterly reports, and you saw it come up. And what we’re seeing is the 5- and 30-day delinquencies have tipped back, flattened out. And so we’re pretty comfortable that with our customer base in the cards, which end of the day, the cards drive the whole provision line now because of just the dynamics of it.

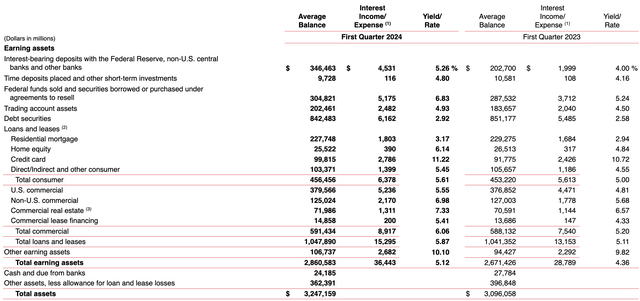

This is not a trivial matter. Credit card lending is one of the bank’s most lucrative businesses. Consider this snapshot of the bank’s lending assets from the company’s latest 10Q:

The image above shows that consumer credit card lending makes up almost $100 billion of B of A’s $456 billion consumer loans. It’s also the company’s most profitable form of lending by a wide margin, yielding 11.2% — almost double the bank’s second most profitable line, home equity.

Risks To Our Thesis

The principal risk we see to our Bank of America thesis (and to banks in general as an investible business) is the eventual implementation of the Basel III ‘Endgame’ regulations, which every major U.S. bank CEO has vehemently pushed back against and which may be only partially implemented. Investors in the financial sector would do well to read up on these regulations and have a grasp on the basics of what the new regulatory regime could mean for the global banking system. Further rate hikes are next on the list, in our view, which could further strain consumers, but we view this possibility as remote as of now.

The Bottom Line

We believe that it’s more likely than not that Bank of America’s upward trajectory will continue — deposit flight is no longer the concern that it was just a year ago, and yields on assets (such as consumer loans) are rising considerably. Even a rate cut should not be a negative for the bank, since a looser monetary environment generally encourages lending. At the end of the day, however, we remain bullish on Bank of America’s outlook.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations—buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.