Summary:

- Bank of America reported better than expected earnings for Q2, driven by strong investment banking results and solid net interest income.

- Despite strong performance, risks include a decline in federal fund rates and balance sheet deterioration.

- BAC faces potential challenges with a changing interest rate environment. Shares are likely fully valued.

ProArtWork

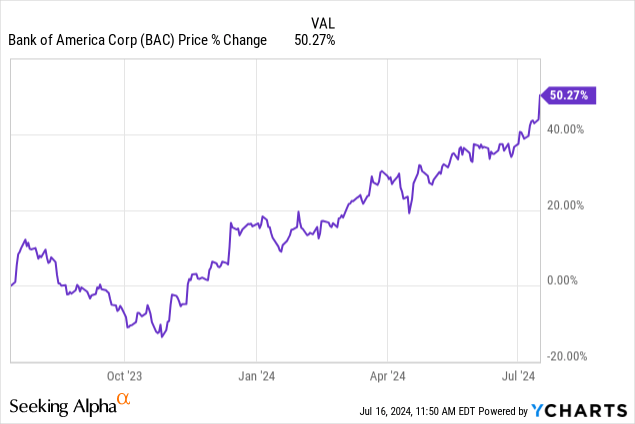

Bank of America (NYSE:BAC) submitted a better than expected earnings report card for the second fiscal quarter on Tuesday, driven by strong results in the investment banking division. The earnings report resulted in a more than 5% price gain, driving shares to their highest price since the beginning of FY 2022. The Wall Street bank also continued to see resilience in its net interest income and retained strong balance sheet quality. While I see risks relating to the federal fund trajectory in the next two quarters, I believe Bank of America’s business has a sound foundation, which is why I am standing by my hold rating!

Previous rating

I rated shares of Bank of America a hold in April after the bank reported earnings for its first-quarter. In the second-quarter, Bank of America delivered strong earnings, driven by investment banking, reported high net interest income and maintained strong asset quality on its balance sheet. With the Fed set to pivot soon, I do see net interest income risks, and I am not changing my hold rating.

All you need to know about Bank of America’s Q2’24

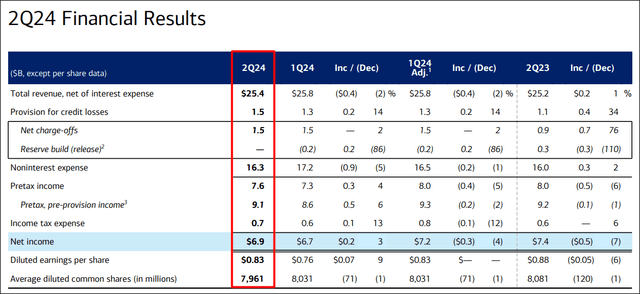

The Wall Street bank reported better than expected earnings and revenues for the second-quarter. Bank of America had adjusted earnings of $0.83 per-share, beating the consensus prediction by $0.03 per-share, chiefly due to a strong performance in the investment banking segment. In terms of revenues, Bank of America brought in $25.8B in Q2’24, which came in $200M ahead of the consensus.

All things considered, it was a very successful quarter for Bank of America. Its investment banking business and high interest rates in the market boosted the bank’s financial results: investment banking fees soared 29% year over year to $1.6B. Other Wall Street banks, such as Morgan Stanley (MS), also reported a boost to their investment banking revenues in Q2.

In total, Bank of America generated net income of $6.9B in the second-quarter, showing a quarter-over-quarter increase of $200M year-over-year increase.

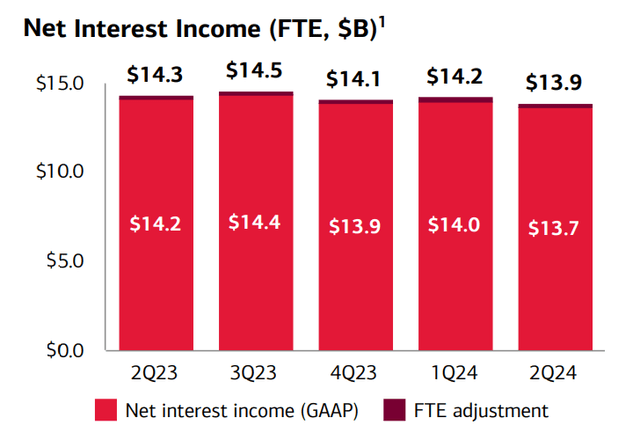

Bank of America generated $13.9B in net interest income in the second-quarter, showing a decline of 2.9% year over year, mainly because of higher deposit costs. While the bank’s net interest income looked solid, the CPI inflation update from June — which showed a 0.3 PP deceleration in inflation compared to May — suggests that the Fed will soon pivot (I expect a first federal fund rate cut in September 2024). A pivot in the federal fund rate would change the short term NII outlook for large banks like Bank of America, and investors should start to see continual declines in net interest income going forward.

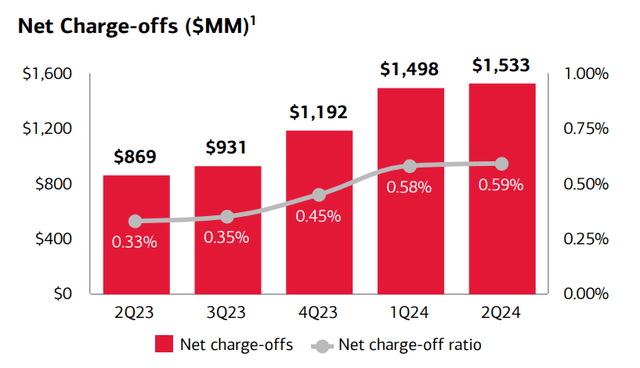

Net charge-offs didn’t get much worse

Bank of America, besides growing its profitability Q/Q, delivered stable balance sheet quality. Net charge-offs, which are an indicator of credit quality, remained fairly steady at $1.5B and represented a total net charge-off ratio of 0.59%. Bank of America’s credit quality overall looks very solid and unless fundamentals seriously deteriorate, the bank continues to make a solid value proposition.

Bank of America’s valuation

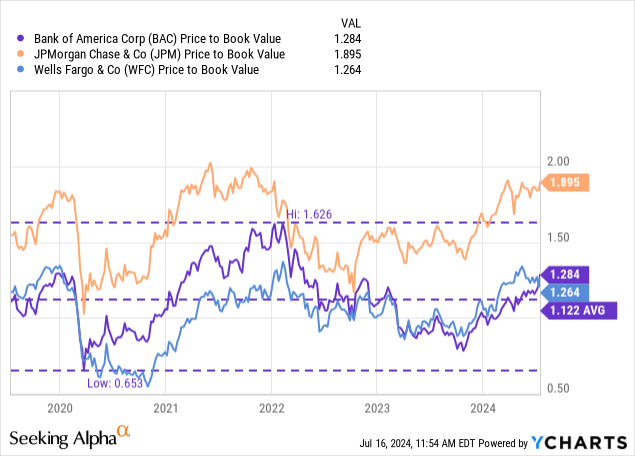

Bank of America has a moderate valuation based off of book value and trades at about the same level as Wells Fargo (WFC), the bank’s biggest rival in commercial banking. Bank of America’s P/B ratio of 1.28X is above the bank’s longer-term valuation average of 1.12X due to a higher-for-longer rate world that has boosted Bank of America’s net interest income. JPMorgan Chase & Co. (JPM) is trading at a way higher P/B ratio of 1.90X which is due to Jamie Dimon’s solid leadership, large size and strong earnings that were demonstrated even during the regional banking crisis of FY 2023.

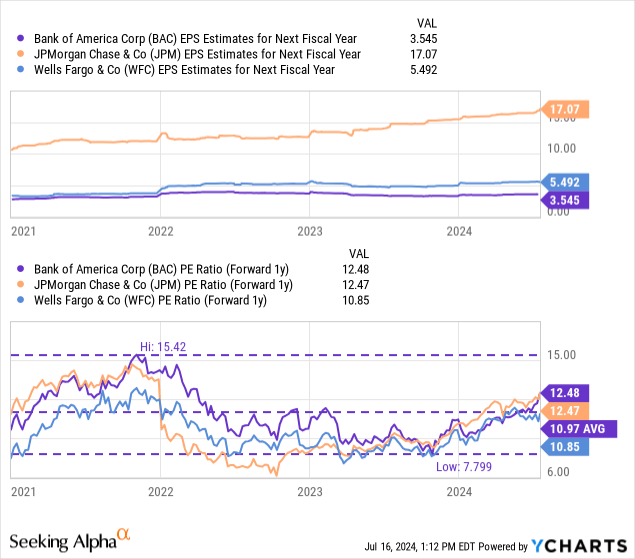

In terms of earnings, Bank of America is trading at a P/E ratio of 12.5X and since shares are also priced above the longer-term average price-to-earnings ratio of 11.0X, I believe the upside potential here is limited. This is especially true, in my opinion, in the context of a looming Fed pivot which is set to translate to lower net interest income potential. Importantly, a Fed pivot points to lower NII for a longer period of time, since a bank’s net interest income is cyclical. With the Fed just getting ready to lower the federal fund rate, more rates cuts are set to follow, creating headwinds to NII growth.

I believe Bank of America is fairly valued at a P/E ratio of ~12X given that the bank is profitable, but faces deteriorating NII prospects in FY 2024 and especially in FY 2025. A 12X earnings multiplier (on a FY 2025 basis) implies a fair value of $42.50. Since Bank of America’s shares are currently trading at $44.23, I see the Wall Street bank as about fairly valued.

Risks with Bank of America

The biggest risks for Bank of America, as I see it, relate to a fast decline in the federal fund rate as well as to a deterioration in the bank’s balance sheet quality. So far, Bank of America is doing well in all of these areas, but a recession may change this trajectory and result in weakening credit quality and higher loan defaults. What would change my mind about Bank of America is if the Fed were once again to err on the side of caution and push federal fund rate cuts into the future.

Closing thoughts

Bank of America submitted a very decent earnings scorecard for the second fiscal quarter on Tuesday that resulted in a top and bottom-line beat and caused shares to soar 5%. Results were chiefly driven by a surge in investment banking fees and still high net interest income (though the bank’s NII has been decreasing in the last year). While Bank of America benefits from a high interest rate world, the Federal Reserve is most likely to lower federal fund rates for the first time in September which should lead to a deteriorating NII outlook in the longer term and make weigh on the investment attractiveness of large Wall Street banks. Given Bank of America’s strong profitability and balance sheet quality, however, shares remain a hold for me at this point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.