Bank of America: An Irrational Fear Trade

Summary:

- Both irrational fear and exuberance tend to provide nice opportunities for the contrarians.

- Bank of America stock is trading near 5-year lows while offering a yield much higher than 5-year average.

- Dividend seems safe based on both EPS and Free Cash Flow.

- Technically, the stock is in the extremely oversold levels.

- If you believe the bottom is not in, consider selling cash-secured puts.

Brandon Bell

As you can tell from my author profile, bank stocks in general and Bank of America Corporation (NYSE:BAC) in particular don’t get me too excited. I have a preference towards Consumer Staples and Technology stocks as an investor as well as an author. I do hold JPMorgan Chase & Co. (JPM) and Wells Fargo & Company (WFC) but they are far from even being equal weight in terms of allocation.

I realized something when thinking about this article and Bank of America. My first credit card was in fact a Bank of America Visa (V) card I got while still in Graduate school. And I still have it. However, the moment I got access to brands like American Express (AXP), this Bank of America card fell way off the priority list and is used literally for one auto-pay transaction every month to keep my longest running card alive.

That got me wondering why I never fully got behind Bank of America, neither as a consumer nor as an investor.

- Perhaps it was the fact that the company slashed its dividend from 64 cents a share to 1 cent a share during the 2008 crisis. The dividend did not start to recover till 2014. To be fair, almost every Bank had to do this during the crisis.

- Perhaps I felt it was unfair to the other banks that Bank of America never repeatedly got skinned the way Wells Faro was despite same or more troubles like the historical FIRREA settlement or the more recent wrongful freezing of accounts.

- Perhaps it was that other banks looked more attractive for me, both as an investor and a consumer. For example, JPMorgan and Jamie Dimon have always been seen as the frontrunners in Technology among large banks.

Nonetheless, as I’ve preached here, I shouldn’t let my biases cloud my judgement when it comes to an investment or trade opportunity. In this article, I present a few reasons why I am now an “almost” believer in this stock after the recent Banking Blues. I also offer a way to get around my fears around the word “almost”. Let us get into the details.

Bear of America

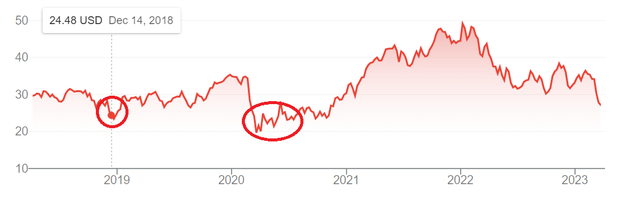

The stock is down almost 20% YTD, making it a bear market for the stock by definition. Obviously, individual stocks tend to go up or down than the market average but this sell off means that Bank of America’s stock is trading near five-year lows. Only twice in the last five years has the stock traded below this range for a meaningful amount of time: one during COVID uncertainties and the other in December 2018 when the market fell about 10% with fears around the Fed’s policies (sounds familiar, right?).

Yield and Dividend Coverage

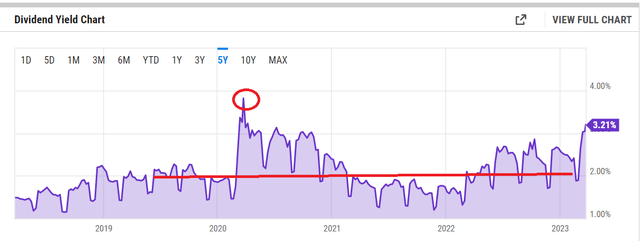

As a result of the sell-off and a dividend growth streak of 9 years, Bank of America’s current yield of 3.24% is the highest it has been in the last 5 years, except, once again the COVID period, where the yield topped just below 4% as shown below.

Now, with the company’s as well as the banking industry’s history of dividend cuts, let us evaluate how strong the dividend coverage is based on both Free Cash Flow (“FCF”) and Earnings Per Share (“EPS”).

- Total shares outstanding: $8 Billion.

- Current quarterly dividend: 22 cents/share

- Quarterly FCF needed to cover dividends: $1.76 Billion ($8 Billion shares times 22 cents a share)

- While Bank of America’s quarterly FCF range has been wild, ranging from -$52.33 Billion to $59.1 Billion in the last five years, the average stands at $6.288 Billion. That gives the stock a payout ratio of 28% based on quarterly FCF average. That is, $1.76 Billion needed to cover dividends divided by the average quarterly FCF of $6.288.

- I generally don’t use Median for my analysis but given the wide range here in FCF, looking at the Median makes sense. A median quarterly FCF of $3.394 Billion still gives a fairly comfortable payout ratio of 52%.

- Based on forward EPS estimate of $3.42, the stock has a payout ratio of 26%.

Overall, it seems reasonable to assume that barring a 2008 scenario, Bank of America’s dividend seems safe and I’d wager that the company is likely to announce its 10th consecutive dividend increase later in the year.

Goliaths Over Davids

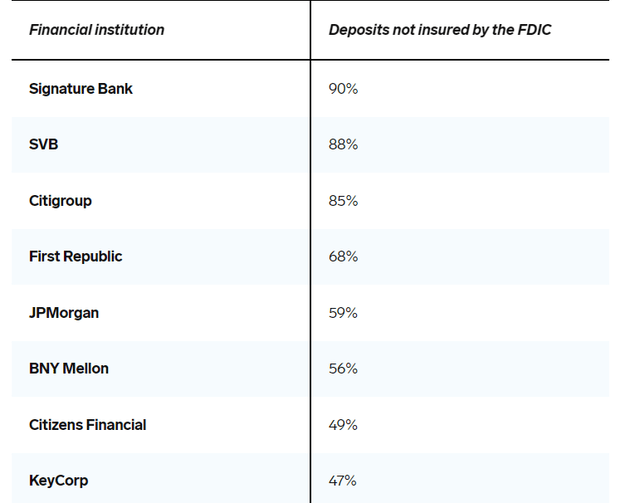

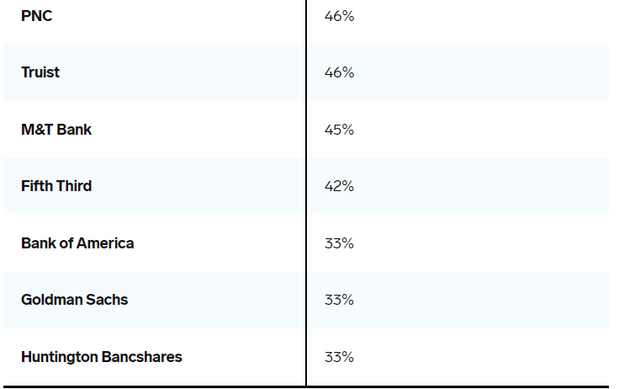

And how does one write an article on a Bank at this time without talking about the FDIC and uninsured deposits? Bank of America is among the best of breeds in this regard, ranking at the very bottom in terms of percentage of deposits uninsured. I strong believe this is a case of the Goliaths winning over the Davids for the following reasons:

- The Big Banks are unlikely to be exposed to a single or few risky depositors to the extent of damaging their entire business.

- The Big Banks have faced the most scrutiny outside of perhaps Tobacco and Oil companies, since 2008. In a battlefield, you are likely to see the veterans with scars proceeding with caution than the youngins with beautiful faces (waiting to be scared).

Finally, in a show of confidence, strength, and even unity, the Goliaths, including Bank of America, recently funded First Republic Bank (FRC) with $30 Billion.

Uninsured Deposits (businessinsider.com) Uninsured Deposits (businessinsider.com)

Proceeding with Caution

While being laid off is no fun for anyone involved, the company’s moves to cut spending is welcome in these uncertain times.

- Hiring was paused in January in an early sign the company was watching its expenses.

- With the market just coming off a tumultuous 2022, the move to cut jobs in investment banking in February was in line with the industry.

- More recently, with the interest rate situation, it also made sense to cut some workforce in lending.

With operating expenses increasing about 40% in 2022 to $84 Billion, I think the company has more room to further reduce costs both in labor as well as in other areas. After all, this is banking and we are talking about uncertainties in mortgages, lending, investments and even deposits. What better time to slim down your expenses?

Too Weak Technically

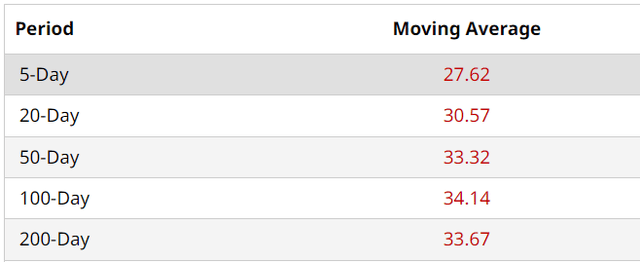

Yeah, that heading is a curve ball, sort of. The stock is indeed too weak technically as shown below as it is trading well below all the key moving averages. However, that also means the turnaround could be near. The stock’s Relative Strength Index (“RSI”) of 15 suggests the stock is extremely oversold and a bounce is likely at the slightest hint of good news (or at least, lack of distress).

BAC Moving Averages (barchart.com)

Still Not Convinced?

This feels like I am talking to the mirror. If you are still not convinced that Bank of America is looking like an attractive play here to buy outright, then consider the trade below. The Banking worries are real, irrespective of whether the underlying fundamentals say so or not. Selling puts on beaten down stocks is one of my favorite ways to enter or add to existing positions in such scenarios. Take a look at the options chain below.

BAC Options Chain (Think or Swim)

- In this option chain, the put seller is agreeing to buy 100 shares (per contract) of Bank of America should the stock fall to $25 or below by April 28th, 2023. For this “risk”, Mr. Market is paying the put seller 79 cents per share or $79 per contract. Since the put is cash-secured, the put seller is setting aside $2,500 per contract to be able to execute this trade.

- A return of 3.16% in a month for agreeing to buy the stock ~ 8% below the current market price says all you need to know about the fear or risk here.

- In addition, Bank of America is expected to reported earnings on April 18th and as everyone knows, things get volatile around earnings.

- But, if you do get assigned at $25, you will likely be getting a yield close to 4% once the company announces this year’s dividend increase. The dividend look safe and has sufficient room to the upside as shown above.

Conclusion

As someone who got serious about markets and investing in 2008/2009, I’ve generally been skeptical about the Banks. This skepticism grew once I selected my primary investment style, dividend growth. So, for a very long time, I looked down on companies that slashed dividends. While I still hold a large allocation to dividend growth stocks, over time, I’ve diversified into technology stocks and short-term trades that benefited due to irrational exuberance or fear.

Bank of America looks interesting enough to get my attention here and I may enter the long side by selling cash-secured puts as described above. What about you? Please leave your comments below.

Disclosure: I/we have a beneficial long position in the shares of AXP, JPM, WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.