Summary:

- We have written about the rising issue of commercial loans within the banking industry.

- BAC has been increasing its exposure to commercial loans.

- You need to do due diligence on the banks that house your hard-earned money to make sure it’s safe.

MCCAIG

As part of our ongoing series of articles on bank stability, and at the request of many of our clients, we wanted to address the major risks we foresee for bank stability in the coming years.

But before we begin, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I’m sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail, well before anyone even considered these issues. And I can assure you that they have not been resolved. It’s now only a matter of time.

More than a year ago, we published an article on Bank of America (NYSE:BAC), in which we highlighted some of the bank’s issues. In particular, we said that a massive increase in BAC’s commercial loan book looked like a major concern to us, although BAC’s management named this significant growth in its commercial credit portfolio as a “de-risking of the bank’s balance sheet.”

In this article, we would like to show some recent data suggesting that BAC’s decision to massively increase its commercial loan book could turn out to be a major strategic mistake.

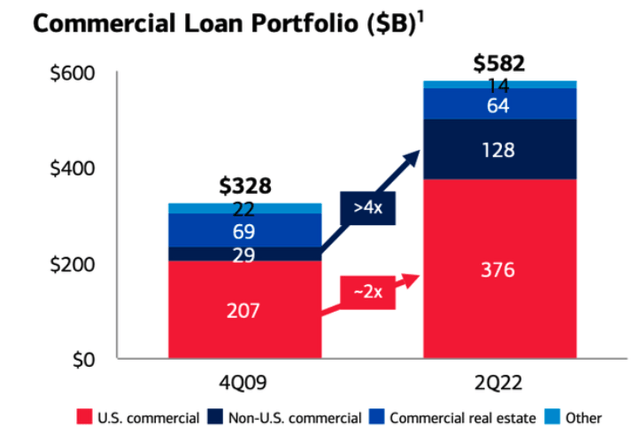

Here’s the chart from our previous article. As you can see, BAC’s U.S. commercial loan portfolio almost doubled over the period of 4Q09-2Q22.

According to the latest BAC’s 10-Q, its commercial loan book, including commercial lease financing, has reached almost $390B, which accounts for 37% of the bank’s total outstanding loans.

We have been warning about a challenging environment in the commercial lending space for more than 18 months. The latest data, which we will discuss below, indicates that this segment will likely face major issues in the coming years, and, as a result, banks that have been increasing their exposure to commercial credit over the past several years, such as BAC, will see a significant deterioration in their asset quality.

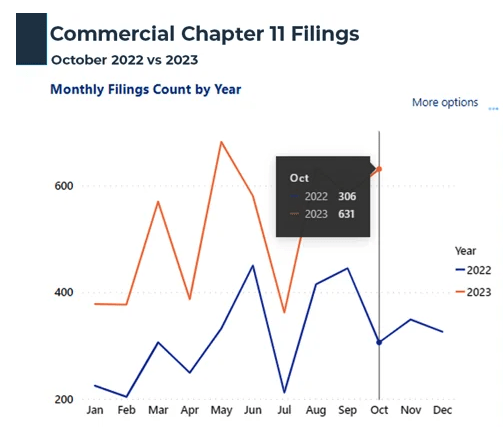

First, a week ago, Epiq Bankruptcy, a provider of U.S. bankruptcy filing data, reported that commercial Chapter 11 filings grew by 106% YoY in October 2023 and reached 631. Overall commercial filings increased by 14% YoY to 2,188.

Epiq Bankruptcy

The data implies that we’re already seeing an increase in corporate defaults. However, a recent study published by the Fed suggests that this is just the beginning, and the commercial segment is likely to see a massive wave of defaults.

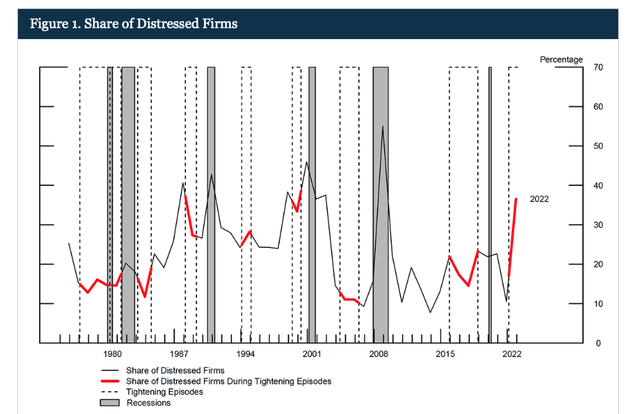

Several months ago, the Fed published an academic paper in which the regulator was trying to estimate the effects of monetary policy tightening. According to this study, the share of nonfinancial firms in financial distress in the U.S. economy has reached 37%. Importantly, this level is higher than during most previous tightening episodes since the 1970s.

The authors of the study concluded that such a high share of distressed firms will affect the whole U.S. economy:

“With the share of distressed firms currently standing at around 37 percent, our estimates suggest that the recent policy tightening is likely to have effects on investment, employment, and aggregate activity that are stronger than in most tightening episodes since the late 1970s. The effects in our analysis peak around 1 or 2 years after the shock, suggesting that these effects might be most noticeable in 2023 and 2024.”

Actually, the share of nonfinancial firms in distress could be even higher as the Fed sometimes underestimates negative effects and is biased towards more optimistic scenarios.

Bottom Line

With commercial Chapter 11 filings rising at an annual rate of 106% and the share of distressed firms standing at 37%, we do believe that BAC’s bet on commercial lending could become a huge strategic mistake for the lender, as well as for other large banks that have been aggressively increasing their commercial books over the past several years.

By contrast, the top 15 banks that we have recommended for our clients have very limited exposure to commercial lending, as we have been cautious about this segment for quite some time now.

At the end of the day, we’re speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you’re relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It’s time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology outlined here.

Housekeeping matters

This article, as well as Saferbankingresearch.com, is a combination of efforts between Avi Gilburt and Renaissance Research, which has been covering U.S., European, LatAm, and CEEMEA banking stocks for more than 15 years.

If you would like notifications as to when my new articles are published, please hit the button at the bottom of the page to “Follow” me.

Also, for those that are questioning why all comments (including mine) go through moderation, you can read here: Haters Are Gonna Hate – Until They Learn.

Lastly, I have asked the editors to close the comments section, as I will be out through the weekend. The comments section will re-open when I return next week.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.