Summary:

- Bank of America Corporation stock price responded to worries rather than the earnings announcement itself because the market looks forward.

- The company is far too diversified for “office” and credit card worries (for example) to dominate.

- The spread between cash costs and investment returns for the bank is widening.

- There is a Bank of America Corporation automation transition underway in both bill payments and customer assistance that may dominate profits through large cost savings.

- Money center banks often service the strongest and largest clients. Therefore, they recover the fastest in the industry.

J. Michael Jones

Bank of America Corporation (NYSE:BAC) recently issued its latest earnings report. While it would appear that the announcement beat at least some expectations, Mr. Market is in the “worry” mode. Therefore, good news appears to have been minimized while bad news receives an overreaction. Investors who understand the market mood swings can take advantage of something like this to do their due diligence and decide if they want to get into an issue that is probably still in the recovery stages of the business cycle and will likely go higher from the current price.

When it comes to banks, there are concerns about commercial real estate, the timing of interest rate cuts by the Federal Reserve, and a lot more. The optimism that led to an initial pricing rally appears to have faded for now, which has led to several of these stocks giving back some of the initial gains. Then again, banking shares, like any stocks, often climb a wall of worry initially because the market does look forward. Therefore, since a lot of these issues began to surface, there is likely to be more volatility on the way up along with market doubts.

Many of these perceived cyclical stocks are valued by the market at an average earnings value during the total business cycle. Therefore, these stocks tend to look expensive at the beginning of a rally and cheap when things are going right (forever, it would seem). Many times, it is just as hard for investors to realize that there are better days ahead when it would appear that the current situation is loaded with profitability challenges.

Money center banks, in particular, are so well diversified and usually able to deal with the best clients in the country. Therefore, a bank like this one will generally be one of the least hurt by current trends, while being the first to participate in the recovery of many of its customers. The extremes to which Mr. Market tends to go appear to be unwarranted when it comes to such a bank because earnings will not be nearly as volatile as they are for smaller banks.

An Overlooked Point

Banking is largely very dependent upon the concept of matching and the concept of loan spreads. In this case, management only mentioned once that loan spreads were widening. That big profitability advantage was lost in all the worries about the other stuff.

“Lastly on a positive note, loan spreads continued to widen.”

This quote came from Alastair Borthwick, Chief Financial Officer, during the conference call. This quote came while he was discussing slide 6 in the corporate presentation.

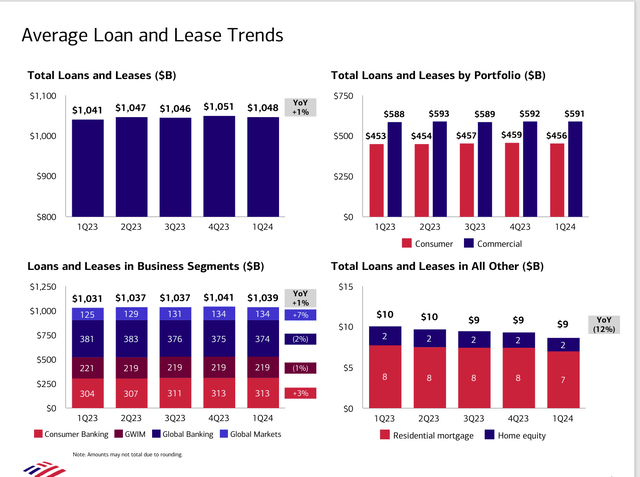

Bank Of America Business Loans And Leasing Trends (Bank Of America First Quarter 2024 Earnings Conference Call Slides)

While the market is busy worrying that business is holding steady (as opposed to growing), management mentioned a huge reason why profits are likely to increase in the future as long as the trend continues. As is often the case, the spread often widens during a time when interest rates are expected to decline. This event usually happens along with an inverted yield curve.

Economic Worries

What the market generally worries about is that the inverted yield curve will bring about a recession. When that is combined with the fact that the first year of a new presidential term, which will be fiscal year 2025, generally has the lowest returns for stocks in terms of the presidential cycle, the worries are not exactly unfounded.

But then again, economists and the market have been predicting, time and again, a recession that just has not happened. What has happened instead is the reigning in of an overheated economy that brought about inflation. This has led to what may be the best economic record (and job creation record as well) since Calvin Coolidge in 1924, who had 4 full years of economic growth during the administration he was elected to. It was not that bad before that, either, when he succeeded Warren Harding. Few presidents until the current administration can match that record.

But that means that if the current trend keeps up, the worries of the market will vanish to send the stock price higher. A healthy, growing economy is just what a bank like this needs, rather than an overheated economy that results in another 2008.

Banks the size of this one generally do not grow all that fast, though an acquisition can change that picture materially. Bank of America has made opportunistic acquisitions in the past. It is likely to make some in the future.

The last consideration is that a recession is generally a brief event that passes within months rather than years. Therefore, any effects are unlikely to be long-lasting.

Digital Trends

The consumer business trends were not all that great and are likely to remain in that mode for a while. However, management has a huge cost savings underway in the conversion of customers from using employees to using digital programs for their needs instead.

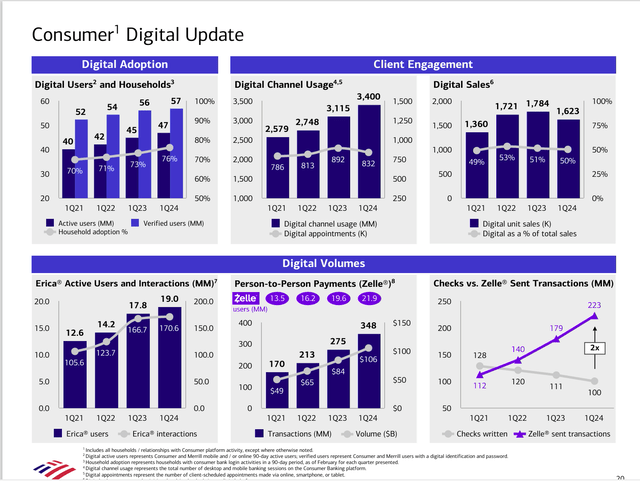

Bank Of America Automated Customer Services Use (Bank Of America First Quarter 2024 Earnings Conference Call Slides)

What management has mentioned is the key idea that the use of these services has entered the point where the doubling of the demand for virtual assistants is happening in a shorter period of time.

Computers are far less expensive than employees for just about any service you can name. This trend is resulting in a much lower need for actual physical branches. As a result, banks are beginning to close branches to save money.

As long as those “doubles” of use continue to accelerate, which they could for the near-term maybe heading into the long-term briefly, that cost savings could prove the dominant factor in profits for a couple of years.

The discussion about electronic payments instead of paper checks is a very similar discussion. The banks that benefit proportionately from this the most will have a lower cost lead for a little while that will lead to better profits. Clearly, Bank of America is in that race.

Profits

Offsetting this was the news that charge-offs had been moving up, even if erratically in some cases. There was the concern about credit card profits and, of course, “office.” But that is nothing close to the whole business.

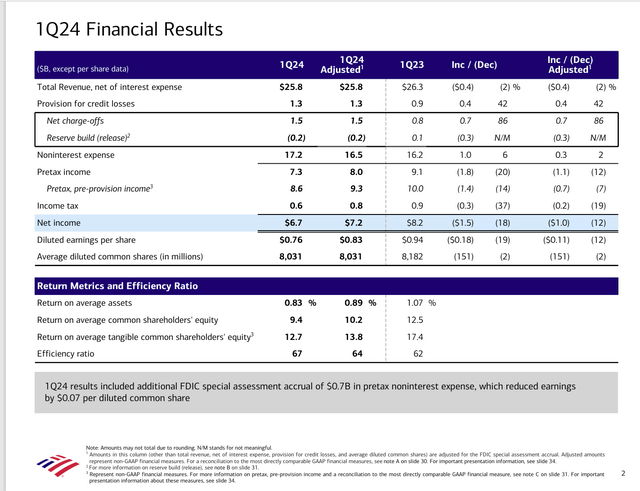

Bank Of America Summary Of First Quarter Results (Bank Of America First Quarter 2024 Earnings Conference Call Slides)

Management reported profits that were lower compared to the fourth quarter. But those profits were still better than expected by many observers.

The effect of the presidential election year is likely to be positive on bank profits. There are a fair number of worries about fiscal year 2025. However, as a country, we have yet to willingly dive “over the edge.” The worst that is likely to happen is a brief recession that will affect a quarter or two of the results.

The real factor appears to be that economists are in a “new era,” as economic theory has failed them when it comes to forecasting. Banks employ numerous economists and statisticians to try and figure out the best way to go.

Investors, meanwhile, need to keep their eyes on the different spreads throughout the business. The automation sweeping the industry is likely to lead to an unprecedented time of cost-cutting as computers replace humans for countless routine services throughout the industry. There is a similar story happening with electronic payments rather than paper checks in the mail.

That means that Bank of America Corporation remains a Strong Buy, as it is likely to remain a big beneficiary of automation that is now underway. There is no longer a depression in the future, as there was in 2008 and 2020. Therefore, this business is likely to continue to grow in the single digits. That return from growth will be augmented by share repurchases and the dividend. The automation of services and payments could provide a profit bump for a couple of years as that trend accelerates.

Risks

The economy is low visibility, and the forecast assumptions in the article can change quickly without further notice.

Similarly, the spreads between money costs and the investment yield of that money can likewise change quickly in the future.

The loss of key personnel can be damaging to the company’s future.

Politics plays a huge part in the outlook for international banking. Those effects of political changes can rapidly change the outlook of this company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to do their own research that includes the review all company documents, and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Long Player believes oil and gas is a boom-bust, cyclical industry. It takes patience, and it certainly helps to have experience. He has been focusing on this industry for years. He is a retired CPA, and holds an MBA and MA. He leads the investing group Oil & Gas Value Research. He looks for under-followed oil companies and out-of-favor midstream companies that offer compelling opportunities. The group includes an active chat room in which Oil & Gas investors discuss recent information and share ideas. Learn more.