Summary:

- Bank of America investors have outperformed the S&P 500 recently.

- BofA has a solid banking franchise, benefiting from a higher-for-longer Fed.

- BAC’s exposure to CRE loans is expected to remain well-controlled.

- I argue why BofA investors should consider staying invested to ride the potential rally further. Read on.

J. Michael Jones

Bank of America: Outperformed The S&P 500 Recently

Bank of America Corporation (NYSE:BAC) investors who ignored the selloff in April and added more shares have been rewarded. I reiterated my bullish BAC thesis in mid-April, enunciating why the market misunderstood potentially lower NII in Q2. I reminded investors that Bank of America management maintained confidence that BAC’s NII would bottom out and inflect higher in the second half.

CEO Brian Moynihan maintained his confidence that BAC remained well-positioned to benefit from a potentially higher-for-longer Fed. While recent inflation and softer labor market dynamics increasingly point to the Fed potentially lowering interest rates by the end of 2024, the rate cut cadence is uncertain. Despite that, BAC’s confidence in its robust NII outlook suggests interest rate cuts are expected to stay well-controlled. While the US economy is expected to cool, consumer spending has remained resilient but is increasingly under more stress. While the unemployment rate has ticked up recently, it remains well below BofA’s conservative scenario estimates. Therefore, BofA’s well-diversified banking franchise and solid profitability are crucial anchors in underpinning BAC’s uptrend continuation thesis.

BofA: Need to Assess Fed’s Impact

Fed Chair Jerome Powell’s upcoming testimony on Capitol Hill will likely be scrutinized by bank investors for insights. Investors are keen to assess the impact of the Fed’s revised regulatory framework to increase capital requirements on the leading banks. In addition, other requirements to cap banks’ earnings streams could also be in focus. JPMorgan (JPM) has already cautioned JPM customers to expect higher fees as JPM looks to maintain profitability. Given BAC’s focus and exposure in consumer banking, investors are urged to monitor these developments.

Bank of America should also benefit from the ability to reprice loans across its consumer and commercial businesses. Wealth management and investment banking are also expected to lend additional fee-based growth recovery to BAC’s earnings resilience. Therefore, I have assessed that these are constructive developments in helping BAC maintain its premium valuation multiple (compared to peers).

BofA: Earnings Resilience Expected

BofA’s Q2 earnings will be released on July 16. Given BAC’s recent outperformance against the S&P 500 (SPX) (SPY), investors are likely anticipating a robust release. BofA underscores its confidence in targeting a “mid-teens” RoTCE, suggesting room for improvement. In addition, the bank’s advancement in lifting its digital capabilities should also help improve operating leverage. Therefore, investors should continue monitoring commentary on a potentially lower efficiency ratio.

However, there are concerns over big banks’ exposure to commercial real estate loans. BAC’s exposure to CRE also led to net charge-offs of $191M in Q1. Notably, BAC “recorded charge-offs on 16 office loans,” which likely affected investor sentiments back then. Despite that, BofA reminded investors that the bank was “quick to recognize impacts in the commercial real estate office space.” Therefore, BofA has maintained a proactive approach to managing exposure and reserves. As a result, investors are urged to monitor the net charge-offs in the upcoming Q2 scorecard to assess whether it could culminate in a “notable decline in the second half of the year.”

BAC: Valuation No Longer Cheap

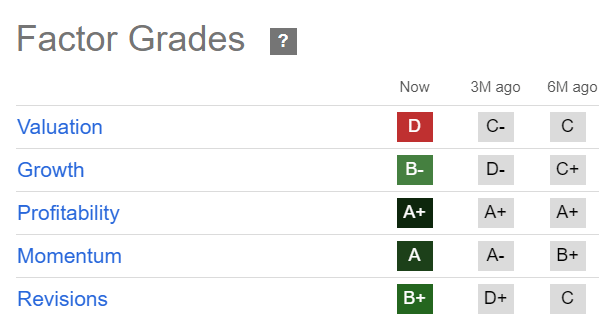

BAC Quant Grades (Seeking Alpha)

BAC’s valuation is no longer assessed as undervalued (“D” valuation grade). BAC’s forward adjusted EPS multiple of 12.5x and TTM tangible book value per share multiple of 1.63x are markedly above its peers’ median and BAC’s 10Y average.

Therefore, the market has likely reflected higher optimism in BofA’s outperformance throughout the cycle. Investors must carefully assess the impact on BofA’s earnings as the Fed potentially moves to reduce interest rates in the second half.

It is critical for BofA to see more robust lending volume increases to mitigate the possible NII impact. A higher-for-longer environment should continue to underpin bullish sentiments on BAC. However, higher potential upside could be less attractive than the buying opportunities at BAC’s April bottom.

Is BAC Stock A Buy, Sell, Or Hold?

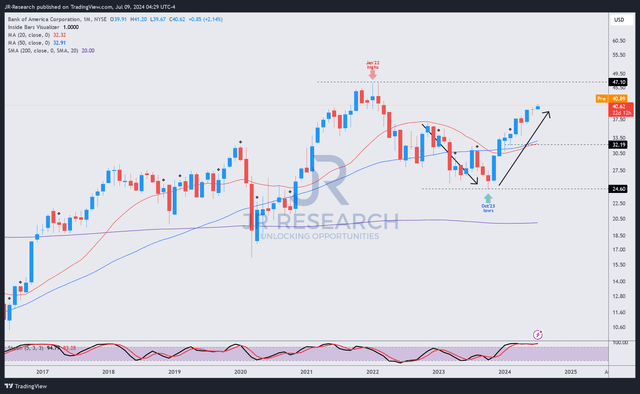

BAC price chart (weekly, adjusted for dividends, medium-term) (TradingView)

BAC’s price action (adjusted for dividends) suggests an ongoing rally that began in earnest from BAC’s October 2023 lows. Buying momentum has remained robust (“A” momentum grade), as BAC looks increasingly likely to rally toward its January 2022 highs ($50 level).

While near-term downside volatility is anticipated, it hasn’t translated into sell signals, suggesting the need to be unduly cautious. Therefore, investors may consider capitalizing on potential earnings-related selloffs to add more exposure.

With BAC’s long-term uptrend bias undergirded by BofA’s robust fundamental factors, I assess it as appropriate to maintain my bullish thesis in the banking leader.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!