Summary:

- Bank of America’s loan book and securities portfolio have a significant difference between fair value and book value.

- The unrealized losses on the portfolio of securities held to maturity amount to $131 billion.

- The Series GG preferred shares of Bank of America offer an attractive yield and are callable at any moment.

Justin Sullivan/Getty Images News

Introduction

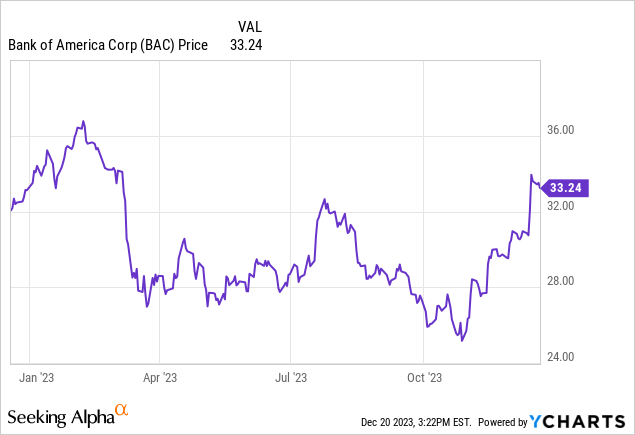

A few weeks ago, I wrote an article on the so-called “busted” preferred shares issued by Bank of America (NYSE:BAC) as it was unlikely that those shares will be force-converted anytime soon. While I have pretty much always focused on the Series L preferred shares, Bank of America has issued several other series of preferred shares, and in the comment section of the previous article, some readers commented that the other series of preferred equity issued by Bank of America warrant a closer look.

The difference between fair value and book value of the loan book and securities portfolio

In this article I will obviously not just copy the analysis on the preferred dividend coverage level and the asset coverage level I explained in the previous publication as nothing has changed. I feel comfortable owning the preferred stock of Bank of America, as the preferred dividends are quite well covered. I’d like to refer you to the older article to read my arguments.

In another article about a different financial institution, a reader commented that I was being too harsh on Bank of Marin as I argued the unrealized losses on the value of the securities held to maturity was undermining the balance sheet of the bank. Bank of Marin would lose in excess of 60% of its equity value if its loan book and securities portfolio would be marked to market. That reader commented that even “Bank of America would be in the mid-50% range” when it comes to the unrealized losses on the securities portfolio and the loan book.

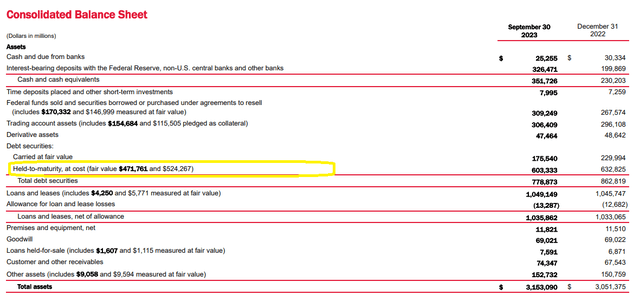

The impact of the unrealized losses on the portfolio of securities held to maturity is easy to establish, as that’s something the company discloses on its balance sheet. The portfolio of securities HTM has a carrying value of $603B, but the fair value is just $472B, which means there’s a $131B difference.

BAC Investor Relations

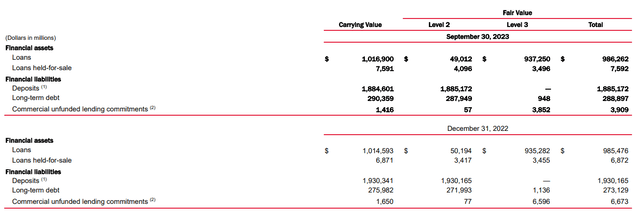

The difference between the fair value of the loan book and the carrying value is disclosed in the footnotes to the financial statements. As you can see below, the carrying value of the loans is approximately $30B higher than the fair value.

BAC Investor Relations

This means it’s indeed correct that BAC would see its equity value drop by in excess of 50% if the bank would apply the mark to market principal on its loan book and the securities HTM. And although that isn’t the best news for the common shareholders, I think there are two counter-arguments here.

First of all, as market interest rates go down, the fair value of these assets will increase. Over the next few quarters we should see the fair value of these assets reduce the gap to the carrying value. And as I’m focusing on the preferred shares, which means the common equity is first in line to absorb the shocks.

The bank has more than just the “busted” preferred shares

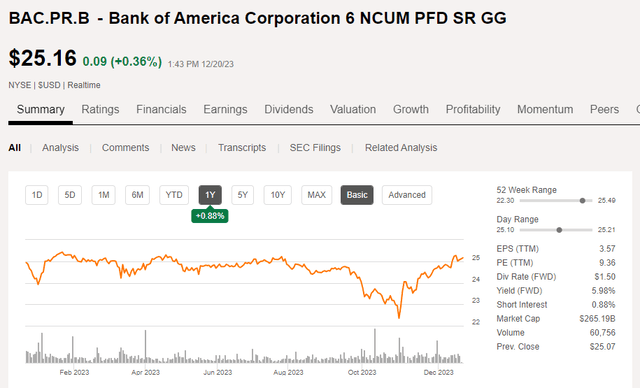

One of the other series of preferred shares I’m keeping an eye on is the Series GG preferred shares, which is trading with (NYSE:BAC.PR.B) as its ticker symbol. This series of the preferred shares has a fixed preferred dividend of $1.50 per share, payable in four equal quarterly tranches of $0.375. This security is now callable at any moment.

Seeking Alpha

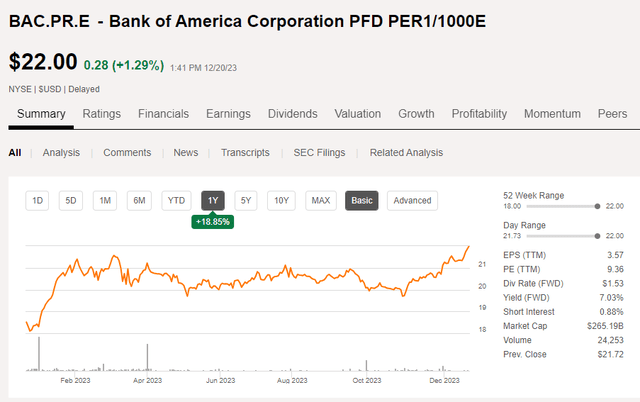

The stock is trading at just under the $25 call price, resulting in a yield of just over 6%. That makes it relatively attractive for an investor who doesn’t want to be exposed to fluctuating short-term interest rates. As I think it’s more likely to see interest rate decreases in the near-term and mid-term future, I don’t really want to speculate on floating rate securities, although I’m keeping an eye on one specific issue: The Series E preferred share which is trading with (BAC.PR.E) as the ticker symbol. The Series E currently pay a variable preferred dividend using the three-month SOFR plus the 0.26161% mark-up and an additional mark-up of 0.35%.

Seeking Alpha

As the 3 month SOFR is currently approximately 5.36%, the Series E preferred share would be paying a preferred dividend of close to 6% ($1.49/share). That’s very close to the $1.50 payment on the Series GG preferred shares, but the Series E are trading about 12.5% below the share price of the Series GG.

Why is that? First of all, that’s mainly because the market is already taking lower three-month SOFR rates into account. At the current share price $22, in order to yield 6% (in line with the Series GG preferred shares), the market is already anticipating a three-month SOFR rate of approximately 4.66%. But if the three-month interest rate would drop to, say, 3.5%, the annualized preferred dividend would drop to $1.03 per share. In which case, the Series E would be yielding just 4.7% based on a $22 share price. In case that scenario does unfold and the market for instance requires a 5.5% yield on the preferred equity of Bank of America, the share price of the Series E will fall to $1.03 / 0.055 = $18.73. As I think a decreasing short-term interest rate is more likely than an increase, I’m steering clear of the Series E for now.

Investment thesis

Until now, I predominantly focused on the busted preferred shares, but in the comment section on the previous article, the Seeking Alpha community has proven its value by also highlighting the other preferred securities issued by Bank of America. I’m still leaning toward the fixed rate preferred shares as I’m not sure where the short-term rates will be headed, but I’m also warming up to the common shares.

As Powell recently indicated, we may see some rate decreases in the not so distant future. The financial system in the United States should benefit from rate decreases, as the default rate should come down, while the unrealized losses will decrease pretty rapidly.

I currently have no position in Bank of America nor in its preferred shares, but I’m keeping an eye on the Series GG preferred shares and I recently started to write some put options (with a strike price in the low-$30s) on the common shares of Bank of America as I wouldn’t mind establishing a long position at around $30-$31.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have written put options on Bank of America, but all those put options are currently out of the money.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!