Summary:

- Bank of America is now selling at a discount to book value.

- Investors appear to misunderstand the origin of the crisis in the banking market. This is a crisis of liquidity, not credit quality.

- The Fed has done an excellent job in controlling sector-specific liquidity risks and valuations can be expected to rebound to pre-crisis levels.

Brandon Bell

Shares of Bank of America (NYSE:BAC) whiplashed in the last three weeks as the existence of a large amount of unrealized losses in banks’ bond portfolios caused a panic sell-off in the sector which, in many cases, affected U.S. regionals much more heavily than top tier banks like Bank of America. However, Bank of America’s shares are now also trading at what I believe to be an exaggerated discount to book value. Bank of America is classified as a systemically-important bank which makes it highly unlikely that authorities would let the bank fail. I also believe investors misunderstand the origins of the current crisis in the financial sector which makes a rebound of bank valuations even more likely!

Unrealized losses in held-to-maturity portfolios are the root cause of this crisis, not credit quality

The failure of Silicon Valley Bank has been driven chiefly by losses in SVB’s investment portfolio, not because of credit quality issues. The bank invested a large portion of its deposits in U.S. Treasuries and mortgage-backed securities which lost value due to the Fed raising interest rates rapidly in 2022. This caused unrealized losses in so-called held-to-maturity portfolios which are not market-to-market. Silicon Valley Bank was forced to liquidate its portfolio at a $1.8B loss, causing bank run.

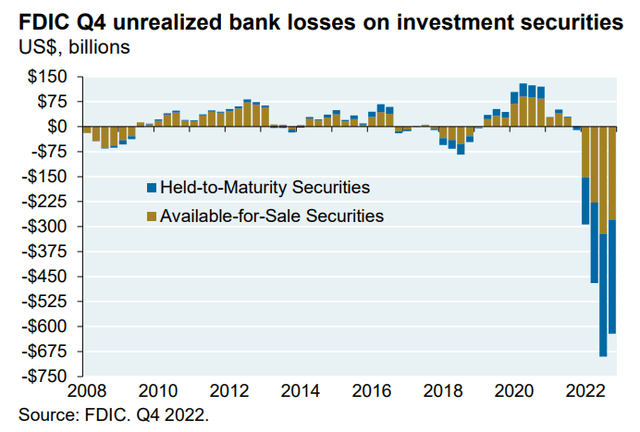

The Federal Deposit Insurance Corporation has highlighted that the U.S. bank sector is sitting on $620B in unrealized losses due to the Fed’s interest rate increases. Bank of America is said to have $114B in unrealized losses which are largely related to U.S. Treasury securities and high-quality mortgage-backed securities.

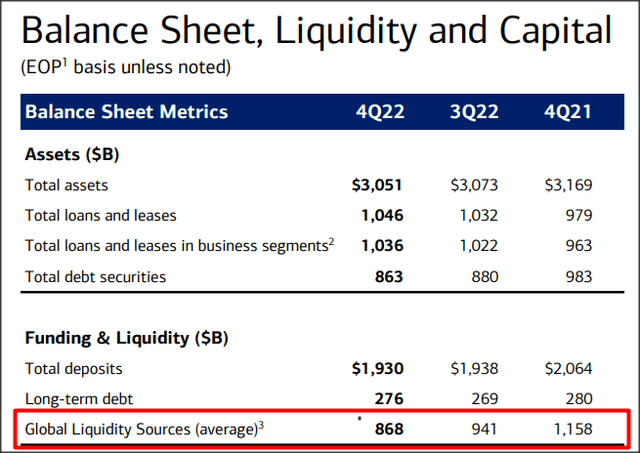

The important thing to understand is that banks like Bank of America are not at risk of having to sell these securities and if they hold them until maturity, no loss is incurred. Bank of America should not have to sell these securities for three reasons: (1) The Fed has made emergency liquidity available to the banking sector in order fund potential outflows, (2) As a systemically important bank, Bank of America has actually seen deposit inflows (~$15B) from the U.S. regional banking sector since the start of the crisis, and (3) Bank of America has a very comfortable liquidity situation. According to the bank’s latest disclosure, Bank of America had $868B in available liquidity.

Bank of America’s valuation is now very attractive

Bank of America is a systemically important bank and the second-largest bank in the U.S. after JPMorgan Chase (JPM) which is the reason why I believe the U.S. government and the Fed are never going to allow their failure. Authorities have learned from the financial crisis in 2007 and I believe the deposit backstop guarantee the Fed provided at the onset of the crisis has so far been highly effective.

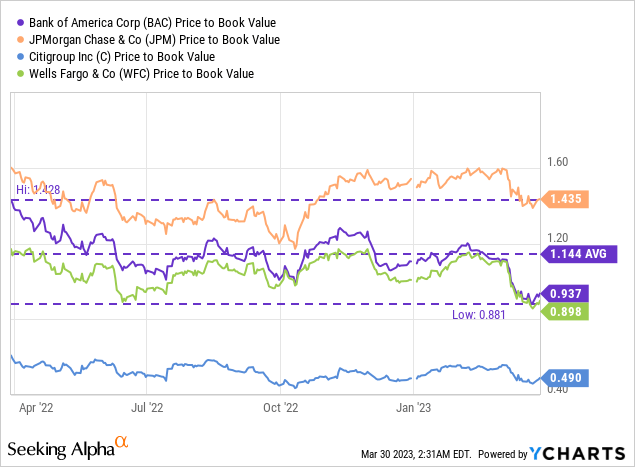

However, Bank of America has taken a big valuation hit as the SVB crisis unfolded and the bank’s shares are still trading at a 6% discount to book value despite having no major credit quality issues. Other banking rivals in the top tier also trade at discounts to book value, such as Wells Fargo (WFC) and Citigroup (C). I believe that the Fed has done a great job in managing the crisis and since banks now have considerable access to liquidity to fund deposit withdrawals, it appears that bank valuations have a reasonable chance to recover in the near term.

Shares of Bank of America are currently trading at a 6% discount to book value and are trading significantly below the 1-year average price-to-book ratio of 1.14 X. The discount to the 1-year P/B average, implied by the current valuation, is 18%. Considering that Bank of America is a systemically important bank with an implicit rescue guarantee from the Fed, I believe BAC stock is a bargain.

Risks with Bank of America

Unrealized losses in securities portfolios do not have to become realized losses if Bank of America keeps the investments on its books until maturity date. Only if the bank sells securities such as U.S. Treasuries or mortgage-backed securities before the maturity date does it transform an unrealized into a realized loss. Bank of America has no need to sell any securities given its deposit net inflows and access to Fed-provided liquidity, meaning investors are mostly concerned with nothing, in my opinion.

Final thoughts

I believe the SVB implosion has led to a skewed perception of how serious the financial crisis really is. The Fed has done an excellent job in providing incremental liquidity quickly in order to control the risk of deposits leaving smaller, more vulnerable banks. Bank of America is not one of them. Also, investors may not fully understand the reasons behind the collapse of SVB. Silicon Valley Bank collapsed because the bank was forced to liquidate its bond portfolio which was made up of the safest available investments, U.S. Treasuries. Since Bank of America has more than sufficient liquidity, is seeing deposit inflows and not required to sell any securities, I believe the discount to book value will soon be reversed!

Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.