Bank of America: No Good Incentive To Turn Bullish Ahead Of Q1 Earnings

Summary:

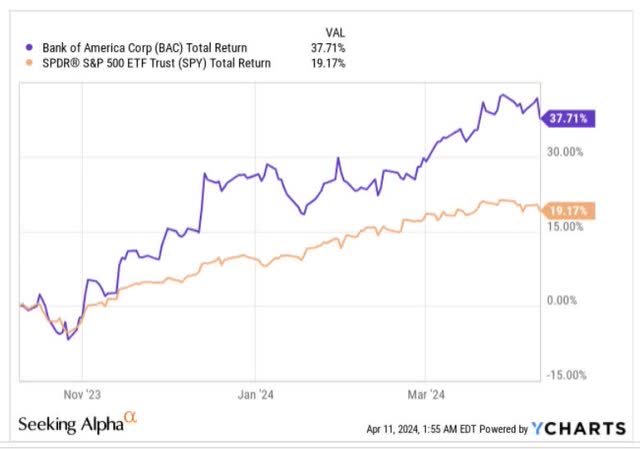

- Bank of America has generated healthy returns of 38% in the past six months, outperforming the S&P 500 by close to 2x.

- BAC will publish Q1 results on the 16th of April, and we pick out some of the major sub-plots that could dominate the event.

- The higher for longer narrative should hold BAC in a good position given its relatively high asset sensitivity, but forward valuations no longer look attractive.

- We don’t believe the risk-reward on the long-term charts look appealing, and the stock may not benefit from rotational interest.

brunocoelhopt

Introduction

Bank of America (NYSE:BAC), the global financial behemoth with $3.2 trillion in assets, has done rather well for its shareholders in recent periods. Over the past six months, it has managed to generate returns of 38%, which translates to almost double the returns of the S&P 500.

YCharts

In less than a week from today, BAC will have to deal with a catalyst which could be instrumental in deciding if this phase of alpha-generation may well continue – we’re referring to the bank’s Q1-24 results, which are due to be announced on the 16th of April, before the market opens. For context, since the bank last reported earnings in January, it has generated double-digit returns and outperformed the key benchmark by 300bps.

Earnings: Key Sub-Plots

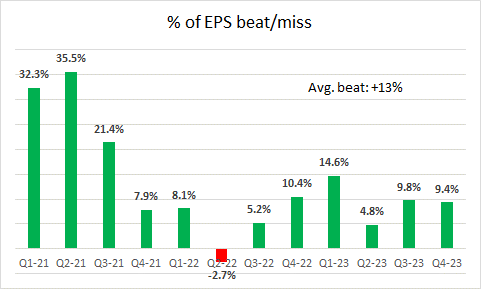

If one is to only go by BAC’s track record during earnings season, we don’t feel investors need to be too anxious about Q1, particularly when it comes to meeting street estimates on the bottom-line front.

Yes, in the most recent Q4, it first looked like BAC had come out with a shocker on the EPS front when it only reported an EPS of 0.35, which was a good 45% below street estimates. But on closer scrutiny, it was revealed that this was due to two separate pre-tax “one-off” charges (FDIC special assessment charges and BSBY cessation charges) aggregating to $0.35 at the EPS line. If not for those one-off items, BAC would have generated Q4 EPS of $0.7, which would have represented a +9.4% beat relative to consensus expectations.

All in all, it’s worth noting that over the last three years, BAC has fallen short of consensus EPS numbers only twice, and on average, this is a bank that typically beats quarterly bottom-line estimates by around 13% on average.

Seeking Alpha

In the upcoming Q4, consensus is currently watching out for an expected EPS figure of $0.77. If BAC ends up meeting that number, it wouldn’t be a great look from a YoY basis as it would represent an -18% decline in earnings, much in line with the Q4 YoY decline (on the adjusted EPS number of $0.7). Investors need to recognize that the YoY contraction on the bottom line will likely persist all the way until Q3-24, and will only turn positive by Q4 (although the pace of YoY declines in Q2 and Q3 will likely come in at an improved pace of -9 to -13%).

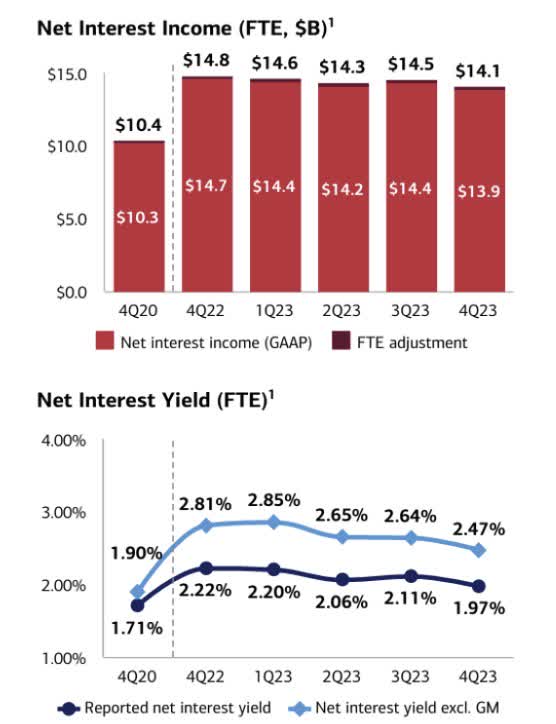

Earnings pressure is lingering for quite a few reasons. Firstly, you have the NII (net interest income) trajectory, which appeared to have peaked in Q4-22, and since then has been falling, mainly as deposit pricing gets readjusted at a faster pace than rates on assets.

Q4 presentation

In Q1, Bank of America also would have faced one less working day and this will likely compound NII weakness, where the expectation is that it could come in around $150m lower sequentially (this will likely be better than what was seen in Q4, where NII came off by roughly $400m). All in all, Q1 NII will likely be between $ 13.9bn to $14bn, and this declining trend also will play out in Q2 as well.

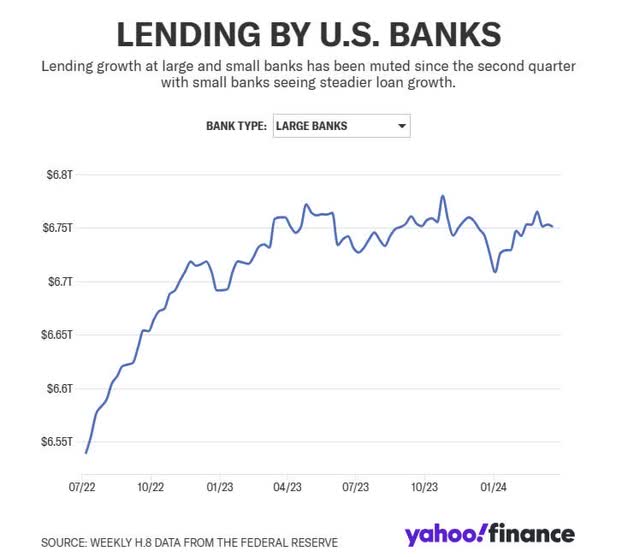

Investors also need to note that in the current high-rate environment, BAC is not getting a great deal of uplift on the loan growth front as clients are not too keen to utilize their revolvers. Of course, BAC is not alone on this front as other large banks too haven’t seen much YoY loan growth for much of Q1. Toward the end of March, loan growth for large banks was virtually non-existent, and at this stage, one does wonder if BAC will be in a position to meet its low-to-mid-single digit loan growth target for the year, particularly as the “higher for longer” narrative shows further stickiness. It’s worth noting that in March, the CFO stated that the Q1 loan growth was off to a “slowish start.”

Yahoo finance

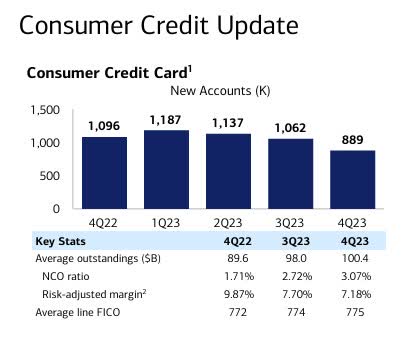

Besides weak revolver momentum on the commercial side, there also will likely be a drop-off in high-yield credit card momentum for BAC, as seasonal shopping trends abate in Q1. Even otherwise, it’s worth noting that BAC has been trimming the pace of new credit card accounts since Q1-23. In Q4, this had fallen off by 16%.

Q4 presentation

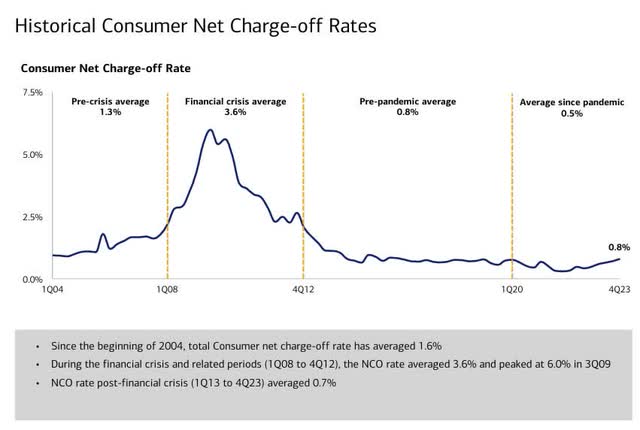

Of course, a large part of this is dictated by tighter standards and a spike in the net charge-off rates much of which is being driven by a consumer portfolio which accounted for 77% of the total $1.2bn net charge-offs that the bank incurred in Q4. Industry data through February suggests that these credit card charge-off pressures likely increased for BAC. Having said that, do consider that even if we continue to see the consumer related net charge-off rate grow even further in Q1, it’s still likely to remain well below the two-decade average of 1.6%.

Q4 presentation

For much of 2023, BAC did well to keep its opex base under control (opex saw sequential declines all through 2023) primarily by lowering the headcount by 5,000 employees, however it’s fair to say that it’s unlikely to get much better from here in Q1, particularly as there also will be some sequential elevation of expenses to the tune of $700-$800m. Much of this will be payroll tax related, but higher revenue linked to improved sales and trading momentum will play a part.

BAC’s non-interest income component in Q1 may get a boost from healthy investment and brokerage momentum, but on a YoY basis it’s questionable if the growth rate will be too impressive as the base effect from March 2023 will be exceedingly strong ($11.8bn as of Q1-23)

Closing Thoughts: Why Bank of America Stock May Not Be A Good Buy Now

Given its relatively high asset sensitivity, there may be some merit in sticking with BAC stock as rate cutting expectations get pushed down even further. At the start of the year, the expectation was that we could have as much as six cuts, now it’s down to just two to three. However, we do wonder if the market is over indexing this asset sensitivity card.

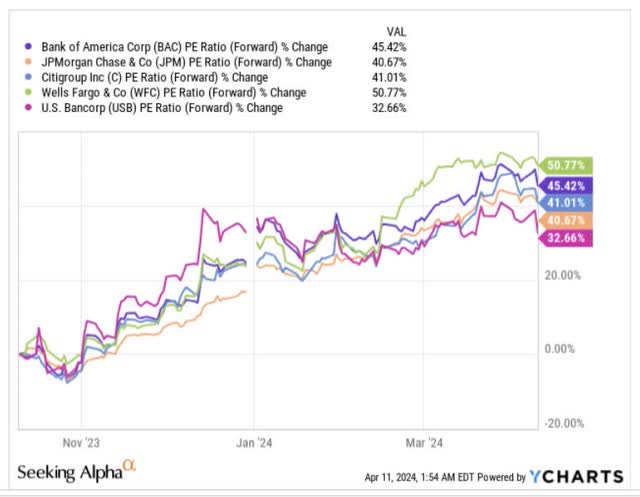

Note that over the last six months, consensus EPS estimates for FY24 have actually been trimmed by 4%, yet the stock has seen its forward P/E expand by 45%, with only Wells Fargo (WFC) (among the top five banks by market cap) seeing a more pronounced degree of re-rating.

YCharts

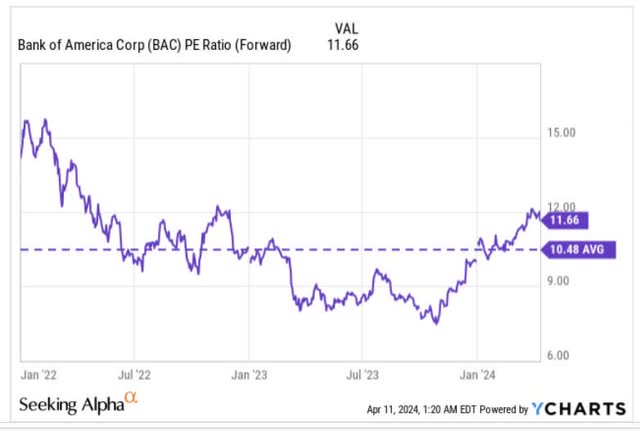

Now, as things stand, the stock no longer looks cheap, trading at a forward P.E of 11.66x, which implies a double-digit premium over its five-year average.

YCharts

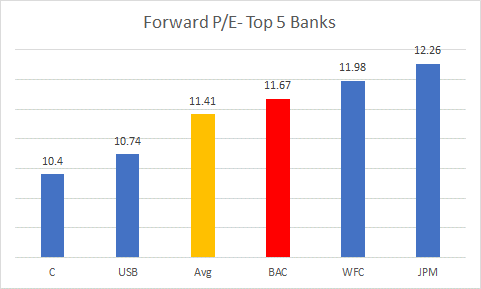

Note that the BAC’s P/E also is pricier than its peer-set average.

YCharts

Then, the chart below suggests that investors specializing in rotational opportunities within the banking space are unlikely to take a fancy to BAC at this point.

YCharts

Currently, the stock’s relative strength ratio vs. the SPDR S&P Bank portfolio is 28% more than its long-term average, and may even mean-revert to the downside.

Investing

Finally, do also consider BAC’s long-term price movements for the last 15 years; these movements have basically taken place within a certain ascending channel, with the stock largely respecting these boundaries except for a period in 2021/2022 where it broke past the channel, only to then fall back into it a few months later. Given how long this channel has held, we think it would be preferable to turn more constructive only when the stock is closer to the lower boundary of the channel, which is not quite the case now. In fact, as things stand, the stock is now only 12% off the upper boundary, but around 40% off the lower boundary, representing unfavorable risk reward.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.