Summary:

- Bank of America is set up for a strong quarter after large bank peers reported non-spooky Q3’23 earnings.

- The banking sector isn’t facing the large credit costs feared by the stock market.

- The stock is cheap trading at only 8x ’23 EPS targets while valued at a compressed P/TBV of only 1.2x.

John Kevin/iStock via Getty Images

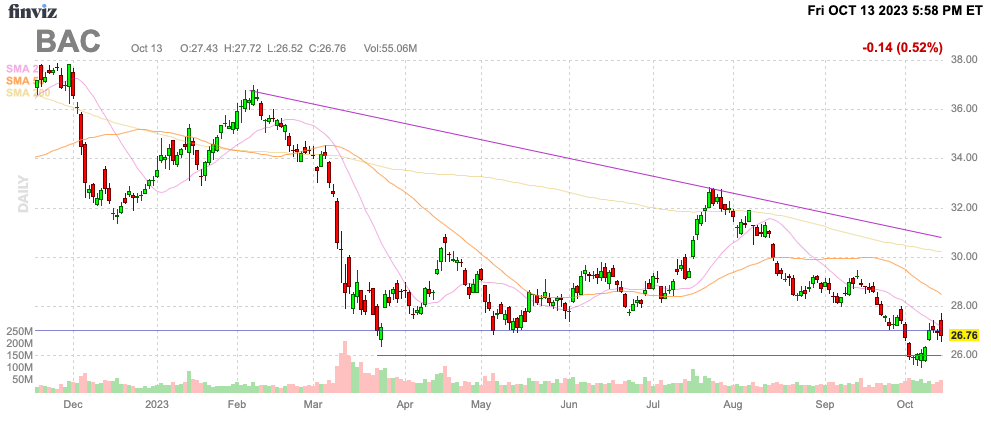

The large banks entered the Q3’23 earnings report with low expectations due to expected credit hits and higher deposit costs. Instead, the large banks reported non-spooky results on Friday the 13th, setting up Bank of America (NYSE:BAC) for a big quarter when reporting on October 17. My investment thesis remains ultra Bullish on the bank stock, with the market building in a big recession into the current valuation.

Source: Finviz

Focus On Credit Costs

The biggest fears with large banks are higher credit losses from the U.S. economy getting weaker. The reality is that the large bank peers didn’t report increases in credit losses, yet the banks continue to take higher credit provisions for future losses.

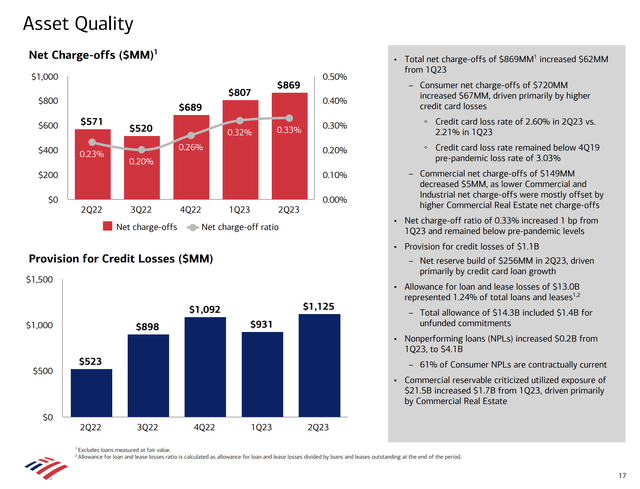

Going back to Q2 numbers, BoA reported net-charge offs grew to $869 million, up slightly from $807 million in the prior quarter. The large bank is definitely facing higher credit expenses after unsustainable low levels in 2022 when quarterly charge offs hardly reached $500 million per quarter.

Source: BoA Q2’23 presentation

In Q2’23, BoA took a $1.1 billion provision, causing credit costs to exceed actual losses by over $256 million. In total, the large bank has $14.3 billion in provisions for credit losses, which greatly reduces the need for a dramatic boost to credit losses going forward.

JPMorgan Chase (JPM) and Wells Fargo (WFC) both confirmed this scenario with slightly higher net charge-offs, while the provision for credit losses was actually lower than previous quarters. Instead of the banks taking higher credit charges, the impact was actually smaller.

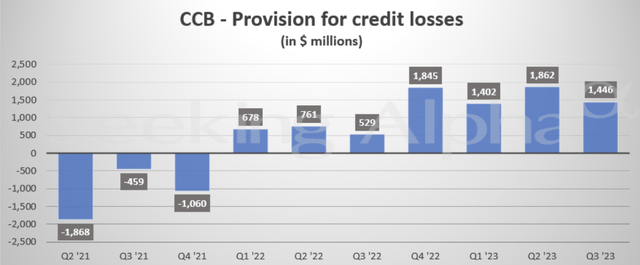

As an example, JPMorgan reported that credit provisions in essence peaked back in Q4’22 at $1.85 billion. The large bank has just boosted credit provisions to cover future losses for 4 straight quarters now, but the quarterly provision was down $0.4 billion from the prior quarter level to only $1.45 billion.

Good Setup For Q3

Without higher credit costs, BoA will report a strong quarter like the other large banks. Analysts forecast the following numbers for Q3’23:

- EPS of $0.82 (1.2% YoY)

- Revenue of $25.1 billion (2.3% YoY)

JPMorgan reported revenues grew a massive 22% YoY with a $470 million revenue beat. Naturally, BoA won’t report the same growth rate, but the company should easily beat consensus for meager revenue growth of only 1.2%.

The prime reason is the higher net interest income without a corresponding boost in credit costs or non-interest expenses. Even Wells Fargo under an asset cap reported NII beat Visible Alpha consensus estimates of $12.7 billion by $0.4 billion.

The numbers support BoA reporting an easy beat for the quarter. The big question is whether the stock can actually rally, considering the ongoing fears of a future recession will still remain implanted in the minds of investors.

The stock only trades at 8x 2023 EPS estimates of $3.38 and the company should easily soar past these estimates. Along with the other bank stocks, the P/E multiple is currently compressed.

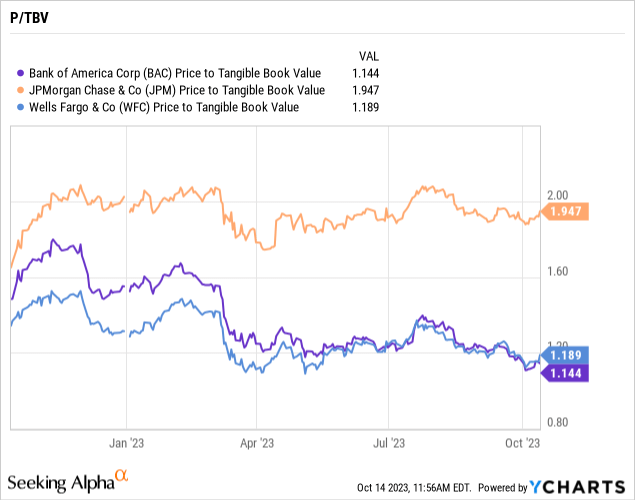

BoA has become so cheap, the stock trades at a price to tangible book value of only 1.2x, similar to Wells Fargo. JPMorgan now trades at nearly double the P/TBV multiple, at nearly 2.0x.

The large bank has a TBV of $23.23 per share, up from $21.13 last Q2. The downside risk appears very limited here, while the upside is for BoA to return to the previous highs of nearly $50 back in late 2021 and possibly higher considering the TBV continues to rise at a 10% clip.

Investors can now buy the stock at multi-year lows while getting the stock at nearly the TBV price.

Takeaway

The key investor takeaway is that BoA is poised for a strong quarter and definitely should eclipse analyst targets based on the results from large bank peers on Friday. The stock trades at multi-year lows, a compressed P/E multiple and a depressed P/TBV, all signaling higher stock prices in the future. BoA definitely isn’t guaranteed to rally anytime soon since the stock has been cheap most of 2023 already without a sustainable rally.

Investors should continue building positions in large banks like BoA and enjoy the large 3.6% dividend yield of the bank while waiting for the inevitable higher stocks prices.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.