Summary:

- Bank of America hasn’t visited higher quarterly net interest income and margin since Q4 ’22. Nonetheless, management provided an outlook where they believe Q2 ’24 is the NII trough.

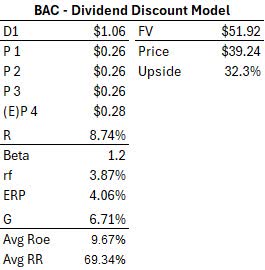

- A dividend discount valuation suggests the stock contains a margin of safety with an intrinsic value above $50, and a multiple history implies that the stock trades at normalized ratios.

- Combining a positive outlook and an appealing valuation, I rate the stock of Bank of America as a buy.

CribbVisuals

Bank of America (NYSE:BAC) is the second-largest bank in the Diversified Banks industry after competitor JPMorgan (JPM). With more than a trillion in net loans, the company operates within four core segments, which are Consumer Banking, Wealth & Investment Management, Banking, and Markets.

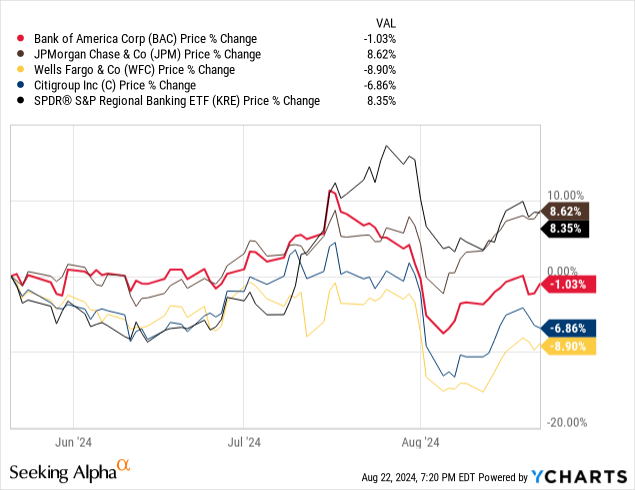

Over the past three months, BAC has obtained a performance of -1.03%, which ranks third among the other money center banks in the US. Yet, their performance has negatively diverged from the stellar returns of the regional banks, represented by the SPDR® S&P Regional Banking ETF (KRE) and rival JP Morgan.

In this analysis, I will analyze the current status of Bank of America, go through their risks and valuation to finally reiterate my buy rating on the stock.

Backdrop of Bank of America

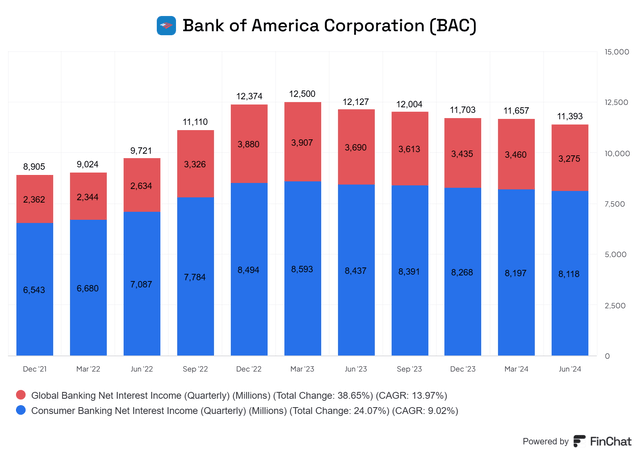

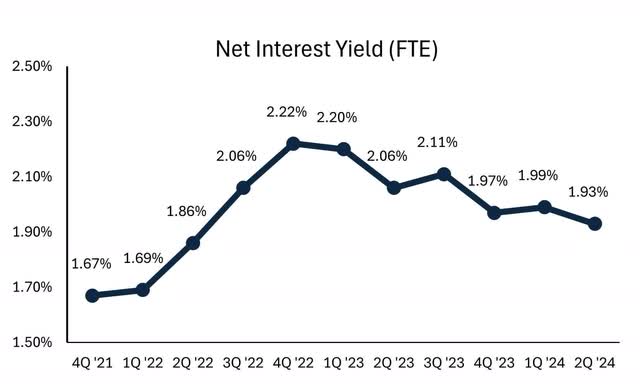

When the rate hike cycle started, Bank of America had five consecutive quarters of net interest income growth in its Consumer Banking and Global Banking (which includes corporate banking) segments. Simultaneously, the net interest margin for the whole corporation expanded, which helped boost NII. Nonetheless, as time progressed, the funding cost pressures started to offset the extra gains from higher rates, to the point where both the NII and NIM started to contract and have been doing so for more than a year now.

Author’s Compilations | Data: BAC’s Presentations

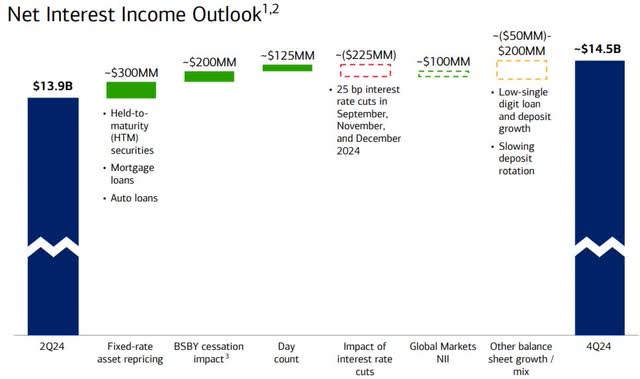

Although in Q2, the trend didn’t reverse, management believes that this quarter has been the NII trough, and provided positive guidance for Q4 in which they expect to achieve $14.5 billion from net interest income compared to the current $13.9 billion most recently achieved in Q2.

Nonetheless, this guidance is based on three 25-bps rate cuts in 2024, which at the current moment is not the most likely scenario based on how the FED’s futures are currently priced. Yet, three rate cuts have a 36.1% probability of occurring and are not a level far away from the 44.3% probability of four rate cuts in 2024.

In addition to their outlook, BAC is perhaps not earning as much as they should, which gives them more room to be more aggressive in yield-seeking. This is because, during the earnings call, recognized bank analyst Mike Mayo pointed out that their asset yield of 5.15% is inferior to the current federal funds rate, to which he later asked if they are currently under-earning with a low NIM of 1.93%. CFO Alastair Borthwick agreed and commented that a normalized NIM level should be around 2.30% through a cycle, implying a potential expansion of 37 basis points from current levels.

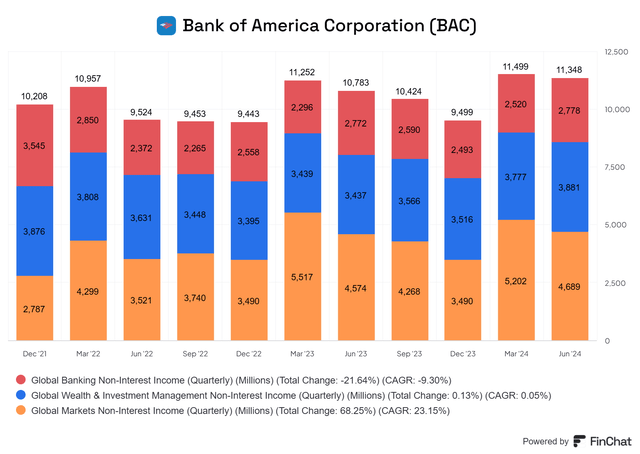

Adding all these things together gives me more confidence in being bullish on the stock. However, attention to non-interest income should also be drawn. For example, in Q2 non-interest income constituted 43% of the company’s TTM revenues, which represents a critical component of the top line.

Here, key segments such as Investment Management and Global Banking, were initially affected due to low deal activity and asset valuations. Nonetheless, Investment Management has fully recovered its revenue level and Investment Banking has shown some signals of recovery from the lows of Q3 ’22. Finally, volatile Global Markets’ non-interest income has assisted in countering the drops in other segments to soften the negative drops of the past, and currently augmenting the Investment Management soar and IB recovery.

As commented on in my previous analysis of Goldman Sachs (GS), deal activity still sits at levels far below the ones experienced in 2021, and also to its historical average. Although it is unlikely for activity to jump to record 2021 levels in the foreseeable future, there are some early signs of M&A and capital raising recovery which would increase even more fee revenue as normalized levels are achieved, especially with the help of interest rate cuts.

BAC: Attractive Valuation with Upside Potential

Although a dividend payment and an earnings release came after my previous analysis, in terms of valuation, things remain unchanged, mainly due to the stock price barely moving, despite management believing that they are at the NII trough. Perhaps this was already discounted, but the good news is that the valuation still remains attractive at current levels.

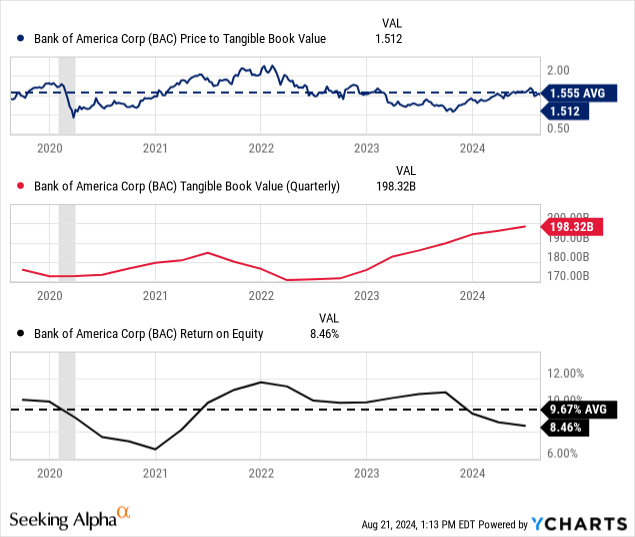

Data from Seeking Alpha, YCharts, Damodaran

Based on a single-period dividend discount model, the stock is suggested to have a fair valuation of $51.92, which represents approximately a 32.3% upside from current prices. Furthermore, a versus history comparison displays a BAC aligned with its five-year past, trading at 1.5x tangible book value.

Even though the net interest income has followed a downtrend for several quarters, ultimately, the growth in a bank is measured by the tangible book value expansion. Here, on a per-share basis, BAC has grown sequentially for the past six quarters. Partially countered by a lower return on tangible equity, which makes each unit of book to be less valuable than before.

Risks to BAC’s Outlook

Perhaps based on the outlook provided by the company, things look bright for BAC. Nonetheless, a lot could unfold in the economy and that is a risk being encountered. If potentially more readings of growing unemployment rates appear, the dropdowns would be notable to the banking industry. For example, in the red days at the start of August, the stock of BAC retracted up to -13.1% in just three days, suggesting how critical positive economic outlooks are in bank stocks.

At the same time, although the bank still expects deposit rotation to higher-yielding instruments after the imminent start of rate cuts, the pace of asset reallocations could continue to be higher than they anticipate. If that occurs, the funding costs would continue to increase as BAC would be more dependent on interest-bearing deposits and wholesale funding, rather than non-interest-bearing deposits.

Takeaway

To me, Bank of America remains a well-run bank. With expectations of improving net interest income going forward, while displaying an undervalued valuation, I will give a buy rating to the stock which is trading at approximately the $40 mark. If the stock appreciates significantly above $50 or there are clearer signs that things in the economy are unfolding, I would have to revisit my bullish thesis, but for now, BAC remains a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.