Summary:

- Bank of America’s Q1 earnings report beat market expectations, with non-GAAP EPS of $0.83 and revenues of $25.82B.

- The bank’s strong balance sheet and capital ratios position it well for growth and potential regulatory changes.

- Other growth catalysts include high interest rates, increased wealth management fees, and diverse operations in various segments.

- The valuation is still cheap. Trading at about 10x FWD pretax earnings, it still fits Buffett’s 10xEBT rule well.

E_Y_E

Thesis

The last time I wrote on Bank of America (NYSE:BAC) was back in October 2023, right before its release of 2023 Q3 quarterly earnings. In that article (see the next chart below) I argued for a bull thesis based on the following key considerations:

A) The expectation that its Q3 EPS to be toward the high end of consensus estimates thanks to a few ongoing catalysts

And B) the value-price gap is too large to ignore, and it was a good time to buy a good bank at cheap valuation.

Seeking Alpha data

Fast forward to now, the bank just released its 2024 Q1 earnings report this morning (April 16). The goal of this article is to argue that the considerations in my earlier article are still valid, and thus BAC is still a good buy candidate.

In the remainder of this article, I will first go over its Q1 earnings report and point out a few key areas. Based on this earnings review, I will explain why the profit catalysts argued in my earlier article still remain effective. Then I will go over its earnings outlook in the next 2~3 years and explain why the valuation is still quite attractive. Since the stock is a top 2 holding in Warren Buffett’s Berkshire equity portfolio, I think it’s very fitting to analyze its valuation against the so-called Buffett rule of 10xEBT (earnings before taxes). And you will see that the stock is still trading around 10x of its FWD EBT despite the large price advancements since my last writing.

BAC 2024 Q1 earnings report

BAC delivered a strong quarter, in my view, beating market expectations on both lines. According to its Q1 2023 earnings report (“ER”), its non-GAAP EPS came in at $0.83, beating market expectation by $0.06. Its revenues totaled $25.82B, beating market expectations by $430M.

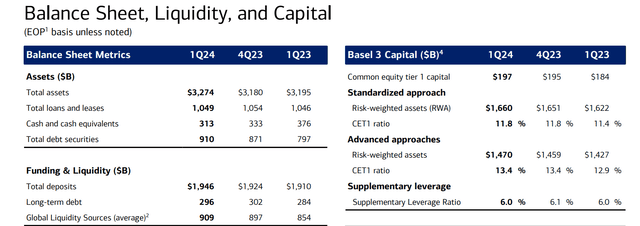

Whenever I review bank earnings, I immediately go to look for its balance sheet and capital after glancing over updates on the top and bottom lines. And the developments have all been positive here since my last coverage. As seen in the chart below (taken from its ER), the balance sheet is healthy. At the end of this quarter, global liquidity stood at close to $909 billion, representing a size increase compared to the $854 billion a year ago. Its credit quality is holding up well, and capital ratios remain robust and stable. To wit, the Common Equity Tier 1 (“CET1”) ratio stood at 11.8% (by the standardized approach), comfortably higher than the regulatory minimum requirement. A few finer points. First, the CET1 ratio is even higher (13.4%) when calculated by the advanced method. And secondly, the CET1 ratio is about 40 basis points higher than a year ago by the standard method and about 50 basis points higher by the advanced method. Back in 2023, its management announced they aimed at boosting its CET1 requirement by about 50 basis points in 2024. I applaud their conservative approach given the ongoing uncertainties and their effectiveness for almost achieving their targets in the first half of 2024.

BAC 2024 Q1 ER

Growth catalysts

I expect such a robust balance sheet to leave Bank of America well positioned for growth and/or weather turbulence ahead (say, if regulators tighten standards).

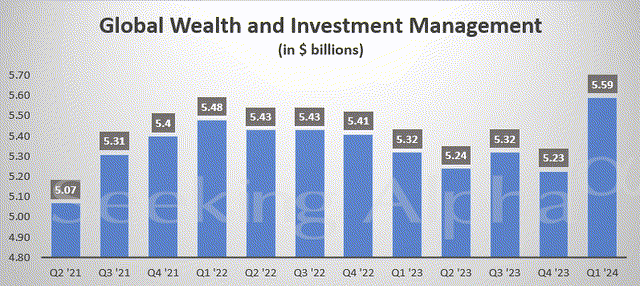

Speaking of growth, I see a range of possible growth catalysts in the next 1~2 years. BAC has a diverse range of operations, organized mainly into four main segments (Consumer Banking, Global Wealth and Investment Management, Global Banking, and Global Markets). I see all of them well positioned to benefit from the addition of clients, higher account balances, improved financial market appreciation, and technology initiatives.

I expect persisting high interest rates to serve as an overarching growth catalyst for BAC. I expect the Federal Reserve to maintain the current interest rates (or even further increase it) in the foreseeable future to combat inflation. This could benefit BAC by increasing its net interest margin (“NIM”), which is the difference between what the bank charges for loans and what it pays for deposits. A wider NIM translates to higher profits for banks.

Another catalyst that’s more particular to BAC involves its wealth management segment. BAC has a large wealth management business. Thanks to a strong stock market and increased household wealth, this segment is experiencing rapid growth, as seen in the chart below. And I expect such growth to translate to higher fees from wealth management services in the near future.

Seeking Alpha data

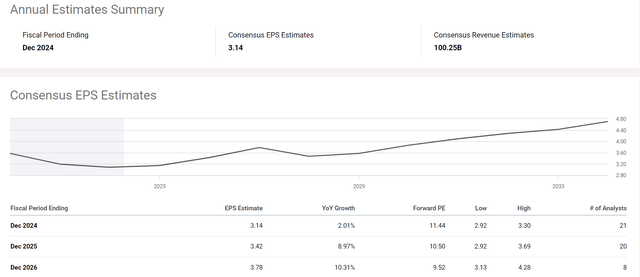

Valuation and Buffett’s 10x EBT rule

All told, consensus estimates project a robust growth curve ahead, and I fully share the optimism thanks to the positive catalysts mentioned above. More specifically, the next chart shows the projected EPS growth in the next few years. As seen, for FY 2025, the consensus EPS estimate is $3.42, which represents an almost 9% increase year-over-year. The growth rate of FY 2026 is expected to be about the same. Based off these projections, the forward P/E ratio is 11.4x for 2024 and only 10.5x for 2025. These multiples are quite attractive, both in absolute and relative terms.

Seeking Alpha data

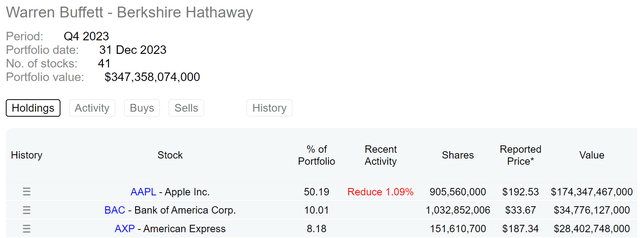

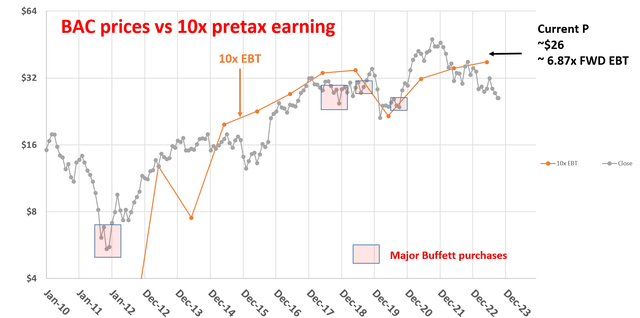

If you’re reading this, I assume you already know that Warren Buffett’s Berkshire equity portfolio has a large stake in the stock (see the next chart below). Hence, a valuation discussion on BAC won’t be complete without mentioning the so-called Buffett 10xEBT rule. If you’re new to this concept, my blog article provides a detailed description. The second chart illustrates the approximate times and prices of Warren Buffett’s major additions of BAC stock, showcasing the value-centric and long-term approach. You also can see how attractive the valuation was at the time of my last coverage: It was trading at only 6.87x FWD EBT at that time.

Looking ahead, my estimate of BAC’s effective tax rates is around 10% for the next few years. Based on this tax rate and the projected FWD P/E above, the implied price/EBT (earnings before taxes) multiple is about 10x for 2024 and 9.5x for 2025, making the stock a good fit to the 10x EBT rule.

DataRoma

Author based on Seeking Alpha data

Risks and final thoughts

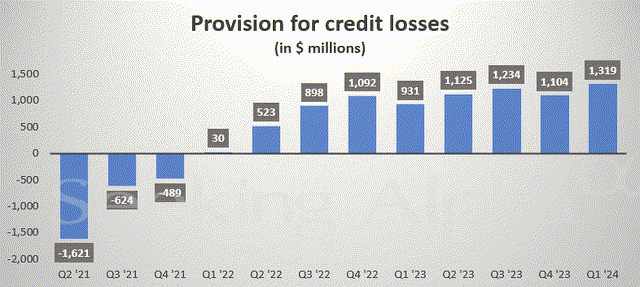

There are some signs of concerns from the ER too. On the top of my mind are costs and credit losses. While I’m optimistic about BAC’s expansion prospects, I will closely monitor its ability to control costs and minimize losses. Costs have been on the rise recently under the overall backdrop of a tight labor market and high inflation. For Q1 2024 alone, BAC reported noninterest expense of $17.2B, an increase of $1.0B, or 6%, year-over-year. The bank also has been cranking up its provision for credit losses. As seen in the chart below, the current provision stands at $1,319M, translating into almost a 20% increase compared to a quarter ago and almost a 40% increase compared to 1 year ago.

All told, my overall conclusion is that the positives outweigh the negatives by a good margin. At ~10x EBT, the downside risks are more than absorbed in the cheap valuation for such a leading bank. Thus, I see a very asymmetric return/risk profile here and rate the stock as a buy.

Seeking Alpha data

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.