Summary:

- Bank of America beats profit estimates and forecasts growth in net interest income despite expected interest rate cuts.

- Bank of America’s 25% premium to book value is undervalued, making it a ‘Buy’ for investors.

- Bank of America’s strong net interest income forecast and potential for book value growth make it a solid investment opportunity.

ProArtWork

Last week we saw better-than-expected results from banks including Bank of America Corporation (NYSE:BAC) which, besides beating profit estimates, is forecasting growth in its net interest income, despite projecting that the central bank would lower interest rates three times in 2024.

I think that Bank of America continues to make a robust value proposition here, particularly because of its net interest income forecast, and the U.S. economy is also doing quite well right now, with receding inflation potentially boosting consumer spending.

Bank of America’s 25% premium to discount is undervalued BAC’s growth and since the bank also grew its book value in 2Q24, I think Bank of America remains a ‘Buy’ for investors.

My Rating History

In April 2024, I penned a piece on the Wall Street bank and explained why I was going all-in. The reason being was that the central bank created the conditions for a higher-for-longer rate environment, which would inevitably profit Bank of America’s large floating-rate asset base.

Though the central bank has since guided for at least one rate cut, the net interest income setup for Bank of America looks healthy and the bank’s forecast for 2024 actually implies growth in its NII this year.

Receding Inflation And Robust NII Backdrop

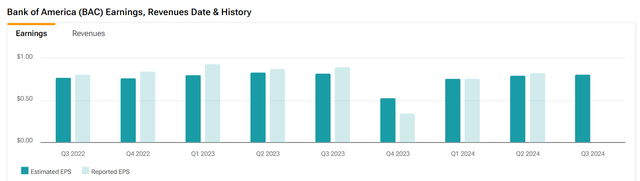

Bank of America reported better-than-expected 2Q24 results, with the bank’s profits of $0.83 per share surpassing the estimate of $0.80 per share. Bank of America profited from strong consumer and investment banking, as well as resilient net interest income.

Most importantly, in the context of receding inflation, Bank of America’s forecast for 2Q24 was very robust, creating a conditions for an expanding book value multiple.

Earnings And Revenue (Yahoo Finance)

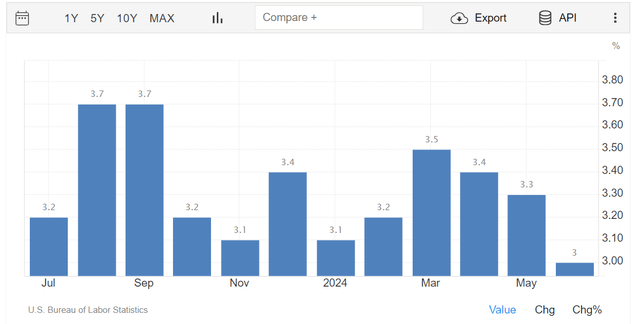

Inflation retreated to 3% in the month of June, making a rate cut in the short term that much more likely. Though inflation slumped to the lowest level in the last year, the outlook for Bank of America’s net interest income growth is still rather solid.

Inflation (Tradingeconomics.com)

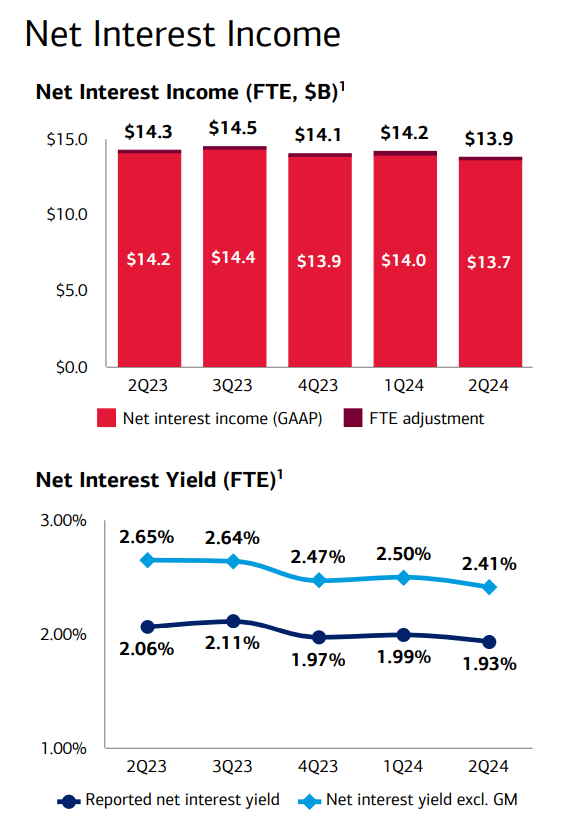

Before I discuss Bank of America’s NII outlook, I will quickly touch on the bank’s net interest income situation in the last quarter.

Bank of America, hands out money to borrowers in the form of loans, meaning it profits from rising interest rates. All banks tend to benefit from rising interest rates, as they can reset their loan rates higher while delaying passing higher interest rates through to their depositors. In the last two years, as the central bank pushed interest rates higher, Bank of America profited from substantial net interest income tailwinds.

In 2Q24, Bank of America earned $13.9 billion in net interest income, down $300 million QoQ. Though the bank’s net interest income has been quite steady over the last year, the prospect of falling short-term interest rates, and therefore falling net interest income, clearly was a risk for the investment thesis in the past.

Net Interest Income (Bank of America)

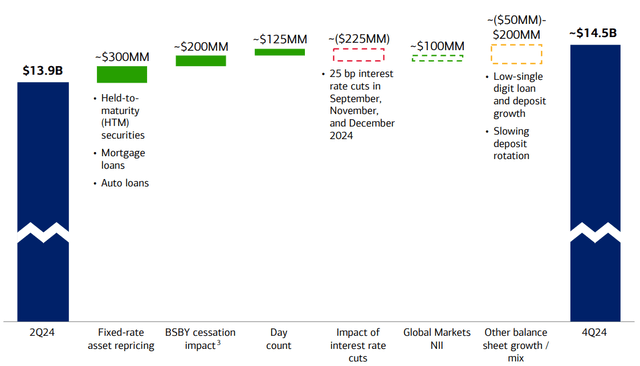

But Bank of America’s net interest income forecast for 2024 is what continues to back my bullish investment thesis for the bank after the release of second quarter earnings.

According to the forecast presented as part of the 2Q24 presentation, the bank anticipates, despite penciling in three interest rate cuts in 2024, to grow its net interest income by a substantial $600 million over the 2Q24 level.

With $600 million being poised to get added to the bank’s bottom line until the end of the year, I think Bank of America is in a solid spot to keep its bull run going. From a valuation angle, the bank’s stock is not too expensive yet and retains a positive risk/reward relationship.

Net Interest Income Growth (Bank of America)

I Still Like The Multiple For Bank of America

Bank of America’s stock immediately after 2Q24 earnings hit a new 52-week high at $44.44, but the stock slightly dipped on Thursday and Friday, possible on some profit-taking. With that said, though, I think that Bank of America’s stock still represents solid value, based on its NII forecast alone.

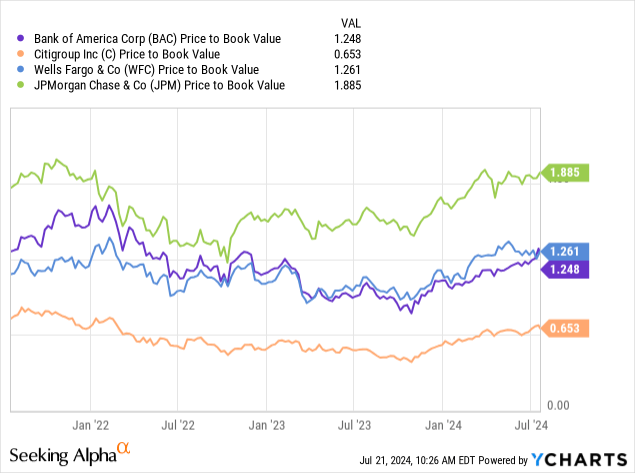

Bank of America added 2% to its book value in 2Q24, up $0.68 per share, QoQ. The bank’s stock is thus selling for a 25% premium to book value.

Wells Fargo & Company (WFC) is selling for a 26% premium, while investors need to pay a whopping 88% premium for JPMorgan (JPM). Citigroup (C) is an outlier due to its inferior profitability and is selling for a discount to book value of 35%.

JPMorgan appears a little bit expensive for my taste here, so I wouldn’t consider chasing the stock at such a high premium to book value. Bank of America and Wells Fargo, however, are selling at much more sensible book value multiples.

With Bank of America presenting a surprisingly strong NII forecast for the present financial year, and inflation on a downward trajectory, I think BAC could sell for a 30% premium to book value, which equates to a $45 intrinsic value. However, my intrinsic value calculation is poised to increase in lock-step with a growing book value.

Why The Investment Thesis Might Ultimately Disappoint

It doesn’t look like the central bank is planning on adopting a more aggressive rate policy in the short term, which would add growing pressure on Bank of America’s net interest income. As far as I am concerned, Bank of America’s risk/reward relationship looks its best in at least a year and with the market now having clarity about the bank’s run-rate net interest income, I think that the bank is in a great position to keep growing its book value.

If Bank of America failed to achieve that or if the central bank emerged as more dovish moving forward, I might revisit my stock classification on BAC.

My Conclusion

Bank of America may not be as cheap as it was in April, but the risk/reward relationship still looks darn good. The bank beat profits estimates, produced substantial net interest income in 2Q24 and the forecast, most importantly, was very robust.

Though inflation is falling, Bank of America still foresees upside in its net interest income, which I think is a very good reason to either remain invested in BAC or buy the stock on the drop after earnings.

Bank of America’s 25% premium to book value is also quite sensible, as far as I am concerned, and unless a recession were to emerge, I think the bank remains in a solid position to grow its book value moving forward.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.