Summary:

- Bank of America beat Q3’23 top and bottom line estimates and reported double-digit Y/Y net income growth.

- The bank’s deposit base stabilized in Q3’23, indicating that investors are no longer aggressively cash-sorting.

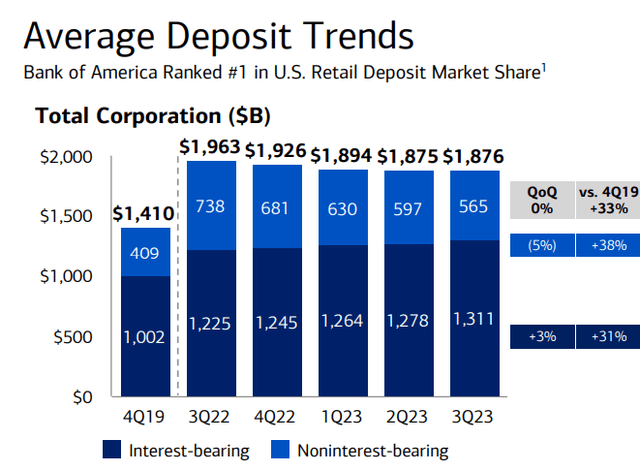

- Bank of America generated $14.5B in net interest income in Q3’23, the first increase since Q4’22.

- Shares of Bank of America remain undervalued based off of price-to-book as well as price-to-earnings.

Spencer Platt

Bank of America (NYSE:BAC) submitted its third-quarter earnings sheet yesterday and the bank kept firing on all cylinders: Bank of America reported a 10% increase year over year in net income, a stabilizing deposit base that is growing through interest-bearing accounts and the lender saw a sequential increase in net interest income as well. I consider Bank of America’s shares to be very much undervalued with a P/E ratio of 8.5X and this goes for the entire large-cap banking sector as well. The risk profile is skewed to the upside for long term investors, in my opinion, and I am buying more shares after the Q3’23 earnings release!

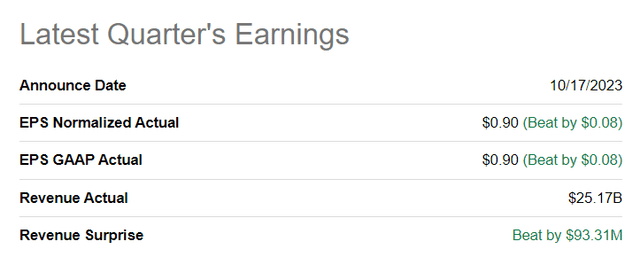

Bank of America beats Q3’23 top and bottom line estimates

Bank of America beat top and bottom line estimates for the third-quarter on Tuesday. The lender generated a top line of $25.17B which beat estimates by $93M. In terms of earnings, Bank of America reported diluted EPS of $0.90, beating the average consensus estimate by $0.08 per-share.

The top and bottom line beat was only the icing on the cake as the bank performed well across the board. Bank of America generated 10% year over year growth and achieved total Q3’23 profitability of $7.8B as customers, in both Consumer and Commercial, showed strong demand for the bank’s products and services. Consumer is doing especially well right now with the bank adding over 200 thousand net new checking accounts and 1.1M credit card accounts.

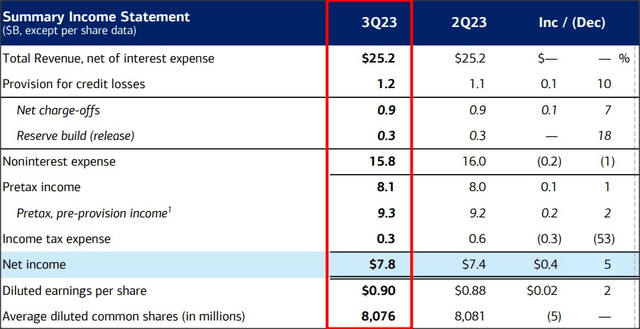

Bank of America’s deposit base also stabilized

Bank of America’s deposit base stabilized in the third-quarter… which is encouraging and suggests that investors/savers are mostly done with their cash-sorting actions.

The Federal Reserve started to raise interest rates last year in order to offset soaring inflation which caused investors to withdraw balances from low-yielding bank accounts and shift them over to high-yielding money market funds. In the third-quarter, however, evidence has emerged that this cash-sorting behavior is much less of a risk for banks than it was last year when the Federal Reserve increased rates at a dizzying speed.

On a consolidated basis, Bank of America reported deposits of $1,876M at the end of the September quarter compared to $1,875M in the June quarter, meaning deposits edged up slightly quarter over quarter… which is good news for Bank of America which saw a continual erosion of its deposit base in the last year. Growth in interest-bearing accounts offset a continual drop in non-interest bearing accounts in the third-quarter.

Net interest income tailwinds

An important take-away from Bank of America’s Q3’23 earnings sheet was that the bank generated $14.5B in net interest income in the September quarter… which reflected an increase of $200M compared to the prior quarter. The lender posted the first increase in its net interest income since Q4’22 which proves that the bank still benefits from higher interest rates in its business.

Source: Bank of America

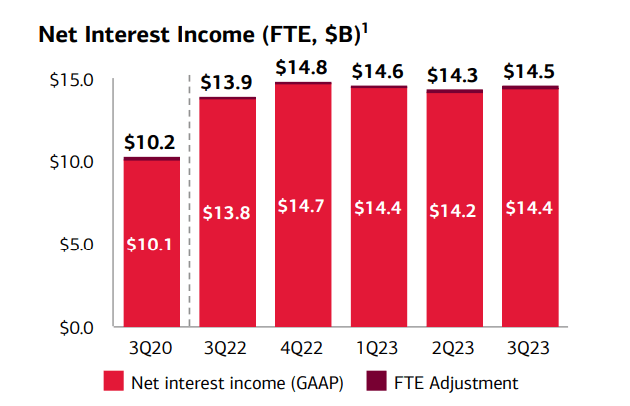

Bank of America’s valuation

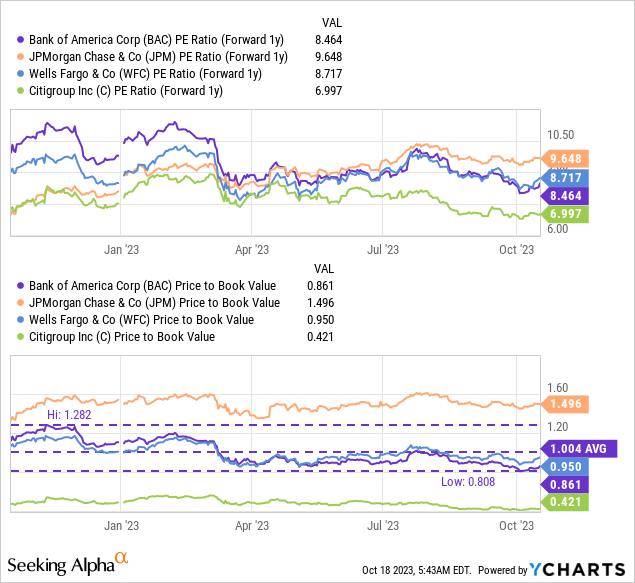

Bank of America is trading at a price-to-book ratio of 0.86X and a price-to-earnings ratio of 8.5X and I believe that Bank of America is not fully valued based off of either of those ratios. Only Citigroup (C) is cheaper based off of earnings as well as book value.

Realistically, I believe Bank of America should be able to trade at least at book value (which is also where the 1-year average P/B ratio sits) or at ~10X forward earnings. Considering that Bank of America is still growing total earnings (10% Y/Y in Q3’23) as well as its rate-sensitive income (NII), the bank appears undervalued to me.

At 10X P/E (FY 2024 projected earnings are $3.26 per-share), Bank of America would have a fair value around $33. At 1.0X book value, the lender would also trade at about $33.

Risks with Bank of America

Risks include a contraction in NII, slowing inflation (makes rate cuts more likely) and moderating GDP growth. One risk factor that I discussed in the past relates to Bank of America’s large amount of unrealized losses in the bond portfolio. These bonds have lost value during the Fed’s most recent rate increases, lowering the worth of their cash flows, and banks as a whole are sitting on large losses in their held-to-maturity portfolios. Investors freaked out over those losses during the banking crisis in the first-quarter, but the bank has a strong balance sheet and liquidity and should not be forced to sell them. Therefore, I believe that the risk profile overall is healthy and favorable.

Final thoughts

Bank of America’s Q3’23 earnings report was a show of strength. The bank generated 10% year over year growth in net income on broad-based strength, especially in Consumer, and the bank even generated a Q/Q increase in net interest income. To me, the most important take-away was that the bank’s deposit base effectively stabilized in Q3’23 which indicates that investors’ cash-sorting behavior has all but ended. Considering that Bank of America is still trading well below its 1-year average P/B ratio and at a 8.5X P/E ratio, I believe investors have more than one reason to consider buying Bank of America for the long term. The price they are getting is more than fair, from both a P/B as well as P/E perspective!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.