Summary:

- Bank of America is set to report next quarterly earnings.

- I expect Q3 EPS to be toward the high end of consensus estimates thanks to a few ongoing catalysts.

- For long-term investors, now is a good time to buy a good bank at cheap valuation. The value-price gap is too large to ignore.

- BAC now trades at a substantial discount according to the so-called 10x pretax rule.

Brandon Bell

Bank of America earnings

Bank of America (NYSE:BAC) is scheduled to report its next quarterly earnings on Oct. 17, 2023, before the market opens. The bank has been operating in a challenging environment lately but has performed reasonably well, in my view. In the meantime, the market has overreacted to these challenges with a dramatic valuation compression. Currently, its stock price hovers near its 52-week low and it trades at an FWD P/E of only ~7.7x. I view the value-price gap to be too wide and this provides a very skewed return profile for both long-term and short-term investors.

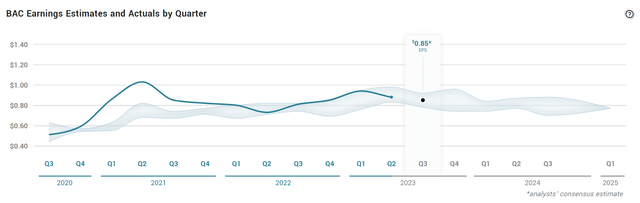

In the near term, I expect a solid Q3 report. As shown in the chart below, the average estimate from consensus for its EPS in Q3 is $0.85 per share. Looking into the consensus estimates a bit more closely, you will see forecasts vary from a low end of $0.78 to a high end of $0.92. I see several near-term catalysts that could push the actual earnings toward the high end. In recent quarters, management has been focusing on cost control. Under an overall inflationary environment, operating expenses climbed by around 5% during the last quarter. In addition, the bank also reported higher FDIC costs. I expect to see the effects of its cost-control efforts in the Q3 report. At the same time, the bank has been focusing on expansion initiatives, such as upgrading its technology and rolling out digital applications. These catalysts should create a bias for upward price movement after the Q3 report.

For long-term investors, I see BAC as a strong bank for sale at a substantially discounted price, as detailed next.

Why is Bank of America stock a buy for long-term investors too?

A few factors differentiated Bank of America from other banks and make it an attractive bank stock for long-term investors. The top factor in my mind is its size and scale. Bank of America is one of the largest banks in the world, thus providing it with resources to handle complex financial needs, from daily banking to loans, trusts and estates, etc. Second, the bank is in strong financial shape. It currently has ample liquidity from a wide variety of global sources. It’s also worth mentioning that Bank of America was among the nation’s large banks that passed the Federal Reserve’s most recent stress test. The minimum Common Equity Tier 1 (“CET1”) ratio requirement will be 9.5%, effective Oct. 1, 2023, per the Federal Reserve’s 2023 Comprehensive Capital Analysis and Review (“CCAR”). And as of June 30, 2023, Bank of America’s CET1 ratio was 11.6% with $190 billion of CET1 capital, far above the minimum requirement. The bank also announced that it will further boost its CET1 requirement by another 50 basis points starting in 2024, further strengthening its financial stability.

Yet, despite its strength, the bank is currently trading at a compressed valuation at detailed next.

BAC and Buffett’s 10x EBT rule

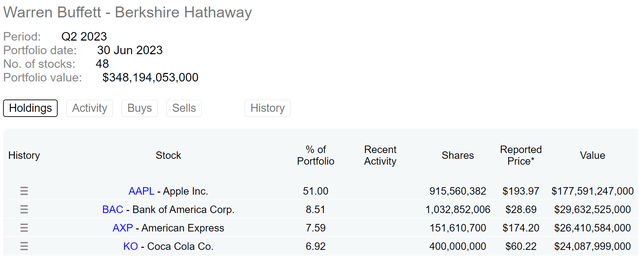

I feel an article on BAC would be incomplete if it did not address Warren Buffett’s stake in the stock. As seen in the chart below, in Warren Buffett’s Berkshire Hathaway equity portfolio (worth more the $348B as of this writing), BAC is the top 2 holding, only after Apple (AAPL). The BAC holding accounted for over 8.5% of the portfolio value and has a market value of close to $30B.

If you follow Buffett trades like me, you must have noticed or heard that for many of his largest and best investments, the price he paid was around or below ~10x pretax earnings (aka, EBT, earnings before taxes). The list includes some of his most famous deals dating all the way back to Coca-Cola (KO) and American Express (AXP), Wells Fargo (WFC), et al. It also includes some of his more recent ones such as Apple and BAC as you can see from the second chart below.

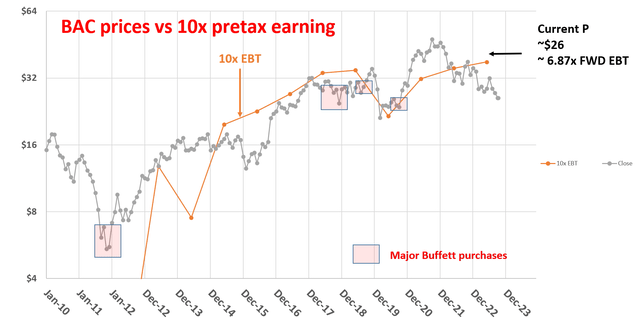

The following chart compares the closing prices of BAC on a monthly basis (the grey dots) and 10x its EBT (the orange line) since 2010. The red squares marked the approximate times and prices of Buffett’s major acquisitions and additions of the stock. As seen, the closing price (at least on a monthly chart) generally fluctuated around the 10x EBT line, like a dog around its master’s leash. As such, in the long term, it had been historically good times to sell when the prices rise substantially above 10xEBT. And vice versa.

Now is a time when its prices are substantially below 10xEBT. As mentioned earlier, it currently trades at an FWD P/E of 7.7x. If assuming an FWD tax rate of 10% (which is about its average effective tax rates in recent years), then its FWD EBT multiple would only be 6.87x, far below the 10xEBT rule of thumb for a good deal.

author based on Seeking Alpha data

Besides fitting historical data, the 10xEBT rule also has good fundamental reasons, especially for financial stocks. Buffet himself discussed the 10xEBT rule in his shareholder meetings and Q&A sessions (an example is quoted below, with emphasis added by me). Readers interested in more details of this discussion can take a look at my blog article, which elaborates on the limitations of EPS and the advantages of using EBT instead.

Buffett: “Geico would be valued differently than Gen RE and other insurance businesses because it’s rational to assume a large underwriting profit and significant growth. You cannot say that about many insurance businesses. I would love to buy a new bunch of operating businesses with similar competitive positions to the ones we own now at nine to ten times pretax earnings.”

Risks and final thoughts

As a bellwether banking stock, BAC’s performance in the near term largely depends on the health of the broader economy. Although – I see a few risks that are more unique to Bank of America given its scale and business model. As one of the largest banks in the world, it’s subject to a high level of regulatory scrutiny. This scrutiny could lead to costly fines and legal fees. Moreover, it also can make BAC more difficult to expand its business and try new initiatives. BAC also is facing increasing competition from fintech companies like other traditional banks. These new entrants are using technology to disrupt the traditional banking industry, offering more innovative and convenient products and services. Finally, one more word about the 10xEBT rule. It’s important to note that the 10x pretax earnings rule should be just one of many factors that you consider in your investor decision (I’m sure that is what Warren Buffett did too). A more detailed discussion is again in my blog article.

All told, my overall conclusion is that BAC is a buy ahead of next quarter’s earnings. The stock is attractive under current conditions for both short-term and long-term investors. In the near term, I expect several catalysts to create a bias for upward price movement after the Q3 report. These catalysts include its cost control efforts and expansion initiatives. In the long term, I see a good bank for sale at 6.87xEBT. The value-price gap is simply too large to ignore.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.