Summary:

- Bank of America released its third quarter earnings Yesterday.

- The release beat expectations on revenue as well as on earnings per share.

- Shortly after the release came out, I sold 33% of my shares.

- Although the earnings were not bad, BAC’s valuation had gotten stretched prior to their release.

- In this article I analyze Bank of America’s Q3 earnings and explain why I sold part of my position after they came out.

Top Wall Street CEO”s Testify At Senate Banking Hearing Win McNamee

Yesterday, Bank of America (NYSE:BAC) released its fiscal third quarter earnings. The release beat expectations on revenue as well as on EPS. Going into the release, expectations were running high, as competitor JPMorgan Chase (JPM) had days prior put out earnings that handily beat expectations and ignited a rally in bank shares. It would have been very easy for Bank of America to disappoint following JPMorgan’s strong performance. Thankfully, the bank’s actual results pleased the markets and delivered a good price to sell at.

If you’ve followed my recent coverage of Bank of America stock, then you’ll know that I’ve been getting less bullish on it over time. It’s not that I think the company itself has deteriorated, or anything, but rather that the stock price has gone up too much. At this point, Bank of America is trading at 14.76 times earnings and 1.22 times book value. With $115 billion in unrealized losses, $296 billion in equity and 7.9 billion shares outstanding, the “adjusted” book value per share is 22.91, and the adjusted price/book is more like 1.83.

The above multiples are actually fairly high by bank standards. Although they are lower than those of the S&P 500 at the moment, banks usually trade at discounts because of heavy use of leverage and various regulations that limit how much of their earnings and assets can be distributed to shareholders.

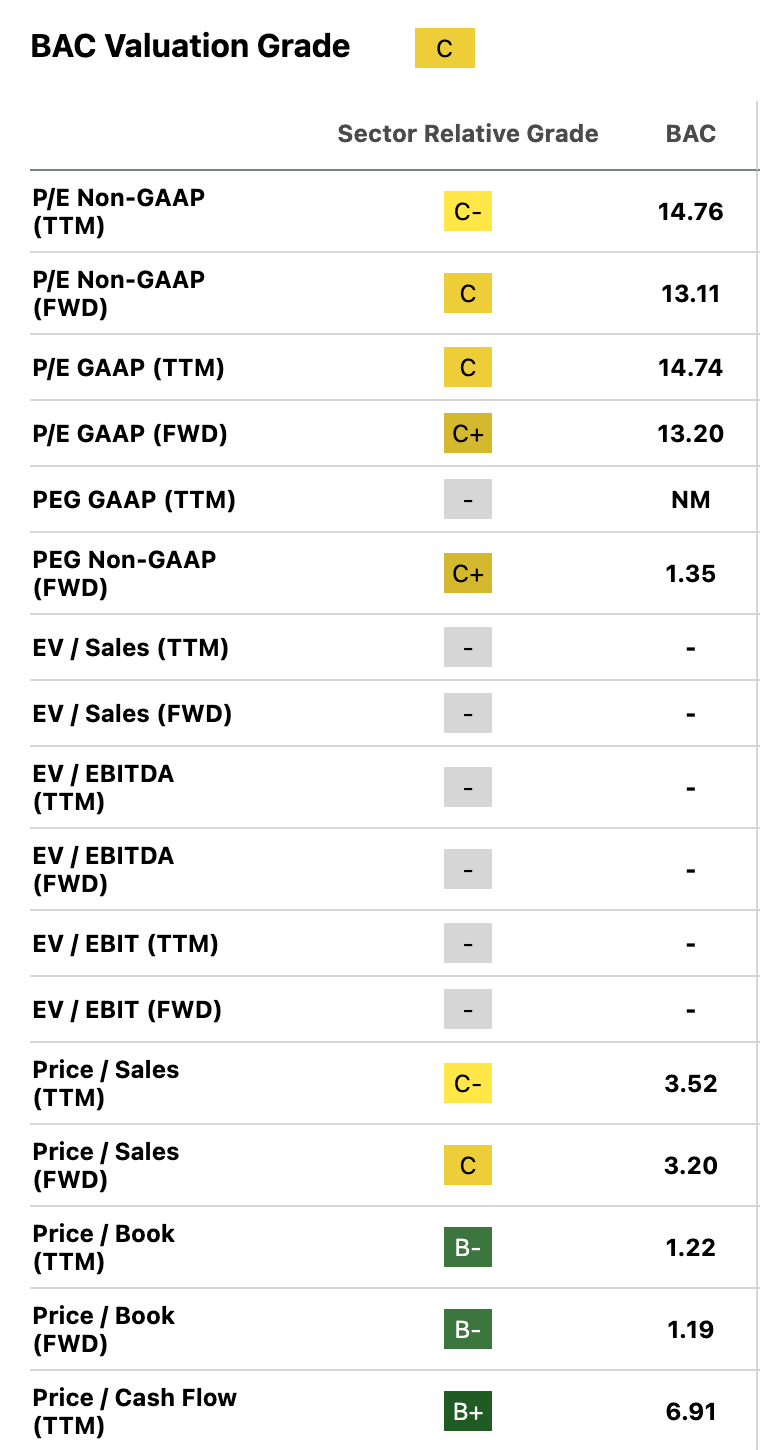

BAC’s multiples are definitely higher than the norm for banking as a whole. For example, the 14.76 P/E ratio is higher than the 8.4-13.5 times earnings range that banks normally trade at. So, there is a case to be made that BAC is overvalued on a sector-relative basis. Seeking Alpha Quant seems to agree, giving BAC a merely-average ‘C’ on valuation.

Apart from the valuation concerns, there are concerns with Bank of America’s just-released earnings, too. Although the release was technically a beat and did trigger a minor rally in BAC shares, there were reasons to find the ‘absolute’ results underwhelming. The results showed a 10% decline in earnings, a tiny 1.3% jump in revenue, and very tepid growth in most segments. The increase in investment banking fees and the 1.8% q/q decline in share count were commendable, but the top and bottom line results were underwhelming.

When I last covered Bank of America, I rated it a hold because it was up dramatically after an earnings release I didn’t see as all that great. Now we have the stock again up after a just ‘so-so’ earnings release and trading above the historical norm for bank stocks as a whole. Seeing all this, I trimmed my position by 33% after the earnings release came out. In this article I will share the reasons why I trimmed my Bank of America position after earnings.

Earnings Recap

To kick things off, I’ll share a summary of Bank of America’s third quarter earnings release, particularly the parts of it that led to my decision to sell BAC shares.

For the third quarter, Bank of America reported:

-

Net revenue of $25.3 billion, up 1.3% (a beat).

-

$0.81 in diluted EPS, down 10% (also a beat).

-

$14 billion in net interest income (NII), down 3% sequentially and up 2% y/y.

-

$1.5 billion in provisions for credit losses (PCLs), basically unchanged.

-

$114.7 billion in unrealized losses on debt securities.

-

$1.4 billion in investment banking fees, up 18%.

There were definite positives in this picture, but there were concerns as well. The unrealized loss remained among the largest of BAC’s peers who reported for the period. The high growth in investment banking looked nice, but the growth wasn’t anywhere near what JPMorgan did in the same period (31%). Finally, the persistently large unrealized loss was not a positive. Although I never thought that the large unrealized loss was an existential threat to BAC, it does make about a third of the company’s reported book value a mirage. So I consider the persistently large unrealized loss on BAC’s balance sheet a bad thing, one that must be compensated for.

Future Prospects

Having looked at Bank of America’s most recent quarterly results, we can now turn to the company’s future prospects. A good starting point here is the company’s guidance from its most recent earnings call.

In their most recent earnings call, BAC’s management team offered the following forward-looking statements:

-

Continued NII growth in Q4 (no specific figure).

-

A positive earnings impact from the BSBY acquisition.

-

Continued deposit growth.

The bank did not give specific numerical guidance for the fourth quarter but its management team did sound vaguely enthusiastic and upbeat on the call. Overall, I would expect a solidly profitable but growth-less Q4 based on what Bank of America’s management said on the call.

We can also turn to macro trends to help gauge what will happen with BAC in Q4.

We know that:

-

The Fed is cutting interest rates, which should cut into the NII margin somewhat.

-

Dealmaking at investment banks is up, and this can be expected to continue as lower rates make investors more eager to invest. So we’d expect the high growth in IB fees to continue.

-

The wealth management business should also see increased client activity due to the aforementioned factors.

Given the mixed signals above, I’d expect Bank of America to put out earnings next quarter that are unchanged year-over-year. This is pretty close to what management hinted at on the call, so I feel the signals I’m operating off here are material.

Valuation

Now we can turn to valuing Bank of America shares in light of the recent earnings release and call.

First, here are some select multiples courtesy of Seeking Alpha Quant:

Bank of America multiples (Seeking Alpha Quant)

Some of these multiples appear appealing, especially when you compare them to the S&P 500. However, remember that banks are usually cheaper than the markets as a whole due to leverage and liquidity risks and various restraining regulations. Also, BAC’s price/book multiple increases to 1.83 when you adjust it for the unrealized loss on held-to-maturity securities. With these considerations in mind, BAC stock is not as cheap as it looks.

Since I’ve estimated 0% earnings growth for BAC for the near term, I can discount its cash flows based on that assumption.

Bank of America’s normalized EPS is $2.29. The 10-year treasury yield is 4%. I sometimes use risk premia as high as 5% when valuing stocks, but since I have many factors from both the earnings call and the economy to support my “0% forward growth for BAC” thesis, I’ll just use 1% here. So we’re discounting $2.29 at 5%. That produces a $45.8 fair value estimate–some upside, but not a whole lot.

Given that I acquired most of my Bank of America shares below $30, and that the stock is much closer to being fully valued today than it was when I bought it, I made the decision to trim my BAC at $42. At $45, I would exit the position.

The Bottom Line

Bank of America is doing reasonably well this year, but is close to being fully valued. By my estimates it’s worth somewhere between $45 and $46. I consider the stock a hold now and I’d consider it a sell at $45-$46. So, I’m happy to have trimmed my position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.