Summary:

- Bank of America reported profits of over $3 billion in the fourth quarter, falling short of expectations.

- The bank saw growth in its loan and deposit segments, despite a drop in net interest income.

- The outlook for 2024 looks positive for BAC, as long as the economy avoids a recession.

J. Michael Jones

Bank of America Corporation (NYSE:BAC) reported earnings for the fourth quarter on Friday that fell short of expectations, but the bank still reported profits for the last quarter in the amount of more than $3 billion.

Bank of America reported a QoQ drop in net interest income as well and pressure on short-term interest rates is growing, but the bank’s loan and deposit segments are seeing encouraging growth.

I think that investors are presently a bit overtaken by negative sentiment created by the central bank’s outlook for short-term interest rates, but 2024 could be shaping up to be a strong financial year for Bank of America if the economy doesn’t slide into a recession.

My Rating History

A large discount to book value, which translated into a positive risk/reward relationship, was the main reason for me to make a Buy recommendation for Bank of America about three months back.

Before this Buy classification, I was much more neutral on Bank of America, mostly because of the expectation of a recession, but these concerns faded away as the year progressed.

Considering that the latest inflation report pointed to an inflation flare-up as well, there is now also a chance that the central bank will lower interest rates only slowly in 2024 which could aid Bank of America’s net interest income prospects.

Bank of America’s 4Q-23 Performance

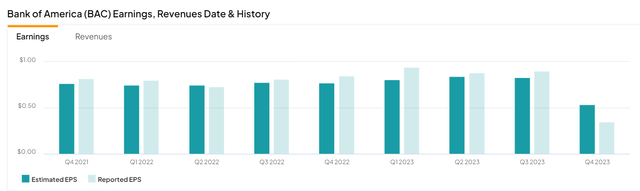

On Friday, we saw Bank of America reveal a quarterly profit of $3.1 billion which was down from the $7.1 billion it reported in the year-ago period. Earnings per share fell from $0.85 per share in 4Q-22 to $0.35 per share in 4Q-23, representing a YoY decline of a rather large 59%.

The reported profit per share missed the consensus of $0.53 by a large margin as well. Correcting for charges that are of a non-recurring nature, Bank of America reported $0.70 per share in profits, however.

Estimated Earnings (Yahoo Finance)

Solid Deposit Performance And Negative Net Interest Income Growth

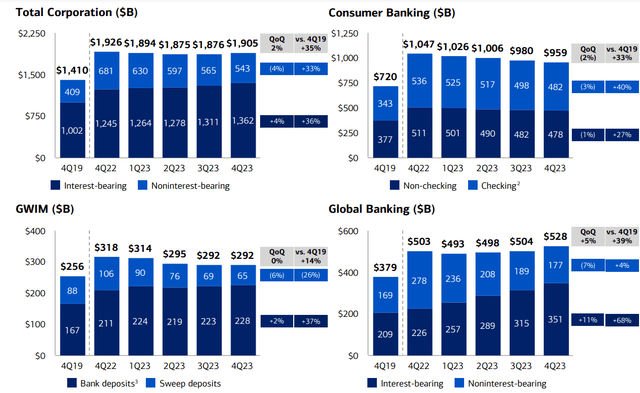

Bank of America’s deposits grew for the second quarter in a row in the fourth quarter. Bank of America suffered declining deposit balances in the first six months of 2023, but the expectation for short-term interest rates to drop has led to an uptick in deposit balances in the last quarter.

The bank ended the financial year with $1.9 trillion of deposits on its balance sheets, reflecting 2% QoQ growth that was primarily made possible because of 4% growth in interest-bearing accounts.

By far the biggest growth in terms of deposits took place at the Global Banking division which reported an 11% QoQ jump in interest-bearing deposits.

Global Banking Division Deposits (Bank Of America)

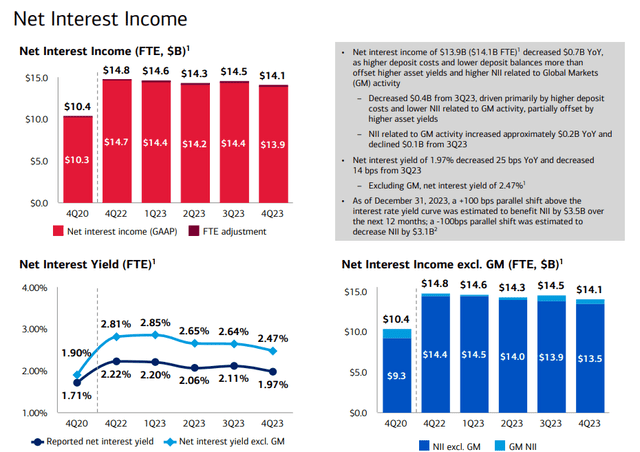

Bank of America’s net interest income was the second-most interesting performance area for me after deposits. The bank earned $14.1 billion in net interest income in the fourth quarter which was the lowest amount in a year and Bank of America’s net interest income has dropped three times in the last four quarters.

Bank of America’s net interest income depends on the central bank’s rate policy and pressure on short-term interest rates means that Bank of America could be looking at a deteriorating net interest income situation in 2024. As such, investors must expect Bank of America to report QoQ declines in its net interest income in the coming quarters.

On the flip side, Bank of America may report net interest income growth if the central bank were to decide that it had to slow its rate cuts in 2024, possibly because of concerns over an inflation flare-up.

Net Interest Income (Bank Of America)

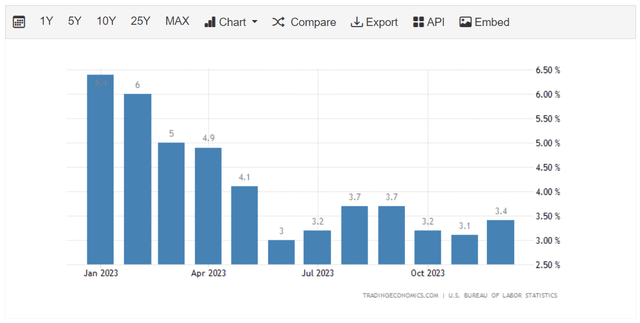

Inflation, against expectations, ticked up in December, possibly indicating that the inflation problem is not as controlled as investors, or the central bank, may think.

As a consequence, there is a chance that Bank of America might profit from higher-for-longer short-term interest rates in 2024 which in turn would improve the bank’s net interest income potential.

The annual inflation rate for the month of December, as per the latest report, was 3.4%, reflecting a 0.3 percentage point negative development compared to the November month.

Inflation (Tradingeconomics.com)

Loans And Leases Are Still Growing

Bank of America’s fourth quarter was not a stunner in terms of loan growth, but the bank is loaning out a growing amount of money and this bodes well for 2024, particularly if the U.S. economy can hold its head above water and continue to grow.

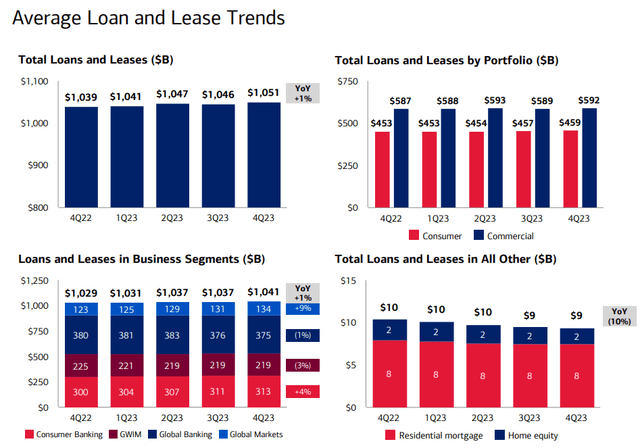

Bank of America’s loans and leases went up by 1% YoY to $1.05 trillion in 4Q-23 and it was the fourth quarter of steady growth for the bank in 2023.

If the central bank lowers short-term interest rates this year, Bank of America may see growing demand for personal credit, auto loans, mortgages and credit cards, all of which would boost the bank’s profit potential in its loan segments.

Average Loans And Lease Trends (Bank Of America)

Investors Can Buy Bank of America Below Book Value

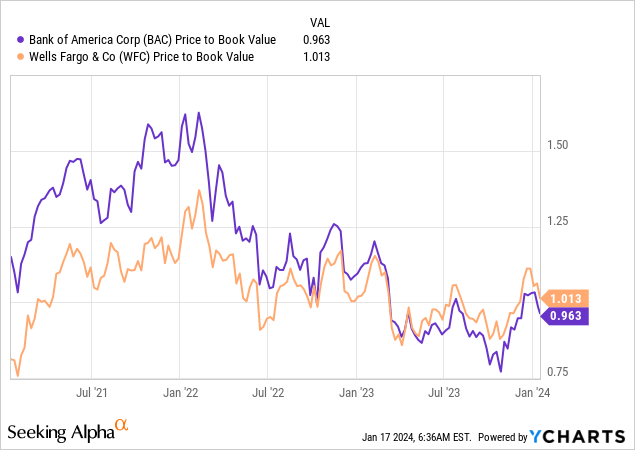

Investors now have the opportunity again to buy Bank of America below its book value, which I think is a rather conservative estimate of the bank’s intrinsic value.

Bank of America is the second-biggest bank in the United States and the bank’s book value is growing: It was up 2% QoQ to $33.34. Since Bank of America is selling for $32.80, investors can pick up the bank’s stock at 0.96x book value. Last week, Bank of America was selling for a premium to book value.

Since the bank’s near-term profit situation has not dramatically changed and the book value is still growing, I think investors would want to push back against fears over an earnings recession. Wells Fargo & Company (WFC) is selling for 1.01x book value and is an equally interesting investment in the banking sector.

The Central Bank And Interest Rate Risk

Whether Bank of America can put up robust earnings in 2024 depends on the underlying health of the U.S. economy.

Furthermore, the inflation trend will influence the central bank’s pace of rate cuts which could surprise to either the upside or the downside in 2024.

At its most fundamental core, Bank of America is seeing loan and deposit growth. Only if these two trends reversed, then I would be concerned about my investment.

My Conclusion

To sum up, Bank of America’s 4Q-23 was quite a decent and the bank remained highly profitable. I see good things happen for Bank of America in 2024 and its loans and deposits should keep growing.

With that being said, though, there are challenges with regards to net interest income. Despite the headwinds the bank experienced in terms of net interest income growth in 4Q-23, which was again negative, Bank of America’s underlying loans, deposits and book value are growing.

Despite a decline in profitability in 4Q-23, Bank of America is a healthily growing bank with a compelling valuation. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.