Summary:

- Bank stocks have grown increasingly risky amidst a collapse in the regional banking sector.

- Bank of America may face lower risk of fallout, but one must wonder how long the company can continue paying next to nothing on deposit rates.

- The company has a strong balance sheet and is repurchasing shares.

- Despite the risks, the stock remains too cheap at around 9x earnings.

Brandon Bell

Bank of America (NYSE:BAC) cannot catch a break. After the company seemed to finally recover from the financial distress suffered during the Great Financial Crisis, ending up with Warren Buffett’s Berkshire Hathaway (BRK.B) as its largest shareholder, the company is now wading through the perils of the current macro environment. The crisis at regional banks may benefit the company due to its image of safety, but it has nonetheless cast a light on the long term risk of its low deposit base. BAC stock remains very cheap on a price to earnings multiple though perhaps not as cheap as some in the regional bank sector. Yet the relative premium is justified considering the company’s strong balance sheet and seemingly lower disruption risk in the near term.

BAC Stock Price

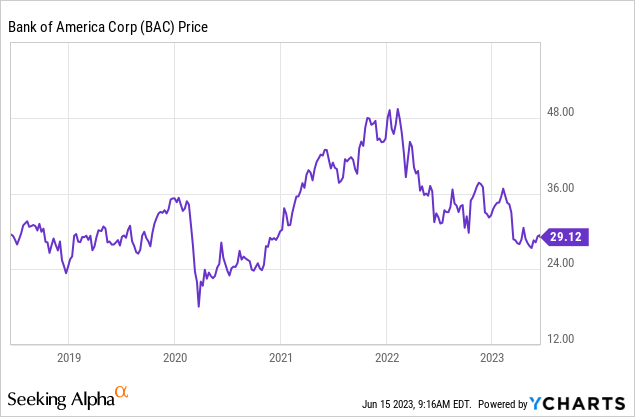

Rising interest rates are proving to be a double-edged sword for bank stocks. BAC remains well off its recent highs and trades at the same levels it did 5 years ago.

I last covered BAC in January, where I discussed how the company was adapting to an environment with rising recessionary risks. The stock has declined around 16% since then, largely due to the sudden crisis in the regional bank sector. It is as good time as any for an update on my thesis.

BAC Stock Key Metrics

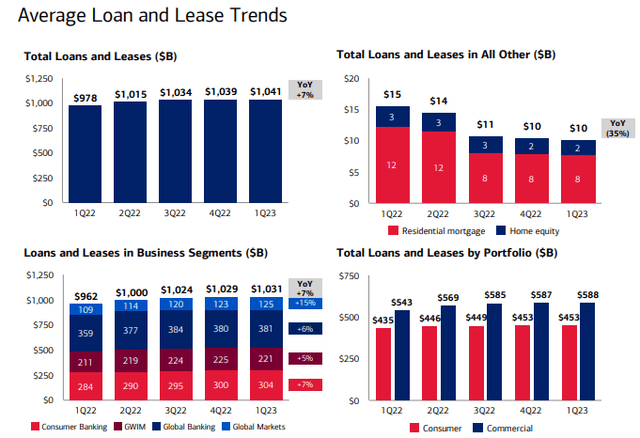

In its most recent quarter, BAC capitalized on the rising interest rate environment, growing its loan book by 7% YOY.

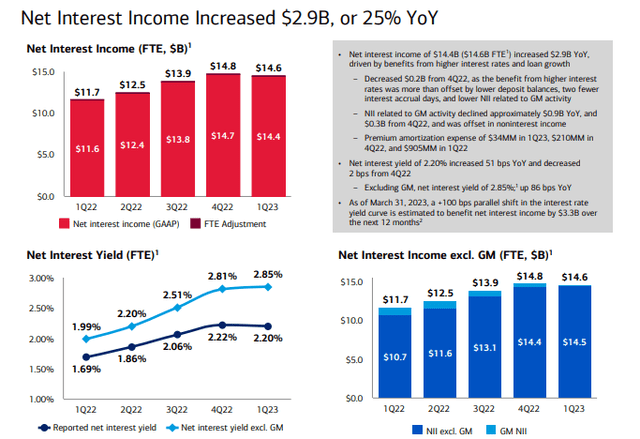

Net interest yields continued to rise on a year-over-year basis, though they stabilized sequentially.

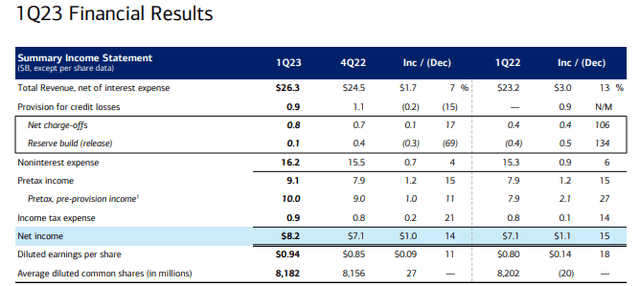

BAC delivered $0.94 in earnings per share, growth of 18% YOY. Excluding provisions, pre-tax income grew by 27%. Rising provisions has been a headwind in recent quarters but may be a tailwind at some point in the future.

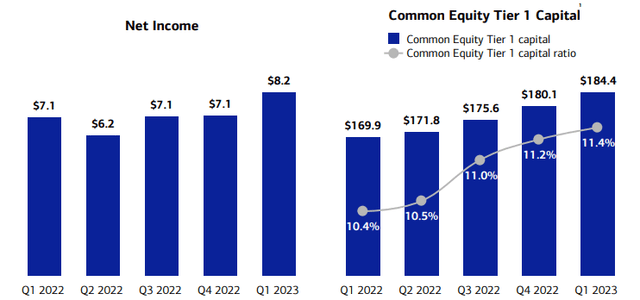

BAC earned $8.2 billion in net income, paid out $1.8 billion in common dividends and bought back $2.2 billion in shares. The retained earnings helped the company further increase its CET1 ratio to 11.4%, well over the current 10.4% minimum requirement and even higher than the 10.9% minimum requirement as of January 2024. Because BAC is already well capitalized, the company may be more aggressive than peers in its share repurchase program.

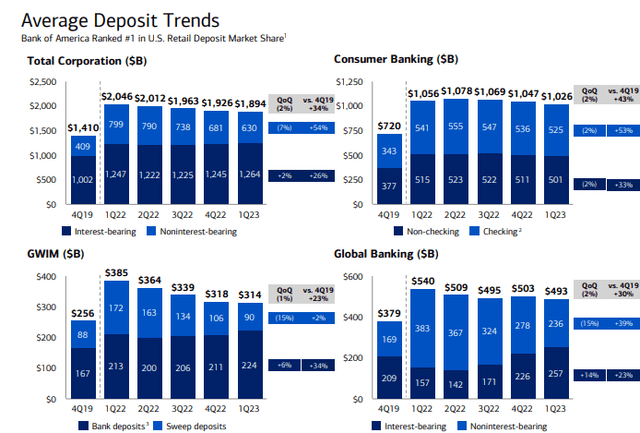

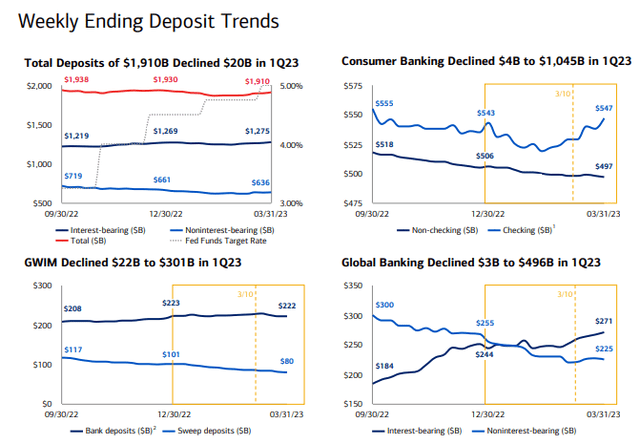

These are strong results, but the collapse of Silicon Valley Bank and First Republic Bank (OTCPK:FRCB) have crashed the party. BAC entered this environment from a position of strength, but investors now appear skeptical of even the strongest banking operators. BAC saw deposits continue to decline sequentially as customers moved balances to higher interest accounts.

That said, BAC noted that there were some signs of stabilization, with some business lines seeming the trendline move upward on a weekly basis in late March.

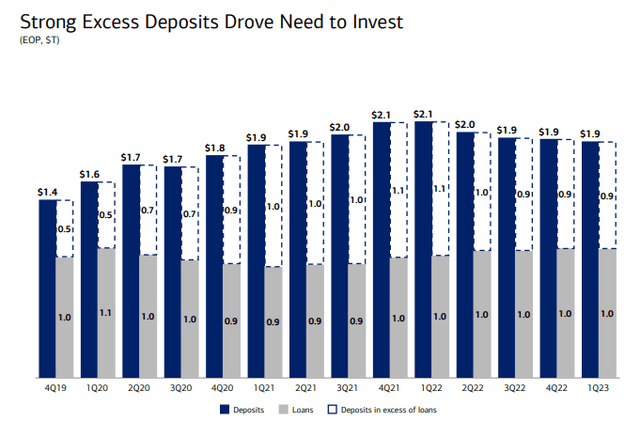

On the conference call, management noted that while they were not sharing any explicit numbers, they did see a “noticeable flight to safety.” Management noted that they mostly saw an increase in accounts, as “relationships take longer time to build and onboard.” BAC ended the quarter with a comfortable margin of excess deposit over its loan book.

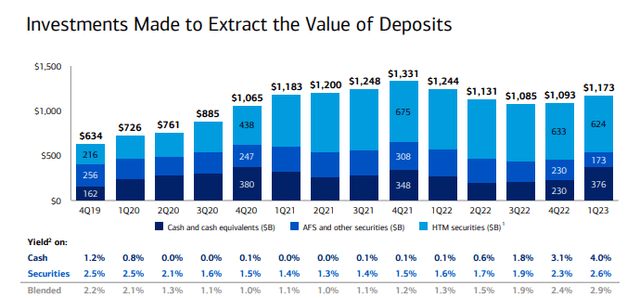

But that might not be enough to guarantee safety in a tough environment. In particular, some investors may be concerned about the large amount of unrealized losses in its “held-to-maturity” (‘HTM’) portfolio. HTM securities are meant to be held to maturity (hence its namesake). While losses are not expected to be material if held until maturity, losses can be substantial if sold prior to maturity. Banks typically use short duration funding sources (deposits) to fund long duration assets (loans like HTM securities), so if they were to see a sudden decline in deposits then they might need to sell off HTM assets at a large loss – this in large part drove the crisis seen at regional banks. We can see below that most of BAC’s investment portfolio is held in $624 billion worth of HTM securities.

However, as noted in their annual filings, there are nearly $114 billion of unrealized losses in their investment portfolio. If BAC had to sell off its investment portfolio at current market prices, then its CET1 ratio could crumble from above 11% to around 6%. Such a scenario might not be so likely considering that the company has a diversified deposit base and might be viewed as one of the safest financial institutions to bank with, but it must be noted that the regional banking crisis took many by surprise as well. Management noted that they intend to just “ride it out and grind it down,” allowing its HTM portfolio to gradually decline as they seek to better match the duration of their assets to liabilities.

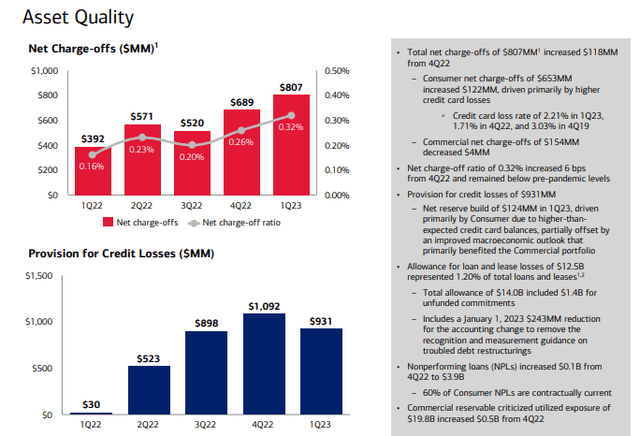

In the meantime, credit quality remains strong – while charge-offs continued to increase, they remained below pre-pandemic levels.

Looking ahead, management has guided for net interest income to decline around 2% sequentially, mainly due to “expected deposit movements as well as lower global markets’ NII.” Management expects one more rate hike followed by several cuts this year. Management expects further pressure on deposits for three reasons. Management expects the Fed tightening to lead to reduced industry deposits, lower wealth management deposits due to the payment of income taxes, and continued rotation of commercial deposits towards interest-bearing assets. None of these factors are really different from what has been going on in the past several quarters, but investor interpretation of the same trend has changed for the worse due to a deterioration in investor sentiment.

Is BAC Stock A Buy, Sell, or Hold?

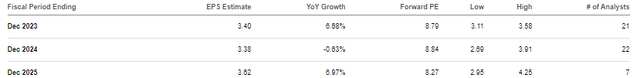

At recent prices, BAC stock was pricing in more of the bearish fears than bullish hopes. The stock was trading at around 9x earnings – a modest valuation considering the company’s strong balance sheet, name brand power, and commitment to returning cash to shareholders through dividends and share repurchases.

I continue to expect the stock to eventually re-rate to around 12x to 15x earnings as investors warm up to the generous shareholder yield. That implies around 50% potential upside from multiple expansion to complement the 11% shareholder yield. Throw in around 2% to 3% of annual earnings growth from market share gains and operational efficiencies and BAC can be a big winner over the long term.

What are the key risks? While BAC might be more insulated than regional banking peers in the near term due to its image of safety, the tail-end risk of lower net interest yields remains. BAC continues to pay next to nothing on its checking and savings accounts even as many peers are paying single-digit percentage rates. It is possible that future customers prove more price-sensitive and trusting of digital banks – this would inevitably put great pressure on BAC’s expense structure. BAC may have to adapt by increasing the riskiness of its loan portfolio, which may have a negative impact on its valuation multiple even if it is able to sustain its earnings power. I must also note that even in the near term, it is also possible (albeit unlikely) that BAC customers flee to another large banking peer, like JPMorgan Chase (JPM) due to BAC having failed during the Great Financial Crisis. Even if there is no apocalyptic occurrence, it is possible that BAC stock continues to trade at value multiples indefinitely, though I find this risk to be overstated due to the management’s willingness to execute on their share repurchase program. While I am mindful of the deteriorating investor sentiment, I continue to rate BAC stock a buy due to the low valuation and ongoing share repurchase program.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!