Summary:

- BoA is poised for a strong Q1’23 earnings report based on results from large bank peers.

- Analysts predict a minimal $0.83 EPS for Q1, and BoA should leap past this estimate.

- The large bank should report higher credit costs, but the sector didn’t report alarming cost escalations.

- BAC stock is cheap, trading at 8.6x very conservative ’23 EPS targets.

John Kevin

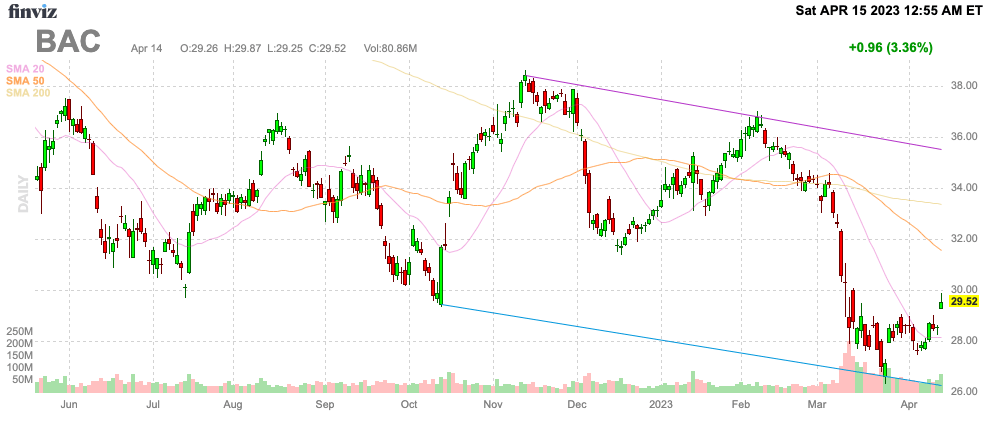

The whole banking sector has been weak the last month following the regional banking crisis, but the mega banks like Bank of America (NYSE:BAC) are primed for reporting strong quarterly results. The large bank reports Q1’23 results prior to the open on Tuesday with strong numbers more likely after bank peers reported on Friday. My investment thesis remains very Bullish on BoA following the March dip while the business remains strong.

Source: Finviz

Q1’23 On Deck

BoA reports prior to the open on Tuesday with analysts predicting a minimal EPS growth of 3% to $0.83. The large bank is forecast to generate up to 9% sales growth to reach $25.3 billion.

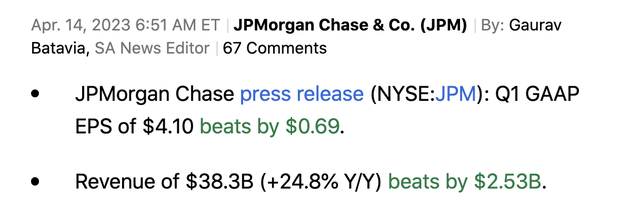

Banking rival JPMorgan Chase (JPM) rallied over 7% to end last week due to a big EPS beat for Q1’23 and revenues topping estimates by an incredible $2.5 billion.

The other large banks like Citigroup (C) and Wells Fargo (WFC) reported strong Q1’23 numbers on Friday, as well. If anything, BoA is much more like JPMorgan due to the asset cap at Wells Fargo and the global banking focus of Citigroup.

The sector numbers very much support a big revenue beat by BoA with a large influx of new loans and deposits from customers fleeing regional banks. JPMorgan actually grew revenues by nearly 25% in the quarter in a sign of the strengths in the large bank sector. Even Wells Fargo reported revenues $670 million above analyst estimates and the bank has restrictions from the asset cap.

Even better, JPMorgan Chase was able to smash the $2.63 EPS from last Q1 while absorbing much higher credit costs. The large bank was hit with $2.3 billion in credit costs for Q1’23, though the net charge-offs were only $1.1 billion. JPMorgan absorbed $800 million in additional credit costs this quarter compared to the $1.5 billion in charges last Q1 while producing those booming earnings.

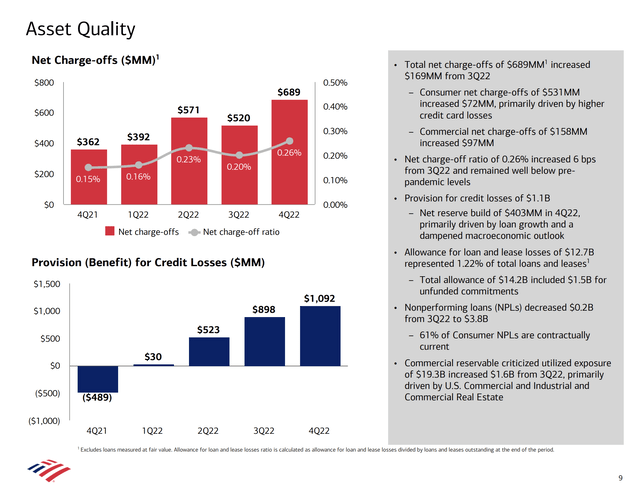

For its part, BoA had prior quarter credit costs of $1.1 billion with only $689 million in net charge-offs. JPMorgan not only had higher net charge-offs but also took a much larger reserve build for Q1’23.

Source: BoA Q1’23 presentation

Either way, BoA investors should prepare for a higher level of credit costs, but the peer banks reporting on Friday don’t support anything wildly out of expectations despite the banking crisis during March. BoA only had $3.8 billion in non-performing loans at the end of 2022 while the allowance for loan losses was up at $14.2 billion.

The data would appear to support BoA reporting a much higher EPS in Q1’23 compared to the level from last year. The large banks benefitted most of the quarter from higher NIM while deposit costs weren’t under pressure for the quarter. BoA will likely face this issue more in Q2 and the remaining of 2023 until the Fed starts cutting interest rates.

Takeoff Ahead

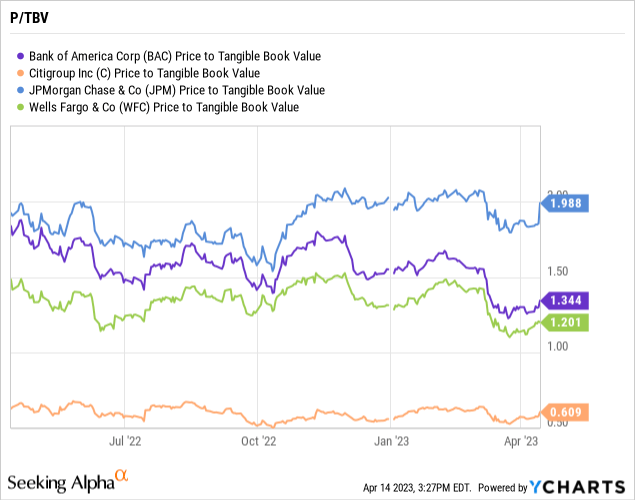

The regional banking crisis crashed the large banking stocks sending BoA back down below $30. The stock has seen the P/TBV dip to only 1.34x. JPMorgan Chase has always traded at a premium and that bank stock is already back to 1.99x.

JPMorgan trades close to the peak levels while BoA is far below the early 2023 P/TBV multiples of 1.65x. BoA should be ready for takeoff, likely being second in line behind JPMorgan to attract new customers looking for safety during the banking crisis.

The stock trades at only 8.6x the 2023 analyst EPS targets of $3.32. Based on the JPMorgan numbers, investors should expect BoA to easily smash Q1’23 numbers on a path to exceed the 2023 estimates.

The biggest question with banks is always around what credit costs are taken in the short term versus actual credit losses. These numbers can always impact quarterly and yearly financials that could impact the stock in the short term.

BoA has repurchased up to $1 billion worth of stock each of the last 3 quarters. Something for investors to watch is whether the large bank used the recent stock weakness to repurchase shares similar to the Wells Fargo large $4 billion repurchase during Q1.

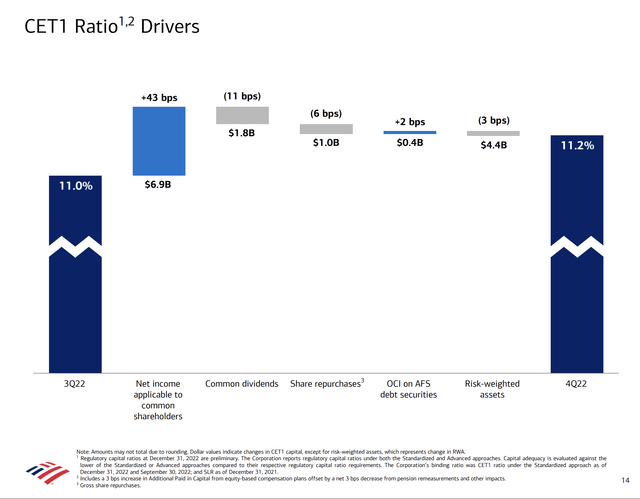

The large bank has a goal of getting the CET1 ratio to 11.4% to push the capital ratio 50 basis points above the new GC buffer hitting at the end of next year. Considering BoA bought $1.0 billion worth of shares in Q4’22 and paid $1.8 billion worth of dividends and the CET1 ratio still rose 20 bps to 11.2%, the bank hopefully boosted the stock buybacks on the market weakness.

Source: BoA Q1’23 presentation

Investors definitely want to see the bank more aggressive with the stock falling from over $34 to start March and trading below $30 to start April. Naturally, the best time to repurchase shares is during market turmoil and not during the period of strength earlier this year when the stock regularly traded between $34 and $38.

Takeaway

The key investor takeaway is that BoA is primed for takeoff after the strong results of large bank peers on Friday. The stock shouldn’t have traded high during the recent regional banking crisis providing another opportunity to buy BoA on the cheap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C, WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.