Summary:

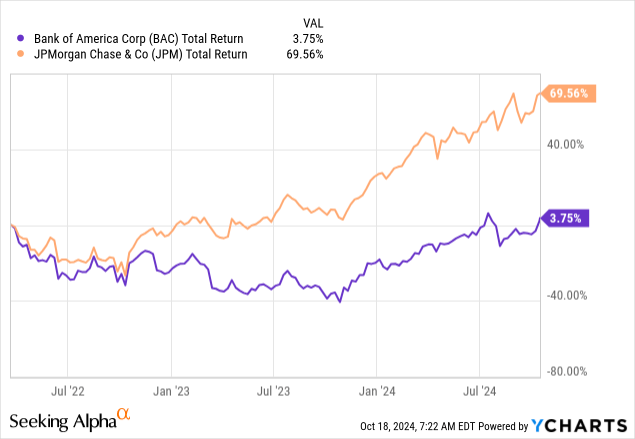

- Bank of America stock has been fairly lackluster over the past two years or so, trailing close peer JPMorgan significantly in that time.

- The bank’s net interest margin hasn’t quite seen the same degree of upside from higher interest rates, but that should change over the full course of the cycle.

- Upside to NIM can drive profitability closer to management’s goal. At 11x forward EPS estimates, the stock looks like a reasonable value for long-term investors.

ablokhin

At the risk of opening by stating the obvious, Bank of America Corporation (NYSE:BAC) hasn’t quite enjoyed the same pop from higher interest rates that some of its peers have, and yes, I have JPMorgan Chase’s (JPM) recent purple patch firmly in mind as I typed that. Unsurprisingly given that, BAC stock has been very soft in this period – virtually flat with dividends and trailing close peer JPM by a whopping 66ppt since the Fed’s first hike of the cycle back in 2022.

While it is understandable that some folks will chalk this up to management dexterity (or lack thereof in this case), these are two G-SIBs we are talking about here. I am not a banker or professional analyst, but it would strike me as unlikely that these kinds of institutions are in the business of making significant directional “bets” (lacking a better word) on interest rates. With that, the underlying drivers of BAC’s income performance are probably fairly nuanced, and a full review likely needs the entire rate cycle to play out first.

Given the usual caveats about predicting the future, BAC does look better placed now to capture significant net interest margin (“NIM”) upside, and that can drive a nice pop in its earnings as profitability normalizes closer to management’s target. With these shares trading for around 11x 2025/26 earnings, I think BAC can scratch out 10%-plus long-term returns from here. I am bullish on the bank and attach a “Buy” rating.

NIM Expansion Now Coming Into Play

I haven’t covered BAC on Seeking Alpha before, but I have read plenty of other contributors’ pieces. As you would expect from a crowdsourced site, views range from bullish to bearish. One thing that has been something of a constant in recent times is BAC’s management coming in for criticism in the comments section – particularly in relation to the bank’s securities portfolio.

Like many things bank-related, BAC’s bond portfolio is complicated and serves more than one purpose, including as a kind of hedge to manage the potential net interest income (“NII”) volatility associated with a chunk of its funding base (e.g., retail current accounts). While this was perhaps a headwind for BAC in the first part of the rate cycle, this structural hedge income should be a nice tailwind for BAC going forward based on the current forward curve.

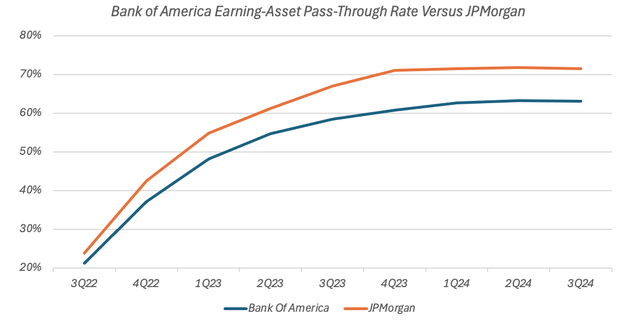

Viewing its balance sheet as a whole, BAC’s overall earning-asset pass-through rate has, not surprisingly, lagged JPM’s by a decent margin since 4Q21 (i.e., the quarter preceding the Fed’s first interest rate hike).

Data Source: Bank of America and JPMorgan Quarterly Results Releases

At the same time, BAC has also been a bit weaker than JPM on funding. BAC’s deposit base is solid – costing it just ~2.1% last quarter including non-interest-bearing balances – and its deposit pass-through rate has been roughly the same as JPM’s at around 40%. However, including various forms of wholesale funding, BAC’s overall cost of funding its earning assets has increased by around 60% of the increase in the Fed funds rate compared to ~55% for JPM.

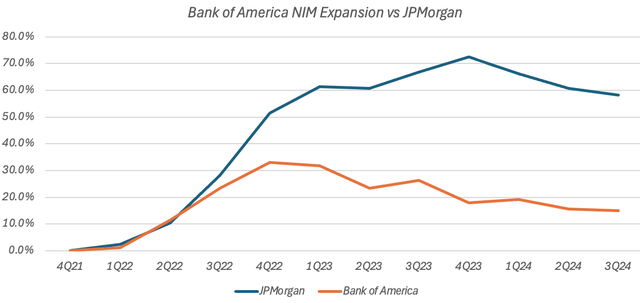

That has basically driven the bank’s lackluster NIM performance, with BAC only seeing a ~15% net yield pick-up since 4Q21 versus a meatier ~60% over at JPM.

Data Source: Bank of America and JPMorgan Quarterly Results Releases

Bank NIM can basically be broken down into separate margins on both earning assets and funding sources, plus an “everything else” bucket that, among other factors, includes the yield spread (colloquially referred to as borrowing short-term to lend longer-term). For BAC, that means that pass-through rates on its assets and liabilities, the composition of its balance sheet, and the shape of the yield curve are all things that will feed into NIM going forward.

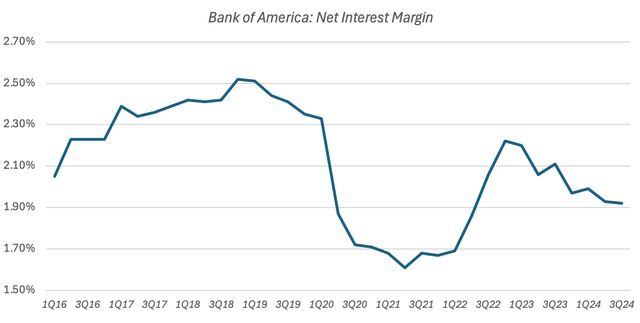

It also means that the absolute level of interest rates probably isn’t all that important, explaining how BAC’s NIM can be much lower now than it was five/six years ago, when the effective Fed funds averaged ~2%:

Data Source: Bank of America Quarterly SEC Filings

The various moving parts mean that concrete NIM predictions are difficult to make, particularly over the long run. Nonetheless, BAC does look set to gain more from lower funding costs than it will give up on the asset side, driving some nice NIM expansion over time. Sell-side analysts appear to agree on the direction of travel, with NIM seen heading toward 2.1% over the next 1-2 years. Management has also mentioned in the recent past that a roughly 2.3% NIM is their long-term view of where BAC should be:

So I’d say right now in terms of the 1.93%, we feel like we are under earning. We feel like that number is going to go up over time. It’ll go up as net interest income goes up. But additionally, I think the balance sheet is likely to stay kind of flattish here. So the numerator is going to grow, the denominator is going to stay pretty tight here. So we think we’re under-earning there. We think through a cycle, we got to get back to a more normal number like 2.30-ish over time. That takes a while. It’s a grind, Mike, quarter-after-quarter, so that’s where we’re headed.

Alastair Borthwick, Bank of America CFO, Q2 2024.

This may look aggressive when looking at BAC’s recent NIM in isolation, but it would basically only bring it back into line with its pre-COVID average, as per the chart above.

BAC held just over $2.9 trillion in interest-earning assets on its balance sheet last quarter, so that degree of net yield pick-up would be material in terms of earnings. This will take time to play out, and BAC’s NIM did slip a single basis point in Q3 to 1.92%, but I am looking for NIM to push on nicely from here.

Given all that, BAC does appear to be under-earning at the moment, as management stated above. Third quarter net income applicable to common shareholders was $6.4 billion ($0.81 per share), mapping to an adjusted return on tangible equity of ~12% (adjusted in that I have removed AOCI losses from its balance sheet; BAC’s reported ROTCE was 12.8% in Q3).

Applying a 2.3% NIM to BAC’s current balance sheet would essentially add an extra ~$2 billion to quarterly net income. Given roughly $215 billion in current tangible common equity (again I have excluded AOCI from this), ROTCE would see a nice bump up to around the mid-teens level, which is also roughly what management thinks BAC’s longer-term earnings power is:

And in terms of return on allocated capital, right now we’re right around that 14%. We want to be 15% or higher for our shareholder.

Alastair Borthwick, Bank of America CFO, Q2 2024.

BAC Stock Still Looks Decent Value

With the above firmly in mind, I do think this stock is decent value for investors with a longer-term outlook. BAC’s current $42.60 share price works out to a 1.62x multiple of tangible book value (or ~1.5x excluding AOCI). That implies a ~12.7x P/E based on Q3 reported ROTCE of 12.8%, which would fall to ~11x based on a ~15% ROTCE. Consensus EPS for 2025/26 also points to a roughly 11x forward P/E.

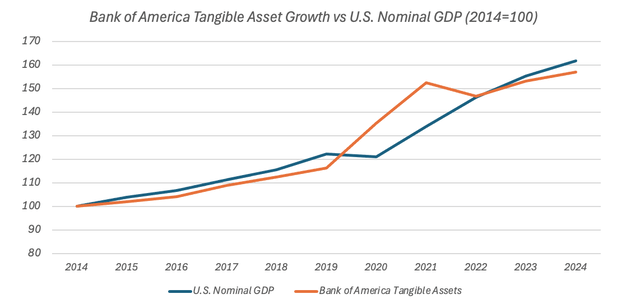

That kind of valuation doesn’t need BAC to conjure up anything particularly special in terms of long-term growth to justify. BAC being the circa $3.3 trillion asset giant that it is, long-term growth in line with U.S. nominal GDP probably isn’t an outrageous assumption – and BAC’s tangible asset base has roughly matched GDP growth over the past decade or so.

Data Source: Bank of America Annual Filings; World Bank

Certain bodies like the Congressional Budget Office think that long-term nominal GDP growth will be around 3.5% from here. Assuming BAC does earn a ~15% ROTCE through the cycle, it would only need to retain around ~25% of its net income to fund that kind of growth (i.e., 25% retained income multiplied by a 15% return roughly equals 3.5% growth). The remaining 75% of its earnings should essentially be available to distribute to shareholders via dividends and buybacks.

On a P/E of 11x (or a ~9% earnings yield to flip it on its head), that does give these shares a credible path to ~10%-plus annual returns, with that consisting of ~3.5% underlying net income growth plus around 7% from capital distributions (i.e., 75% multiplied by 9%).

Summing It Up

Bank of America has been fairly lackluster over the recent interest rate cycle, especially compared to its closest peer/comp JPMorgan. While management has copped its fair share of criticism in terms of the underlying drivers of that, there is probably more nuance to this than meets the eye. With BAC looking better placed now that interest rates are coming down, the bank can start pushing on toward management’s long-term goal of earning a mid-teens ROTCE.

With that, shareholders don’t need BAC to move mountains regarding growth to turn that into solid returns. While this will ultimately take some time to play out, I think it is just about enough to tip the stock into a “Buy” rating for long-term investors.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.