Summary:

- Buffett’s recent actions raise questions – why does he keep selling BofA stock? I’ve decided to approach this question from my unbiased side as I haven’t covered BAC before.

- I see BAC trading at about fair P/E on a forwarding basis (it’s even ~4.5% lower compared to the medium-term average multiple).

- Since the COVID-19 pandemic era, BAC’s paper losses have exceeded $110 billion – more than twice the unrealized losses of its main peers (JPM and WFC).

- The largest portion of the MBS part of BofA’s debt portfolio – something over $448 billion – is quite long-dated (due in over 10 years), yielding just 2.12%.

- BAC’s deposit base is eroding rapidly despite the money supply surge in recent years. The bank is losing competition for clients, in my view. It may be the main reason for Buffett’s recent sales.

tupungato

A few hours ago (as of the time of this writing) Bloomberg reported that Warren Buffett’s Berkshire Hathaway Inc. (BRK.A) (BRK.B) sold an additional $863 million of Bank of America Corporation (NYSE:BAC) stock, trimming the conglomerate’s stake closer to a ~10% regulatory threshold. It was far from the first sale from the greatest investor: Buffett began to trim his massive position around mid-July. Even after months of selling, Berkshire’s remaining stake in Bank of America is still worth ~$32.1 billion (based on the stock’s last closing price), making it, by far, the largest investor in the bank.

Buffett’s actions raise legitimate questions among investors – why is he selling BofA? I have decided to approach the answer to this question from my unbiased side (I didn’t cover BAC stock before). Despite the large number of articles devoted to this topic, I think some points haven’t yet been widely discussed.

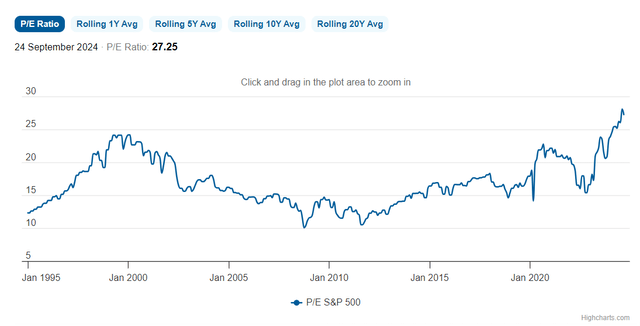

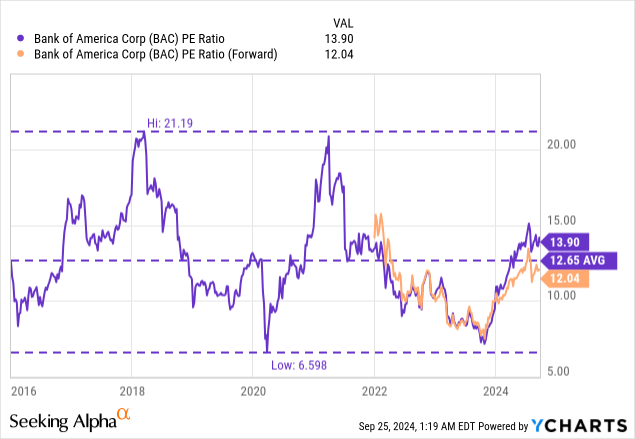

Many people suggest, based on my observations, that Bank of America’s valuation appears stretched, which they believe is one of the key reasons for Buffett’s decision to sell. However, I don’t perceive BAC as overvalued – take a look at the historical perspective:

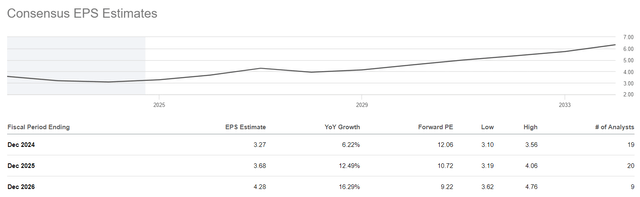

I don’t know about you, but I see BAC trading at about fair P/E on a forwarding basis (it’s even ~4.5% lower compared to the medium-term average multiple). And we have to have a context for this value: the S&P 500 (SPY) (SP500) index is trading at an estimated 27x earnings, according to World P/E Ratio data, so BAC is actually relatively cheap given its size and market positioning.

Moreover, Bank of America’s P/E multiple is expected to decline from here leaning on an EPS CAGR of 9.4% for the next 3 years – this consensus expectation is also fully justifying the stock’s current valuation, in my view.

Another opinion I have read from many authors is the assumption that Bank of America will earn less if the Fed lowers the interest rate. Indeed, the lower the interest rate, the lower the yield on new loans issued, and the lower the bank’s net profit. I think that could have been a trigger, but the root of the problem for BAC seems to be a little deeper.

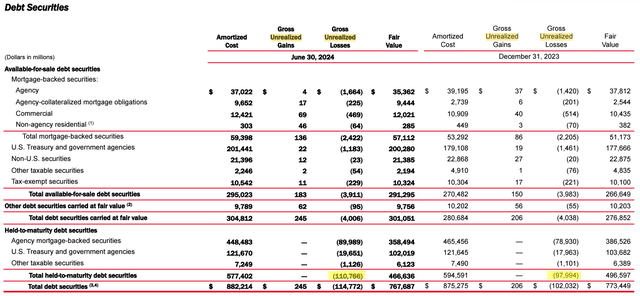

Today, Bank of America is reckoning with strategic decisions made during the first days of the COVID-19 pandemic – an era when it put massive amounts of the $670 billion of deposit inflows into the low-yielding (and thus high-price) bond market. Since then, end-of-the-second-quarter paper losses have exceeded $110 billion – more than twice the unrealized losses of its main competitors, JPMorgan Chase & Co. (JPM) and Wells Fargo & Company (WFC).

BAC’s 10-Q for Q2 2024, notes added

The largest portion of the MBS part of BofA’s debt portfolio – something over $448 billion – is quite long-dated (due in over 10 years), yielding just 2.12%. So even if the Fed cuts by another 50-100 b.p. immediately tomorrow, this significant part of the bank’s portfolio will stay a relatively bad deal for them.

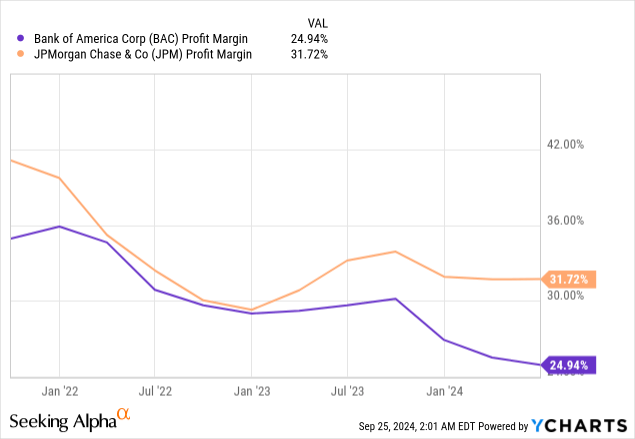

Of course, Bank of America is not facing a liquidity crisis similar to that of Silicon Valley Bank, which collapsed after a bank run. Also, the bank’s portfolio has good ratings and is backed by the full faith and credit of the US government, thereby encouraging the notion that the loans will generally be repaid with interest. However, the high proportion of low-yield investments severely curtails the income that can be garnered from customer deposits, especially when new issues during the hawkish policy were offering richer yields. Bank of America’s net interest margin, a crucial measure of performance, for example, has languished well behind that of JPM. Below I’m providing a comparison of classical net margin based on YCharts data, but you get the point – BAC is clearly underearning and lagging:

Another point of concern for investors – the rise in provisions for credit losses (up 34% YoY in Q2). From the Q2 earnings call, we hear that Bank of America has observed changes in its asset quality metrics, influencing its need to increase provisions. For example, there was a noted increase in credit card delinquencies and some uptick in commercial real estate losses – these trends compelled the bank to up its provisions to safeguard against potential defaults:

There was little change in our asset quality metrics this quarter. Provision expense was $1.5 billion. That was $189 million higher than Q1, driven by a smaller reserve release in Q2. Net charge-offs of $1.5 billion were little changed, with a small increase in credit cards, mostly offset by lower commercial real estate office charge-offs. On a weighted basis, we remain reserved for an employment rate of nearly 5% by the end of 2025, compared to the most recent 4.1% rate reported. The net charge-off ratio was 59 basis points, largely unchanged for Q1.

One more reason that might have led Buffett to his decision to keep selling BAC stock in massive quantities is an assumption, that the bank loses competition. This is a reason that is rarely written about, but thanks to Daniel from Unrivaled Investing for mentioning it in his video in X (September 17, 2024).

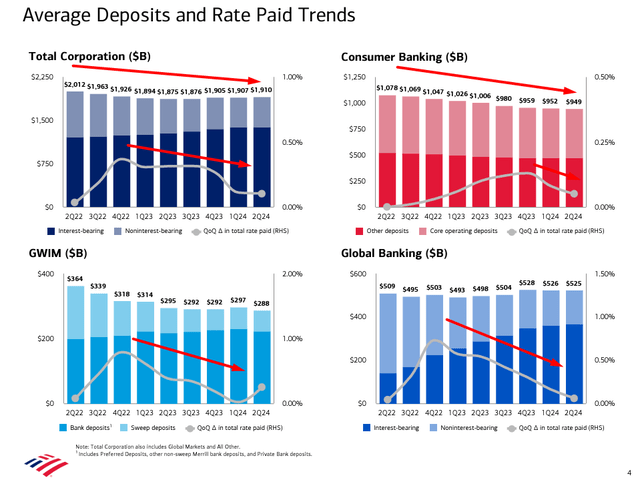

If you look at the company’s deposit dynamics in recent years – a time of increasing inflation and money supply growth in the U.S. – you will see that BAC’s deposit base is eroding rapidly.

BofA’s IR materials, Oakoff’s notes

BAC’s net interest income just hasn’t grown amid the expansion of money supply over the past years. This is not surprising, as many of the bank’s deposits are still only earning 1% per annum, which doesn’t compare to the potential yields of many other financial institutions. For example, Interactive Brokers Group, Inc. (IBKR) still offers more than 4.5% per year on unused account balances. This means that when an investor invests money, they can simply leave a certain amount unallocated, and this will give them a return many times higher than on BofA’s deposit account. What is the point of leaving money in a traditional bank if even inflation would eat it up?

So the growing competition in the market for financial institutions is clearly having an impact on the prospects that the greatest investor may see for Bank of America today.

However, I hesitate to give BofA a “Sell” rating – I think “Hold” is far more appropriate. From what I can see today, Bank of America is in robust financial shape, with a standardized Common Equity Tier 1 ratio of ~11.9% at the end of Q2, well above the new regulatory minimum. Also, BAC’s liabilities are cleverly diversified: more than half of its assets are covered by deposits, while the remainder consists of long-term debt instruments, repurchase agreements, commercial paper, and trading liabilities, which ensures a stable and balanced financial structure. Some Wall Street analysts like the Argus Research team (proprietary source, August 2024) see “sluggish lending revenues in 2024 amid weak loan growth and higher deposit costs”, but they do see a continuing rebound in investment banking. They also note an improvement in earnings quality and still modest valuation levels:

We believe that BAC’s earnings quality has been steadily improving, as evidenced by its better ROE metrics. Shareholder returns also improved following the 2024 CCAR results, with an 8% dividend increase.

We believe that BAC shares, trading at 13 times our 2024 EPS estimate, remain attractively valued. Our target price of $48 (raised from $45) assumes a multiple of about 14.5 times our 2024 estimate.

At least as far as the valuation is concerned, I can only agree – BAC really doesn’t look too expensive today. However, the partial loss of its competitive advantages due to inflated unrealized loss balances and low-yielding deposits makes me a bit concerned about the future growth potential of the stock. Therefore, I’ve decided to rate the stock a “Hold” today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.