Summary:

- Bank of America stock is down substantially over the past year in spite of rising interest rates.

- Widening yield spreads have been overshadowed by rising provisions for credit losses.

- The bank increased its CET1 ratio to 11.2% while still repurchasing stock.

- BAC stock is too cheap at under 10x forward earnings.

Spencer Platt

Bank of America (NYSE:BAC) initially dipped on Friday after releasing fourth quarter earnings before seeing a material recovery. Investors at first focused on the rising provisions for credit losses and elevating risks of a recession, but BAC continues to benefit from rising interest rates. BAC increased its balance sheet CET1 ratio to 11.2% and even repurchased some stock. While BAC is likely to trade based on sentiment regarding economic health, the company is showing resilient fundamentals with a strong financial position that should be able to weather any storm. Meanwhile, the stock trades at just 11x trailing earnings, making share repurchases a legitimate catalyst for tangible upside.

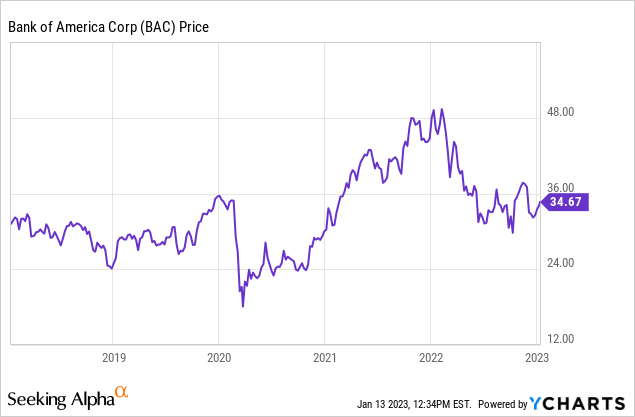

Bank of America Stock Price

BAC trades barely where it did five years ago in spite of reducing shares outstanding by 24%.

I last covered BAC in December where I rated the stock a strong buy based on the low valuation and vastly different financial profile than pre-GFC times. The stock has since returned 6% but still trades at compelling valuations.

BAC Stock Key Metrics

The latest quarter can be interpreted in two ways. On one hand, revenue grew by 11% YOY, largely due to rising interest rates. On the other hand, increased provision for credit losses led net income to basically stagnate YOY. For reference, the $1.1 billion in credit loss provisions in the quarter was a stark contrast as compared to the $0.5 billion release of credit loss provisions in the prior year. Excluding provisions for credit losses, BAC grew pretax income by 23% YOY.

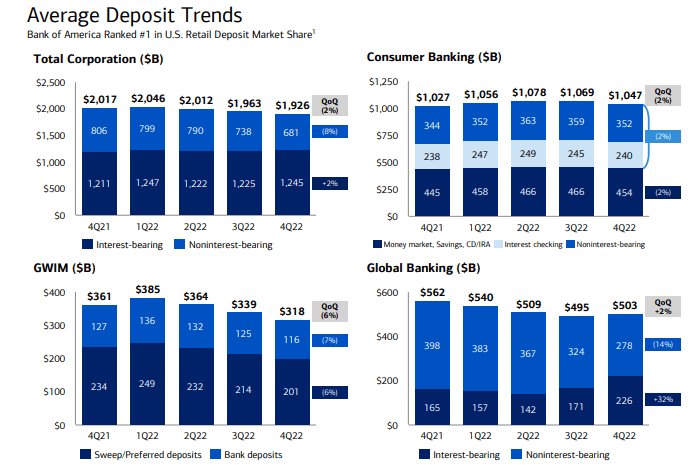

As can be expected during times of rising interest rates, deposit levels continued to show sequential weakness, likely due to some customers moving deposits to higher rate competitors.

2022 Q4 Presentation

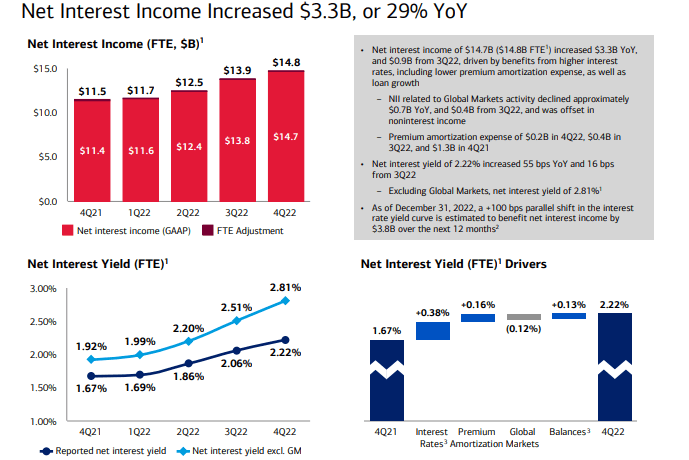

Those headwinds to deposits were more than offset by rising net interest income, as net interest yields have risen back to 2018 levels.

2022 Q4 Presentation

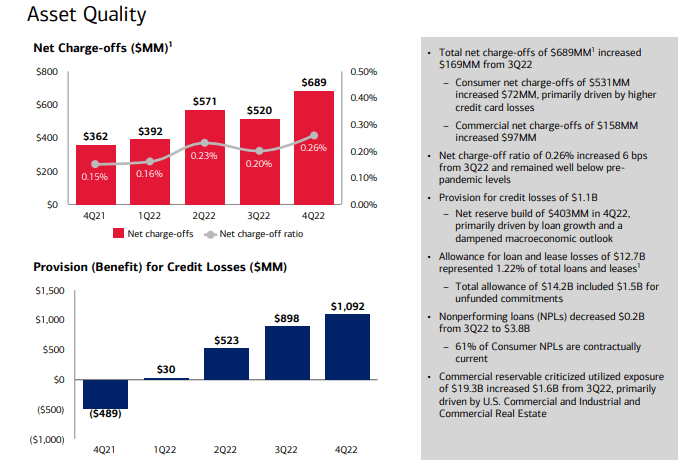

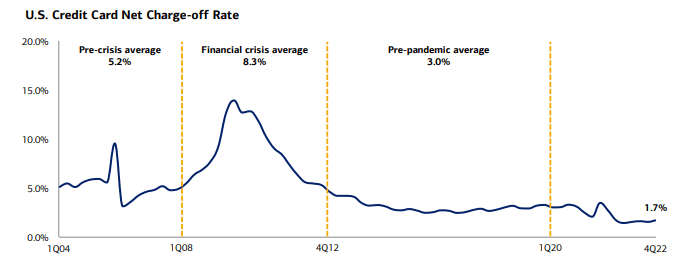

The net charge-off ratio increased to 0.26% but remained below pre-pandemic levels. If we are about to enter a recession, that impact has not yet hit BAC’s financial results.

2022 Q4 Presentation

BAC notes that credit card net charge-off rates remain far below pre-pandemic levels. While BAC stock seems to trade like a recession is imminent, its financial health remains resilient.

2022 Q4 Presentation

Meanwhile, BAC further improved its balance sheet, with its CET1 ratio rising 20 basis points sequentially to 11.2%. As a reminder, management had previously targeted a 11.4% CET1 ratio by 2024. Because their balance sheet is essentially already there, BAC will be able to reward shareholders with material share repurchases at these low levels.

Is BAC Stock A Buy, Sell, or Hold?

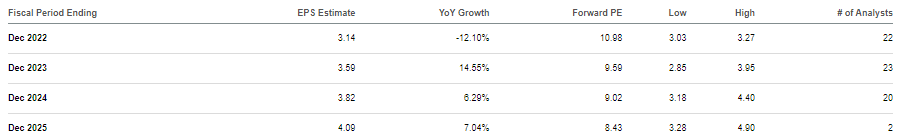

Prior to the recent correction, BAC stock had been trading strongly due to hopes that rising interest rates would boost its bottom line. Pessimism has taken hold, as investors are now more focused on how a recession might hurt the financial results. That has led the stock to trade at 11x trailing earnings and below 10x forward earnings.

Seeking Alpha

That valuation makes little sense in my opinion. Some investors may still have nightmares of the Great Financial Crisis and may be holding that against the company. The irony is that the GFC led to tight regulation which helps ensure that it cannot happen again. If things get very bad, then I could see BAC having to pause share repurchases in the near term, but I find it highly unlikely that the bank will have to dilute shareholders as it did during the GFC, as its CET1 ratio is far higher than before.

Even after an increase in risk premiums across the board, it is very rare to find companies with long track records of returning all earnings back to shareholders through dividends and share repurchases with stocks trading at double-digit earnings yields. I continue to view fair value as being between 15x and 20x earnings. I can see BAC earning that multiple on its own terms through continued execution on earnings and share repurchases, but I could also see it benefiting from the typical multiple expansion that takes place from being associated with Berkshire Hathaway (BRK.B) – as evidenced from stocks like Coca-Cola (KO) or Apple (AAPL). By that latter point, I am suggesting that BAC can at one point begin to trade more in-line with premium valued banking peers like JPMorgan Chase (JPM).

What are the key risks? It is possible that another GFC situation may occur. It might not be for the exact same reasons, but a tough economy might cast a spotlight on things that otherwise would not have appeared. While that may seem unlikely, the bank’s unraveling during the GFC seemed unlikely as well. BAC may never be able to disassociate itself from recessionary fears, meaning that it may perennially trade at low multiples. That may cap upside potential to around 15% to 20%, which while still attractive, may make the stock less exciting relative to (for example) beaten-down tech stocks. BAC may also be facing long term secular headwinds from the fact that its deposit yields are so low. It is unclear if newer generations are more price sensitive and may be willing to bank with lesser-known competitors in pursuit of higher interest rates. Due to the possibility of solid share repurchases in 2023, I continue to find BAC a strong buy as the low valuation is in itself a potential catalyst for future upside.

Disclosure: I/we have a beneficial long position in the shares of BAC, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!