Summary:

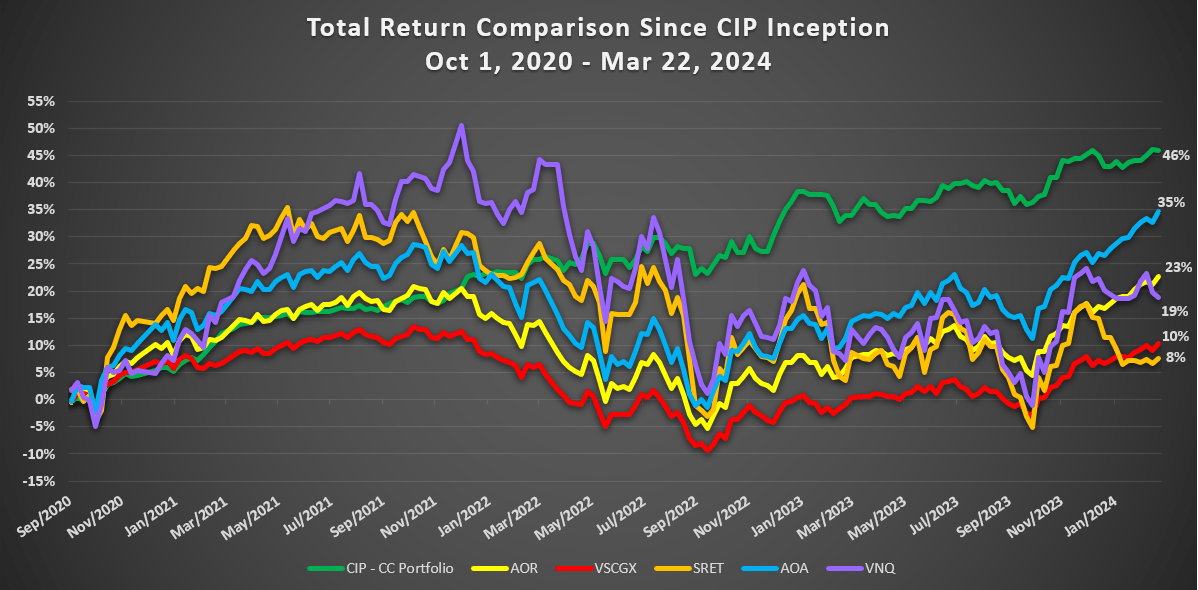

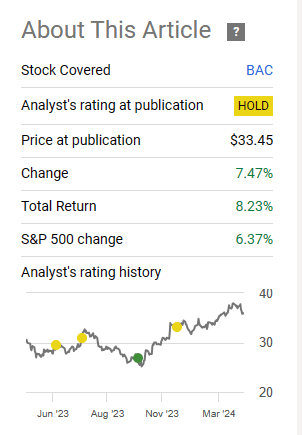

- Bank of America’s stock has performed well and kept pace with broader trends since October 2023.

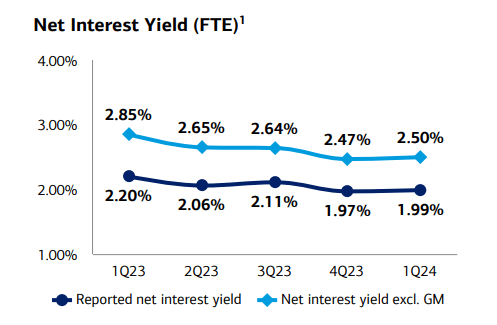

- The bank’s net interest margin and net interest yield have exceeded expectations and remained steady.

- Signs of the coming recession are showing up in many metrics. This is a great time to sell.

jetcityimage

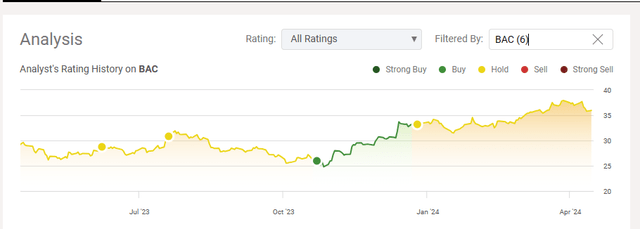

In our last coverage of Bank of America Corporation (NYSE:BAC) (NEOE:BOFA:CA), we have generally had the view that the franchise was fairly valued, and the returns would be average. We did do one shift from that view in late October 2023 as the stock became rather undervalued and offered a compelling entry point. Thanks to the barn burner of a rally that followed, we were forced to shift back into neutral and have remained there since.

The stock has done well since then regardless and kept pace with broader trends.

Seeking Alpha

We go over the recent results and update our view on this banking giant.

Q1-2024

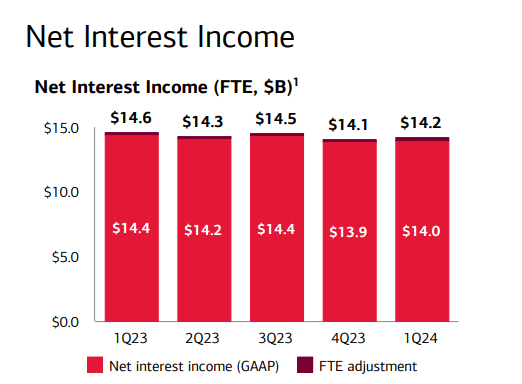

While the net interest margin peaked some time back, it has stayed relatively healthy. The total amount came in at $14.2 billion.

BAC Q1-2024 Presentation

This has certainly exceeded our expectations, and we will go into some details on this a bit later. Net interest yield/margin also stayed steady. After peaking some time back, this too has been far more buoyant than what we would have expected.

BAC Q1-2024 Presentation

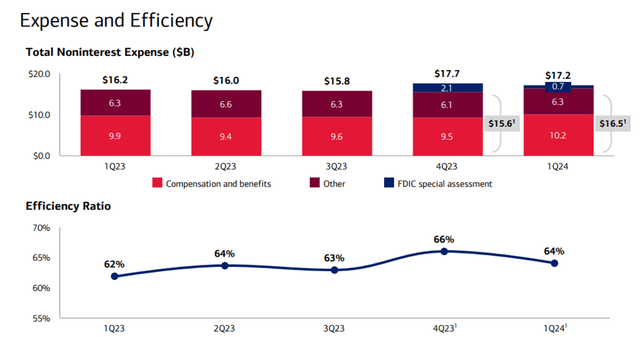

There was a notable surprise on the non-interest expense as BAC felt the $700 million special FDIC assessment.

Noninterest expense of $1.0 billion included an accrual of $700 million for the estimated amount of the FDIC special assessment for uninsured deposits of certain failed banks.

Source: BAC.

While this may seem overly punitive on the remaining banks, one really has to also acknowledge that BAC, like JPMorgan Chase & Co. (JPM), Wells Fargo & Company (WFC), and The Goldman Sachs Group, Inc. (GS), benefit from the “too big to fail” logo. In every panic, deposits rush to these institutions at the expense of regional banks. So in fact we think this tax is more than fair as a counterbalance. At least for these banks. Despite the special assessment, the efficiency ratio ticked lower. Lower is better for this number, unlike what the name would imply.

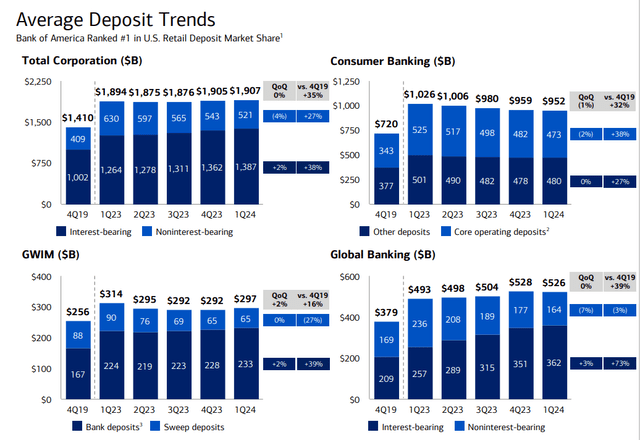

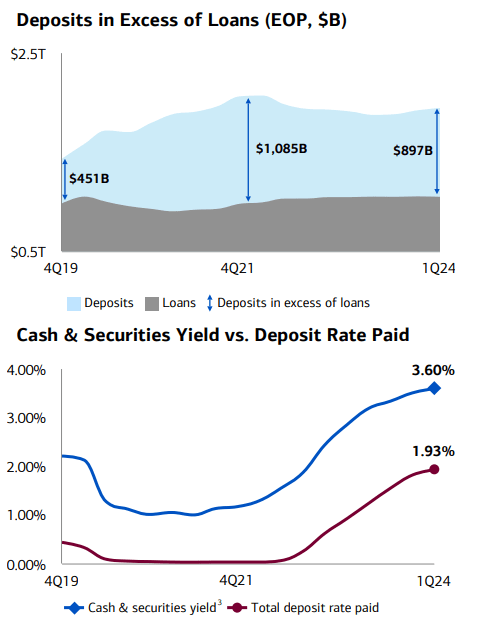

The average deposit trends also remained rather firm, and the bank is not seeing the flight into money markets that you would expect with such high rates.

The bank is paying more today than what it did a year back on these deposits.

BAC Q1-2024 Presentation

Even so, the consumers forgoing such large amounts of interest remains a strange phenomenon to us.

Outlook

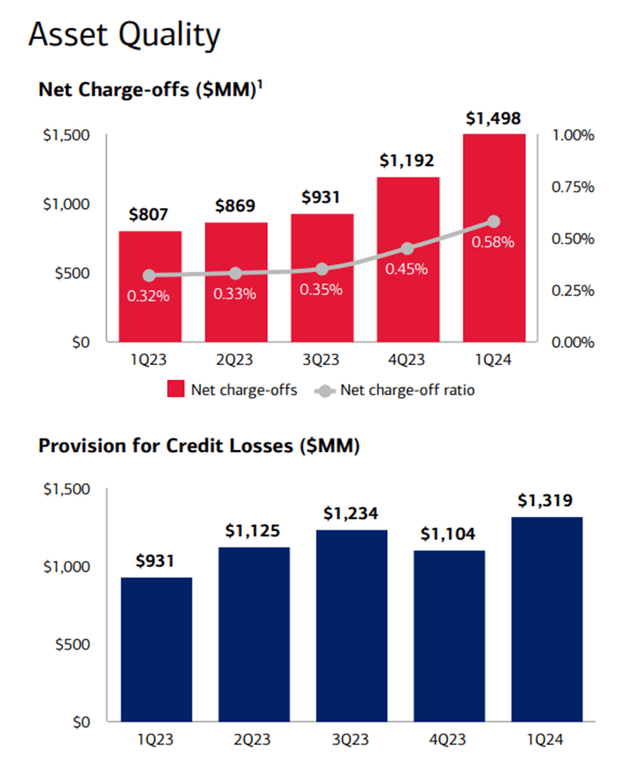

The most important part of the earnings release is what we want to cover in our outlook. While the debate has raged on the hard vs. soft landing, it’s clear what’s actually happening to BAC consumers. Charge-offs are rising and quickly approaching double the levels we saw just in Q1 2023.

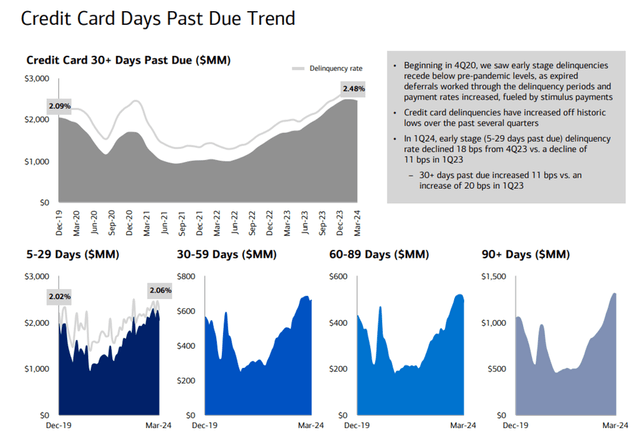

At the same time, provision for credit losses has remained steady as the bank is wagering that we’re close to the peak in charge-offs. Maybe that is exactly how it will play out. But perhaps it won’t. Just look at the change in delinquencies, especially the 90 days past due.

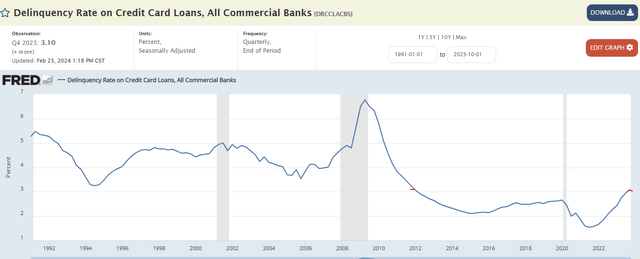

BAC is hardly on its own here. The delinquency rate on credit card loans is now at levels last seen in Q4 2011.

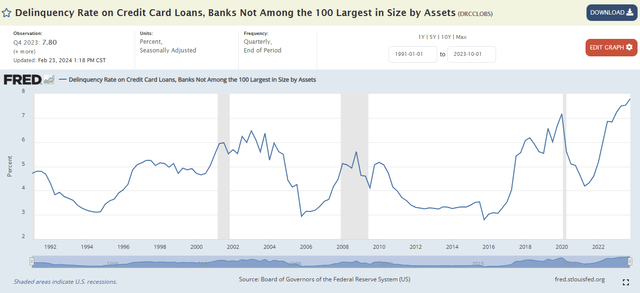

Here’s what gets really interesting. If you exclude the 100 largest banks, the delinquency rate is at an all-time high. Yep, even exceeding the global financial crisis.

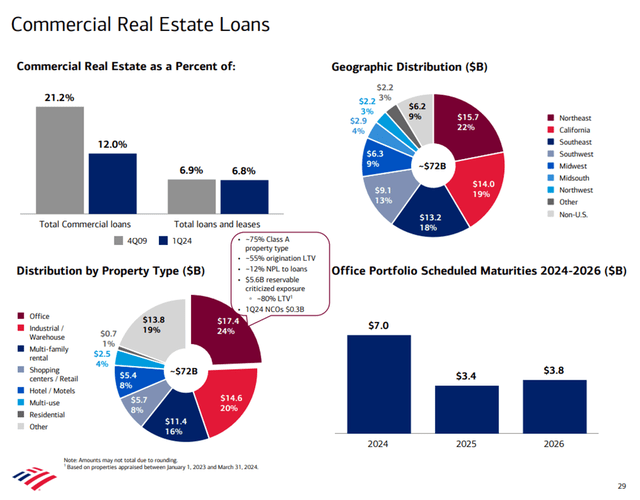

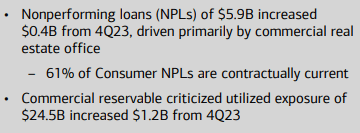

This may seem strange, but it fits with some other data points we’re seeing. The credit profile of the customers of the largest of the banks has been far better than what we have seen the regional do. We believe there’s a lag in the spillover and eventually, BAC’s charge-off rate will increase dramatically vs. where we sit today. That was the take on the consumer side. What about the commercial? The area also looks well-behaved at present with low charge-offs, though even there we’re seeing some cracks.

BAC Q1-2024 Presentation

CRE is a far smaller portion of the portfolio today relative to 2009. So we don’t see this as a game changer in a recession.

But the problems here are just in their fourth or fifth innings, and as we have seen, they have recently begun to accelerate. This will likely hit earnings hard at some point, and it will likely lead to multiple compression down the line.

Verdict

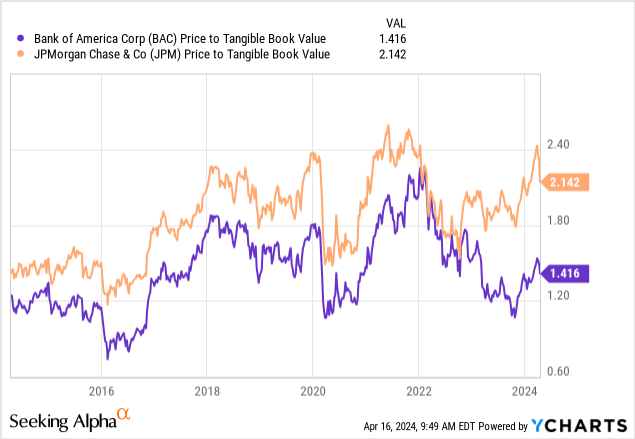

BAC remains cheap relative to JPM. We see value in paying a 0.7X tangible book value differential for JPM here. Even the market thought in early 2022 and valued both at about the same level.

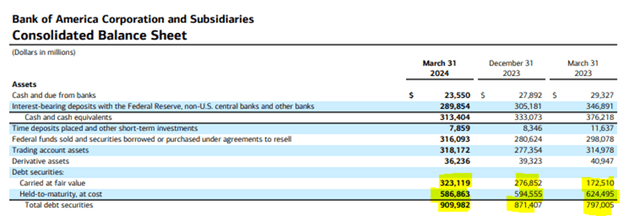

So if we had to stick our neck out for one of the “too big to fail,” BAC would get our vote here. That said, this late in the cycle, and the yield curve remaining relentlessly inverted, creates risks that we’re not too comfortable with. Just because it’s undervalued relative to some other bank does not make it a low-risk stock. With the vertical move in longer-dated yields, we think investors will once again focus on this segment (held to maturity) which we last looked at about a year back.

We think this might actually be a great time to sell BAC and move on to the sidelines. We’re downgrading it as such and think BAC heads lower.

Preferred Shares

In our previous coverage, we had also discussed Bank of America Corporation 7.25% CNV PFD L (NYSE:BAC.PR.L). These busted convertible preferred shares were trading at $1,222 at the time. We had moved them to a “hold” and suggested a sell rating could be warranted if they moved over $1,300. They did not quite get there and have retreated meaningfully from that level.

At present, they yield 6.27%, with the stripped yield being marginally higher (ex-dividend March 28, 2024). They are not the worst income producer out there, but since our outlook calls for the 10-year Treasury yield to breach 5%, we think these could continue to remain under pressure. We would not consider a buy unless they move under $1,050.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.