Summary:

- Bank of America, or BofA, needs to tread through less visibility in its net interest income growth in H1’23, complicated by the need to raise its deposit rates.

- The Fed and the market have also been squaring off on whether an earlier-than-expected pivot could be on the horizon.

- Despite that, analysts still expect BofA to post earnings growth in 2023.

- With BofA confident of avoiding a steep recession, the bank’s execution should improve in H2’23 with more visibility.

sshepard

Bank of America Corporation, or BofA (NYSE:BAC), reported a solid slate of earnings for Q4’22. However, instead of buyers following through with an upward push toward its November highs, sellers resisted, leading to a significant pullback this week.

We explained in our previous article that market operators have been positioning for a more tepid net interest income (NII) environment since November 2022. As such, investors are likely concerned that BofA could face challenges in lifting its NII growth further in 2023 as the Fed potentially dials down the pace of its rate hikes. Moreover, BofA will likely be pressured to increase its deposit rates, lending a further headwind to its NII growth.

Management was careful during the earnings call not to look into its crystal ball as analysts attempted to assess the annualized run rate of the bank’s Q1’23 NII projections of $14.4B. Notwithstanding, management articulated that investors should expect “less variability” in its NII cadence.

So, how should investors assess management’s guidance in this case?

Investors who have modeled for BofA to continue lifting its annualized NII run rate could be disappointed but shouldn’t be. It’s a much more challenging environment, even for the bank’s forecasters, as CFO Alastair Borthwick accentuated:

So look, we don’t have a great deal of precedent. It’s obviously a historic period. It’s difficult to forecast quarter-to-quarter, and it’s — our models are just a lot more sensitive right now. So I think we’re going to try and share with you what we know when we know it, but it’s just a more difficult environment at this point to predict looking forward. (BofA Q4’22 earnings call)

The bank also argued for a mild recession to occur. That’s not too bad because we believe that BAC’s valuation had likely contemplated such an outcome at its October lows, as discussed previously.

With that squared off, we don’t expect BAC to revisit its October lows, even though investors could remain cautious in their assessment of NII growth tailwinds.

Management has consistently been executing well, as seen in the increase in its CET1 ratio by 25 bps to 11.2%, well covering its requirements. Hence, BofA has several levers to pull as it focuses on loan growth in a challenging environment, as consumer spending starts to weaken.

Hence, the normalization phase (which is why it’s called normalization) should be expected through H1’23. With the Fed likely moving into data dependency phase after that, it should lend greater visibility into the bank’s NII forecasting models with less variability as it communicated.

However, we believe investors need to deal with less visibility in H1 as the market and the Fed squares off about the potential of an earlier-than-expected pivot.

Hence, the critical question is whether market operators have appropriately valued BAC through these headwinds?

BAC last traded at an NTM P/E of 9.7x, well below its 10Y average of 12x. Hence, we believe the market has proffered sufficient space for BofA to execute through murky waters, even though it’s still expected to lift its earnings in FY23.

Accordingly, Wall Street analysts have penciled in an EPS growth of 9.9% for FY23, after FY22’s 10.6% downtick. Hence, BofA is not expected to reclaim its FY21 EPS metric of $3.57 in FY23, as Wall Street remains cautious.

Therefore, we believe the bar remains relatively constructive for BofA to cross, as reflected in its less optimistic valuation relative to its long-term historical averages.

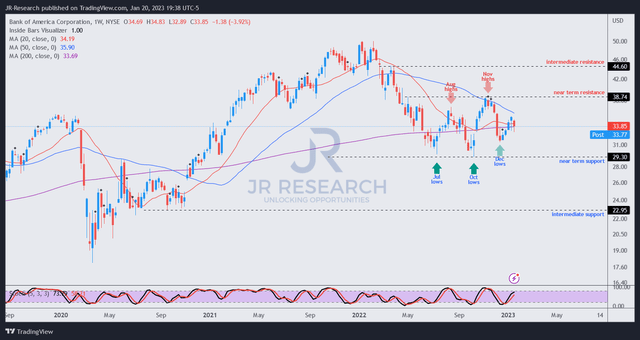

BAC price chart (weekly) (TradingView)

BAC has recovered from its December lows (pre-earnings) and remains well undergirded along its 200-week moving average or MA (purple line).

Accordingly, we believe long-term buyers have returned to defend against sellers from pressuring BAC’s price action down to its December lows.

Notwithstanding, buyers need to inspire further upward momentum to regain control over its November highs, which could bring back more buyers looking to pile into BAC.

Therefore, we encourage investors looking to add more exposure not to wait till then, as the reward/risk ratio looks attractive now, bolstered by constructive valuation.

Rating: Buy (Reiterated).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!