Summary:

- Bank of America has announced a 9% dividend increase, giving investors a current yield of 3.36%, the highest in at least 10 years.

- While the dividend growth rate has slowed, it remains steady and high enough.

- BAC stock looks undervalued compared to peers.

Brandon Bell

I recently profiled JPMorgan Chase & Co.’s (JPM) dividend increase and the underlying strength of the dividend coverage. As mentioned in that article, Bank of America (NYSE:BAC) had not yet announced its capital plans post-stress test at the time of writing. However, Bank of America has since announced a 9% dividend increase, almost double JPMorgan’s 5% increase.

In my most recent article on Bank of America, I had argued that the market was treating the stock with irrational fear. The stock has remained more or less flat since then while the S&P 500 is up 10%. Obviously, bank stocks have been under stress (pun intended) with questions about inflation, interest rates, and of course, the stress test results. Most of the big banks have done fairly well on the stress test and while Bank of America had to set up follow-up meetings with Federal Reserve to clarify the test results, the company has eventually rewarded investors with a handy dividend increase? But, how safe is the new dividend? Let’s find out.

New Dividend and Yield

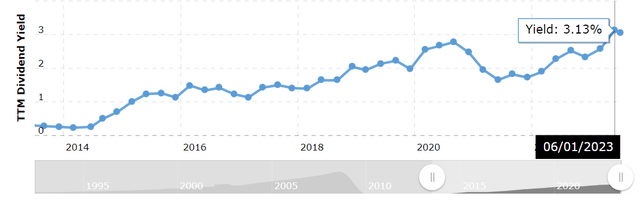

The new annual dividend of 96 cents per share (24 cents/quarter) gives Bank of America investors a current yield of 3.36%. This is handily higher than JPMorgan’s 2.90% and slightly higher than Wells Fargo & Company’s (WFC) 3.27%. More importantly, Bank of America’s current yield of 3.36% is the highest it has been at least in the last 10 years as shown below.

Payout Ratio (Based on Earnings Per Share)

Based on Bank of America’s forward earnings estimate of about $3.38, the stock has a forward payout ratio of 28.40%. This is in line with Wells Fargo’s payout ratio based on its new planned dividend of 35 cents/quarter and also in line with JPMorgan’s 29%, as seen in my recent review.

Payout Ratio (Based on Free Cash Flow)

Generally speaking, I’ve been using Free Cash Flow (“FCF”) as my primary metric to evaluate dividend coverage due to the flakiness that can be attributed to EPS. However, let’s bear in mind Free Cash Flow is not the best metric to evaluate a bank, which primarily exists to help fund liquidity by lending its cash out. However:

- Total shares outstanding: 8.06 billion

- Current quarterly dividend: $0.24/share.

- Annual FCF required to cover dividends: $1.93 billion.

- BAC’s FCF in 2022: -$6.327 billion.

- Payout ratio using 2022’s FCF: NA

Okay, while that looks scary, do not fret. As stated in this well-explained article, Free Cash Flow is not a good metric for financial institutions.

“Remember that “Free Cash Flow” is meaningless for financial institutions because changes in working capital can be massive due to the balance sheet-centric nature of their businesses.

Plus, capital expenditures are minimal and are not directly related to re-investment in their business.“

Furthermore, the article states that a better way to evaluate whether Banks are in a position to reward investors is by comparing their Return on Equity [ROE] to Cost of Equity [Ke]. While ROE is a popular metric and measures the return a company achieves, Ke is not that well known. Ke refers to the return expected by the market (investors) to own the underlying asset, Bank of America stock in this case. BAC’s ROE is almost 10% while the Ke is 7.13%, which suggests the company is exceeding expected returns.

Dividend Growth Rate [DGR]

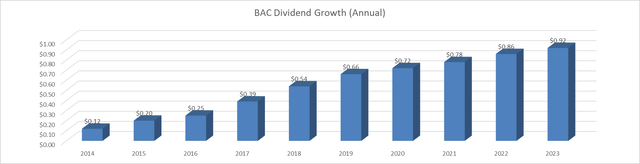

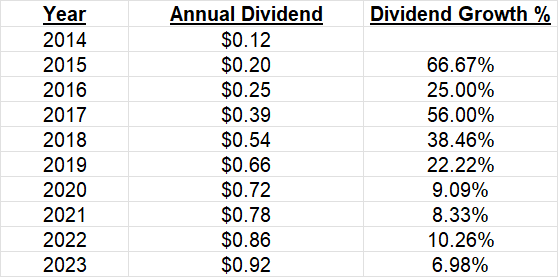

Since paying 12 cents per share on an annual basis in 2014, Bank of America has increased its dividend payout more than 7 times to reach the current dividend level of 92 cents per share (on annual basis). The dividend growth rate has fallen over the years but this is to be expected and even appreciated as the last thing I want as a dividend growth investor is a reduced dividend. In other words, slow and steady is perfectly fine with me. That said, the 5-year dividend growth (average) rate of 11.40% is not too shabby.

BAC DG (Compiled by Author, data from Seeking Alpha) BAC DGR (Compiled by Author, data from Seeking Alpha)

Buyback

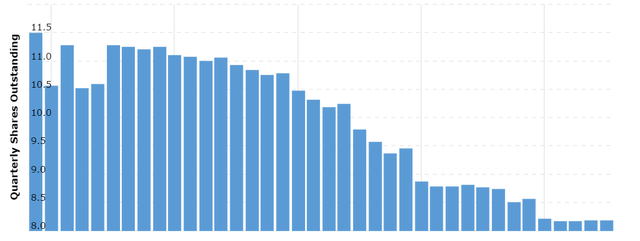

Bank of America, just like JPMorgan Chase, has also been reducing its shares count steadily over the years:

- 8% reduction in the last 3 years.

- 21% reduction in the last 5 years.

- 30% reduction since 2014.

As I’ve stated before, meaningful reduction in shares count has double benefit for shareholders of companies that pay dividends. Not only do buybacks enhance EPS, but also save money every single quarter as the retired shares do not demand/expect their quarterly dividend with wide eyes like we silly investors do.

BAC Shares Outstanding (Mactrotrends.net)

Extrapolation

I am not as comfortable projecting dividends with banks as I am with, say, consumer staples stocks. However, let’s assume a paltry 5%/yr increase on average per year over the next 5 years. Bear in mind, BAC’s 5-year average stands at 11.40%. The yield on cost should go up respectably for someone buying here, breaching the 4% mark conservatively.

| Year | New Annual Div/Share | Yield on Cost |

| 2023 | $0.92 | 3.23% |

| 2024 | $0.97 | 3.39% |

| 2025 | $1.01 | 3.56% |

| 2026 | $1.07 | 3.74% |

| 2027 | $1.12 | 3.92% |

| 2028 | $1.17 | 4.12% |

Outlook and Conclusion

The latest dividend increase is backed up by solid financial strength, as was the case with JPMorgan Chase. While some Seeking Alpha investors seem to be disappointed with the 9% increase, let’s not forget it wasn’t long ago that we were all expecting a repeat of 2009 when regional banks started collapsing like nine pins. Better safe than sorry when it comes to my dividends, please.

Although this article is about BAC’s dividend, let’s take a quick look at the company and stock’s outlook.

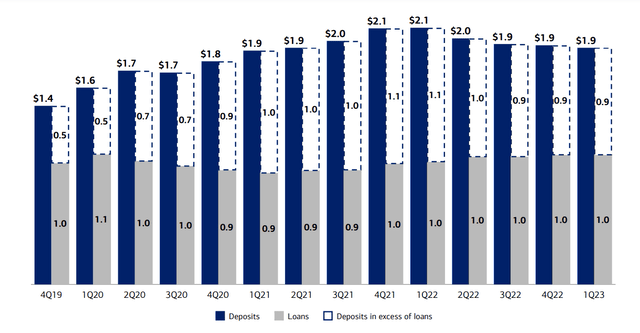

- Business Strength: Bank of America’s Q1 2023 presentation highlights many of its strengths. For example, the bank’s blended yield on cash and securities reached 2.90% in Q1 2023 and has been increasing every single quarter since Q2 2021 when it achieved just 1% blended yield. Another sign of strength is the fact that excess deposits necessitated the company to invest additional cash that was above its safe capital buffer. Finally, the fact that 85% of the company’s clients use more than one product shows the depth and breadth of customer stickiness.

BAC Deposit Strength (investor.bankofamerica.com)

- Stress Test: Bank of America was among the top 3 most improved banks in the recent stress test. Aa result, BAC’s stress capital buffer fell by 90 basis points. The fact that the company took its time to clarify the results with the Federal Reserve before announcing a near double-digit dividend increase should comforts investors that the company knows what it is doing. In addition, as Stated in the Seeking Alpha news item referenced above, Bank of America:

- screened best in DFAST (Dodd-Frank Act Stress Test) as it had the biggest increase in stressed pre-provision net revenue,

- had the second lowest loan loss rates of the Big Five Banks (Citi, JPMorgan, Bank of America, Goldman Sachs, Morgan Stanley), and

- had the third largest AOCI (accumulated other comprehensive income) benefit

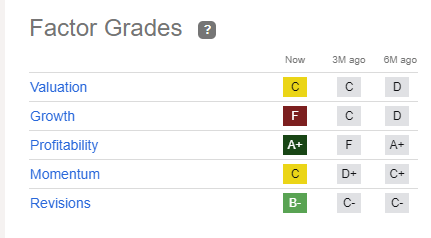

- Valuation: At a forward multiple of 8.40, Bank of America stock is cheaper than Wells Fargo at 9.10 and JPMorgan Chase at nearly 10. The relative cheapness of BAC’s stock shows in its YTD performance relative to its peers. BAC stock is down nearly 15% YTD while JPMorgan is up nearly 7% and Wells Fargo is up by 2%.

- Price Target: Analysts have a median price of $35, which is about 23% higher than the current price. Including the handy 3%+ yield, that would represent a handy 26% return, double that of the expected returns from JPMorgan using the same metrics.

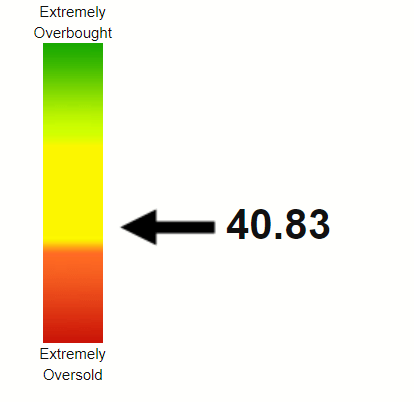

- Technical Strength: From a technical perspective, Bank of America’s stock has a Relative Strength Index (“RSI”) of 41 as shown below. This shows a stock under pressure, although the RSI has improved considerably since my March review (when it was at 15). The 100-Day moving average is only about 3% from here and given the confidence shown by the management with the 9% dividend increase, I expect the stock to take out the 100-Day moving average soon as long as the market does not get shaky overall.

BAC RSI (Stockrsi.com)

- Risks: The biggest risk for bank stocks in my opinion is Federal Reserve policies. Generally speaking, banks tend to do well when rates are higher as the impact of spread between what a bank pays as interest (say, savings account) and what it charges as interest (say, mortgage) is more pronounced. The fact that Federal Reserve did not raise rate for the first time in 15 months is almost immediately followed by news that they are ready to start increasing rates again. Specific to Bank of America, the paper losses due to over-allocation to Government bonds at the wrong time (in hindsight) is still hanging over the stock as these losses are expected to show up in real-earnings in the near future.

BAC SA Rating (Seekingalpha.com)

Conclusion

To conclude, although I am invested in JPMorgan and Wells Fargo, it appears like Bank of America looks is the better choice to invest fresh capital based on its valuation, yield, and what appears like the market’s mis-pricing, The fact that the stock is trading below its book value makes it even more interesting. I will be looking at selling $24 puts in the near future on sell-off days to set myself up for a 4% yield entry position in Bank of America.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.