Summary:

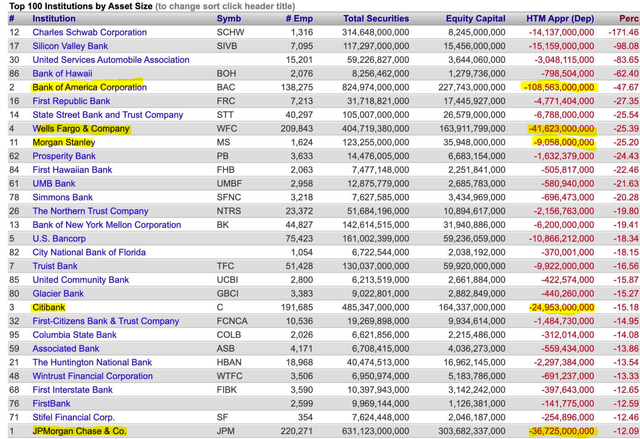

- Bank of America has incurred a paper loss of approximately $109 billion due to its decision to invest heavily in U.S. government bonds.

- This loss is significantly higher than those of its competitors such as JPMorgan Chase, Wells Fargo, Citigroup, and Morgan Stanley.

- The low yields on these long-dated securities compared to current interest rates could pose an earnings problem for the bank.

Drew Angerer

Bank of America (NYSE:BAC) is sitting on a ∼$109 billion paper loss; a consequence of its capital allocation decision made when interest rates were low, and money/ liquidity cheap. Like now-bankrupt SVB, Bank of America received enormous amounts of deposit inflows (∼$670 billion) during the COVID pandemic, deposits which the bank used to buy (mostly U.S. government bonds) at historically high valuations and low yields.

Now, while the securities that BAC bought were traditionally considered “risk-free”, their value declined sharply due to the shift from quantitative easing (QE) to quantitative tightening (QT) and the subsequent rise in interest rates. (Remember: the price of bonds is inversely related to its yield, and thus the level of interest rates). To illustrate the point, the chart below shows the 3-year performance of the iShares 20+ Year Treasury Bond ETF (TLT) — highlighting a sharp repricing of bonds, driven by inflation concerns and the subsequent efforts of central banks, including the Federal Reserve, to raise interest rates rapidly.

Seeking Alpha

As a result of the repricing of bonds, Bank of America’s investment portfolio suffered substantial paper losses, surpassing $100 billion, as disclosed by the Federal Deposit Insurance Corporation at the end of the first quarter. These losses stand out prominently when compared to the unrealized losses incurred by rivals.

For reference, the unrealized losses of key competitors JPMorgan Chase (JPM), Wells Fargo (WFC), Citigroup (C), Morgan Stanley (MS) amounted to only approximately $37 billion, $42 billion, $24 billion and $9 billion respectively.

FDIC

An interesting comparison versus JPMorgan stands out, and highlights the importance of a bank’s management team. While BofA CEO Brian Moynihan was quite nonchalant about capital allocation during the 2020-2021 bubble in fixed income markets …

Deposits have crossed $1.9 trillion and the loans are $900 billion and change. And that difference has got to be put to work . . . we’re not timing the market or betting. We just sort of deploy it when we’re sure it’s really going to be there

… JPMorgan’s CEO Jamie Dimon was very reluctant to move excess cash into low-yielding treasuries …

I would not be a buyer of Treasuries … I think Treasurys at these rates, I wouldn’t touch them with a 10-foot pole.

The performance of the two bank’s equity reflects the thinking accordingly: During the past 12 months, JPM stock is up almost 30%, as compared to a loss of approximately 8% for BAC.

Seeking Alpha

Of course, Bank of America may likely never be forced to “realize its paper losses”, because the bank’s investment portfolio primarily holds government-backed securities with high credit ratings, which are expected to be repaid as the underlying loans reach maturity. Additionally, BofA maintains a cash reserve of ∼$370 billion, rendering liquidity challenges similar to those experienced by SVB very unlikely.

But still, the “paper losses” provoke an earnings problem: Bank of America finds itself holding long-dated securities that yield around 2%, in a world where interest rates are closer to 5%. Needless to say, this puts the bank at a disadvantage compared to other banks.

Bringing back the comparison with JPMorgan, investors should consider that JPM’s net interest margin for the first quarter came in at 2.6%, as compared to BofA’s 2.2%. Mostly as a result of the lower interest rate margin, BofA’s interest spread, which represents the difference between asset yields and funding costs, stood at 1.43%, as compared to 2.04% for JPMorgan.

Stress Test Results Confirm Confidence In The Banking System

Talking about paper losses on bank’s balance sheets, I would like to point out that there is no reason to be concerned about financial distress in the banking system. In fact, the banking system appears to do very well – as indicated by the Federal Reserve’s annual stress test results released 28th June.

All 23 U.S. banks subjected to the stress test successfully “survived” a severe downturn scenario which modelled a global recession marked by a 10% surge in unemployment, a 40% decline in commercial real estate values, and a 38% drop in housing prices. In the worst case scenario, combined projected losses for the largest U.S. banks would total $541 billion, whereby loan losses account for 78% of the total, and trading losses for the remainder. Within loan losses, credit cards emerged as the most problematic category – by far, with an average loss rate of 17.4%, significantly higher than the next-worst average loss rate of 8.8% for commercial real estate loans. But despite the projected half-a-trillion loss, U.S. banks would still manage to operate smoothly, and be able to pay any outstanding financial obligations and write new loans.

As a consequence of the strong stress test results, several of the major banks have already announced plans to increase shareholder distributions, including JPMorgan, Morgan Stanley, Wells Fargo, and Goldman Sachs (GS). JPMorgan will raise its dividend to $1.05 per share, Morgan Stanley to 85 cents per share, Wells Fargo to 35 cents per share, and Goldman Sachs intends to boost its dividend to $2.75 per share.

Conclusion

Banking is all about capital allocation. And BofA’s management team appears to be less effective/ sophisticated doing the job than Wells Fargo’s, JPMorgan’s and Citigroup’s management team, as highlighted by a ∼$109 billion paper loss in BofA’s investment portfolio. While the paper loss will likely not provoke a solvency or liquidity concern, it will definitely result in lower profitability vs. peers.

Reflecting on BofA’s now forced marriage with low-yielding fixed income securities, in order to avoid realizing parts of the nine-figure paper loss, I see BofA’s NII and ROE lagging peers through at least 2025. And accordingly, I assign an underweight/ Sell recommendation to BAC stock, vs. an overweight/ Buy for JPM and C.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advise

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.