Summary:

- Last year I wrote an article about how I “bought the panic” in Bank of America shares after the stock dipped to $29 in Q4.

- Today there is a similar panic afoot; on Friday the stock fell a shocking 6.2% in one day.

- This time around, there is more fundamental justification for the selling than there was in Q4: Silicon Valley Bank is struggling, and banks are being pressured to raise CD rates.

- It looks like there’s some potential for margins to get squeezed here, but large banks like BAC enjoy protection.

- If it fell to $23.30, BAC would be valued similarly to the bottom of the great financial crisis, a level from which it rallied 1,000%.

Drew Angerer

Bank of America (NYSE:BAC) stock crashed 6.2% on Thursday, on news that a small regional bank was at risk of going bust, and large banks were having to raise CD interest rates. In a Thursday article, Reuters reported that Silicon Valley Bank (SIVB) was forced to issue shares, which caused the stock to crash 56% in a single day. Around the same time, Bloomberg reported that U.S. banks were having to jack up CD rates in order to meet capital requirements.

It was a tough day for bank stocks; the whole S&P banking sub-index fell 4%. Not only did stocks slide but the selloff coincided with meaningfully negative fundamental developments: higher CD rates, the collapse of crypto bank Silvergate (SI), and SIVB’s dilution.

Caught up in the midst of all of this was Bank of America, which crashed in sympathy with its smaller, riskier cousins. Although BAC itself did not report any materially negative news on Thursday, sector wide selling took place due to the events at Silvergate and SVB.

This isn’t the first time in the last 12 months that a selloff of this magnitude has occurred in BAC shares. In the fourth quarter of 2022, BAC stock slid all the way down to $29 from $38. At that time, the cause of the selling wasn’t clear. The most recent financial reports from big banks were good, showing high growth in net interest income. This time around, there is more negative information circulating than before, so the recovery from today’s levels may take longer.

The last time Bank of America crashed like this, I wrote an article titled “Bank of America Why I Bought the Panic,” in which I outlined reasons why I had chosen to buy more BAC stock instead of sell it. Basically, I felt that rising interest rates would help BAC rather than harm it, and that strength in non-lending parts of the company’s business (e.g. brokerage services) could offset any impact from the inverted yield curve.

Today, I feel much the same way. Granted, the news is worse this time around; there was almost no materially negative news about banks during the Q4 crash, today there is. That being said, there is a very good reason for SVB to be crashing right now: much like Silvergate, it has massive crypto exposure. In this case, exposure to Coinbase (COIN) common shares, which are the single biggest asset in SIVB’s portfolio. Crypto related stocks have been struggling lately, thanks to a major decline in the price of Bitcoin and the collapse of exchanges like FTX and Celsius.

It’s not hard to see that the selling in Bank of America is overdone here: BAC isn’t invested in crypto. Or at least, it isn’t disproportionately invested in it. The company’s 13F reports show thousands of individual stock holdings, consistent with a “broad diversification” investment strategy. There is no particular crypto exposure on BAC’s books beyond that which would emerge by buying the market; therefore, Silvergate and SVB like issues do not apply here. The rising CD rate issue does affect Bank of America, but as I’ll show momentarily, larger banks are better positioned to overcome that problem compared to small ones. Finally, given BAC’s explosive growth since 2009, there is a case to be made that the stock only has to fall to $23.3 to hit parity with its valuation in the 2008/2009 financial crisis, a level from which it eventually rose 1,000%. For these reasons I consider BAC a buy at today’s levels and would consider it a great buy if it fell to $23.30.

The CD Issue

I already showed in the opening paragraphs that Bank of America is not particularly exposed to crypto blowups, like the banks that triggered Thursday’s financials selloff. This leaves us with one major risk factor that could explain today’s selloff in BAC shares:

Increasing CD rates.

There is no question that CD rates are rising right now.

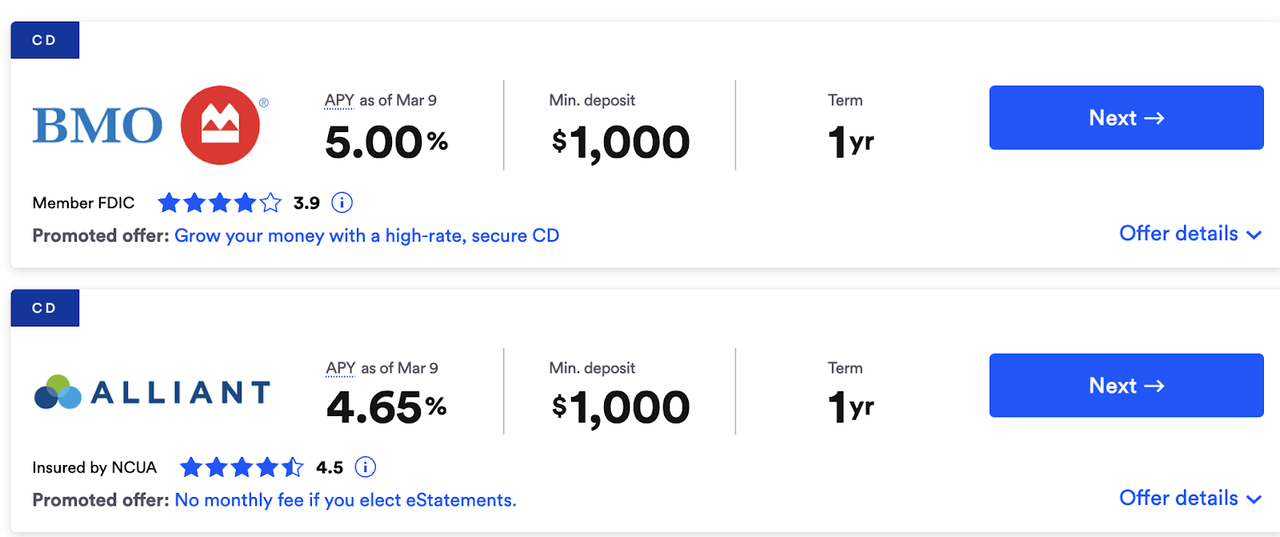

A quick Search on Bankrate revealed the following CD rates, along with a few others that aren’t quite as high.

High yield CDs (Bankrate)

So we’re seeing American citizens being offered 4.65% to 5% interest on CDs. That will take a bite out of the margins of the banks offering it.

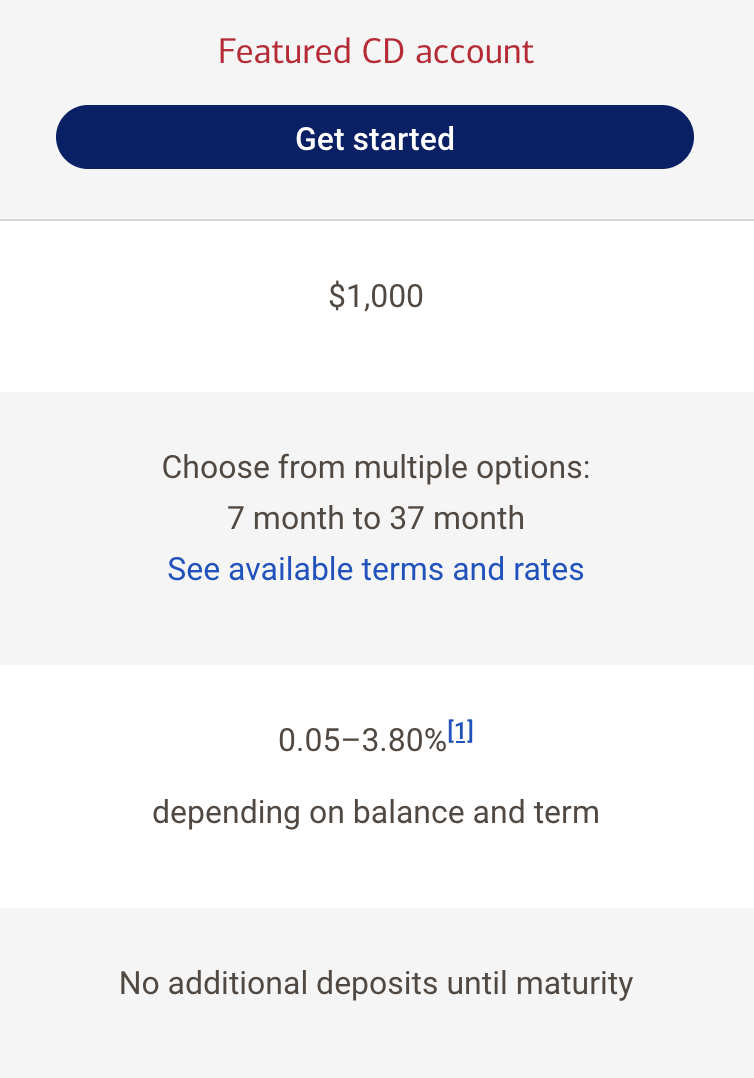

Bank of America does not seem to be offering such CD yields. According to Bankrate, BAC’s best CD had a mere 0.03% APY on March 9. After seeing this data, I decided to pry a little further into the matter, by looking at Bank of America’s own website. Here’s what I found:

Bank of America CD rates (Bank of America )

Basically, BAC’s CD interest is a bit lower than other banks’, but it’s not as low as the Bankrate list makes it appear. With the company’s featured CD, you can get 0.05% APY on a small deposit, and up to 3.8% on a larger one. The yields available are not competitive with the highest out there, but are not nothing.

The fact that Bank of America isn’t rushing to raise CD rates may actually be bullish for the stock. It’s a downer for BAC’s depositors, who may turn elsewhere for yield, but it suggests that the bank has enough capital to ride out a mild to moderate loss of depositors. Banks are required by law to have certain amounts of capital–cash, common stock, and other such things. Because banks are required by law to keep certain amounts of capital, they often raise their CD rates to keep depositors in periods when they are withdrawing cash. The fact that BAC isn’t doing this yet–or at least not doing it much–may indicate that it has other high quality sources of capital that will enable it to meet its regulatory requirements. If that’s the case then it may never have to raise its CD rates as high as the banks shown above have raised them.

Valuation – The Reason I’m Bullish

Having looked at some risk factors facing BAC today, it’s time to get into why I’m bullish on the stock.

Basically, it comes down to its valuation.

Compared to the S&P 500, Bank of America shares are currently cheap, trading at:

-

10.21 times earnings.

-

2.86 times sales.

-

0.99 times book value.

These are pretty low multiples. The price/book multiple in particular seems to suggest that BAC trades for less than the value of its assets, net of debt. That may indicate an undervalued stock.

On the other hand, there are other signs that BAC stock isn’t THAT cheap just yet. By sector-relative standards, it’s about average, hence its ‘C’ rating on valuation in Seeking Alpha’s Quant system. Basically, banks usually trade at low multiples compared to other sectors, due to fear of 2008-style disasters, relatively slow growth, and regulations that limit banks’ operational flexibility.

Nevertheless, there are signs that Bank of America may be worth more than what investors are currently paying for it. There’s the low price/book ratio, of course. That metric currently suggests undervaluation, though depositors running away to invest in treasuries could change it quickly.

There’s also the matter of terminal value. Specifically, terminal value under an assumption of no growth. “Terminal value” is a type of discounted cash flow model where you don’t assume any future cash flows, you just discount the current level of earnings, assuming a chosen discount rate, and a rate of assumed growth. If you assume 0% growth, you’re using a very conservative model, because it’s not hard for companies to grow at least 0% long term.

According to Seeking Alpha Quant, BAC had $3.19 in diluted EPS in the trailing 12 month period. With that much earnings growing at 0%, you get the following price targets using 4%, 6% and 10% discount rates:

-

4% (the current 10 year treasury yield) – $79.74.

-

6% (current 10 year treasury yield plus a small risk premium) – $53.

-

10% (current 10 year yield plus a large risk premium) – $31.90.

As you can see, BAC comes out with upside to today’s price ($30.50) whether you use no risk premium, a small risk premium, or a large risk premium. In other words, if Bank of America can pull off 0% growth for the foreseeable future, it is objectively worth more than what it trades for today.

A final note on valuation: at the bottom in the Great Financial crisis, BAC stock cost $3.95. It had $0.54 in trailing earnings per share (“EPS”), so a 7.3 P/E ratio. Today, BAC has $3.19 in EPS, so, if the stock fell to $23.3, investors would be buying it at a financial crisis era valuation. The last time that happened, BAC rallied 1,000% from bottom to top over 13 years!

The Bottom Line

The bottom line on Bank of America is that it’s a pretty good value at today’s prices. Here we’ve got bank stocks selling off like Armageddon is just around the corner, and it was all triggered by a bank that specialized in crypto, and another bank that specialized in high risk high tech investments. None of this should tell you anything about the value of a large diversified bank, yet investors are acting like it does.

At this point, Bank of America is undervalued even if it never grows again. I’ve said that about other stocks in the past, but in most other cases I used relatively low discount rates to arrive at my conclusions. Bank of America is undervalued even if you slap on a gigantic 6% risk premium–plus it’s trading below book value! If you think the U.S. economy has any chance of positive growth in the next five years, then you should conclude that Bank of America is undervalued. There are few scenarios where a stock price as low as the current one holds up long term.

Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.