Summary:

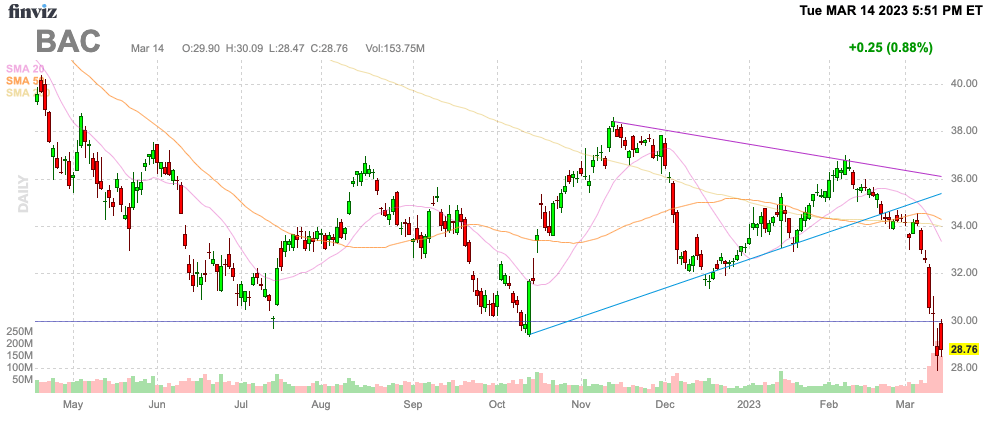

- Bank of America has crashed this week with the stock falling below $29 to new yearly lows.

- The large bank appears to be getting stronger during this crisis with up to $15 billion in new deposits.

- The company has large unrealized losses in the HTM portfolio, but the bank has the deposits and assets to avoid these losses.

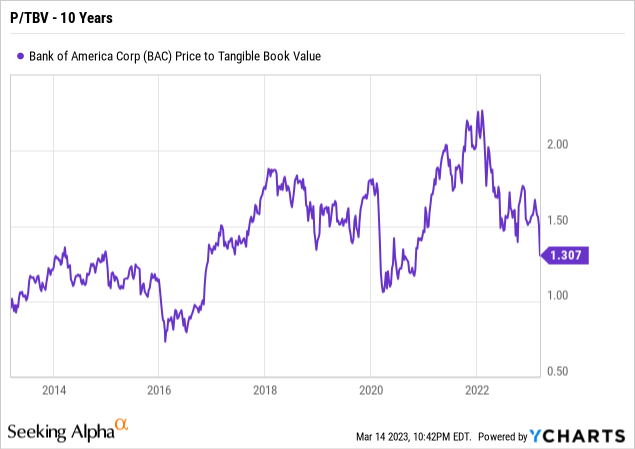

- BAC stock is a major bargain trading down to 1.3x TBV, the lowest multiple outside of Covid since 2016.

Hwangdaesung/iStock via Getty Images

Bank of America (NYSE:BAC) continues to trade down dramatically due to the ongoing banking crisis, yet the large bank is set to benefit from customer transfers. BoA looks prepared to collect more deposits to fund loans with no capital problems. My investment thesis is far more Bullish on the stock on the recent weakness with BoA now trading below $30 towards levels not seen since Covid.

Source: Finviz

Irrational HTM Fears

With the deposits from failed regional banks flowing to the big banks like BoA, the only reason the stock is trading at multi-year lows is the fears on held-to-maturity (HTM) securities. Most of the banks now have large unrealized losses which don’t matter, if the maturities are held until maturity.

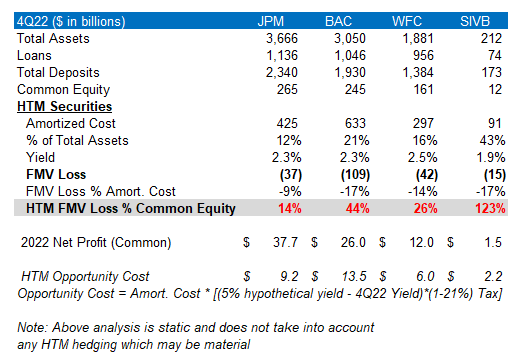

A big part of the undoing of SVB Financial Group (SIVB) was the combination of the large Silicon Valley bank having uninsured deposits fleeing the bank while being invested in HTM securities with unrealized losses nearly equal to the capital levels. These securities were slowly running off and being replaced with higher rate securities, but SVB had practically all of their capital wiped out via being forced into a situation requiring these securities to be sold due to the bank run.

BoA has a large HTM securities loss compared to FMV of these bonds, but the large bank has far more capital and no need to sell the bonds to incur the losses. Not to mention, BoA doesn’t have the same deposit issue, with nearly 50% of customers in insured deposits.

Source: Twitter @andrewcoye

Now the bank doesn’t sit favorably compared to the other large banks, with JPMorgan Chase (JPM) and even Wells Fargo (WFC) with HTM security losses closer to 20% of common equity. Regardless, none of these large banks are at any risk of large losses or a bank run considering the securities are constantly being repaid and reinvested in new loans or higher rate securities without incurring any losses.

In fact, Bloomberg is reporting that BoA has collected $15 billion in additional deposits after the SVB failure. The bank has limited risk with the deposit base growing.

The Fed could be forced to pause rate hikes and was already close to ending the rate hike scenario that would’ve placed these banks in a tougher HTM loss position. The banking crisis has caused interest rate declines that should help reduce the listed HTM security losses while the portfolio should’ve rolled off additional securities in the quarter at par with BoA buying looking to produce more loans.

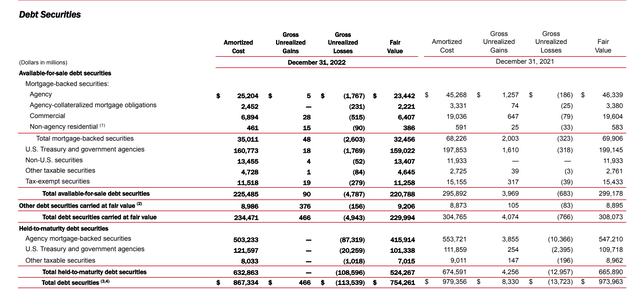

The large bank has a total of $633 billion in HTM securities, so the $109 billion in unrealized losses is only a small portion of the portfolio. BoA has another $225 billion in AFS debt securities with limited unrealized losses of $4.8 billion.

In essence, the large bank has a substantial amount of securities that can be cashed in to cover any deposit outflows. The issue facing SVB were deposit outflows that exceeded AFS securities, requiring the bank to raise capital in a failed attempt to add capital and prevent a need to sell the HTM portfolio at massive losses.

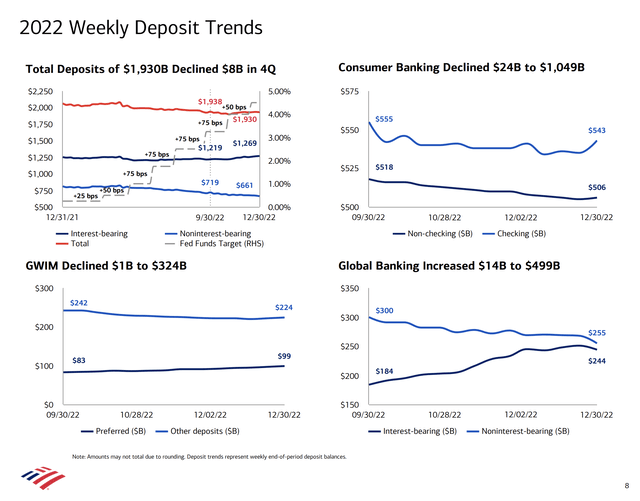

BoA has $1.93 trillion in deposits. Though the bank faced deposit declines in the last year, the company has nearly $1 trillion in very sticky consumer banking deposits and apparently a large inflow of new deposits.

Source: BoA Q4’22 presentation

The other banking segments actually saw deposits increase due to a shift into interest-bearing deposits. Otherwise, the bank just doesn’t face the deposit flight risk hitting the regional banks that failed recently with or without new deposits.

Ridiculous Value

The large bank is a big winner from the fears sending deposits out of the regional banks. The stock has hit unreasonable lows despite strong NII and a strong earnings profile even with the wealth management and capital markets business struggling with the tough economic environment.

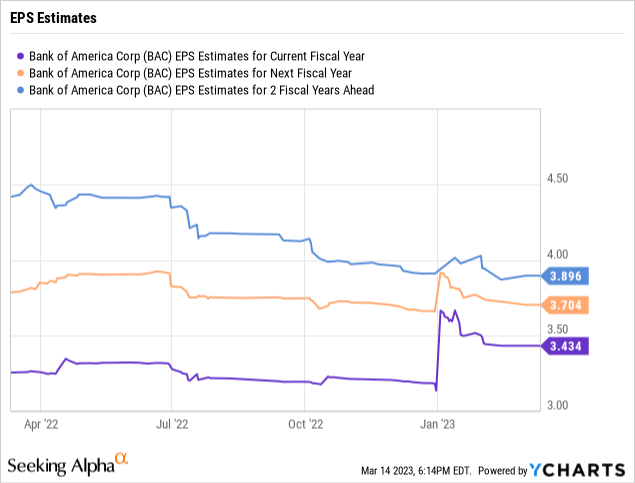

BoA is forecast to produce a $3.43 to $3.70 EPS in 2023 and 2024 while the stock now trades at only $28. Investors can now buy the large bank stock at a similar discount as when Covid hit the global economy and an economic shutdown occurred.

The stock has a tangible book value of $21.83 per share. If BoA falls much further, the stock will trade close to TBV. BoA hasn’t traded this low since 2016 outside of the Covid lows when an investor could’ve bought the stock at $20 and flipped it for nearly $50 by the start of 2022.

Takeaway

The key investor takeaway is that BoA trades at multi-year lows for no rational reason. The stock could face more downside risk as the market is still on edge, but the large bank has the growing deposit base to actually benefit from the crisis and the flight to safety in the banking sector.

Investors should use this period to load up on BoA close to TBV while the stock trades at only 8x EPS targets.

Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause after several bank closures, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts, and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the outsized risk of high-flying stocks.