Bank Of America: Ignore The $114 Billion ‘Unrealized Losses’

Summary:

- Bank of America stock is down 30% from a year ago, at just 1.3x Tangible Book Value and a P/E of around 9x.

- The market is fearful about banks and $620bn of “unrealized losses” in their bond portfolios, with Bank of America seen as most at risk.

- These fears largely stem from a misunderstanding of accounting rules, and a new Fed support program has removed most of the risks.

- Bank of America has always been able to retain plentiful cheap deposits, and large banks are benefiting from the current crisis.

- With shares at $28.73, our forecasts indicate investors may double their money by2025 year-end. The Dividend Yield is 3.1%. Buy.

Sean Rayford/Getty Images News

Introduction

Bank of America Corporation (NYSE:BAC) stock is just above its 52-week low, down 30% from a year ago:

|

Bank of America Share Price (Last 1 Year)  Source: Google Finance (14-Mar-23). |

The market has become fearful about U.S. banks. Some commentators have pointed to $620bn of “unrealized losses” in their bond portfolios, with BAC supposedly among the most vulnerable with $114bn such losses. These fears largely stem from a misunderstanding of how debt securities are treated under accounting rules. In reality, the outcome at U.S. banks will be driven by the quality of their deposit bases. The bailout of Silicon Valley Bank depositors and a new support facility from the Fed have removed most of the risks. BAC has a strong record in deposits, and large banks have in fact been benefiting from the current crisis. BAC stock currently trades at 1.3x Tangible Book Value, a P/E of around 9x and a Dividend Yield of 3.1%. Our forecasts indicate investors can potentially double their money by 2025 year-end (with an annualized return of 29.3%). Buy.

Why Is Bank of America Stock Down?

The market has become fearful about U.S. banks. Such fears have led to a bank run at Silicon Valley Bank (SIVB), where deposits reportedly attempted to withdraw one quarter of the deposits on a single day, and ultimately led to SIVB being taken over by regulators (along with Signature Bank (SBNY)) over the weekend.

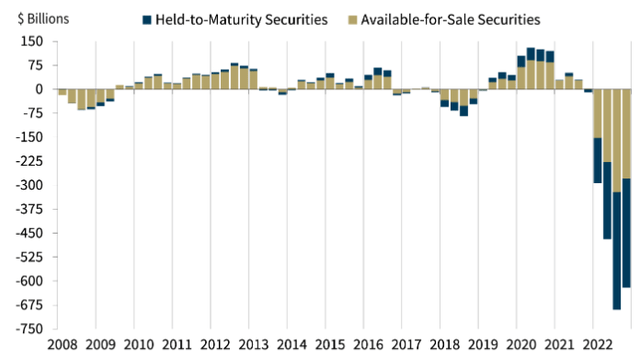

Some commentators have pointed to $620bn of “unrealized losses” in bond portfolios held by U.S. banks highlighted by, among others, FDIC Chairman Martin Gruenberg in a speech on February 28:

|

U.S. Banks’ Unrealised Gains/(Losses) on Investment Securities (2008-22)  Source: FDIC. Note: Insured Call Report filers only. |

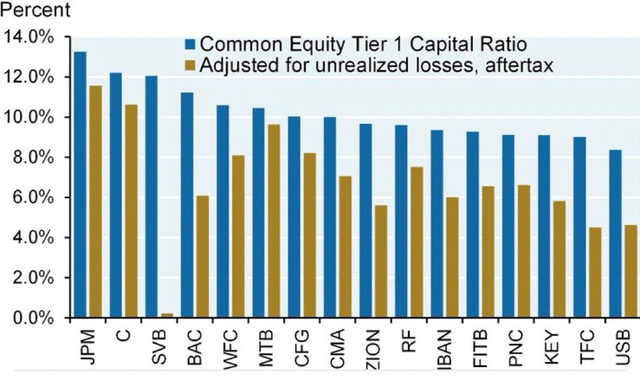

BAC is supposedly the most vulnerable big bank, with $114bn such losses which, if realized, would reduce its Common Equity Tier-1 (“CET1”) Ratio from 11.2% to around 6% (lower than the 10.4% regulatory minimum):

|

U.S. Banks’ CET1 Ratio & Impact from “Unrealized Losses”  Source: JPMorgan equity research. |

These fears largely stem from a misunderstanding of how debt securities are treated under accounting rules. The “realized losses” only partially reflect economic reality, and they have only become important because enough people in the market think they are important. As Tom Michaud, CEO of Keefe, Bruyette & Woods (an investment bank focused on the financial sector) said in an interview (subscription required) with the Financial Times on 13 March:

“These underwater bond positions are going to have to be addressed. That’s what the market has decided (our emphasis) it wants to focus on … Most owners of bonds – whether you’re a bank or not – have a loss in your bond portfolio. Interest rates are higher, so that shouldn’t be a shocker to anybody … The real issue is confidence in uninsured deposits.”

We will explain why “unrealized losses” do not mean what some bears think they mean with a simple example.

Explaining “Unrealised Losses” – An Example

Suppose we have three banks, each with $100 of funds ($5 in equity, $95 in deposits):

- Bank A lends out $100 at 4% in a 5-year loan with a bullet repayment at the end.

- Bank B buys $100 of 5-year U.S. Treasury bonds, with a 4% coupon, at $100 with the intent to hold them

- Bank C buys the same $100 of bonds for trading.

All three banks will receive $120 over 5 years. Bank A will report the $100 on its balance sheet as a Loan, Bank B will as Debt Securities Held to Maturity (“HtM”), and Bank C will as Debt Securities Available for Sale (“AfS”).

Suppose the 5-year interest rate jumps from 4% to 5% the next day. What happens?

The price of 5-year U.S. Treasury bonds being traded in the market will drop by around $5 to $95, which means:

- Bank A: Nothing happens to its balance sheet, though it may eventually have a smaller Net Interest Income on its P&L if it has to pay more for its deposits.

- Bank B: Same as Bank A, though the Debt Securities HtM line on the balance sheet will now have a footnote that says “Fair Value” of $95 and an “unrealised loss” of $5.

- Bank C: It is now insolvent, because the Debt Securities AfS line in the balance sheet will have to be marked down to the $95 “Fair Value”, realising a $5 loss that wipes out its equity.

Note that the economic outcome has stayed the same in all cases – each bank is still set to receive $120 over 5 years, more than what they put in, and no money will change hands unless deposits start leaving. That Bank C is regarded as insolvent even before deposits leave is an accounting and regulatory quirk.

The “unrealized loss” at Bank B will disappear over time because, as we get closer to the bonds’ maturity date, their market prices will rise to converge on their face value, as they become increasingly certain to be repaid.

There is a key technical detail – Bank B will be technically insolvent if it sells any of the bonds for any reason, for example to raise cash when depositors withdraw funds. In that case, accounting rules require HtM securities to be reclassified as AfS and marked to Fair Value, realising any losses immediately. And Bank A can go bust if deposits start leave and it has to sell the bonds at a price lower than $95 in a fire sale.

The key determinant of outcomes for both Bank A and Bank B is the deposits – will they leave or cost more?

Bank of America looks mostly like Bank A and Bank B. As of 2022 year-end, the total size of BAC’s balance sheet is $3.1 trillion and it has, among other things, Loans & Leases of $1,033bn, Held-to-Maturity Debt Securities of $633bn and Available-for-Sale Debt Securities of $221bn.

“Unrealized Losses” at Bank of America?

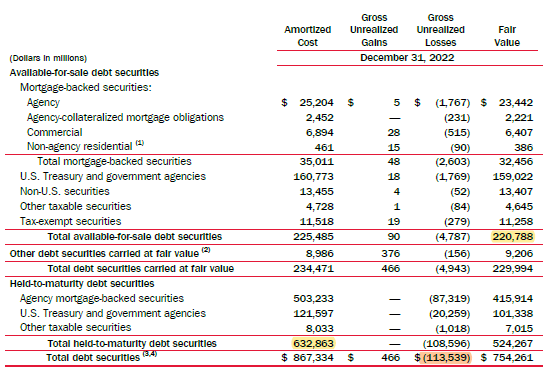

The table below shows BAC’s Debt Securities portfolio, with the same numbers as mentioned above:

|

BAC Debt Securities Portfolio (Q4 2022)  Source: BAC 10-K filing (2022). |

The $633bn Held-to-Maturity Debt Securities are carried at amortized cost, which means there were $109bn of “unrealized losses”; including other items, total “unrealized losses” were $114bn. This is the figure that some bears have referred to, and it is a large number in absolute terms and in comparison with BAC’s $172bn of CET1 capital.

However, as shown in our example above, these “unrealized losses” do not have to be realized unless BAC has to sell the debt securities, do not mean that it will end up receiving less than what it paid, and will disappear over time as the bonds mature.

What matters is how much of BAC’s deposits will try to leave and how much more it will cost to keep them.

BAC Has Always Had Ample Liquidity

Even if BAC starts losing deposits, it has ample liquidity without needing to touch its Held-to-Maturity bonds, including:

- $30bn cash and due from banks

- $200bn deposits at the Fed and other central banks

- $230bn debt securities Available for Sale, already marked at Fair Value

These add up to $460bn, equivalent to 24% of BAC’s total deposit base.

Regulators Have Removed Most of the Risks

The bailout of Silicon Valley Bank depositors and a new support facility from the Fed have removed most of the risks.

On Sunday (March 12), the U.S. Treasury, the Federal Reserve and the Federal Deposit Insurance Corporation together announced that all depositors at both Silicon Valley Bank and Signature Bank will be made whole, regardless of their account balances, with SIVB depositors to gain access to their cash the next day. This removes most of the rationale for customers to withdraw deposits from banks.

The Fed also announced a new support facility, the Bank Term Funding Program, which will lend money to banks for up to one year in return for collateral; Treasury Bonds and Mortgage-Backed Securities are both eligible as collateral and will be valued at par. This means banks can raise cash without selling any of its Held-to-Maturity Debt Securities, and also sidesteps the issue of “unrealized losses” in their portfolios.

The par values of BAC’s Held-to-Maturity Debt Securities are not disclosed and cannot be easily estimated because of different coupons, but most long-dated bonds trade below par (simply because bond prices reflect the present value of future cashflows). If we assume BAC can only borrow an amount equal to the Fair Value of the bonds, that $524bn will brings BAC’s total liquidity to $984bn, or more than 50% of its deposit base.

The risk of BAC needing to sell Held-to-Maturity Debt Securities and realise the “unrealized losses” is thus close to zero.

Bank of America’s Strong Deposits

The risk to BAC from the current crisis is not one of immediate insolvency, but one of lower future earnings, if keeping its deposits now requires higher interest rates to be paid.

Management has always expected deposits to become more expensive after rate rises. At Q4 2022 results, CFO Alastair Borthwick indicated that Net Interest Income (“NII”) will fall by about 3% sequentially in Q1 2023 (from $14.8bn to $14.4bn, partly due to seasonality and fewer days) and be flattish (“less variability”) through 2023 despite continuing loan growth. If deposits become more expensive, NII may end up lower than expected.

However, we believe any deterioration will be limited – BAC’s retail and commercial franchises have always been strong on deposits, and large banks have in fact been benefiting from the current crisis.

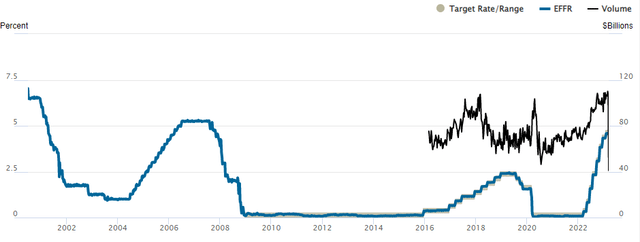

BAC has a record of retaining large amounts of zero-interest deposits and paying below market in past rate cycles (BAC’s deposit beta has averaged 20-25% in past cycles, according to management):

|

U.S. Federal Funds Rate (Since 2000)  Source: Federal Reserve of New York website (14-Mar-23). |

- In 2019, after the Fed rate peaked at about 2.40% in Q2, BAC finished the year with an average balance of $409bn in zero-interest deposits (29% of total deposits), and on interest-paying deposits it paid an average 0.61%

- In 2007, when the Fed rate was as high as 5.25%%, BAC had an average balance of $174bn in zero-interest deposits (24% of total deposits), and on interest-paying deposits it paid an average 3.33%. (This was before the Merrill Lynch acquisition and BAC was a much smaller bank.)

As of Q4 2022, with the Fed rate at about 4%, BAC had an average balance of $681bn in zero-interest deposits (35% of total deposits), and on interest-paying deposits it paid an average 0.96%. These figures may deteriorate slightly in future quarters, but we expect the impact to be manageable.

In fact, so far in the current crisis, large banks have been benefiting from deposit inflows, as the Financial Times reported on March 14 (subscription required):

“Large U.S. banks are being inundated with requests from customers trying to transfer funds from smaller lenders … in what executives say is the biggest movement of deposits in more than a decade … (Despite the Silicon Valley Bank bailout) depositors are still attempting to move balances into larger banks such as JPMorgan (JPM), Citi (C) and Bank of America, as well as money market funds”

BAC is evidently “too big to fail”, and the influx of deposits will likely help relieve some of the NII headwinds that management has been expecting from having to retain deposits with higher rates.

BAC Stock Key Metrics

As of 2:40 pm EST, BAC shares are at $28.73. This implies a Price / Tangible Book Value multiple of 1.32x. (Tangible Book Value was $21.83 per share at 2022 year-end.) Relative to our assumed long-term ROTCE of 15%, this implies a normalized P/E of 8.8x.

Relative to history, BAC shares are on 8.0x 2019 EPS and 9.0x 2022 EPS (adjusted for subsequent buybacks).

BAC stock pays a dividend of $0.22 per quarter, or $0.88 annualized, representing a Dividend Yield of 3.1%. Management targets a Payout Ratio of around 30%, and the dividend was raised by 5% (from $0.21) last July.

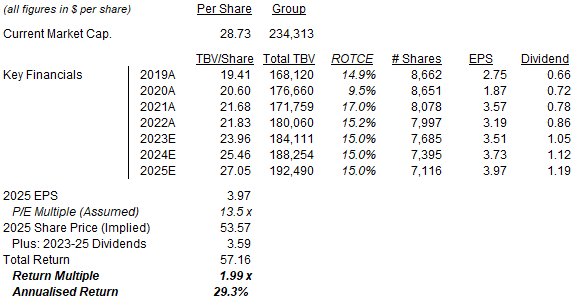

BAC Stock Forecasts

We keep the assumptions in our forecasts unchanged:

- ROTCE to be 15.0% for all years

- From 2023, Net Income to be 15% retained for growth, 30% paid out as dividends and 55% on buybacks

- Buybacks to be carried out at a P/TBV of 1.9x

- 2025 year-end P/E of 13.5x

Our new 2025 EPS forecast is unchanged at $3.97:

|

Illustrative BAC Return Forecasts  Source: Librarian Capital estimates. |

With shares at $28.73, we expect an exit price of $54 and a total return of 99% (29.3% annualized) by the end of 2025.

Most of the upside is expected to come from an upward re-rating in BAC’s P/E, reflecting the discount embedded in the stock during the ongoing market crisis. However, the Dividend Yield (currently 3.1% and growing) and the forecasted 8% EPS CAGR during 2022-25 alone should give a low-teens annualized return.

Is BAC Stock A Buy, Sell, or Hold?

We reiterate our Buy rating on Bank of America Corporation stock.

Disclosure: I/we have a beneficial long position in the shares of BAC, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.