Summary:

- Bank of America reported Q3 earnings with a slight stock increase of 0.55%, surpassing most analyst estimates.

- The key highlight is that net interest income started seeing a sequential recovery of 2%, despite an EPS decline.

- After Q3 earnings, the price-to-tangible book valuation became cheaper, so I reiterated my “buy rating” on the stock.

skodonnell

Bank of America (NYSE:BAC) reported Q3 earnings on Tuesday. Unlike peers such as JPMorgan (JPM) and Wells Fargo (WFC), which soared after reporting earnings, BAC’s stock started the trading day with a slight increase of 0.12%.

On a one-year basis, Bank of America has slightly outperformed its peers with a 58.17% price return, but with the other major banks also gaining above the 50% mark.

In my previous analysis of BAC, I rated them as a “buy,” especially after considering that management believed that Q2 was the net interest income trough. Three months later, management was right, as net interest income grew 2% sequentially. Still, there is some progress to be made, as the downward trend has yet to revert for the year, as NII remained -3% lower.

Considering this, I will revisit my “buy” rating on BAC by analyzing the key highlights in Q3, together with the new valuation, risks, and market outlook.

Bank of America: Actual Numbers vs. Analyst Expectations

Let’s start with where earnings sat versus what analysts expected. On this occasion, most items were beaten, including EPS, revenue, and net interest income. Although the latter two were not beaten by a large differential, EPS sat 6.6% above consensus. Despite 6.6% being a decent margin, it was not as appealing compared to the 9.5% beat of JPM and 10.1% of WFC. Last, the only line item missed was the provision for credit losses, just by a tiny 0.65%.

BAC: Q3 Earnings at a Glance

Although net interest income rose sequentially, this wasn’t true for non-interest income, which declined by -2.5%. Yet on a yearly basis, the gains from non-interest income more than offset the declines in NII, making total revenue rise by a slight 0.7%.

Net income was flat sequentially and -11.6% down for the year. In addition, the effect of $3.5 billion share repurchases couldn’t soften the declines, and diluted EPS saw a -2.4% drop QoQ and -10.0% YoY.

Moving to the balance sheet, US non-interest-bearing deposits continued to decline $4.8 billion from Q2. Yet, interest-bearing deposits saw a small gain of $17.0 billion, bringing total deposits up 2.4% year-over-year. At the same time, the loan book (net of allowances) rose slightly to 1.8% QoQ and 2.6% YoY. Concerning unrealized losses on debt securities, this item improved sequentially, passing from $114.8 billion to $89.4 billion.

Furthermore, the common equity tier 1 capital ratio decreased by a modest ten bps to 11.8%, but it was still comfortably above the new 10.7% minimum requirement as of October 1.

Finally, the yield on earning assets was basically flat at 1.92%, but with early signs of slight decreases in yields on interest-earning liabilities and net charge-offs of 3.70% improved 18 bps from the preceding quarter.

Bank of America: NII Growth Expected again in Q4

During the earnings call, management reiterated that they were right on the NII flip, as previously guided, and seemed pretty confident that the same will happen in Q4. At the same time, they signaled that they were quick to adjust the deposit yield on their Global Banking and Wealth business following the 50 bps rate cut in September. Nonetheless, these moves just materialized by a small portion since the rate cut was close to the end of the quarter. Furthermore, BAC expects yields within those segments to fall below 2% later in October.

In addition, the bank is seeing a good deposit growth outlook, with Global Baking returning to normal seasonality, Wealth flattening, and Consumer Banking slowing in withdrawals and in place of finding a floor. The same is true regarding loan growth, as there was some of it this quarter, and credit line utilizations remain below pre-pandemic levels.

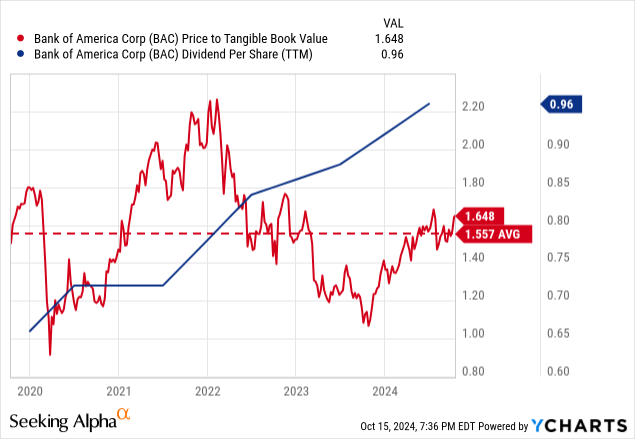

BAC: Price to TVB Became Cheaper in Q3

With a tangible book value per share of $26.25 and a closing price of $42.14, the current price-to-tangible book is at 1.61x. This is an improvement from three months ago when the post-earnings valuation stood at 1.74x, but obviously higher than a year ago, when banks were cheap, and BAC’s post-earnings valuation sat at 1.16x. Nonetheless, a price-to-tangible book of 1.61x sits within the historical five-year average of 1.56x.

In addition, considering that the dividend yield remains close to its historical level and that the dividend has been exhibiting a five-year CAGR of 9.24%, the stock remains at an attractive entry point at the $40 level.

Non-Interest Income Slow Down Risk

Gains in non-interest income through 2024 have helped alleviate the NII headwinds of money center banks. Yet, compared with peers, Bank of America is clearly underperforming, with non-interest income even lower for the quarter.

| (in million $) | Q3 ’24 | Q3 ’23 | YoY | |

| Investment banking fees | BAC | 1,403 | 1,188 | 18.1% |

| Investment banking fees | WFC | 668 | 545 | 22.6% |

| Investment banking fees | JPM | 2,267 | 1,729 | 31.1% |

| Market making | BAC | 3,278 | 3,325 | -1.4% |

| Trading activities | WFC | 1,366 | 1,193 | 14.5% |

| Markets & Securities | JPM | 8,369 | 7,768 | 7.7% |

Source: BAC, JPM, WFC Supplemental Information Q3

For example, regarding investment banking fees and market-making activity, BAC remains third on the list, as displayed in the table above. This is not a minor issue since BAC’s non-interest income was down QoQ in Q3, and a slowdown of non-interest income would alter NII tailwinds. Especially due to BAC’s mixed income composition, which as of Q3, had a fair distribution of 55% NII and 45% non-II.

Takeaway

With the initial numbers of net interest income recovery, a slightly cheaper cost on interest-earning liabilities, and robust asset quality ratios, Bank of America’s future looks bright over the next year as long as things do not unfold in the economy. Despite non-interest income growth underperforming peers such as JPM and WFC (especially in investment banking), it still has ample room to expand further. Even more so when considering the dovish monetary policy.

These earnings, in conjunction with a valuation that even decreased and sits at normalized levels, make me reiterate my “buy” rating on Bank of America.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.