Summary:

- Berkshire Hathaway has reduced its stake in Bank of America by 17%, prompting a reevaluation of the bull thesis.

- Bank of America has experienced a decline in non-interest bearing deposits across its business segments, indicating a potential weakening of its competitive advantage.

- JPMorgan has outpaced Bank of America in both overall deposit growth and non-interest bearing deposits, challenging BAC’s traditional dominance.

- Bank of America’s aggressive digital banking strategy may have unintended consequences, such as reduced cross-selling opportunities and weakened customer relationships.

PM Images

Introduction

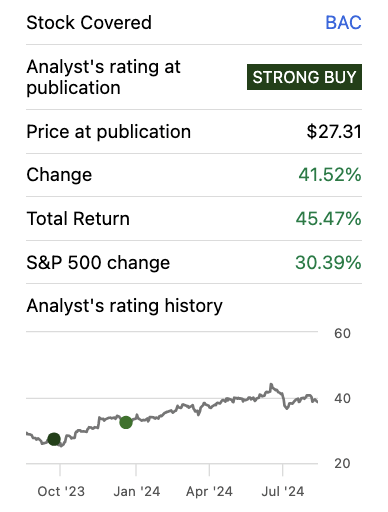

We first gave Bank of America (NYSE:BAC) (NEOE:BOFA:CA) a Strong Buy recommendation in October 2023 for two reasons: we witnessed the bank halt a bank run and resume deposit growth. In January 2024, we downgraded our rating to a Buy since further pressure started to show up on the expense line even as deposit growth persisted.

Analyst history (Seeking Alpha)

Berkshire Hathaway’s Recent Moves

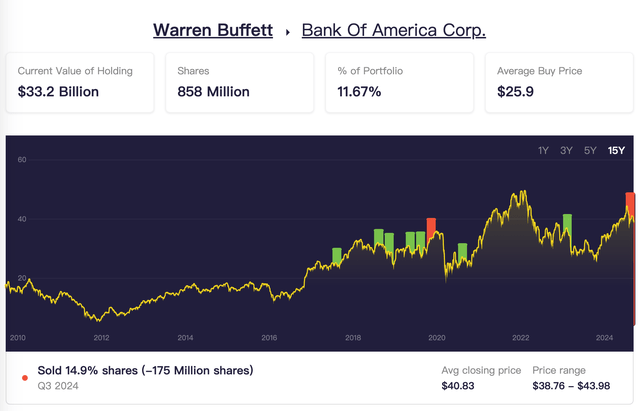

Since July 2024, Berkshire Hathaway (BRK.A, BRK.B) has reduced the number of shares it has in Bank of America by 174 million. We think it is time to evaluate our bull thesis in light of this. The 174 million shares represent a 17% reduction from Berkshire’s peak holdings of 1.032 billion shares in BAC. The period most likely corresponds with the Federal Reserve’s anticipated reduction in interest rates beginning in September 2024, which should further suppress bank net interest returns. Therefore, the significant headwind from changes in the interest rate environment poses a risk to the stock, as it is trading near its record high.

Berkshire’s holding (Stockcircle)

If the uncertainty is caused by a potential interest rate cut, the rationale behind the trim becomes clear. But as we were reviewing, we saw that Buffett had expressed concern at the Berkshire Hathaway annual meeting about the possibility that the deposit would no longer be sticky, which may put the bank’s business model in jeopardy, in our view. We therefore want to assess whether the bank’s moat has undergone a paradigm shift and how Bank of America has evolved thus far post-pandemic. This offers insight for long-term investors who may consider trimming alongside Buffett, given the potential rate cut, while looking for bargains afterward.

The Importance of Deposits for Commercial Banks

First, we want to explain why, in our opinion, the health of deposit growth is the most important factor in evaluating the competitiveness of a commercial bank.

Although Bank of America and other major commercial banks have diversified business lines, such as commercial loans and investment banking, these businesses are derived from their core deposit operations. Banks provide customers with safe and convenient accounts to attract low-interest deposits, which are then used to fund loans. Other commercial opportunities, such as investment banking services (bonds, equities, and advisory), are byproducts of these loans. Therefore, if deposits are no longer stable, it means banks have lost control of their deposit base, which would impact all other business lines.

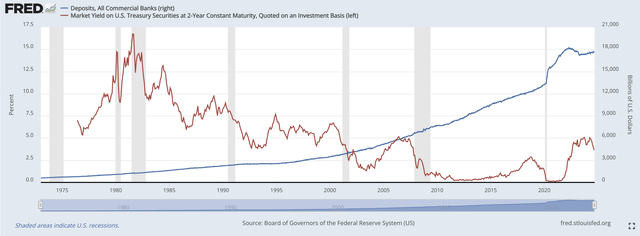

Looking at the long term, banks have continued to gain deposits even during all crises since 1975. Therefore, the decline in deposits that occurred for the first time in 2023 is significant. (See the below chart)

2-year treasury rate and bank deposit balance (FRED)

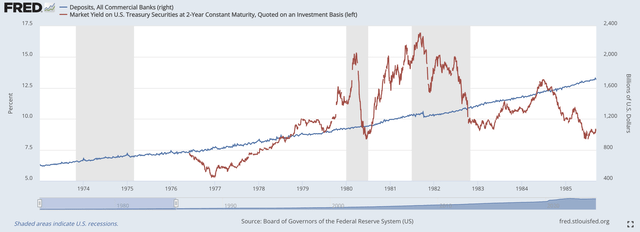

Some attribute this shift to the rise in interest rates, which has moved deposits into higher-yield assets. However, it’s important to note that current interest rates are only around 5%. This does not fully explain why deposits remained stable and grew from 1970 to 1995, even when the Fed raised interest rates to as high as 15%. (See the below chart)

treasury rate and deposit during 1970-1995 (FRED)

Bank of America’s Deposit Trends

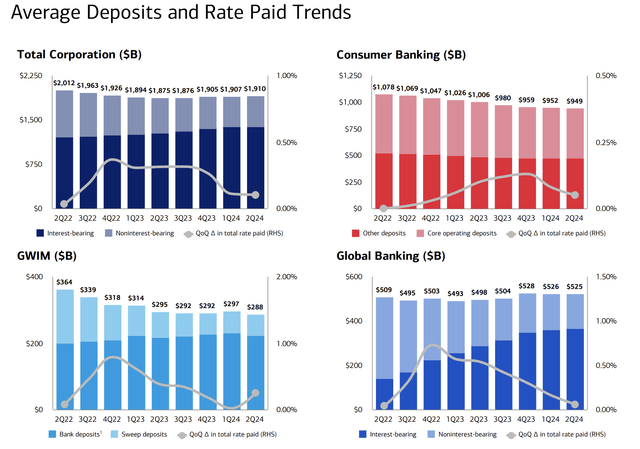

We might learn more if we dig into the deposit’s specifics. Bank of America’s deposit balance growth followed a similar trend to that of the broader commercial banking sector. Deposits declined during 2022-2023 before returning to growth in late 2023. However, despite the overall deposit balance increasing, non-interest-bearing deposits continued to shrink. This phenomenon is observed across its three deposit centers: consumer banking, wealth management, and global banking. (See the below chart)

The Shift in Deposit Composition

Non-interest-bearing deposits reflect the preference of those who view the bank as their primary choice for safety and convenience. In contrast to interest-bearing deposits, which are sought by those seeking yields, non-interest-bearing deposits are more stable and considered “sticky,” forming the core of deposit balances. The above trend indicates that: (1) consumers began moving away from Bank of America starting in 2022, (2) new customers coming to Bank of America after 2022 are seeking higher-yield interest accounts, and (3) the number of consumers who prioritize the bank for safety and convenience is decreasing.

This shows that Bank of America is now competing with other banks for deposits by offering higher interest rates. As a result, its competitive advantage is diminishing, even though it has returned to deposit growth.

Comparison with Peers

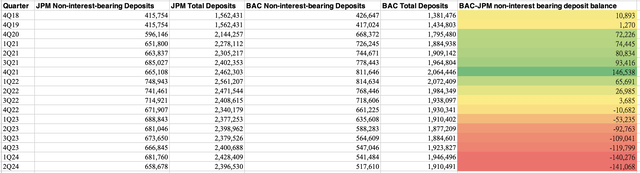

What is its comparison to its peer, then? Indeed, JPMorgan encountered a similar issue, (see the chart below) with its non-interest bearing deposits continuing to decline. This implies that the banking sector might have experienced similar issues.

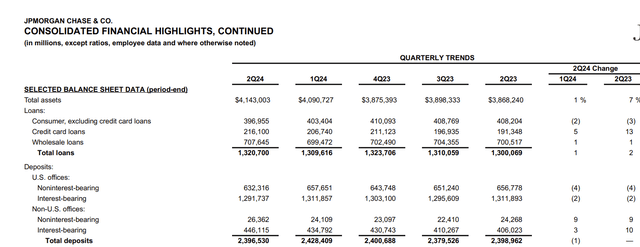

Interest and non-interest bearing deposit balance (JPM)

However, in 2023, JPMorgan’s growth in non-interest-bearing deposits challenges Bank of America’s leading position in low-cost deposits. (See the below chart) As mentioned earlier, the core advantage for commercial banks is their deposit balance, specifically non-interest-bearing deposits. Bank of America has long been dominant in this area, which is why Buffett has invested in Bank of America rather than JPMorgan.

Non-interest bearing deposit balance of JPM and BAC (From JPM and BAC and edited by LEL)

The Impact of Digital Banking

So, how did this happen? While JPMorgan’s acquisition of First Republic Bank in 2023 likely contributed to its growth in non-interest-bearing deposits, this is not the full picture. Bank of America’s more aggressive embrace of digital banking may be the main cause.

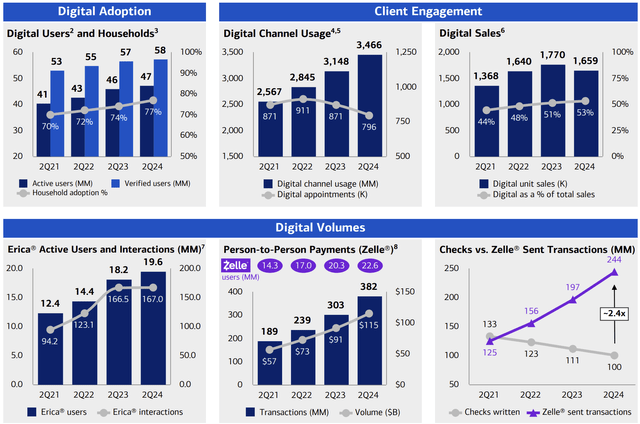

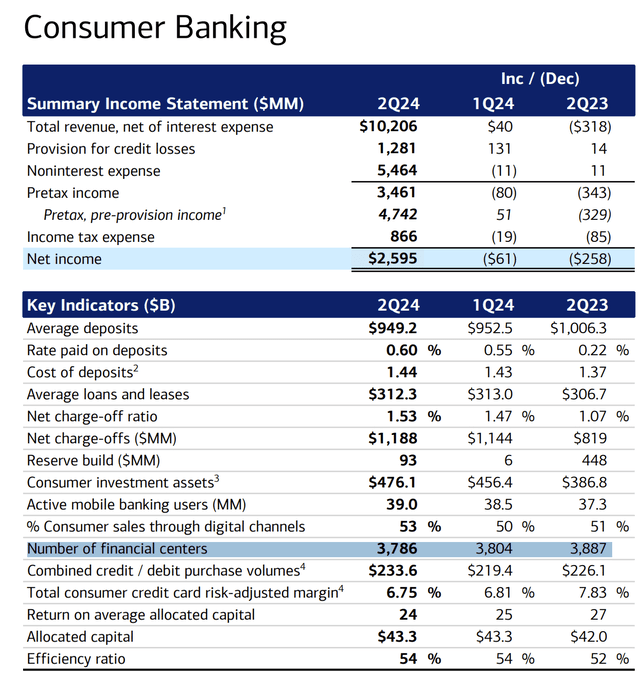

Bank of America has demonstrated strong growth in digital banking, indicating its adaptation to the new competitive environment. However, as shown in the chart below, while the number of digital users and overall users has increased, digital appointments have decreased. This suggests that while consumers are using digital banking more frequently, their visits to physical branches have declined. Customers are increasingly using digital banking as a digital wallet, as evidenced by the rise in Zelle usage.

However, like Venmo, digital banking faces monetization challenges because banks can no longer charge fees for P2P transfers as they did for wire transfers. Additionally, fewer physical branch appointments mean fewer cross-selling opportunities for bankers. Despite Bank of America’s efforts to catch up with fintech peers by enhancing its digital banking, this shift has weakened its value proposition. As fintech firms offer a broader range of products, such as personal loans and mortgages through online APIs, traditional banks are becoming more like digital wallets rather than the comprehensive financial service centers they once were.

Some believe that banks have higher occupancy costs compared to fintech peers, and therefore offering an omnichannel approach is a good strategy to fend off competition. However, Bank of America’s attempt to counter fintech competition with its omnichannel strategy has not been very successful.

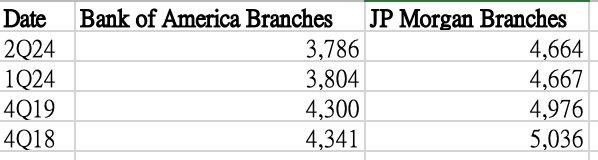

Branches of JPM and BAC (From JPM and BAC and edited by LEL)

Bank of America has closed branches more aggressively than JPMorgan since 2018, yet its expense ratio increased from 47% to 54%, while JPMorgan reduced its ratio from 55% to 46% compared to pre-pandemic levels. (See the below charts)

Efficiency ratio of BAC (BAC) Efficiency ratio of JPM (JPM)

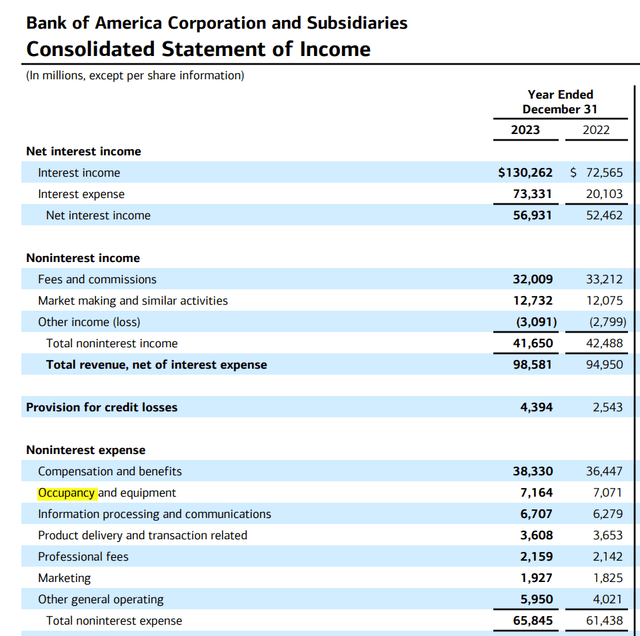

This outcome isn’t surprising, as banks’ occupancy costs are actually lower than commonly thought. For example, occupancy and equipment costs accounted for only 7% (calculated from numbers in the below chart) of total revenues in 2023, similar to 2019 levels. Therefore, fintech does not gain significant advantages from banks’ physical office savings.

In our view, a successful omnichannel strategy should focus on enhancing cross-selling between physical branches and digital banking, rather than just reducing retail footprint. By shifting aggressively to digital banking, banks risk losing more in cross-selling opportunities and customer bargaining power than they gain from lower occupancy costs.

Buffett is known for his philosophy of investing in things with a clear outlook for the next 30-50 years. However, banks are currently experiencing a paradigm shift and showing weakened deposit bargaining power. Additionally, Bank of America is losing its edge in low-cost deposits to its competitor, JPMorgan. These factors could diminish Bank of America’s visibility. Therefore, the future of Bank of America will likely depend on its ability to innovate its products.

Valuation and Conclusion

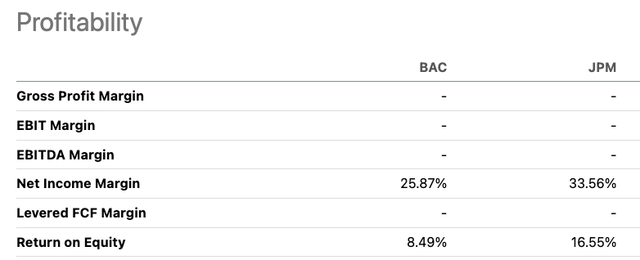

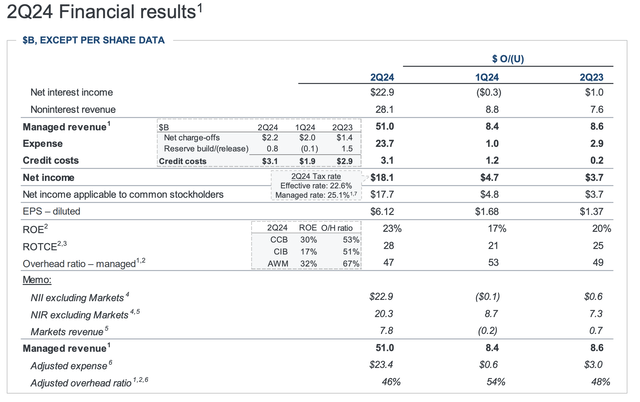

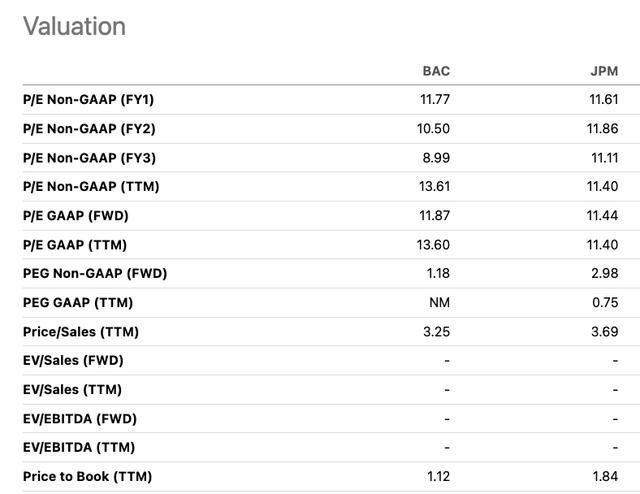

Bank of America trades at a similar P/E ratio to JPMorgan but at a lower P/B ratio.

valuation multiples (Seeking Alpha)

This probably reflects the fact that, compared to JPMorgan, its general probability level is lower.

We believe that JPMorgan has surpassed Bank of America in both overall deposit balance and, more importantly, in non-interest-bearing deposits. We are concerned that Bank of America’s aggressive pursuit of digital banking strategies, compared to JPMorgan, may further weaken its competitive advantage. Consequently, we do not see a current opportunity for Bank of America to outperform JPMorgan.

Furthermore, although management believes they should benefit from rate cuts due to their pricing capability in a post-rate cut environment, we are concerned that the rate cut starting in September may introduce uncertainty in consumer behavior, as discussed in our recent article. We think that high rates have already compressed purchases of durable goods like housing and autos. If consumers shift their spending to these segments, Bank of America may not necessarily be the beneficiary, as other competitors might be more aggressive. For example, Wells Fargo could have the advantage of a rate in mortgages, and Ally Financial might capture market share by partnering with auto dealerships.

Since fintech currently does not pose a direct threat to BAC, we believe the downside risk from fintech competition is limited. The greater pressures come from the uncertain post-rate cut environment and competition from JPMorgan. As a result, we think the current valuation reflects Bank of America’s competitive position, with limited upside potential. Given this, we will likely lower our rating to Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.