Summary:

- Bank of America’s stock has fallen and a trader has made a large bet that the drop will continue.

- The bank’s earnings and revenues forecast have worsened, with sales and earnings expected to decline.

- Rising Treasury rates and loan loss provision concerns are contributing to the bearish outlook for the stock.

Brandon Bell

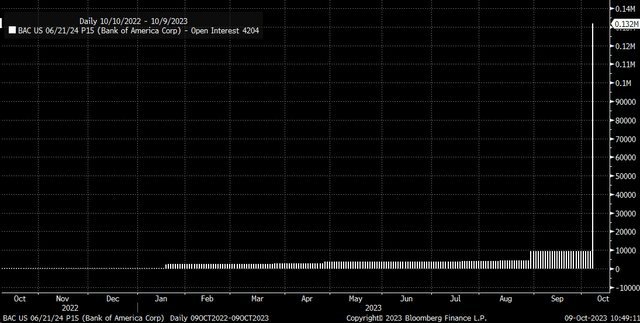

Bank of America’s (NYSE:BAC) stock has fallen sharply in recent months, and now a trader has made a big bet that the drop isn’t over. On Oct. 9, the open interest for a Bank of America put option increased dramatically, suggesting the stock falls sharply between now and the middle of June.

Weaker Fundamentals

Certainly, the earnings and revenues forecast for Bank of America have deteriorated in recent months, with earnings and sales estimates falling sharply, with analysts now forecasting sales to fall slightly in 2024 while earnings drop by 4%.

Additionally, net interest income is expected to fall by around 3.8% in 2024 to $54.9 billion from $57.1 billion. Flat to slightly lower revenue and declining net interest income certainly won’t help the shares of Bank of America going forward.

Additionally, for the third quarter, earnings and sales forecast have been steadily falling for some time now and are expected to rise by 2.3% y/y to $25.1 billion, while earnings are expected to rise by about 1% y/y to $0.82 per share. At the same time, the outlook for the fourth quarter is worse than the third quarter, with earnings forecast to drop by 11.2% to $0.76 per share as revenue falls by 1.5% to $24.3 billion.

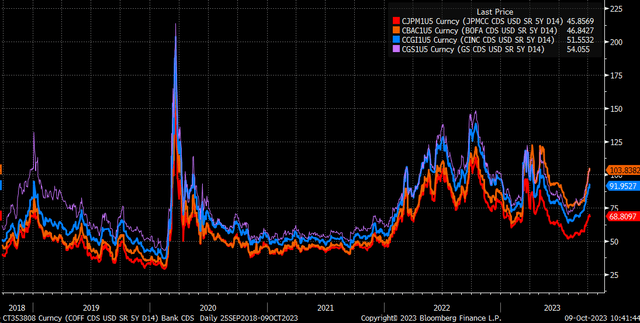

Meanwhile, the risk that rising Treasury rates pose to the bank’s balance sheets and rising loan loss provision concerns are reflected in the credit market, with the credit default swaps for Bank of America and JPMorgan (JPM), Citi (C), and Goldman Sachs (GS). A rising rate implies a higher cost to insure against a potential default as of Oct. 9.

Betting On A Big Drop

This weak outlook for Bank of America has an options trader making a large bet that the stock will continue declining in the coming weeks. The open interest for the June 21, 2024, $15 puts rose by 122,420 contracts on Oct. 9. The data shows the puts traded on the ASK for $0.27 per contract. This is a very large bet, with the trader paying about $3.3 million in premiums to create the bearish trade. In this case, the trader appears to be making a directional bet that Bank of America’s stock continues to decline in price and is not necessarily a bet the stock falls below $15.

Oversold But At Risk For Further Declines

The stock appears to be consolidating and has managed to retrace some recent losses. Right now, resistance is around $28. However, if the stock should fail to push through resistance at $28, it’s likely to revisit support at $25.50, with the risk of the stock breaking support at $25.50, leading to a bigger decline.

A drop to $24.90 could lead to a gap fill that dates back to November 2020, while a drop below that $24.90 level could lead to a further decline to around $23.10. However, it’s worth noting that the stock is already oversold, and that could mean it consolidates for some time longer, while a move above $26.50 could lead to further gains back to around $28.

The company is expected to report third quarter results on Oct. 17 before the start of trading. That will likely be the next major catalyst for where shares go. A further deterioration in the fundamentals could lead to further downside risk, even if the stock appears to be technically oversold in the short term, which could have motivated the bearish options bet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

TRY READING THE MARKETS AND GET THE FIRST 2-WEEK FREE

Reading the Markets helps readers cut through all the noise, delivering stock ideas and market updates while looking for opportunities. We also educate our members on what drives trading to help them make better decisions.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.