Summary:

- Bank of America Corporation easily passed the ’23 stress test.

- The large bank now offers a 3.3% dividend yield that signaled a great buying opportunity during Covid.

- The stock is cheap at 8.5x ’23 EPS targets, and Q2 results on July 18 should solidify the deep value here.

Bruce Bennett

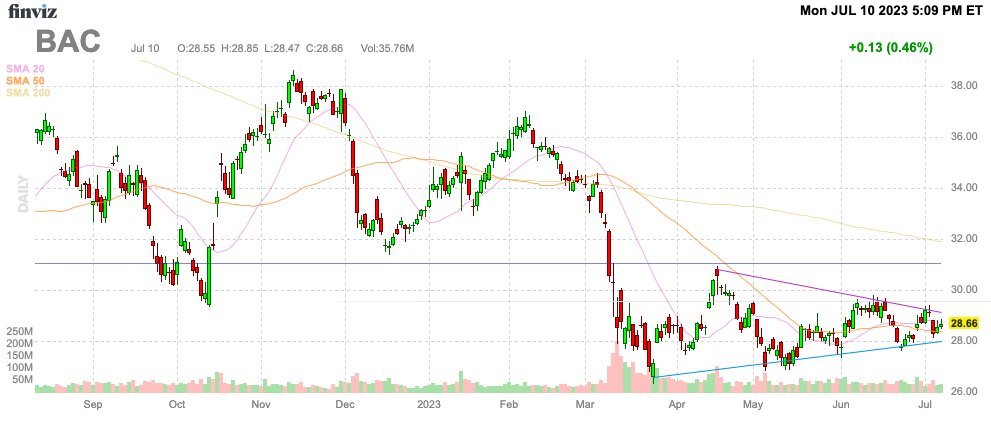

Despite solid stress test results and a dividend hike, Bank of America Corporation (NYSE:BAC, “BoA”) still trades at the yearly lows. The large financials have remained under some pressure due to fears of additional capital requirements from Basel IV rules, but BoA remains far too profitable to ignore. My investment thesis remains ultra Bullish on the stock below $30 with a dividend now topping 3%.

Source: Finviz

Stress Test Results

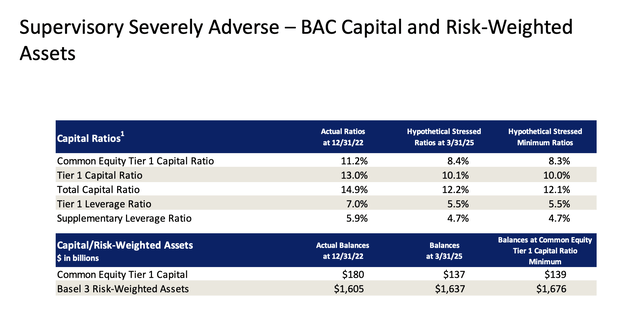

The 2023 Dodd-Frank Act annual stress test results showed BoA losing a combined $52.2 billion under the severely adverse scenario. The forecast losses include $11.0 billion worth of goodwill impairments not impacting tangible book value and capital requirements.

Even under this likely unrealistic scenario where housing prices fall 38% and the unemployment rate soars 6.4 percentage points to 10%, BoA still sails through the period with a minimum Common Equity Tier 1 Capital ratio of 8.3%. Under the most dire scenario, the large bank would have $139 billion in capital left over.

Source: BoA ’23 Dodd-Frank Stress Test presentation

BoA would need losses to more than triple the forecasted levels before even running into a scenario of running out of capital. The biggest issue facing the bank is far too much capital and new Basel IV rules that could require holding even more capital despite large banks not facing any issues during the recent regional banking crisis.

The large bank even faces a scenario where the losses include a $13.3 billion build in the allowance for provision expenses. In essence, a large portion of the losses during the period aren’t even losses yet.

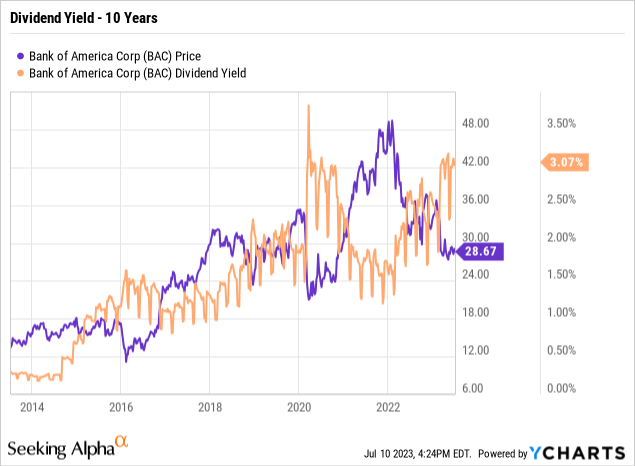

Tasty Dividend Yield

BoA hiked the quarterly dividend by 9% to $0.24, up from $0.22. The stock now offers a 3.3% dividend yield, and the yield hasn’t been this high in the last decade outside the Covid dip, which provided a great buying opportunity.

BoA still has a payout ratio below 30% after this hike in a sign of the crazy aspect of the high dividend yield. The large bank will generate substantially more capital than the dividend payouts, which will either be utilized to build capital positions or repurchase cheap shares.

The large bank still has a dispute with the Fed regarding the stress test results. BoA only provided details on hiking the dividend by 9%, but the management team didn’t provide any details on the share buyback.

Last stress test results, BoA announced a plan to utilize the remaining $17 billion on the prior share buyback plan. The bank screened the best in the stress test with a big increase in pre-provision net revenue actually leading the stress capital buffer, or SCB, to decrease by 90 basis points after jumping 100 bps in the 2022 CCAR.

Oddly, some analysts like Piper Sandler analyst R. Scott Siefers appeared to suggest the discrepancy with the Fed numbers added risks to the test results while the reality appears some relief:

…a little more uncertainty in BAC’s results than we would like, but hopefully no change to the end result.

BoA reports Q2’23 earnings on July 18. The bank is forecast to report another strong quarter with revenues up 10% to $25.0 billion with EPS up 15% to $0.84.

Going forward, BoA will face a tougher environment where revenues will no longer benefit as much from higher rates while costs could rise. The large bank ended last quarter having excess deposits of $0.9 billion, so BoA isn’t really set to face issues with higher deposit costs.

The stock remains incredibly cheap at 8.5x ’23 earnings estimates. The market is far too negative on the stock trading below $30 with BoA offering such a large dividend yield now.

Takeaway

The key investor takeaway is that Bank of America Corporation passed the 2023 stress test with flying colors. In fact, some analysts seem to think the results were too good to believe.

Regardless, Bank of America Corporation stock is far too cheap and BoA has plenty of capital to reward shareholders with solid capital returns once questions regarding capital levels are resolved. Best of all, shareholders get a 3.3% dividend yield to wait for more clarity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.