Summary:

- Bank of America is the second largest bank in the U.S. and is one of the largest globally.

- Having a solid diverse portfolio of banking and investment services gives the bank solid cross-selling and cost-efficiency benefits.

- According to my valuation analysis, BAC stock is significantly undervalued.

Scott Olson/Getty Images News

Investment thesis

Bank of America (NYSE:BAC) has a rich history of pain and success. The aftermath of the Great Recession was brutal for the bank, but all these problems are far in the rearview mirror. Today, BAC is successful and one of the largest global banks and firmly holds its place in the U.S. “Big Four” elite club. The bank demonstrates solid cost-efficiency, which is unlocked due to BAC’s hyper-scale and massive customer base. From the revenue side perspective, I like the bank’s solid revenue mix. BAC’s consolidated financial performance is less rate-sensitive than if the bank was more dependent on the net interest income-related streams. All in all, I assign BAC a “Strong Buy” rating.

Company information

Bank of America is one of the world’s largest financial institutions, serving individual consumers, small- and middle-market businesses, institutional investors, large corporations, and governments. BAC delivers a full range of banking, investing, asset management, and other financial and risk management products and services.

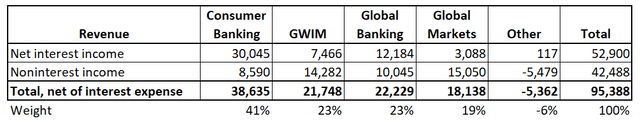

The bank’s fiscal year ends on December 31. BAC operates in four business segments: Consumer Banking, Global Wealth & Investment Management [GWIM], Global Banking, and Global Markets. Consumer Banking is the largest segment, accounting for about 41% of the total revenue.

Financials

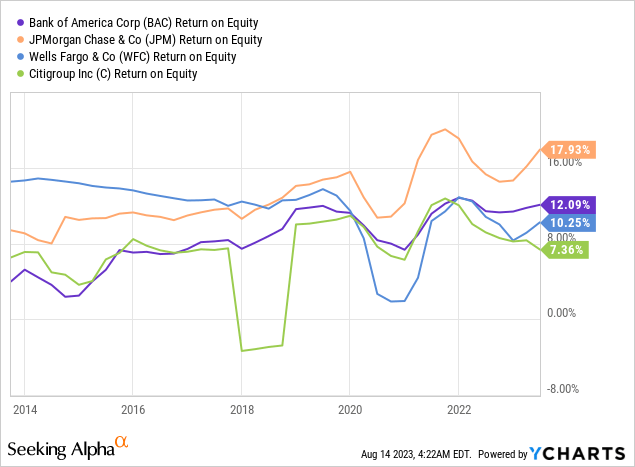

Bank of America got the highest possible A+ profitability grade from Seeking Alpha Quant. BAC’s net income margin is higher than 30%, substantially higher than the sector median. It is crucial to underline that the bank delivered a notable ROE improvement over the past decade and is the second most efficient bank by this metric among the “Big Four”.

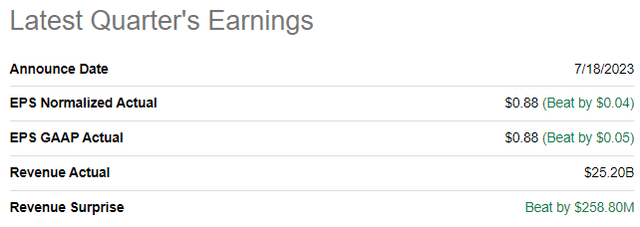

The latest quarterly earnings were released on July 18, when the bank topped consensus estimates on revenue and the bottom line. Revenue demonstrated a solid 11% YoY growth, mainly due to a 14% increase in net interest income. Top-line strength allowed the adjusted EPS to expand from $0.73 to $0.88.

Performance was solid across all segments, primarily due to rising interest rates. Despite a 15% net income decline in GWIM, I see several positive trends for this promising segment. The segment ensured an $83 billion total net client flows since Q2 FY 2022, which is solid. Apart from that, this segment provides the bank with solid cross-selling opportunities. According to the latest quarterly earnings presentation, about 52 thousand referrals were sent to other lines of BAC’s business.

It is also crucial to mention that consumer banking digital sales grew 8% YoY. That is important because BAC has a vast tech budget to address secular technology shifts in the banking industry, and it pays off.

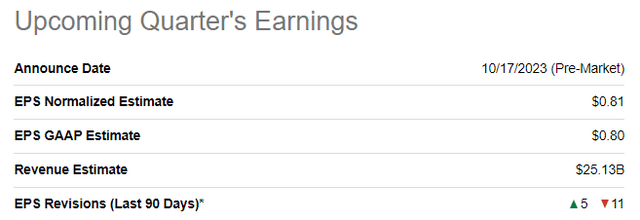

The upcoming quarter’s earnings are scheduled to be released on October 17. Quarterly revenue is expected by consensus at $25.13 billion, indicating a 2.5% YoY growth. The adjusted EPS is expected to be flat at $0.81 as the increased costs will weigh on the bottom line, but I think this is temporary pressure and not secular.

BAC’s balance sheet looks sound, with a Common Equity Tier 1 ratio of 11.6% as of the latest reporting date. The solid balance sheet allows the bank to demonstrate a solid track record of dividend hikes and share repurchases. BAC has a $25 billion stock repurchase plan over time, announced in October 2021.

Overall, I like the bank’s solid revenue mix, which allows it to smoothen the consolidated financial performance amid changes in net interest income cycles. From a cost perspective, the bank’s hyper-scale allows it to be more cost-efficient and use these efficiencies to finance innovation and development. Being a “one-stop shop” financial organization with a diverse set of banking and investment offering means that BAC has strong positioning to cross-sell services. I also like the bank’s consistently massive stock buybacks and attractive common stock with a 3.1% forward dividend yield.

Valuation

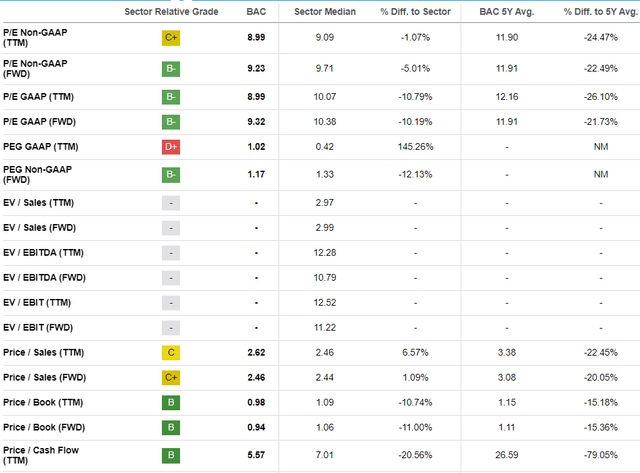

The stock price declined 6.6% year-to-date, a significant underperformance compared to the broader market. BAC also underperforms the Financial sector (XLF) this year. Seeking Alpha Quant assigns the stock a low “C-” grade, primarily due to a high TTM GAAP PEG ratio. Apart from it, multiples look attractive, especially compared to historical averages. For the valuation of banks, I pay the most attention to price-to-book ratios, which are currently double-digits lower than the sector median and BAC’s five-year averages. To me, that is a clear indication of the undervaluation.

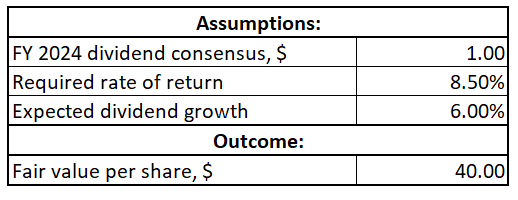

I would like to proceed with the dividend discount model [DDM] approach. I use an 8.5% WACC as a discount rate, as suggested by GuruFocus. I have dividend consensus estimates suggesting an FY2024 payout of one dollar. Dividend growth is tricky, but BAC has a strong dividend history, and I think looking at past performance would be reliable. To be conservative, I take the last three years’ CAGR and round it down to 6%.

Author’s calculations

Incorporating all the above assumptions into the DDM formula returns BAC’s fair stock price at $40, meaning there is a 28% upside potential. That said, both valuation multiples analysis and the DDM suggest there is a double-digit upside potential, meaning the stock is attractively valued.

Risks to consider

As a bank, BAC faces significant macroeconomic risks. The bank’s extensive consumer loan portfolio of about half a trillion dollars includes various types of loans such as mortgages, credit card debt, and personal loans. The quality of these loans is directly tied to borrowers’ ability to make timely repayments. While today we see the U.S. unemployment rate at historically low levels, the current macro environment is very uncertain. Federal Funds rates are at their highest level in over two decades, with the door still open for another hike in September. The business activity level is poised to cool down, meaning the unemployment rate will likely increase. While I do not think that the increase in unemployment will be dramatic and significantly undermine the quality of BAC’s loan portfolio, it is highly likely to affect the market sentiment regarding banks adversely.

Another major risk for the banking industry is business disruption by fintech. The banking industry is one of the oldest and undergoing massive technological change. Every year more and more transactions are made digitally, and customers do not want to visit physical offices when they now have the ability to get banking services via their smartphones. Bank of America’s massive scale is a risk when discussing secular shifts. The bigger the entity, the more difficult it is to transform smoothly and efficiently. On the other hand, the bank has a rich history and has successfully adapted when many other past technological disruptions occurred.

Bottom line

To conclude, Bank of America stock is a “Strong Buy”. The second largest bank in the U.S. and one of the largest banks in the world is traded at a substantial discount and offers an attractive forward dividend yield with a rich history of dividend hikes. I like the bank’s solid revenue mix, which allows it to smoothen financial performance amid temporary weaknesses in one of the segments. The bank is also well-positioned to gain and retain customers because of its convenient “one-stop shop” offerings, which include banking and investment needs. The company’s vast scale and large customer base allow it to be cost-efficient and allocate more resources to innovation and development, which will likely create long-term value for shareholders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in BAC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.