Summary:

- Bank of America’s loan portfolio shows low exposure to commercial real estate, with only a (relatively) small portion past due.

- Bank of America’s preferred shares offer a 5.65% yield, but swapping to Series L could provide a higher yield with similar risk.

- The bank’s preferred dividends are well covered, making them an attractive investment option.

jetcityimage/iStock Editorial via Getty Images

Introduction

As other central banks (in Canada and the Eurozone) have started to reduce their benchmark interest rates, I’m not quite confident the interest rates on the financial markets have peaked. That’s why I’m still expanding my fixed income portfolio as I’d like to further increase my exposure to that pillar while adding duration as some securities in my fixed income subdivision will mature in the next few years.

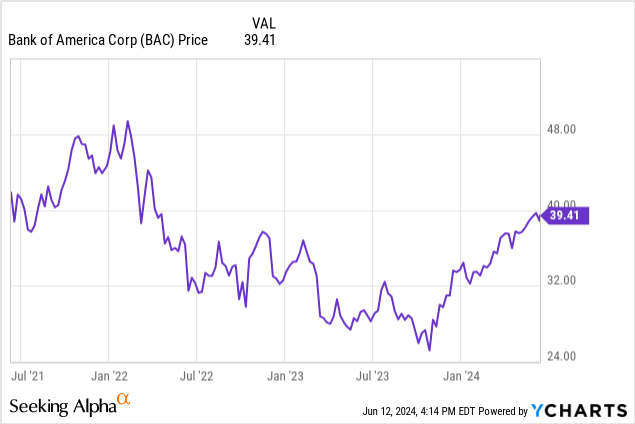

I have been keeping an eye on the preferred shares issued by Bank of America (NYSE:BAC) which generally offer a yield of around 6%. As I wanted to add duration to my portfolio, I will be focusing on a preferred share issue with a low preferred dividend coupon as that reduces the call risk. In this article I will zoom in on the bank’s loan portfolio where the total amount of loans past due remains pretty low, and where the exposure to commercial real estate represents just a single digit percentage of the loan portfolio.

The preferred dividends are very well covered

As I discussed the financial results of Bank of America in a previous article, I will just provide a brief overview, as in this article, I’d like to zoom in on the assets in its loan portfolio.

As mentioned in my previous article;

[…] after deducting the $532M in preferred dividends, the net income attributable to the common shareholders of Bank of America came in at $6.14B for an EPS of $0.76.

A decent result but a bit lighter than expected. Just like other banks (for instance, Regions Financial, whose case I explained in another recent article here), Bank of America had to deal with yet another FDIC special assessment for uninsured deposits of failed banks which had a negative impact of approximately $700M on pre-tax results.

Based on the Q1 results, Bank of America needed less than 10% of its net income to cover the preferred dividends.

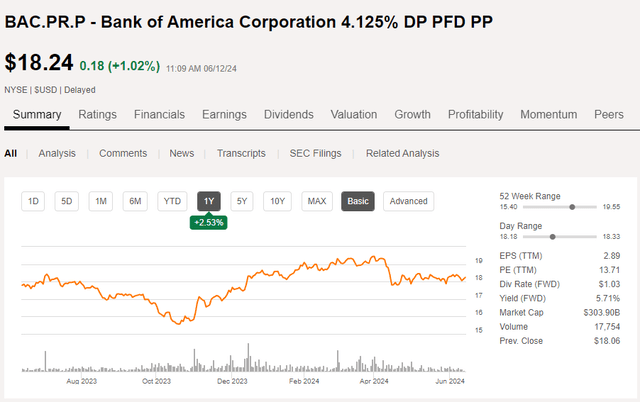

In a previous article, I discussed the Series PP preferred shares (NYSE:BAC.PR.P). The bank issued that series at the bottom of the rate cycle and Bank of America was able to lock in a cost of capital of just 4.125% which makes this series of preferred shares very cheap equity. This reduces the “risk” of Bank of America calling this specific series of preferred capital, which means the Series PP meets the requirements to add duration to my portfolio. Considering this is very cheap capital for BAC, these preferred shares will likely only be retired if the interest rates and cost of capital decrease below the previous bottom.

Seeking Alpha

As explained in the previous article. The PP-Series pay 4.125% preferred dividend which means the annual dividend is $1.03125, payable in four equal quarterly tranches of $0.2578125 per share. These securities are non-cumulative and can be called from Feb. 2, 2026 on. But as mentioned, the cost of capital is so low I just don’t see that scenario unfolding.

This means I’m looking at the Series PP as a perpetual preferred share and the current yield is approximately 5.65% based on the most recent share price of $18.24.

A closer look at Bank of America’s loan portfolio

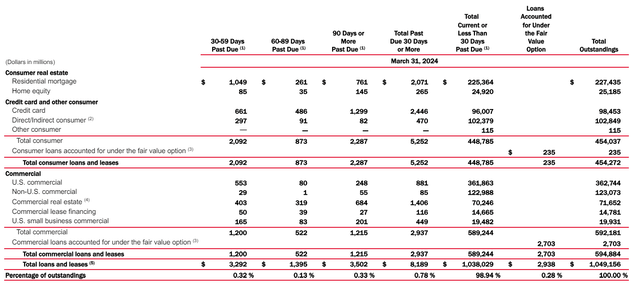

Looking at the bank’s balance sheet, we see there’s a total of $1.05B in loans outstanding. As you can see below, approximately 43% of the loan balance is related to consumer real estate with in excess of $227B in mortgages while there’s an additional $25B in home equity. Another important element of the consumer-focused loan book is the $98.5B in credit card debt. It will be important to keep an eye on the default rates in the credit card portfolio. But as you can see below, “only” $2.4B of the $98.5B in credit card debt was more than 30 days past due. And as mentioned at a presentation earlier this week, Dean Athanasia confirmed BAC is seeing a normalization and people “‘aren’t overspending anymore.”

BAC Investor Relations

Investors in the financial sector have recently been pretty nervous about the exposure to commercial real estate (‘CRE’). Fortunately Bank of America has very little exposure to CRE with just $72B on the balance sheet, of which almost $70.3B is in good standing. And keep in mind that even when a loan defaults, it does not automatically mean the bank loses its entire investment.

Investment thesis

I feel quite confident owning preferred stock in Bank of America. That being said, I’m also wondering if a 5.65%-5.7% yield is sufficiently attractive to add to my portfolio, especially as the preferred shares are non-cumulative. I already have a long position in BAC’s preferred shares Series L (NYSE:BAC.PR.L) which offers a 6.1% yield based on the current share price of $1187/share.

That’s a full 50 bp difference for basically the same risk: The Series L is a so-called “busted” preferred share (for more details, please read this December 2023 article) and the near term call risk is close to zero.

Considering both series of preferred shares carry the same (capital and dividend coverage) risk and a similar duration risk, I think it makes sense to swap my small position in BAC.PR.P and increase my position in BAC.PR.L instead as the difference in yield is just too large to ignore.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC.PR.L either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!