Summary:

- My favorite way to play this banking anti-bubble is not through the Regionals, but through the large banks that should be getting more and more deposits.

- While money market funds will take cash off the balance sheet, the rate environment should keep net interest margins ripping upwards as long as the overall deposit trend is flat.

- Bank of America is my favorite bank. They’ve attracted deposits from the Regional Bank attack, which may improve their net interest margins over time.

- With a book value under 1 and a forward P/E around 8X, this is a clear Graham Number Value.

Stephen Chernin

Looking for the next anti-bubble

Expounding on my search for the next anti-bubble of hated stocks, I’m picking up two distinct trends. My old anti-bubble, big tech, and the likes of Amazon (AMZN), Google (GOOG) (GOOGL), and Meta (META), have all bounced off their lows. Investors in the Nasdaq are now turning from bearish to bullish. While Amazon and Google remain on my buy list for now, I am loading up my next group of stocks that have been beaten but are not down for the count by a long shot.

The banks and semiconductor sectors still seem like the most logical two hated segments. How to approach each one is the question. The safest way in my opinion regarding banks is just to buy the big banks. Many of these big banks have been dragged down without merit. Short attacks based on a narrative that every Regional Bank balance sheet is unsound. The fact is, most banks have made responsible decisions, but the lack of liquidity forces losses when bad news makes depositors flee.

Bank of America Corporation (NYSE:BAC), is my favorite bank. They’ve attracted deposits from the Regional Bank attack which may improve their net interest margins over time with less risk. They have a huge holder in Berkshire Hathaway (BRK.B)(BRK.A), which adds a line of support where we know a big chunk of stock will remain idle.

With a book value under 1 and a forward P/E around 8X, this is a clear Graham Number Value. Buffett used to be bigger into bank stocks in years of yore, saying they are one of the easiest businesses to run. The recent environment has shown that banking has become more complex than ever, but Bank of America Corporation remains one of the more vanilla systematically important banks out there. Bank of America Corporation is a buy at these levels.

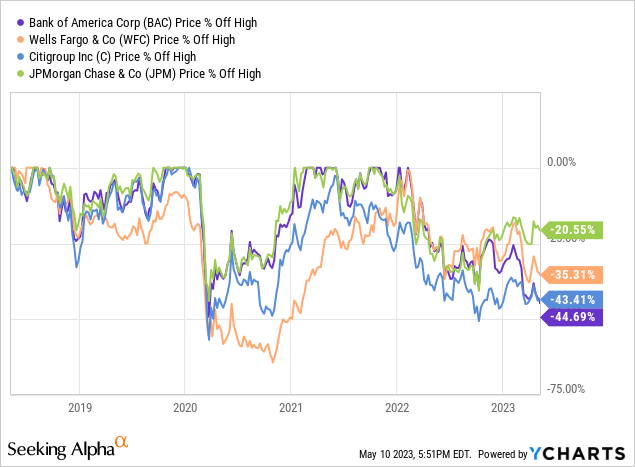

The chart

Above are the 4 big SIB banks and the percentages off their 5-year highs. We can see from the above that Bank of America Corporation leads the way followed by Citigroup (C). Wells Fargo is my largest bank holding being that I bought the majority of shares during the Covid crush of bank stocks. Wells Fargo (WFC) is not too far behind in their current 5-year discount. I wouldn’t be opposed to an equal-weight portfolio here of all the SIBs to play the bank anti-bubble.

What they do

From the Bank of America 10-K:

Bank of America is one of the world’s largest financial institutions, serving individual consumers, small- and middle-market businesses, institutional investors, large corporations and governments with a full range of banking, investing, asset management and other financial and risk management products and services.

Through our various bank and nonbank subsidiaries throughout the U.S. and in international markets, we provide a diversified range of banking and nonbank financial services and products through four business segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking and Global Markets.

Valuation model

The classical valuation model to price banks has to do with both assets and earnings. Most banking and insurance companies currently trade favorably using the Graham Number. These are price targets where the price to book times the P/E ratio does not cross Benjamin Graham’s line of 22.5 You can set a price target by using the square root of 22.5X TTM Book Value X TTM EPS. Here is a grid of the SIBs and their discount to the Graham Number:

Data courtesy of Yahoo Finance

| STOCK | BOOK VALUE | TTM EPS | GRAHAM NUMBER |

| BAC | $31.58 | $3.33 | $48.64 |

| C | $96.59 | $7.28 | $125.78 |

| JPM | $94.34 | $13.56 | $169.65 |

| WFC | $43.09 | $3.45 | $57.83 |

| STOCK | CURRENT PRICE | DISCOUNT |

| BAC | $27.32 | 43% |

| C | $46.37 | 63% |

| JPM | $136.48 | 19.55% |

| WFC | $38.28 | 33.8% |

Here we can see Citigroup remains the most undervalued of the group, but also the one that seems to lack traction when the group ascends upwards. Bank of America Corporation is next in line at a 43% discount. While very few bank stocks ever trade at a premium to the Graham number, the margin between fair value and current values is a fairly wide chasm.

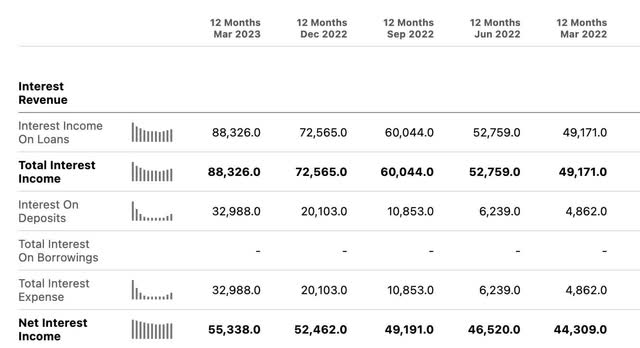

Net interest income trends

Drilling down on net interest income, we can see a steady rise from March 2022 to current for Bank of America Corporation. Up nearly $11 Billion since rates started to take off, these large SIBs are the beneficiary of rate increases while the Regional Banks are the losers.

The Regionals also took on undo risk during the past decade in loan originations from my observation. Back in 2019-2020, I was screening for low PEG ratios, and small banks from all over the world were continuously hitting my screener. I didn’t know exactly why, but they must have been offering unique, profitable products to their balance sheet that the large banks couldn’t touch due to regulations. Now that the interest rate environment has changed, the earnings advantage has switched back to the large institutions that hold all the deposits.

I’m glad I stayed away from the regionals when CNBC was blasting their audience with “buy”! When an entire industry is operating at a PEG ratio below 1 for that many years, something is bound to go wrong in my view.

Balance sheet trends

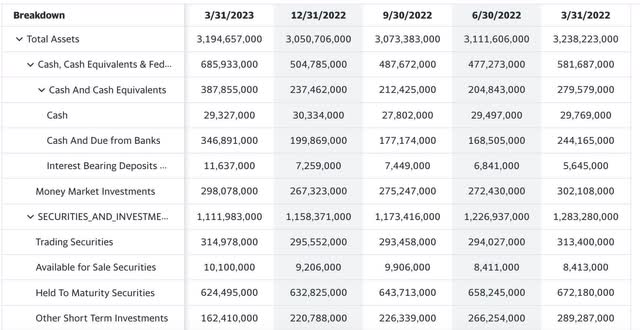

The main observation of banks and their liquidity regarding the balance sheet at the current time are the held-to-maturity securities [HTM] and the available-for-sale securities [AFS]. While Bank of America Corporation’s AFS securities have trended upward year over year, it’s not a huge increase when looked at as a proportion of the HTM securities.

AFS is up 20%, but as a proportion of HTM, it’s only 1.6%. Again, this is another advantage the SIBs have over Regionals, they don’t need to free up much liquidity other than for shortfalls from cash sorting. Regionals have to both worry about cash sorting and large amounts of outgoing wires to SIBs.

Deposit trends

Total deposits have remained relatively flat year over year. Even though we have been hearing about the capital inflows going from Regionals to SIBs, the factor of cash sorting has still made the overall numbers flat. Many depositors are moving to money market funds after the capital hits the bank’s affiliated brokerage. In the case of Bank of America Corporation, that would be Merrill Lynch.

Non-Interest bearing checking accounts are down almost $200 Billion while interest-bearing accounts are up. However, savings accounts still have paltry yields at large banks. The high-yield savings products are normally only offered to large depositors of $50-$100k on the account. We can assume that a large portion of these interest-bearing accounts is a low cost of capital that adds a lot of fuel to Bank of America Corporation’s net interest margins.

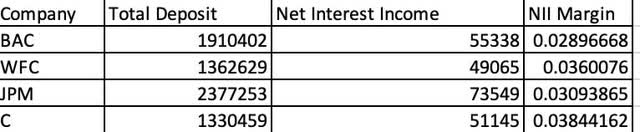

Competition & net interest income trends

my own excel, data from Seeking Alpha

We can see that the 4 large SIBs are operating at somewhere near a 3% net interest margin on their deposits. Bank of America Corporation is operating on the lowest end of the curve and Citi is on the highest. I wouldn’t automatically assume that the higher the margin the better, that could also indicate higher risk in the loan products that are being offered by said bank versus better deposit management.

Bank of America Corporation overall still has the second-highest overall net interest income and the second-highest amount of deposits. I am personally more focused on those numbers versus the margins. High-interest rate loans to low-credit borrowers or high-risk businesses/projects could put even the big banks in a liquidity crunch if they are forced to sell hold-to-maturity securities to make up for bad loans with significant time and cost to seize and sell the collateral.

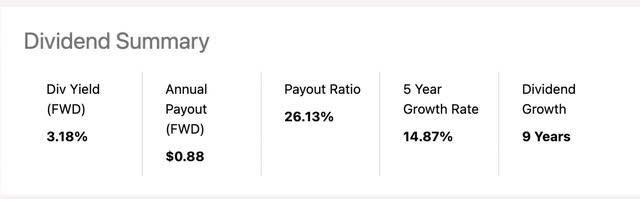

The dividend

The bank dividends are amazing at this point. Bank of America Corporation is yielding 3.18% and has been able to grow the dividend for 9 years. They still have a low payout ratio to boot. Let’s take a look at the competition yields:

| Company | Yield |

| BAC | 3.18% |

| JPM | 2.93% |

| C | 4.4% |

| WFC | 3.13% |

Bank of America Corporation now has the second-highest yield in the group. With the entire segment now yielding over 3%, it’s an amazing turn of events since 2012 when they could barely pay any dividends at all.

Catalysts

As much as the big banks are benefiting from high rates and deposit inflows, the market doesn’t see it that way. As a business, the current situation is working well for the SIBs, as for their stock, not so much. A rate cut should send the group as a whole upwards including Regionals. This is a great time to buy in anticipation of the cuts that are probably at least a year off. Get in before the cuts.

Company specific risks from the 10-K:

-

We may be adversely affected by the financial markets, fiscal, monetary, and regulatory policies, and economic conditions.

-

Increased market volatility and adverse changes in financial or capital market conditions may increase our market risk.

-

If asset values decline, we may incur losses and negative impacts to capital and liquidity requirements.

-

If we are unable to access the capital markets, have prolonged net deposits outflows, or our borrowing costs increase, our liquidity and competitive position will be negatively affected.

The final point from Bank of America Corporation’s company-specific risk is also the one I consider the biggest, cash sorting to money market funds. I don’t see depositors leaving these banks for others, but if short-term money market funds continue to create an inverted yield curve, more and more depositors will move funds to those. This will essentially result in the same thing as a withdrawal. If rates head back in the other direction, the cost of capital for the banks should remain low enough to continue generating 3%, safe margins on deposits. Right now the banks compete with the Federal Government.

Conclusion

My favorite way to play this banking anti-bubble is not through the Regionals, but through the large banks that should be getting more and more deposits. While money market funds will take cash off the balance sheet, the rate environment should keep net interest income ripping upwards as long as the overall deposit trend is relatively flat. More angst about a government default could also move large depositors from money markets into FDIC-insured deposit products that have a similar yield. They may start worrying about bond payments soon whether or not it’s a valid concern.

I believe Bank of America Corporation is one of the more conservative banks in the bunch as evidenced by their lower margins on deposits. Higher credit customers have lower returns, however, the long term should be our biggest concern. Short-term gains on deposits are irrelevant if loans start going bad. I may also try to play the Regional banks through the SPDR S&P Regional Banking ETF (KRE), but I feel it is too early at this time with too many unknowns. For now, I am starting with the big boys. Bank of America is a buy as is the group in general.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, META, BAC, C, WFC, JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.