Summary:

- Bank of America is expected to significantly increase profitability in a normalized interest rate environment due to its low-cost deposit base.

- The bank’s market power and customer trust enable it to maintain higher spreads as interest rates rise.

- The bank’s asset portfolio will take time to adjust to higher rates, but overall net interest margins are expected to improve over the next 5 years.

RichVintage/E+ via Getty Images

Investment Thesis:

Bank of America (NYSE:BAC) is one of the largest banks in the US and millions of individuals and businesses use it for their daily needs. BAC has a leading branch and ATM network and offers a wide range of products and services and can take care of pretty much all customer’s financial needs.

The crown jewel of BAC is its low-cost deposit base, provided by customers for their daily transactional needs. In a world of ultra-low interest rates, low-cost funds were of little value but now the rates and spreads have started rising. We believe that over the next decade, BAC will be significantly more profitable as its business model can yield its full potential in a normalised interest rate environment.

BAC currently generates a Net Interest Yield of 2.1%, pre-pandemic BAC was generating a yield as high as c2.45%. BAC is likely to return to higher yields once short-term rates decline, reducing funding costs and once earning assets re-price fully to reflect higher long-term rates. The recent share price rally was due to the expectation of rate cuts in 2024 and the increasing likelihood of higher Net Interest Margin.

Earnings of BAC are quite sensitive to changes in net interest yields due to the operating leverage of the business. When net interest income yields rise, non-interest costs largely stay the same and profits grow considerably. BAC is very likely to grow earnings considerably over the next 5-10 years, it is also a good quality business with a durable competitive advantage but it currently trades at a 10x PE ratio. We believe BAC is still undervalued by the market.

Improving macro conditions will enable BAC to improve profitability

BAC has a leading deposit-gathering franchise. A large share of the customers of BAC keep their funds in the bank, not because of the interest rate the bank offers, but because of the services they receive from the bank. For this reason, as interest rates rise, the bank does not have to pass on all of the increase to the consumer, unlike the smaller banks. As rates rise, the spread between the rate paid on deposits and the short-term interest rate increases. As spreads increase, more profit can be made with the same level of non-interest expenses and equity. Unfortunately, the full benefit of yield rises can take years to play out and initially, the bank can even experience a contraction in net yields.

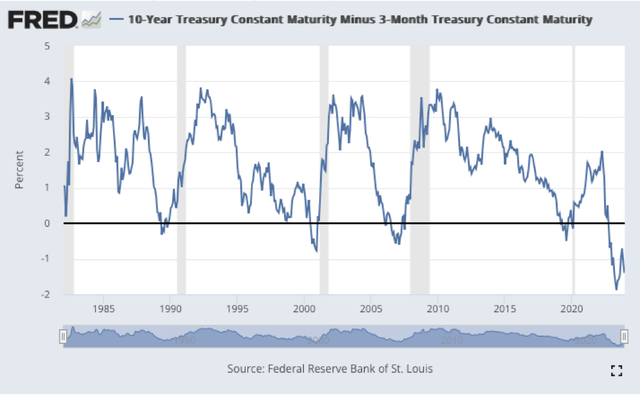

The basic business model of a retail bank is to collect short-term deposits through low-cost checking accounts and lend the funds out on a longer-term basis. The liabilities of the bank are short-term whereas the assets are long-term, because of this the bank benefits when long-term yields are significantly higher than the short-term rates. The level of the rates also affects the net interest spread since the banks usually pay less than the short-term market rates on the funds in checking accounts. Overall the ideal operating conditions for a bank would be positive, but not too high short-term rates and upward sloping yield curve. The premium on a 10-year treasury as compared to a 3-month one seems to have averaged about 1.5-2% over the longer term as can be seen in the graph below. As the Fed targets a 2% inflation rate, the ideal macro conditions would be a 2% short-term and a 4-5% 10-year rate.

St. Louis FED

Currently, the banks are not operating under the ideal conditions, to say the least. The Yield curve is downward sloping, which means that short-term funding is expensive as compared to the pricing of longer-term loans. The current 10-year yield is 4.2%, and the 30-year is at 4.3%, the highest they have been in over a decade which is a very positive sign for banks. The short-term rates, on the other hand, are still elevated at c5.5%. Once inflation and consequently the short-term rates go down, BAC and some of its other peers are very likely to experience improved operating conditions.

The question of market power

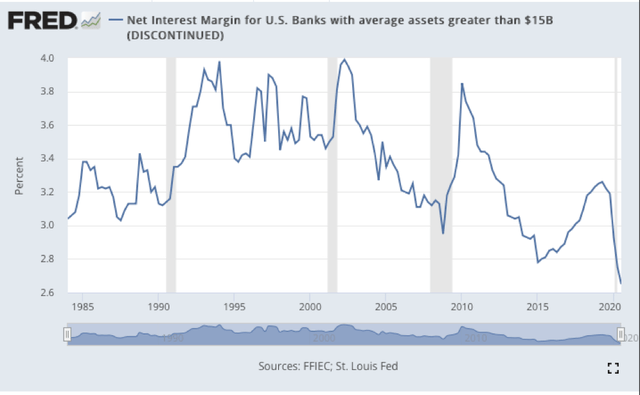

Net interest margins tend to correlate with the level of interest rates but only for the larger universal banks that provide several day-to-day services to their depositors and hold transactional balances. These two attributes are a function of the market power that the banks have.

From Economic Brief of Federal Reserve of Richmond:

“There are good reasons to think that many depositors are indeed price-insensitive. In general, it takes time and effort to change banks and to research various options for banking products. Transaction costs ought to be taken into account as well. Therefore, many depositors might be inclined to reject switching and stick with a particular bank even if they could do better elsewhere. This would support the view that as the Fed raises rates, net interest margins will widen because banks will use depositors’ price insensitivity to adjust the interest rate differential in their favour”

The more operational touch points a bank has with its customer, the higher the switching costs for that customer become. The high switching costs enable a bank to pay its customers less than the current rate on their short-term transactional deposits. It was natural to pay 0% on checking account deposits when the short-term market rates were close to zero, no market power was needed for it. Now that interest rates have risen, the strength of BAC’s market power is getting tested. We believe that BAC will pass the test and will be able to achieve higher spreads once short-term rates moderate.

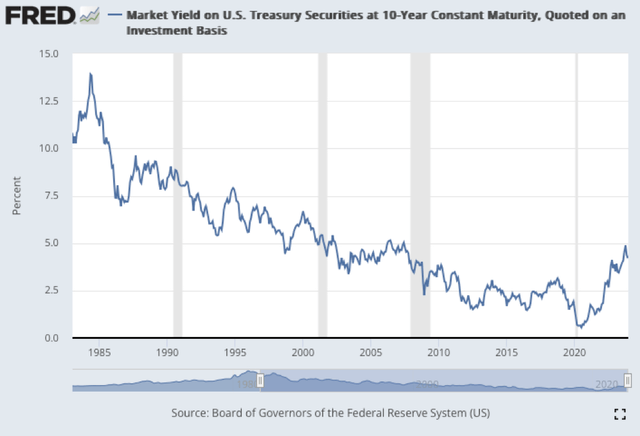

The interest rates as well as the Net Interest Margins have been low for over a decade as can be seen from the graphs below. During this time there have been a lot of regulatory changes as well as technological improvements in the banking industry. Nowadays it is a lot easier and cheaper to transfer funds between institutions, branch networks are also becoming less important as more services are automated and as we are moving towards cashless transactions.

St. Louis FED

St. Louis FED

The aforementioned technological and regulatory advances have most likely reduced the market power of the largest banks to some degree, but the universal banks still hold a very strong position. BAC might not be able to generate the level of net interest margins it was able to 15-20 years ago, but it will still be able to benefit from the improved macro conditions to a large degree.

Technology has made it a lot easier for retail consumers to open new bank accounts and transfer their savings account to any random FDIC-insured deposit-taking institution that is offering a rate higher than the high street banks. On the other hand, the financial services industry essentially has always been about selling trust to its customers. Banking, just like electricity supply or cellular reception is a mission-critical service. Customers only want to entrust their essential needs with trustworthy reliable providers that have long-term track records. Surely the large banks did have issues during the global financial crisis, but customers were still able to access their funds, use ATMs purchase goods and pay others. Technology has changed but the trust has remained very important.

BAC currently pays 3.5% on a 12-month CD account whereas the highest offer on the market is 5.67% offered by Popular Direct Bank and quite a few others are offering over 5%. In theory, everybody should transfer their savings deposits to Popular Direct and its FDIC-insured peers who offer significantly higher rates but in practice few do. The reason for this is an irrational lack of trust. Bank of America is likely to maintain its edge in the retail markets, over the smaller and less known peers.

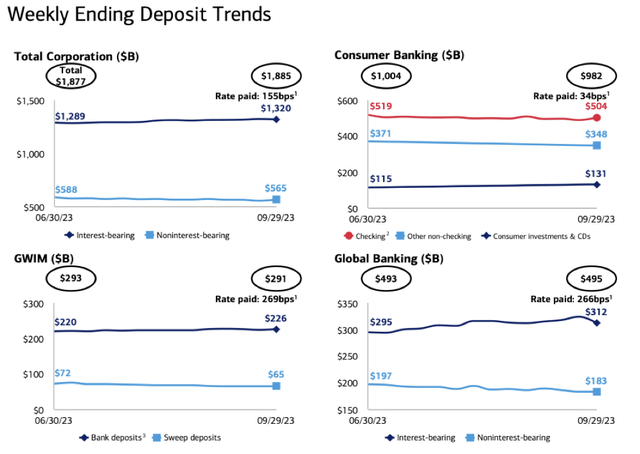

Banking large corporations will have a different dynamic as the customers in this market are professional and a lot more likely to be rational. On the other hand, BAC provides a suite of services to their large corporate clients and often knows how to deal with the complex individual needs of the businesses. Large business customers are a lot more likely to seek appropriate yields on their excess deposits, but they still need to hold transactional balances in their accounts. They are also likely to incur significant switching costs when moving to another institution. Global Banking will not be able to generate the Net Interest Margins of Consumer Banking, as it pays more for its deposits, as can be seen from the graph below. On the other hand, Global Banking is a good quality business that generates the majority of its revenue from services and has a loyal customer base.

BAC Q3 results presentation

How long before assets start paying market rates?

So far we have focused on funding costs and the ability of the bank to pay depositors less than the market rate on their balances. Another aspect to take into consideration when trying to get a sense of the likely path of net interest margins is the average duration of the interest-earning portfolio. The higher the share of fixed-rate liabilities and the longer the maturity of those liabilities, the longer it will take for the yield on an asset portfolio to increase after a rise in market rates.

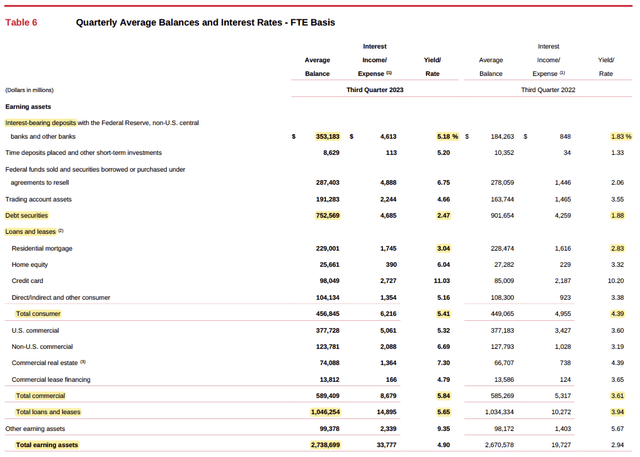

BAC has $2,740 billion of interest-earnings assets, including $778 billion of debt securities, $1,035 of loans and leases and $352 billion of cash. As can be seen from the table below, the yield on cash has increased the most (183%) as it is a current asset, on the other hand, the yield on the long-dated fixed-rate residential mortgages has barely changed. Yields on commercial loans, a loan category with a higher share of variable rates, have increased by 62%. The average duration overall would indicate how fast the portfolio adjusts to the higher rates. The lower the duration the faster the asset portfolio will adjust to higher yields.

BAC Q3 2023 earnings report

Portfolio yield duration would be quite a difficult estimate with precision, but we can get a sense that after say 5 years of higher rates, the yields on mortgages and HTM securities will still be low as the majority of those portfolios were acquired during the low rate period and these assets have fixed coupon rates and maturities over 10 years. Fortunately, these long-dated fixed-rate assets make up only c30% of the overall earning assets. Considering a likely earning asset growth and maturities, it could be that the mix of the low-yielding bonds and mortgages will decline to below 20% in 5 years. We, therefore, could see the majority of overall recovery in net interest margins over the next 5 years, if good economic conditions prevail.

Valuation and financials

In valuing BAC, we take comfort in the dynamism of the US economy. We are quite confident in our assumption that going forward the growth rate of the US economy will average 2-3%, meaning that in 10 years the American economy can produce 30% more goods and services. This means that salaries will be higher, houses will be worth more and businesses will borrow more to finance their enlarged operations. Inflation will likely add an extra layer of growth to the overall nominal size of the economy and the size of the balance sheets of the banks. We would rather err on the conservative end and assume that BAC is likely to be able to grow Total Earning Assets at a nominal rate of 3%. This conservative assumption would also give some space for potential market share losses. Earning assets in the past have grown at about 4%.

The development of Non Interest Income as well as the cost base, has been less structural. These two income statement lines will probably be more difficult to predict going forward as well. We will thus assume a secular growth on non-interest income of 1% and expenses of 2%. We also assume that the Net Interest Margin will grow back to the pre-pandemic level of 2.45% gradually over the next 5 years.

|

Bank Of America financials |

FY2012 |

FY2022 |

10YR Cagr, % |

FY2027 |

5YR Cagr, % |

|

Earning Assets A |

1800 |

2700 |

4.1% |

3,130 |

3.0% |

|

RWA proposed B |

1950 |

2,254 |

2.9% |

||

|

RWA weight |

72% |

72% |

|||

|

Tangible shareholders equity C |

200 |

291 |

7.8% |

||

|

Capital adequacy C/B |

10.3% |

12.9% |

|||

|

Net Interest Margin |

2.3% |

1.9% |

2.5% |

||

|

Net Interest Income bn |

41 |

52 |

2.6% |

77 |

7.9% |

|

Non-Interest Income |

41 |

43 |

0.4% |

45 |

1.0% |

|

Non-Interest Expenses |

72 |

61 |

-1.6% |

68 |

2.0% |

|

Credit loss provision |

8 |

3 |

9 |

||

|

% of assets |

0.5% |

0.1% |

0.3% |

||

|

EBT |

1 |

31 |

44 |

7.3% |

|

|

Tax |

-1 |

3 |

7 |

||

|

Net Earnings |

28 |

38 |

|||

|

Preferred dividend |

-1 |

-2 |

-2 |

||

|

Net Income to Common |

26 |

36 |

6.7% |

||

|

RoE Tangible |

13.1% |

12.4% |

BAC financials and our projections

We estimate that BAC is likely to grow earnings at close to 7% per annum if our assumptions come to fruition. We expect them to be required to grow their capital base to meet the new Basel III capital requirements. With an equity growth rate of close to 8% and a tangible RoE of about 13% we expect BAC to be able to return 40% of its earnings to shareholders in the form of dividends and buybacks. BAC should be able to grow earnings at 6.7% while being able to deliver a 3.8% return yield (dividend plus buybacks). Overall shareholders could expect a return above 11% over the next 5 years assuming that the valuation multiple of earnings of BAC stays the same. Valuation of multiple changes or failure to achieve operational and macroeconomic targets could make this valuation irrelevant and therefore assumptions have to be re-evaluated periodically. The table below provides a more detailed return on investment forecast, given our aforementioned assumptions.

|

Earnings forecast |

FY22 |

FY23 |

FY24 |

FY25 |

FY26 |

FY27 |

Cagr, % |

|

Earnings |

26 |

27.8 |

29.7 |

31.7 |

33.8 |

36.0 |

6.7% |

|

Return |

11.1 |

11.9 |

12.7 |

13.5 |

14.4 |

||

|

Dividend |

7.5 |

8.0 |

8.6 |

9.1 |

9.7 |

||

|

Buybacks |

3.6 |

3.9 |

4.1 |

4.4 |

4.7 |

||

|

PE |

10 |

10 |

10 |

10 |

10 |

10 |

|

|

Market Cap |

261 |

278 |

297 |

316 |

337 |

360 |

|

|

Shares |

7914 |

7811 |

7709 |

7609 |

7510 |

7412 |

|

|

EPS |

3.3 |

3.6 |

3.9 |

4.2 |

4.5 |

4.9 |

8.1% |

|

Value of share |

35.6 |

38.5 |

41.6 |

45.0 |

48.6 |

||

|

DPS |

0.9 |

1.0 |

1.0 |

1.1 |

1.2 |

1.3 |

7.8% |

|

Cash flows |

-34.7 |

1.0 |

1.1 |

1.2 |

49.9 |

||

|

IRR |

11.8% |

BAC financials and our projections

Summary

Bank of America is a strong business due to the trust of its retail customers and the suite of services offered to its higher net-worth individuals and larger businesses. The reliability reputation and the switching costs will enable the bank to keep higher profits once the economic environment improves. The current rally in the share price of BAC was brought about by the expectation of rapid rate reductions in 2024, which would reduce the bank’s funding costs and improve profitability. BAC unfortunately is not as attractive as it was a couple of months ago, but it still trades at 10x PE and offers an above-average growth rate over the medium term. We still see it as an attractive investment.

Risks

- Economic uncertainty. Currently, markets are assuming a soft landing and a favourable interest rate environment for banks, these expectations might not materialise as we might return to a world of ultra-low interest rates or suffer from excess inflation for years to come. An adverse economic environment would make it difficult for a bank to grow Net Interest Margins or even force a balance sheet contraction.

- Systematic risks to the banking sector overall due to poor risk evaluation and selection as was the case during the great financial crisis. Currently Office CRE loan market is experiencing issues, credit card and auto loan delinquencies are also on the rise, especially in the sub-prime segment. BAC has a rather small exposure to the aforementioned segments.

- Regulation and competition from shadow banking. Private credit and direct (crowd) lending are taking market share due to stricter regulation of systematically important banks and technology. Basel III Endgame rules are expected to increase capital requirements for banks and might put them at an even greater disadvantage compared to shadow baking. This is not an existential risk for BAC as they can grow their balance sheet by investing in fixed income as long as they can attract low-cost deposits from customers.

- Risk management failures, both systematic and malpractice by individuals, especially in the Global Markets division. This risk is an unknown unknown and is hard to assess.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.