Summary:

- Bank of America faces a tough Q4, with NII under pressure due to higher rates for deposits and lack of deal activity.

- Analysts forecast EPS of $0.60 and revenue of $23.9 billion (-2.6% YoY) for Q4 ’23.

- Despite the challenges, BAC stock is cheap and Bank of America should easily surpass the dire EPS target.

J. Michael Jones

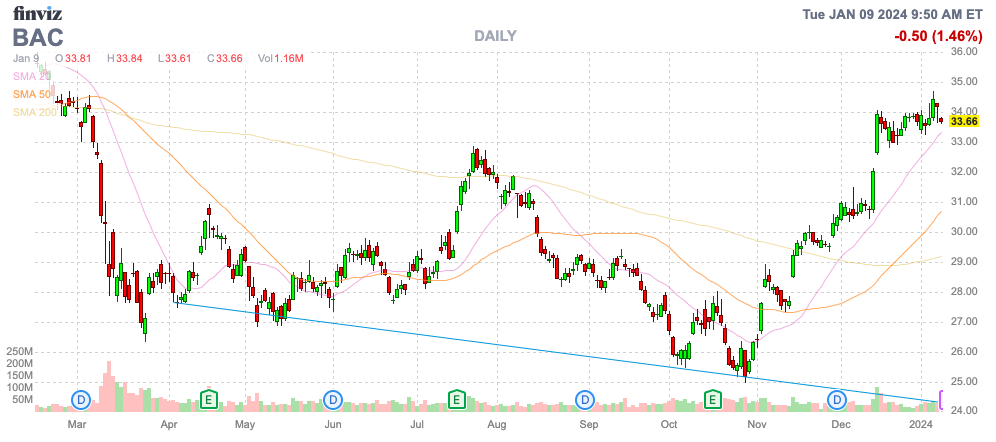

Like the overall stock market, the bank stocks have seen a large rally into the start of 2024. Bank of America Corporation (NYSE:BAC) reports Q4 ’23 earnings before the opening bell on Friday morning in what should be a tough quarter for the banking sector. My investment thesis remains Bullish on the stock, though the easy money was made since the $25 lows in late October.

Source: Finviz

Bank of America Is Facing A Tough Q4 Market

BoA faces a tough market with net interest income, or NII, under pressure due to higher rates for deposits and the general lack of deal activity. Analysts forecast the following numbers for Q4’23 according to FactSet:

- EPS of $0.60

- Revenue of $23.9 billion (-2.6% YoY).

The large bank earned $0.85 last Q4 in a sign of the general impact of higher interest expenses on the deposits component impacting NII. Brian Mulberry, client portfolio manager at Zacks Investment Management, summed up the tough market as follows:

It seems the big banks are feeling the squeeze on net interest income, it is having a negative effect on revenues and forward guidance in this group. Lack of loan demand, lack of M&A activity and very little IPO business is hurting the more profitable activities of the larger banks in addition to paying out 5% to money market depositors.

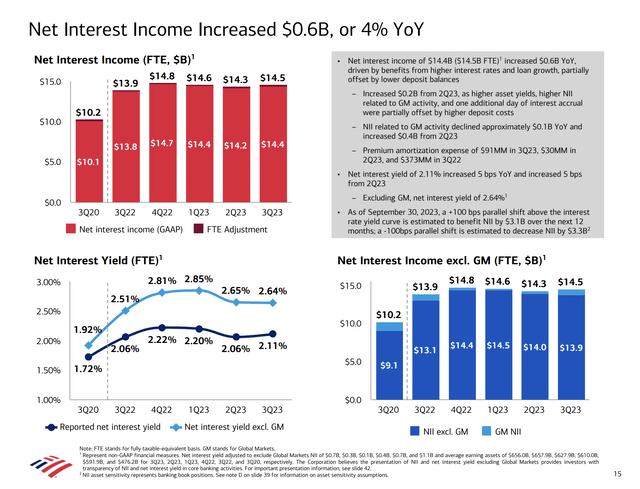

Bank of America saw NII peak at $14.8 billion Q4 ’22, with numbers generally flat this year. Considering the large bank ended the last quarter with deposits in excess of loans by a massive $835 billion, BoA might not see as much pressure on higher interest rates due to not needing high cost deposits.

Source: BoA Q3’23 presentation

The HTM bond portfolio continues to decline dipping to only $603 billion in Q3, down $41 billion from last Q3. BoA continues to generate a solid spread between the cash and securities yield versus the 1.55% deposit rate paid during the quarter.

The prime reason the stock has rallied back from $25 is the realization Fed rate cuts will reduce the unrealized losses in this securities portfolio. The fears banks would be forced to sell the securities at losses drove stock prices irrationally down.

At the most recent conference in early December, CEO Brian Moynihan re-confirmed some of the guidance for Q4’23 as follows:

Well, if you think about the fourth quarter, we still feel good about the NII guidance, $14 billion, which was what we said. We feel good. The big issue on expenses, the FDIC resolution came through. So that’s $2.1 billion to $2.2 billion, slightly higher than the original estimates, but just do the math or the calculation in our expense of $15.6. So that sort of brings the total expense base to $17.7 to $17.8 depending on where the FDIC settles in. So we hit to $15.6, we feel good about.

Management maintained guidance for NII at only $14.0 billion, down $0.8 billion from Q4’22. The potential bigger issue with analyst estimates is the $2.1 billion FDIC charge. This charge impacts estimates, but some analysts exclude the charge in non-GAAP numbers.

With 8.08 billion shares outstanding, the FDIC charge would impact EPS by ~$0.20. The large bank regularly beats consensus EPS estimates by $0.08, including the prior Q2 report and last year’s Q3 report.

Without any excessive provision for credit losses, BoA should easily soar past the $0.60 EPS target for Q4. The large bank won’t likely match the EPS from last Q4 with lower NII and platform fees, but credit losses are probably flat to down with the $1.1 billion charge in the last December quarter with no recession on the way and provisions for the last year far above actual net charge-offs on loans.

Long-Term Focus

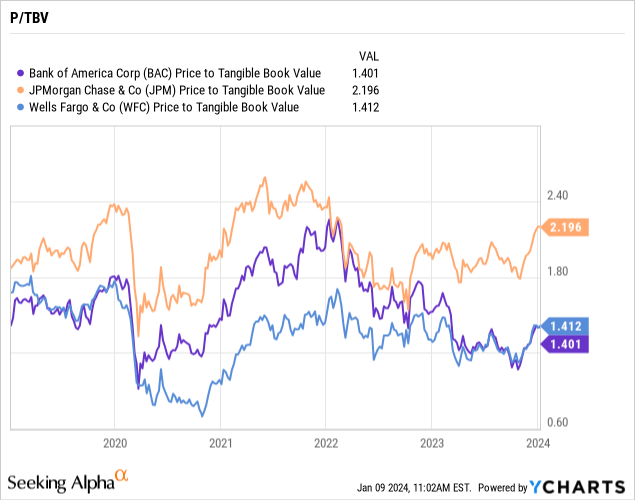

Bank of America is no longer crazy cheap like when the stock recently dipped below tangible book value. The large bank reported a Q2 ’23 TBV of $23.79 and the stock now trades at ~1.4x TBV, similar to Wells Fargo (WFC).

The large bank has regularly traded at higher multiples, but BoA has now dipped to less than 1x TBV in both early 2020 and late 2023. The stock offers solid value at these prices, but BoA does regularly dip to lower multiples, providing the more opportune time to acquire shares.

BoA returned $2.9 billion to shareholders during Q3 and ended the quarter with a CET1 ratio of 11.9%. The company will hopefully provide some more indications on where the Basel III Endgame ratios end up and possible mitigation plans to reduce the RWA impact providing more clarity on stock buybacks in 2024.

The consensus EPS estimates for 2024 have BoA earning $3.25 per share. The stock trades at a relatively cheap 10.5x EPS targets with the stock up at $33.50 here.

Takeaway

The key investor takeaway is that consensus analyst estimates for Q4 ’23 appear to include some dire forecasts for Bank of America or include the $2+ billion FDIC resolution charge in the estimates. Bank of America Corporation stock is no longer the cheap bargain like back heading into the Q3 ’23 earnings report, but BAC has solid upside with a more normal 2024 ahead and the stock still trading at a reasonable valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market starting 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.